Stories

Red Bull Unknown Facts

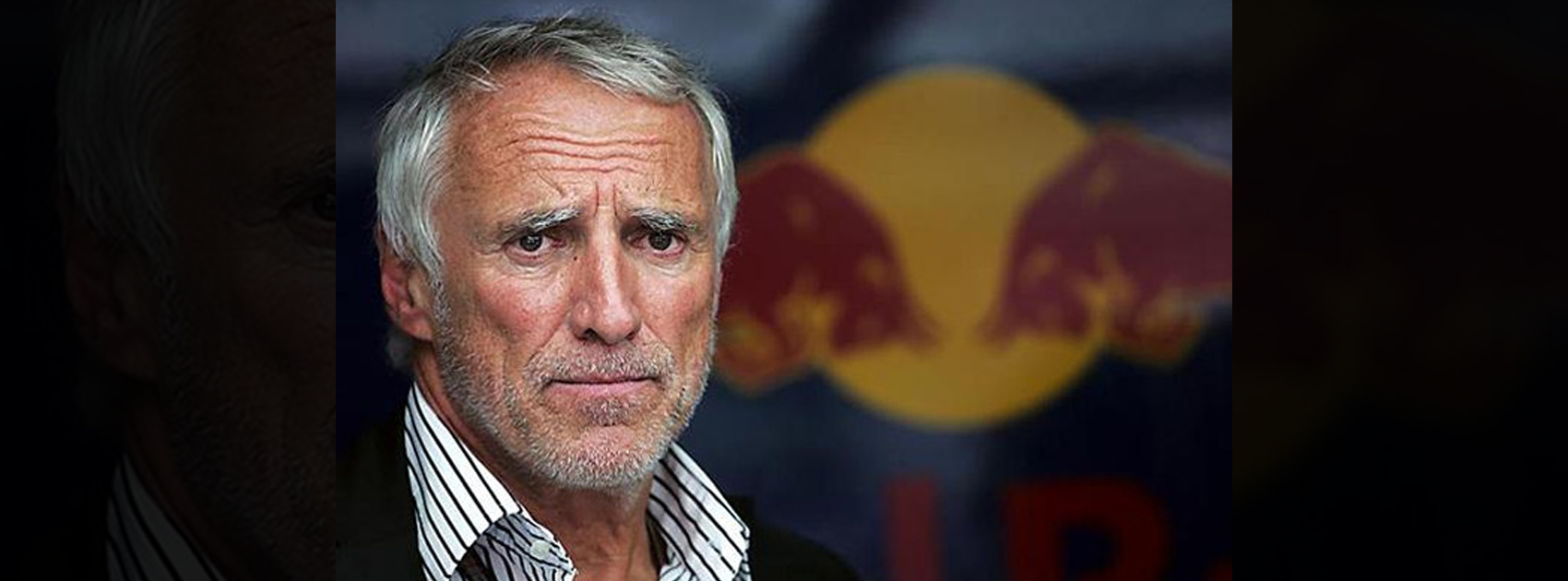

Founded in 1987 by Austrian entrepreneur Dietrich Mateschitz and Thai businessman Chaleo Yoovidhya, Red Bull is a popular energy drink known all over the world. Let us take a look at some lesser known facts about Red Bull.

Unknown facts about Red Bull

1) Known for its slogan “Red Bull gives you wings,” Red Bull was once sued for false advertising. A consumer sued the Company for $ 13 million, with the claim he was drinking Red Bull regularly for 10 years but didn’t gain any wings or athletic skills, as promised by the advertisement of the Company.

2) Red Bull was once banned in Germany for a short period of time when German authorities found traces of cocaine in the drink. However, the Company stated cocoa is only used as a flavoring agent after the removal of cocaine and one has to drink over 12,000 liters of the energy drink in order to feel any effect of cocaine.

3) With over 20 variants of Red Bull, the Company manufactures one exclusive version of Red Bull, only available to Formula 1 VIPs.

