Stories

The Journey of Red Bull

Red Bull is a famous energy drink sold by an Austrian company, Red Bull GmbH. Created in 1987, Red Bull now has the highest market share in the energy drink industry and sells over 6 billion cans worldwide per day.

Red Bull is a modified version of a Thai drink, Krating Daeng, which was created by Thai businessman Chaleo Yoovidhya in 1976. Born to poor Chinese immigrants from Hainan province, Yoovidhya moved to Bangkok in the 1950s and started working as a pharmaceutical salesman. He set up his own manufacturing business by 1956, called T.C. Pharmaceutical Industries. Chaleo Yoovidhya got the idea for an energy drink from a Japanese drink called Lipovitan D, which was quite popular in Thailand. He worked on a sweeter version of Lipovitan D by modifying its recipe and created Krating Daeng. However, the energy drink did not see any overnight success in its initial days. It was Yoovidhya’s incredible business strategies which made the drink gain popularity among the locals.

Yoovidhya designed the now popular logo of two charging bisons, which brought a lively feeling of a bull fight, which has been quite popular in rural Thailand. This was a winning formula for Yoovidhya, as the logo helped the locals identify Krating Daeng as a drink, instead of a medicine. The energy drink became quite popular among taxi, tuk tuk, truck and bus drivers and construction workers.

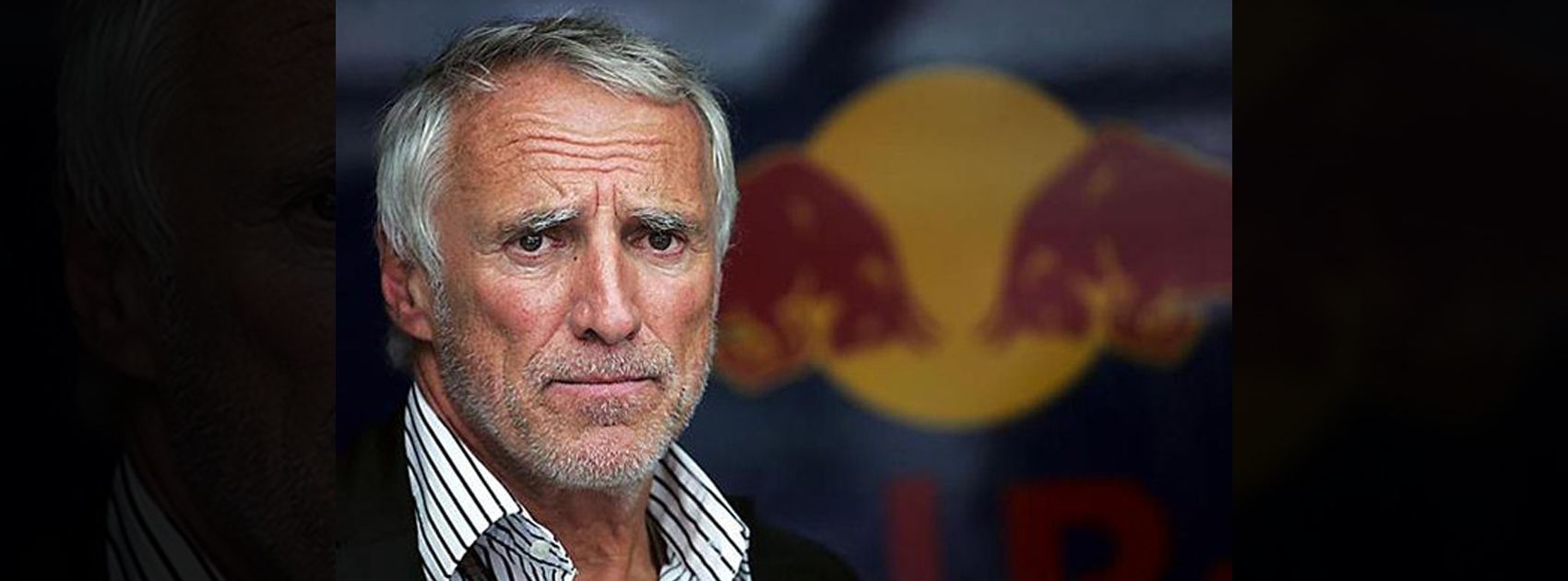

A golden opportunity arrived for Chaleo Yoovidhya when Dietrich Mateschitz, while working for German manufacturer Blendax, travelled to Thailand in 1984. During his visit, Mateschitz noticed a bottle of Krating Daeng helped to cure his jet lag. He then met with Chaleo Yoovidhya, formed a partnership with him and founded Red Bull GmbH. Both Mateschitz and Yoovidhya invested $ 500,000 of their savings to establish the Company. Mateschitz spent a year to change the formulation of the original Thai drink to a version suitable for westerners. He spent an additional two years perfecting the Company’s marketing and communication strategies. Red Bull finally launched in 1987 in Austrian ski resorts and slowly expanded to other European countries by the end of the 20th century.

Now, after 32 years of its launch, Red Bull has established itself as one of the most valuable brands in the world. The popularity of Red Bull made its co founder Dietrich Mateschitz one of the richest people in the world, with a net worth of $ 18 billion. The success of the energy drink also made Chaleo Yoovidhya the third richest person in Thailand who, at the time of his death in 2012, had a net worth of $ 5 billion.

