Stories

Starbucks In Japan Introduces Pen To Pay For Coffee

Japan is famous for being technologically advanced and is known for its brilliant innovations. Starbucks in Japan is also following the trend and has been introducing various technologically driven products. These products are quite useful and help make the customers’ shopping experience better. Starbucks’ stores in Japan have a whole range of products which can be used by the customers to pay from a digital wallet. The range of products comes under the “Starbucks Touch” category and includes items like a flask, phone case and a wallet called The Hug.

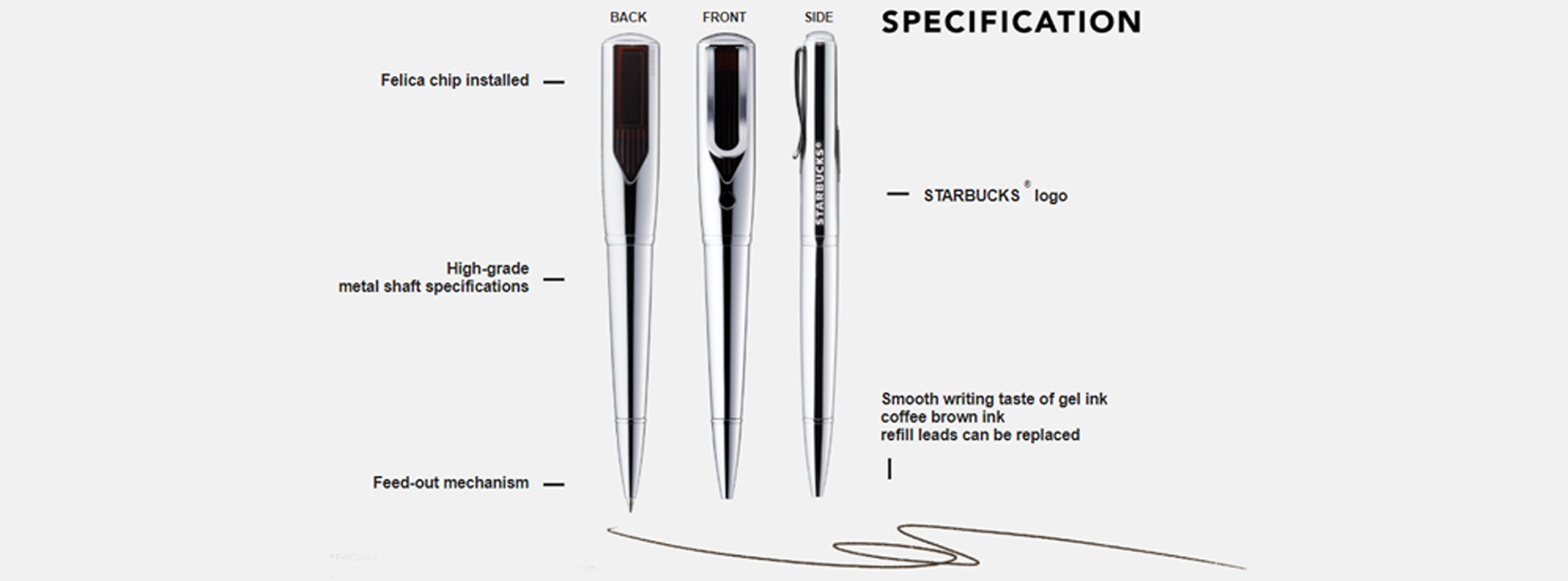

Now, Starbucks added another product, a pen, to their Starbucks Touch collection. Starbucks collaborated with Japanese stationery company Zebra to release the pen. Called Starbucks Touch The Pen, the pen is designed as a drip coffee machine and includes coffee brown gel ink, which is a constant reminder of a perfect cup of coffee.

The pen, just like other products in the collection, comes with a near field communication (NFC) reader embedded in it. NFC is a kind of technology which allows the transfer of information between two devices, when placed next to each other. The pen works using the FeliCa technology, which is a smart card system introduced by Sony and is widely used in Japan. The FeliCa technology is also used in the Starbucks domestic card system.

The pen is available in black, white and silver and can only be purchased from the Starbucks online store. The pen is priced at 4,000 yen ($ 37.46) and includes a preloaded amount of 1,000 yen ($ 9.37,) which is stored in a digital wallet.

