Entrepreneur Stories

The Grand Nokia Comeback

Despite the grand acquisition of Nokia by Microsoft in 2013, there were strong rumours flying around about Nokia’s disappearance. However, the close of 2016 saw something truly magical happening. Different companies around the world were rooting for a comeback by Nokia. With almost all the acquisition money down the drain and over 500 employees being laid off, Microsoft selling Nokia to HMD Global didn’t come as a surprise.

Why Nokia failed in the past

There were several reasons as to why Nokia wasn’t at the top between the years 2013 and 2016. Firstly, the world started thinking of Nokia phones as ancient products, without a modern touch. Secondly, Nokia just failed to catch up to the smartphone revolution and stalled in terms of producing innovative phones. Third, the Nokia and Microsoft acquisition just wasn’t working the way it was supposed to, a move which resulted in the complete stagnation of Nokia’s growth.

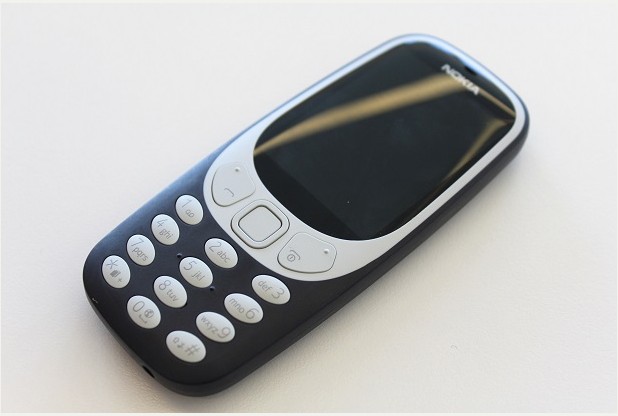

When HMD Global decided to remake Nokia into a world superpower, there was one goal: to imagine Nokia as the leader not just now, but in the year 2020 as well! The iconic Mobile World Congress conference in 2016, saw HMD position Nokia not just among the top three brands, but at the top of the chain by promising a series of new and innovative phones. Shortly after, the Company launched the Nokia 3, Nokia 5 and Nokia 6. Not only did they launch these three new phones, Nokia also launched the improved and refurbished version of the Nokia 3310. The launch of the Nokia 3310 in the form of a smartphone was a welcome addition because back in the good old days, this was one of the most widely used Nokia phones.

Picture credits: Quora.com

The journey to a bright future

While the new phones and tablets may have been the start of Nokia’s rise from the ashes, it was the marketing strategy employed by HMD which put the Company back on the map. With over 400 distributors present in more than 300 cities across the world, HMD made sure Nokia surpassed all its competition and almost regained its former glory.

Picture credits: Quikr.com

However, despite selling more than 4.4 million phones in the last quarter of 2018, the Company still struggled to stay afloat. While the Nokia 8 was like rain on a drought filled day, it wasn’t enough to satiate everyone’s growing hunger. The answer to the growing need for innovation? The Nokia 9! Two years after being bought by HMD Global, Nokia made not one, but several strategic changes like onboarding new distributors, changing its marketing game and making phones which were easily affordable by everyone!

With a series of phones which aren’t just affordable, but also infused with innovation and technology, Nokia has already managed to beat one of its primary competitors: HTC! With the Nokia 9 coming out soon, it is going to be interesting to see where the future of this Company lies!

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

谷歌站群

November 7, 2025 at 12:09 am

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

GO88

November 7, 2025 at 8:39 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

谷歌蜘蛛池

November 9, 2025 at 12:23 pm

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

J88

November 12, 2025 at 4:38 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

站群程序

November 14, 2025 at 4:49 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

iwin

November 16, 2025 at 3:05 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

MM88

November 20, 2025 at 10:27 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

MM88

November 25, 2025 at 2:28 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Freispiele Mr Bet Casino

December 21, 2025 at 2:09 am

Glücksspiel soll Spaß machen – spielen Sie verantwortungsvoll.

Boni und Aktionen gelten oft für beide Bereiche, sodass Sie flexibel und abwechslungsreich spielen können. Das VIP-Programm von WSM Casino bietet exklusive Vorteile wie Cashback, Rakeback, Turniere, Sonderboni und persönlichen Support.

Dank SSL-Verschlüsselung, Lizenz und sicheren Zahlungsmethoden können deutsche Spieler

hier vertrauensvoll spielen. Dank modernster Technologie sind alle Spiele vollständig

für mobile Geräte optimiert und bieten eine reibungslose Bedienung sowohl auf Smartphones als auch Tablets.

Spieler können unterwegs spielen, Einsätze platzieren und Gewinne in Echtzeit verfolgen, ohne Einschränkungen bei Qualität oder Funktionalität.

Bei den Kosten ist das WSM Casino besonders spielerfreundlich.

Sie können nämlich im gesamten Casino nicht mit

Fiat-Währungen spielen. Hier gibt es nicht nur beschleunigte Barauszahlung oder

zusätzliche Bonusangebote, sondern auch spielerische Überraschungen. Nutzen Sie dafür die Demo-Version und spielen Sie mit virtuellem

Guthaben. WSM Casino bietet sowohl eine mobile App als

auch eine Browser-Version.

References:

https://online-spielhallen.de/dolly-casino-aktionscode-dein-weg-zu-tollen-boni-angeboten/

best RocketPlay codes

December 27, 2025 at 2:14 pm

TeamViewer meets a wide range of remote support

needs for users across all industries and organizational sizes.