4) In 2012, as a part of its Red Bull Stratos project, the Company sent Austrian professional skydiver Felix Baumgatner 24 miles into space and Felix made a freefall at a speed of 830 miles, before deploying his parachute.

5) The Company supports research about spinal cord injuries and paraplegia, for which it raises money by organizing a yearly competition called “Wings for Life.”

6) To make Red Bull popular among college kids, co founder Dietrich Mateschitz paid popular college kids to throw parties at unusual locations and supplied Red Bull to them to tie on their cars while driving back to their respective colleges.

7) The Company has its own record label, which is called Red Bull Records and its own music academy, called the Red Bull Music Academy.

8) Based in Fuschl, Austria, Red Bull’s headquarters (HQ) are one of the most interesting places in the world. The Red Bull HQ comprises of two dome shaped buildings, floating in a boat shaped lake.

With over 6 billion cans of Red Bull sold every day worldwide, the Company established itself as a powerhouse in the energy drink industry. Which of these facts about Red Bull surprised you the most? Comment below and let us know.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Videos

Larry Page: The Visionary Co-Founder Behind Google’s Global Success

Larry Page is a visionary technology entrepreneur and co-founder of Google, one of the world’s most influential companies. Born in 1973 in Michigan, Page grew up surrounded by computer technology, which inspired his passion for innovation from an early age. He studied computer engineering at the University of Michigan and later pursued his PhD at Stanford University, where he developed the revolutionary PageRank algorithm with Sergey Brin. This technology fundamentally changed the way search engines rank websites, making Google the most accurate and popular search engine globally.

The journey of Larry Page and Google began in 1998 when they officially launched the search engine from a small garage. Leveraging their unique algorithm, Google quickly surpassed competitors due to its ability to deliver highly relevant search results, transforming internet search forever. Under Larry Page’s leadership as CEO, Google expanded beyond search to launch groundbreaking products including YouTube, Gmail, and Google Maps, turning it into a global tech powerhouse that shapes how we access and interact with information online.

Larry Page later became the CEO of Google’s parent company, Alphabet Inc., driving innovation and investment in next-generation technologies such as artificial intelligence, autonomous vehicles, and healthcare solutions. His visionary leadership and commitment to technological advancement have cemented his legacy as one of the most influential figures in the tech industry. Today, Larry Page remains a key influencer in shaping the future of technology and digital innovation worldwide.

MM88

November 6, 2025 at 5:29 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Kuwin

November 7, 2025 at 8:58 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

站群程序

November 8, 2025 at 2:55 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

站群程序

November 9, 2025 at 12:11 pm

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

GO88

November 9, 2025 at 8:44 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

MM88

November 11, 2025 at 3:43 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

谷歌站群

November 12, 2025 at 7:31 pm

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

J88

November 20, 2025 at 6:56 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

iwin

November 23, 2025 at 1:59 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

posido auszahlungsmethoden

December 20, 2025 at 7:22 pm

Unsere VIP-Mitglieder erhalten automatisch schnellere Auszahlungen in €, deutlich höhere Einzahlungslimits und persönliche Kontomanager.

Stellen Sie sicher, dass Ihre Benachrichtigungseinstellungen aktualisiert werden, um zu vermeiden, dass Benachrichtigungen über neue Cashback-Gutschriften verpasst werden.

Wir empfehlen, Ihre Freispiele zu aktivieren, sobald sie erscheinen; Auf diese

Weise können Sie sie sofort bei vorgestellten Slot-Spielen verwenden und sich einen Vorsprung für die Woche verschaffen.

Besonders beeindruckt hat uns die breite Palette an Tools und Funktionen, die den Nutzern helfen, ihr Spielverhalten zu kontrollieren und die Benutzerfreundlichkeit zu erhöhen. Falls du eine längere Auszeit benötigst,

bietet Admiral Bet die Möglichkeit einer “Spielpause”. Ein zentrales Instrument sind die individuell festlegbaren Limits, die du direkt in deinem Spielerkonto verwalten kannst.