Although the Touch Pen is not that different from the existing online payment options, the device can be considered a part of new technologies which can contribute to saving customers’ time.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Videos

Larry Page: The Visionary Co-Founder Behind Google’s Global Success

Larry Page is a visionary technology entrepreneur and co-founder of Google, one of the world’s most influential companies. Born in 1973 in Michigan, Page grew up surrounded by computer technology, which inspired his passion for innovation from an early age. He studied computer engineering at the University of Michigan and later pursued his PhD at Stanford University, where he developed the revolutionary PageRank algorithm with Sergey Brin. This technology fundamentally changed the way search engines rank websites, making Google the most accurate and popular search engine globally.

The journey of Larry Page and Google began in 1998 when they officially launched the search engine from a small garage. Leveraging their unique algorithm, Google quickly surpassed competitors due to its ability to deliver highly relevant search results, transforming internet search forever. Under Larry Page’s leadership as CEO, Google expanded beyond search to launch groundbreaking products including YouTube, Gmail, and Google Maps, turning it into a global tech powerhouse that shapes how we access and interact with information online.

Larry Page later became the CEO of Google’s parent company, Alphabet Inc., driving innovation and investment in next-generation technologies such as artificial intelligence, autonomous vehicles, and healthcare solutions. His visionary leadership and commitment to technological advancement have cemented his legacy as one of the most influential figures in the tech industry. Today, Larry Page remains a key influencer in shaping the future of technology and digital innovation worldwide.

Auksydkx

May 25, 2025 at 9:24 am

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino.

mnqkb

June 8, 2025 at 3:00 am

average cost of clomiphene can i buy generic clomid order cheap clomid without dr prescription where to get generic clomiphene without dr prescription clomid challenge test clomiphene nz prescription clomid tablets price uk

ycvgbpijp

July 21, 2025 at 12:41 am

O casino.guru é uma fonte de informação independente, relacionada com casinos online e jogos de casino online e não é controlado por nenhum operador de jogo ou qualquer outra instituição. Todas as nossas dicas e avaliações são escritas de forma honesta, com base no melhor conhecimento e julgamento dos membros da nossa equipa de especialistas independentes. No entanto, têm um carácter meramente informativo e não deve ser interpretado, nem considerado como um aviso legal. É da sua responsabilidade assegurar-se que cumpre todos os requisitos impostos pelos reguladores antes de jogar num casino. No caso do Fortune Tiger, o RTP (Retorno para o Jogador) é de 96.81%, que é um retorno alto, tendo em vista outros jogos de cassinos. Porém, se comparado com o novo jogo da pragmatic que é similar, o tigre sortudo, o fortune tiger acaba tendo um rtp um pouco menor.

https://ronniecarefoundation.org/2025/07/15/jogo-mines-gratis-treino-intensivo-sem-riscos-no-casino-online/

Lembre-se, embora o Big Bass Bonanza seja um dos destaques do Pin-Up Casino, existem muitos outros jogos de slot e clássicos de casino disponíveis. Por isso, sinta-se à vontade para explorar e desfrutar das diversas experiências de jogo que este casino online oferece. Bônus de +500% no seu depósito Bônus №2: Ao depositar 80 reais ou mais, você receberá 70 rodadas grátis Cashback no cassino de até 30% – Reembolso de até 30% dos fundos perdidos em uma semana. Bônus de +500% no seu depósito Bônus №2: Ao depositar 80 reais ou mais, você receberá 70 rodadas grátis Cashback no cassino de até 30% – Reembolso de até 30% dos fundos perdidos em uma semana. O 1Win Slots garante aos jogadores acesso para jogar em qualquer dispositivo e sistema operacional, quando e onde quiserem. Seja esperando o ônibus, relaxando em casa ou viajando, a compatibilidade móvel do 1Win garante que a emoção e o entusiasmo do cassino estejam na ponta dos dedos.

gbjenqzul

July 22, 2025 at 5:59 pm

Mobile Version Of The Game Big Bass Splash Big bass Não existe um app do Big Bass Bonanza individual porque ele faz parte do catálogo de jogos dos cassinos online. Isso significa que, para jogá-lo, você precisa acessar alguma plataforma que tenha o jogo disponível. Join the thrilling journey at the bottom of the sea, where a big bass fish eagerly awaits your arrival! Swing your way through the underwater world by swiping food and gold coins towards the direction of the octopus. But beware, other items must be swiped in the opposite direction; otherwise, you’ll lose a life for each mistake. Yes, most online casinos offer Big Bass Splash slot in demo mode. This means that the online casino grants a virtual bankroll for you to play with and experience the various aspects of the game as well as the bonus features. We highly suggest that you play Big Bass Splash slot demo before playing for real money.

