Stories

Starbucks Unknown Facts

Founded in Seattle in 1971, Starbucks is a well recognized brand in the world. Best known for the distinguished taste and quality of its coffee and its customer experience, the Company is now worth more than $ 113 billion. Let’s take a look at some unknown facts about this popular coffee retailer.

Unknown facts about Starbucks

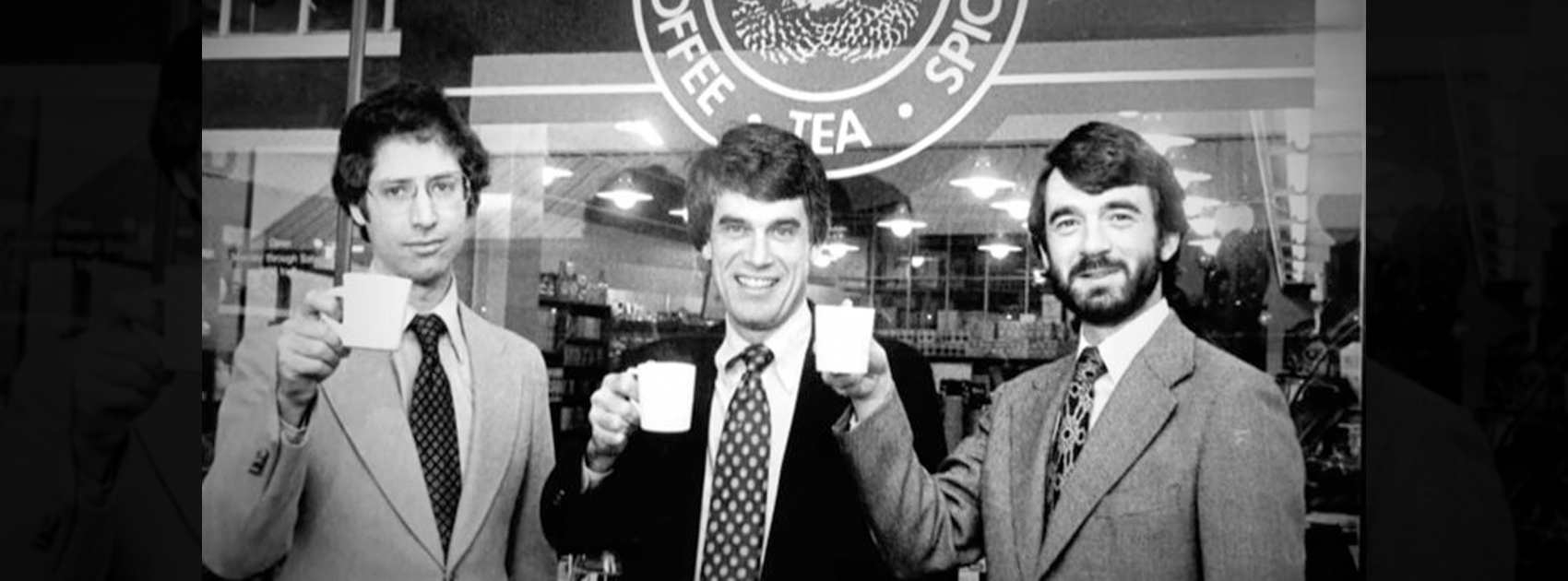

1) Although Howard Schultz is synonymous with Starbucks, the multinational coffee chain was first started by two teachers and a writer, Zev Siegl, Jerry Baldwin and Gordon Bowker respectively. The three owners sold the Company to Schultz in 1987.

2) Starbucks was almost named Pequod, which was the name of the whaling ship in Herman Melville’s Moby-Dick. The Company changed Pequod to Starbucks, which was another character in Melville’s novel.

3) The Company has incredible business ethics and takes good care of its employees. Starbucks spends more money on its employees’ health insurance than on coffee beans.

4) Starbucks is very strict about anything interrupting the aroma of its freshly ground coffee as the aroma is a crucial part of the Starbucks experience. Starbucks banned smoking cigarettes inside its stores and does not allow its employees to wear any kind of perfume or cologne.

5) Starbucks established many secret stores around Seattle. These Starbucks stores are disguised as normal indie coffee shops. Among these secretive stores, Roy Street Coffee and Tea is the place where the Company tests its new recipes and products.

6) There is a Starbucks store inside the Langley, Virginia Complex of the Central Intelligence Agency (CIA,) which is called “Stealthy Starbucks” or “Store No. 1.” The baristas in this store undergo critical examinations before getting hired.

7) The Company, following its eco friendly policy, has opened several stores inside retired shipping containers since 2011. These stores are generally used as drive throughs only.

8) A Starbucks grande coffee contains 320 milligrams of caffeine, which is four times the amount of caffeine you would find in a can of Red Bull.

With an annual revenue of $ 24.71 billion in 2018 and nearly 30,000 stores worldwide, Starbucks has established itself as the world’s best coffee retailer.

Which of these facts about Starbucks did you find interesting? Comment below and let us know.

Entrepreneur Stories

Apple MacBook Air M5 Launched: M5 Chip, 22-Hour Battery in India

Apple has unveiled the new MacBook Air with M5 chip, starting at $999 for 13-inch and $1,299 for 15-inch models. The MacBook Air M5 boasts a 2nm M5 chip with 12-core CPU, 18-core GPU, and 50 TOPS Neural Engine for seamless AI tasks like real-time translation and 8K editing. Up to 22 hours of battery life, Thunderbolt 5, and Wi-Fi 7 make it the ultimate ultraportable, now 10% thinner at 0.44 inches with fanless cooling.

Key MacBook Air M5 features include Liquid Retina XDR display (500 nits, nano-texture option), 12MP Center Stage camera, and six-speaker Spatial Audio. Colors like new Sky Blue join Midnight and Starlight. Pre-orders are live today, with macOS Sequoia 15.4 enhancing Apple Intelligence and iPhone Continuity for students, pros, and remote workers.

Why buy MacBook Air M5 now? It outpaces Snapdragon X Elite rivals with ecosystem magic and future-proof performance, eyeing top 2026 laptop sales. CEO Tim Cook calls it “more capable than ever.” Visit apple.com for M5 MacBook deals and specs.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

MM88

November 5, 2025 at 2:55 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Kuwin

November 6, 2025 at 9:12 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

谷歌外推

November 9, 2025 at 10:37 pm

采用高效谷歌外推策略,快速提升网站在搜索引擎中的可见性与权重。谷歌外推

MM88

November 11, 2025 at 10:39 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

谷歌蜘蛛池

November 12, 2025 at 9:48 am

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

GO88

November 19, 2025 at 11:48 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

J88

November 21, 2025 at 11:29 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

iwin

November 22, 2025 at 11:45 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp