Stories

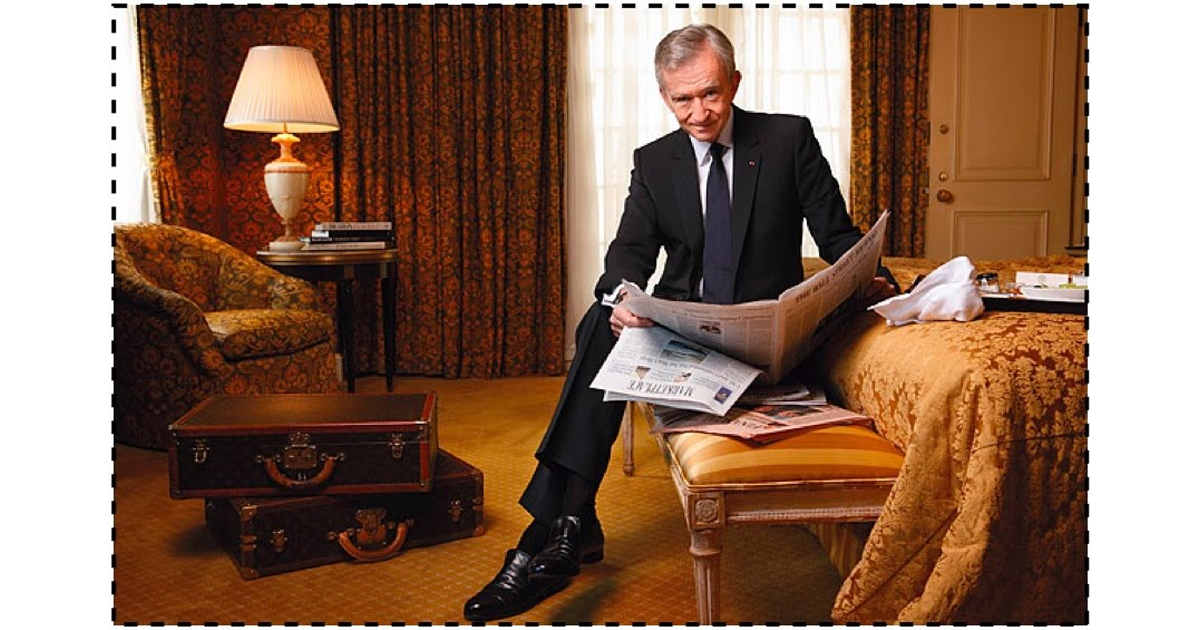

Luxury Leader Bernard Arnault Grows Richer

Bernard Arnault is the chairman and CEO of LVMH Moët Hennessy, which is the world’s largest luxury goods company. He is also the richest man in Europe with a net worth of $ 94.1 billion. Bernard Arnault further expanded his existing fortune by adding $ 5.1 billion in October 2019, making his net worth $ 99.6 billion.

The rise in his fortune is all thanks to the strong sales at LVMH Moët Hennessy. The luxury house reported its sales grew by 17 % in the third quarter of 2019.

In 2019, LVMH faced a possible threat of decline in sales due to protests in Hong Kong, which slowed down the economy in China. China is an important hotspot for many luxury brands as it contributes 5 % to 10 % of all global luxury sales, according to money management firm Bernstein Research. Despite the threat, the Paris based luxury house still saw a rise in its sales worldwide, especially in Asia.

According to reports released by LVMH, its sales grew by 12 % in Asia alone. The Company further reported its fashion and leather goods division saw an increase by 19 %, which was led by Louis Vuitton and Christian Dior. It also reported its makeup division did well, especially in China.

The main reason behind LVMH not facing any decrease in its sales is the large number of brands the Company owns. LVMH has over 75 brands under its name, including Louis Vuitton, Versace, Fendi, Bulgari and Dior. Hence, any disruption in sales of any one brand will not affect the Company in any major manner.

This proved beneficial to Bernard Arnault as his fortune is growing with the rising sales of his Company. Arnault became the third richest man in the world in June 2019. His net worth at the time was close to $ 100.4 billion. However, due to a fall in shares, his net worth went below the $ 100 billion mark. Now, with the rise in the sales of his Company, Bernard Arnault once more came closer to the centibillionaire status.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

J88

November 6, 2025 at 9:53 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

谷歌站群

November 10, 2025 at 4:34 am

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

MM88

November 10, 2025 at 4:19 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

站群程序

November 14, 2025 at 8:44 am

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

iwin

November 16, 2025 at 9:46 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Kuwin

November 21, 2025 at 4:42 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

GO88

November 23, 2025 at 9:16 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

MM88

November 29, 2025 at 9:23 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.