https://curso.ithemi.com/sweet-bonanza-by-pragmatic-play-a-comprehensive-review-for-multi-players/

Jogue de graça e sem baixar o caça-níqueis Big Bass Splash que certamente te manterá entretido por horas! A série Big Bass sempre foi um hit, e agora segue os passos dos seus antecessores com uma jogabilidade emocionante e recursos adicionais. Como pode ver nesta análise de Big Bass Splash, não faltam motivos para experimentar esse jogo com prémios de até 5.000x a aposta! Preparado para atirar a isca? Jogue Big Bass Bonanza, o jogo do pescador, no cassino da KTO e ganhe até 2.100x o valor da sua aposta! Os melhores casinos online em Portugal oferecem condições especiais que podem elevar a sua experiência. Por isso, é importante escolher sites que sejam não apenas licenciados e seguros, mas também com classificação elevada. Conheça o nosso top três: With all our online casino games available on mobile, you can enjoy a few spins on our Slots through your device. Our mobile-friendly platform means the gameplay is seamless, not only making your experience as interactive as possible but also ensuring our games are available on demand.

cmyvibotz

September 17, 2025 at 9:58 pm

Starlight princess demo, görsel açıdan etkileyici bir temaya sahiptir. Oyun, büyülü bir prenses dünyasında geçiyor ve oyuncuları büyülü atmosferiyle cezbediyor. Grafikler mükemmel bir şekilde tasarlanmış ve oyunculara gerçek bir casino ortamı hissi veriyor. 1. CasinoMax – CasinoMax, en iyi casino bahis sitelerinden biri olarak öne çıkıyor. Geniş oyun seçenekleri ve kolay arayüzüyle tanınıyor. Canlı casino, slot oyunları ve spor bahisleri gibi çeşitli seçenekler sunuyor. Üyelerine güvenli bir oyun keyfi yaşatıyor. Çeşitli online casino platformlarında mevcuttur. Oyunu oynamak için güvenilir bir casino sitesine üye olmanız ve demo sürümünü seçmeniz yeterlidir. Casilot’un resmi web sitesinden veya popüler casino incelemeleri sitesinden erişebilirsiniz.

https://maistor-kz.com/bonanza-big-bass-slot-dunyasinin-fenomeni/

Starlight princess demo, görsel açıdan etkileyici bir temaya sahiptir. Oyun, büyülü bir prenses dünyasında geçiyor ve oyuncuları büyülü atmosferiyle cezbediyor. Grafikler mükemmel bir şekilde tasarlanmış ve oyunculara gerçek bir casino ortamı hissi veriyor. Bu oyunun teması, inanılmaz bonusları tetiklemek için gücünü kullanabilen bir anime prensesine dayanmaktadır. Orijinal yuvaya kıyasla Starlight Princess kıyafeti dışında pek bir şey değişmedi. Kanatları büyüdüğü için eskisinden çok daha iyi görünüyor ve büyülü asası da gelişti. Slot oyunları demo versiyonlarının oynanması, oyun sağlayıcısı sitesi üzerinden olduğu için kullanıcılar, bu işlemlerini güvenli olarak yapabiliyor. Casilot erişimini yapanlar, üyelik hesapları üzerinden gerçek para ile slotlarını oynayabiliyor. Para yatırmadan oynamak isteyenler demo oyunları seçiyor.

站群程序

November 7, 2025 at 9:35 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

Kuwin

November 8, 2025 at 5:19 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

MM88

November 11, 2025 at 3:35 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

谷歌外推

November 11, 2025 at 8:56 pm

采用高效谷歌外推策略,快速提升网站在搜索引擎中的可见性与权重。谷歌外推

GO88

November 17, 2025 at 8:17 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

J88

November 18, 2025 at 12:31 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

MM88

November 20, 2025 at 12:37 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

iwin

November 24, 2025 at 2:58 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

chanced casino

December 19, 2025 at 8:34 am

chanced casino chanced casino