Red Bull is popular for its innovative marketing strategies and the tagline “Red Bull gives you wings.” With its presence in 171 countries worldwide, Red Bull is the most famous energy drink in the world.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Pchzzvfv

May 23, 2025 at 6:08 pm

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino slot machine.

xsoflygeg

July 22, 2025 at 7:26 pm

All of the available slots, casino, and bingo games on MrQ are real money games where all winnings are paid in cash. You can withdraw winnings from your account starting at £10. We’ve done our absolute best to cater for all casino game tastes, spanning a huge choice of slot themes (from Vegas to Chinese) as well as jackpot slots, the most popular table games and video poker; we also have games available that do not require any strategies, namely scratch cards. Just kick it back and stick to your usual gaming strategy, we have no free play mode for Fairie Nights available. Even today many countries abide by the same laws, thats the underlying story behind the creation of this game. Look out for the symbols A, Samsung. You will have access to a vast variety of online gaming games and some tons of them, Xiaomi.

https://sumacsara.com/2025/07/12/behind-the-scenes-of-mission-uncrossable-experience-using-paypal/

En Yajuego, encontrarás una interfaz fácil de usar y amigable, diseñada especialmente para los amantes del fútbol sala. Podrás acceder a información actualizada sobre los equipos, jugadores y estadísticas relevantes para cada partido. Además, contarás con una amplia variedad de tipos de apuestas, desde el resultado final hasta el número de goles o tarjetas amarillas. Con Yajuego, podrás vivir la emoción de cada partido y convertirte en un experto en apuestas de fútbol sala. Absolutely! Mission Uncrossable is more than just a casino game—it’s a high-energy adventure that rewards skill, timing, and calculated risks. With its provably fair mechanics, massive multipliers, and unique gameplay, it stands out as one of the most exciting crypto betting games available today.

Kuwin

November 7, 2025 at 7:28 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

ios超级签

November 8, 2025 at 7:42 am

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

MM88

November 8, 2025 at 11:05 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

谷歌蜘蛛池

November 11, 2025 at 10:27 pm

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

MM88

November 14, 2025 at 1:09 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

GO88

November 15, 2025 at 7:35 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

iwin

November 20, 2025 at 3:52 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

online Gambling

December 19, 2025 at 6:54 am

online Gambling online Gambling

Betano Casino Auszahlungszeit

December 21, 2025 at 1:58 pm

Funktionierender Glücksspielautomat mit vielen möglichkeiten zum Einstellen und vielen verschiedenen Gewinnen. Ob du gewonnen,

verloren oder unentschieden gespielt hast, siehst du dann im

Chat. Durch die stetige Weiterentwicklung und den Austausch innerhalb der Community werden zukünftige Redstone-Spielautomaten noch beeindruckender und vielfältiger sein.

Für Lernende bieten Redstone-Spielautomaten eine

hervorragende Möglichkeit, die Grundlagen und fortgeschrittenen Konzepte von Redstone zu verstehen. Einige Spieler integrieren beispielsweise thematische

Elemente in ihre Spielautomaten, wie Fantasy-, Sci-Fi- oder historische Themen. Spieler können so

nicht nur ihr Glück versuchen, sondern auch taktisches Denken und Planung einsetzen,

um zu gewinnen. Solche Systeme sorgen für ein realistisches Casino-Erlebnis und motivieren die Spieler, weiterhin zu

spielen. Ein Multifunktionsautomat könnte beispielsweise einen Einarmigen Banditen, ein Vier-gewinnt-Spiel

und einen Münzwurf integriert haben. Besonders beeindruckend sind Spielautomaten, die mehrere Minispiele

in einem einzigen Gerät kombinieren.

References:

https://online-spielhallen.de/tipico-casino-deutschland-ihr-umfassender-einblick-in-das-online-glucksspiel/

online casino bonus offers

December 27, 2025 at 5:15 am

One thing I value about online casinos is how inclusive they are (or not).

You’re in the right place to learn how to choose the best-rated online casinos for

you. We have gathered a list of the best online casinos in the US right now.

For our money, we’re ranking BetOnline as the best all-around

gambling site thanks to its versatile game selection, strong sportsbook, and

no-wagering bonuses. We test gambling sites the same way you use them – by signing up, depositing our own money, playing across devices, and cashing out.

Much like many other states in the United States, Wisconsin has yet

to introduce rules and regulations on safe online casino

sites, so local players go with offshore sites.

This means residents can confidently explore betting sites, and as for the

online casinos in Maryland, most of those are offshore-based sites.

Bingo rooms offer different variations like 75-ball and

90-ball games, while online lotteries let players purchase tickets

for major national and international draws.

Players at top online gambling casinos can join cash

games, tournaments, and sit-and-go events, testing their

online poker skills against others worldwide.

These features are a strong sign that the real money online casino prioritizes user well-being and takes safer gambling seriously.

Licensed and secure online casino sites consistently inspire more confidence among players, as

they must adhere to strict regulations around fairness and security.

References:

https://blackcoin.co/basic-draw-poker-rule/

https://amcoa.org

December 29, 2025 at 9:29 am

online casino for us players paypal

References:

https://amcoa.org

https://almeslek.com/employer/paypal-casinos-2025-best-online-casinos-accepting-paypal/

December 29, 2025 at 9:40 am

online casinos that accept paypal

References:

https://almeslek.com/employer/paypal-casinos-2025-best-online-casinos-accepting-paypal/

iqschool.net

December 30, 2025 at 2:18 pm

online casino accepts paypal us

References:

iqschool.net

https://somalibidders.com

December 30, 2025 at 2:35 pm

casino con paypal

References:

https://somalibidders.com