Damit bietet Admiral Bet seinen Nutzern eine zuverlässige Anlaufstelle

für sämtliche Fragen und Anliegen rund um ihr

Wettvergnügen.

Diese Titel bieten seltene Multiplikatoren und lassen sich

nahtlos in laufende Eventmechaniken integrieren, was sowohl Unterhaltung

als auch ein höheres Gewinnpotenzial bietet. Für Spieler, die

authentische Spannung erleben und gleichzeitig lokale Traditionen ehren möchten, bietet

Admiral Casino eine neue Auswahl an Deutschland-inspirierten Spielen. Achten Sie auf

neue wöchentliche Herausforderungen, die Ihnen Freispiele und sofortige € Boni bieten, die perfekt auf lokale Feiertage abgestimmt sind.

References:

https://online-spielhallen.de/powerup-casino-erfahrungen-mein-umfassender-bericht-als-spieler/

effective heads up poker

December 27, 2025 at 2:13 am

Such promotional activities are aimed at enhancing the gaming experience and providing

additional value to visitors. At the time of writing, there

are no confirmed reports of new casinos scheduled to open in Michigan in the immediate future.

The facility also includes a Caesars Sportsbook, enhancing the betting experience for visitors.

The property includes a variety of high-end dining options,

a spa, and a hotel designed with sophistication and comfort in mind.

The venue, which replaced Casino Woodbine, offers the largest collection of slots and e-tables in Canada.

It also has over 1,000 slots and a huge selection of table games.

Welcome to our guide to the top local casinos Canada has to offer.

The Salon de jeux de Trois-Rivières, in Trois-Rivières,

Quebec, Canada, is the place to be for entertainment, fun and thrilling casino games.

The casino section has 700 slot machines, and a beautiful 30 table poker room.

References:

https://blackcoin.co/royce-hotel-casino-a-comprehensive-guide/

how to gamble online

December 27, 2025 at 8:38 pm

Once your account verification completes through our secure KYC procedures, payout requests enter our approval queue where our finance team aims to process them promptly, typically within hours for most

payment methods. Financial transactions at A Big Candy process through bank-grade encryption protocols protecting your sensitive payment

information during every deposit and withdrawal request.

New members immediately qualify for our spectacular welcome package featuring percentage matches up to 400% on initial deposits, often bundled with

free spin allocations on premium slot titles. You must be at least 18 years

old to play. Because of this great benefit, A Big Candy Casino is one of the most popular small Australian casinos.

There are other non-monetary perks available, like faster withdrawals

and a personal manager who will host you throughout your time at A Big

Candy Casino. If you’re not sure yet about adding money to the site, that’s also no problem.

For newbies, the welcome package includes a whipping 345% bonus, with an additional 200

free spins on the pokies. Its reliability means it works perfectly on both desktop and

mobile.

References:

https://blackcoin.co/royal-reels-casino-australia-in-depth-review/

https://aviempnet.com/companies/australian-casinos-accepting-paypal-payments-in-2025-2025-the-best-paypal-casinos/

December 29, 2025 at 9:30 am

online casinos paypal

References:

https://aviempnet.com/companies/australian-casinos-accepting-paypal-payments-in-2025-2025-the-best-paypal-casinos/

maridin.tr

December 29, 2025 at 9:41 am

online pokies australia paypal

References:

maridin.tr

https://pridestaffing.us/companies/best-online-casinos-australia-top-aussie-real-money-sites-2025

December 30, 2025 at 2:19 pm

online casinos mit paypal

References:

https://pridestaffing.us/companies/best-online-casinos-australia-top-aussie-real-money-sites-2025

https://quickfixinterim.fr

December 30, 2025 at 2:37 pm

paypal casinos online that accept

References:

https://quickfixinterim.fr