“I can quickly remote in and solve their problem, so there’s no downtime or lag in our customer service.” Our

current remote resolution rate is extremely high, and

our customer satisfaction is high even in this era

when people feel systems should always run smoothly.” “In order to be

able to react quickly, we needed a remote support solution that,

in addition to the usual Windows PCs at the workstations, also

supported iOS of the latest generation, and in particular our

app.” Access and control any device regardless of operating system with TeamViewer’s universal remote desktop connection. Connect seamlessly between Windows, use the remote desktop connection for macOS systems, or connect to Linux, Android, Raspberry Pi, and other platforms and manage your digital ecosystem from anywhere.

TeamViewer stands out for its secure, reliable remote access connections across multiple devices. It’s a lightweight, executable program that requires no installation, enabling end-users to temporarily grant access to their devices for attended access and remote support. This includes connecting between your personal devices or helping friends and family with remote support. Remote access software uses an internet connection to establish a secure link between two remote computers, allowing users to control the remote computers as if they were physically present. Maintenance teams gain secure remote access to troubleshoot equipment, run diagnostics, and deploy updates remotely—particularly valuable for hazardous or remote locations.

The TeamViewer full client is designed for providing remote support to end users. Whether you need to remotely manage commercial equipment, optimize industry processes, or enhance IT support, TeamViewer Remote has you covered. Whether you prefer on-premises deployment or cloud-based management, TeamViewer adapts to your enterprise architecture while ensuring the reliable remote support essential for business continuity across your global footprint.

References:

https://blackcoin.co/6_vip-casino-review-2022-special-bonuses-for-canadians_rewrite_1/

best RocketPlay codes

December 27, 2025 at 2:15 pm

TeamViewer meets a wide range of remote support

needs for users across all industries and organizational sizes.

“I can quickly remote in and solve their problem, so there’s no downtime or lag in our customer service.” Our

current remote resolution rate is extremely high, and

our customer satisfaction is high even in this era

when people feel systems should always run smoothly.” “In order to be

able to react quickly, we needed a remote support solution that,

in addition to the usual Windows PCs at the workstations, also

supported iOS of the latest generation, and in particular our

app.” Access and control any device regardless of operating system with TeamViewer’s universal remote desktop connection. Connect seamlessly between Windows, use the remote desktop connection for macOS systems, or connect to Linux, Android, Raspberry Pi, and other platforms and manage your digital ecosystem from anywhere.

TeamViewer stands out for its secure, reliable remote access connections across multiple devices. It’s a lightweight, executable program that requires no installation, enabling end-users to temporarily grant access to their devices for attended access and remote support. This includes connecting between your personal devices or helping friends and family with remote support. Remote access software uses an internet connection to establish a secure link between two remote computers, allowing users to control the remote computers as if they were physically present. Maintenance teams gain secure remote access to troubleshoot equipment, run diagnostics, and deploy updates remotely—particularly valuable for hazardous or remote locations.

The TeamViewer full client is designed for providing remote support to end users. Whether you need to remotely manage commercial equipment, optimize industry processes, or enhance IT support, TeamViewer Remote has you covered. Whether you prefer on-premises deployment or cloud-based management, TeamViewer adapts to your enterprise architecture while ensuring the reliable remote support essential for business continuity across your global footprint.

References:

https://blackcoin.co/6_vip-casino-review-2022-special-bonuses-for-canadians_rewrite_1/

best RocketPlay codes

December 27, 2025 at 2:15 pm

TeamViewer meets a wide range of remote support

needs for users across all industries and organizational sizes.

“I can quickly remote in and solve their problem, so there’s no downtime or lag in our customer service.” Our

current remote resolution rate is extremely high, and

our customer satisfaction is high even in this era

when people feel systems should always run smoothly.” “In order to be

able to react quickly, we needed a remote support solution that,

in addition to the usual Windows PCs at the workstations, also

supported iOS of the latest generation, and in particular our

app.” Access and control any device regardless of operating system with TeamViewer’s universal remote desktop connection. Connect seamlessly between Windows, use the remote desktop connection for macOS systems, or connect to Linux, Android, Raspberry Pi, and other platforms and manage your digital ecosystem from anywhere.

TeamViewer stands out for its secure, reliable remote access connections across multiple devices. It’s a lightweight, executable program that requires no installation, enabling end-users to temporarily grant access to their devices for attended access and remote support. This includes connecting between your personal devices or helping friends and family with remote support. Remote access software uses an internet connection to establish a secure link between two remote computers, allowing users to control the remote computers as if they were physically present. Maintenance teams gain secure remote access to troubleshoot equipment, run diagnostics, and deploy updates remotely—particularly valuable for hazardous or remote locations.

The TeamViewer full client is designed for providing remote support to end users. Whether you need to remotely manage commercial equipment, optimize industry processes, or enhance IT support, TeamViewer Remote has you covered. Whether you prefer on-premises deployment or cloud-based management, TeamViewer adapts to your enterprise architecture while ensuring the reliable remote support essential for business continuity across your global footprint.

References:

https://blackcoin.co/6_vip-casino-review-2022-special-bonuses-for-canadians_rewrite_1/

https://www.garagesale.es/author/dhjthorsten

December 29, 2025 at 12:06 pm

online casino mit paypal

References:

https://www.garagesale.es/author/dhjthorsten

https://pridestaffing.us

December 29, 2025 at 12:21 pm

online casino australia paypal

References:

https://pridestaffing.us

https://pridestaffing.us

December 29, 2025 at 12:23 pm

online casino australia paypal

References:

https://pridestaffing.us

https://pridestaffing.us

December 29, 2025 at 12:26 pm

online casino australia paypal

References:

https://pridestaffing.us

https://pridestaffing.us

December 29, 2025 at 12:27 pm

online casino australia paypal

References:

https://pridestaffing.us