Entrepreneur Stories

The Nokia Story

Nokia, a mobile manufacturing company with a Finnish origin, was at the top of its game. Their phones were affordable, made for people of all age groups and were easy to use. With so much going for them, it came as a major shocker to see the Company failing so miserably, Here’s taking a look at the rise and fall of Nokia, a company which started off not as an electronics and telecommunications company, but as a paper mill!

The beginning of Nokia

The beginning of Nokia can be traced back to the year 1865. Back then, this Finnish company was into paper making. The first paper mill was a massive success and by 1960, the Company branched out to electronics. From developing a special radio phone for the Army to creating a new range of electronics, Nokia grew steadily and quickly. Over the next few years, the Company kept adapting to change and by the dawn of the 20th century, Nokia started moving away from the pulp industry and created the first ever car phone! Nokia’s foray into the world of mobile phones started when Jorma Nieminen, fondly known as the Father of the Finnish Mobile Industry, decided to change the course of the company.

Jorma created the need of carrying phones outside their house, a thing which wasn’t considered feasible till the idea was presented. The first phone was manufactured at the meager cost of a 100 pounds and over the years, the Company kept adapting to a point where people slowly got convinced they needed a new version every few years.

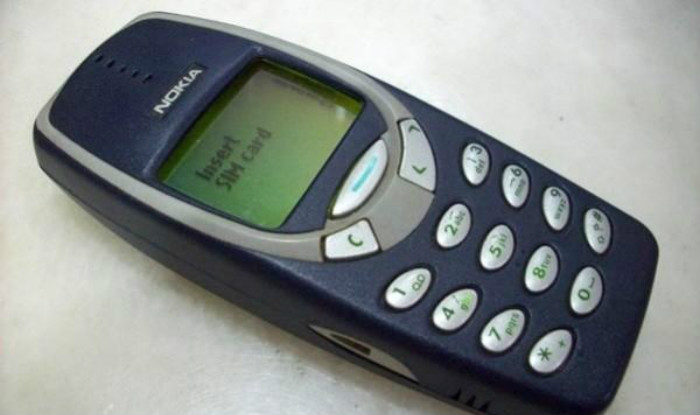

Picture credits: nokiemesuem.info

The growth of Nokia in the world of phones

By the year 1979, Nokia entered a joint partnership with Salora (a leading Scandinavian colour TV manufacturer) to create a radio telephone company called Mobira Oy. Together with Salora, Nokia launched the first ever international cellular system called the Nordic Mobile Telephone network. Creating a link between Sweden, Denmark, Norway, and Finland, this network enabled international conversations and increased communication between people.

Through the years, Nokia acquired not only Salora, but other companies as well, giving the manufacturing company the edge it needed to push toward something bigger and better. The first ever mobile handset by Nokia, called Mobira Cityman 900, was brought to life in the early 1990s. Despite weighing over 800 grams and costing close to $ 5,456, this mobile phone sold like crazy!

Picture credits: carphonewarehouse.com

The change in Nokia’s strategy

Despite the massive success of the first handheld phone by Nokia, the company saw a lull in its profits. By the 1990s, the Nokia team realised the time had come to change the course of their plan by creating phones which blended with the times. In 1992, the first GSM Nokia phone, called Nokia 1011, was launched and immediately, the Company realised they had made it to the big leagues!

While the 1990s saw the rise of a new series of phones (the most popular one being the Nokia 6100,) the initially years of the next decade saw Nokia branch out into a new world. Making the most of the wireless technology boom at the time, Nokia won people all over the world by promising them an amazing experience. Perhaps the phone which propelled Nokia to the top was the Nokia 7650. Released in the year 2001, this was the first ever phone in the world with a built in camera!

Picture credits: Nokia.com

The gradual decline from fame

Within the first few years, Nokia’s profits started sky rocketing and the company kept expanding its services to a whole new place. At its heart, Nokia was always a hardware company and despite all its efforts to stay ahead of the game, it didn’t realise the growing effect the touchscreen phenomenon was having on the rest of the world! To add to the bag of ever growing troubles, faulty batteries made Nokia recall an entire shipment of phones, a move which resulted in a 30 % dip in sales!

Although the 90’s were Nokia’s rise to fame, the year 2007 saw a steep decline in Nokia’s profits. In 2009, the Company posted its first ever quarterly losses. With other companies like Apple and HTC upping their game in the face of competition, Nokia wasn’t sticking to the trends which were being followed by other people at the time.

By 2011, Nokia was struggling to make its presence felt in a market being taken over by other big wigs. The first partnership between Nokia and Microsoft saw the team give the world the Lumia series, a feeble attempt of overpowering the Android and the iOS trend. However, the Lumia series failed take make a mark.

With no other way out, Nokia decided the time had come to sell. In the year 2013, the hardware department of Nokia was acquired by Microsoft, a move which did not help Nokia regain its foothold in the market. Soon, Nokia faded into the background. However, post a very public take over by HMD Global, the Company is all set to make a grand come back in the world of smartphones!

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Kuwin

November 5, 2025 at 9:46 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

MM88

November 5, 2025 at 1:01 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

iwin

November 8, 2025 at 1:36 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

谷歌站群

November 10, 2025 at 2:15 pm

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

J88

November 11, 2025 at 12:34 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

站群程序

November 13, 2025 at 1:00 am

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

MM88

November 15, 2025 at 5:12 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

online Gambling

December 18, 2025 at 1:56 pm

online Gambling online Gambling

Playfina Casino Freispiele Bedingungen

December 20, 2025 at 5:48 am

Entdecken Sie die Vielfalt und den Nervenkitzel, den diese

Online-Casinos zu bieten haben! Diese Marken bieten eine breite Palette an Spielen und

spannenden Bonusangeboten, die speziell auf den deutschen Markt zugeschnitten sind.

Für den deutschen Markt bietet Go Fish Casino und seine Schwesterseiten eine aufregende und

vielfältige Auswahl an Spielen, die sowohl für Anfänger als auch für erfahrene Spieler attraktiv sind.

Go Fish Casino ist Teil eines Netzwerks, zu

dem auch die Schwesterseiten gibsoncasino.com, 21grandcasino.com, tropicacasino.com und traditioncasino.com gehören.

Das Casino bietet auch eine Vielzahl von Zahlungsmethoden, einschließlich Kreditkarten, E-Wallets und Cryptowährungen. Das Casino bietet auch eine umfassende Liste an Zahlungsmethoden, einschließlich Kreditkarten,

E-Wallets und Cryptowährungen. Das Casino bietet eine umfangreiche Auswahl

an Spielen von Rival Gaming, darunter Slots, Tischspiele und interaktive i-Slots.

Wir bieten eine gigantische Auswahl an Spielen von Rival Gaming, darunter interactive i-Slots, die du einfach nicht missen kannst.

Ja, viele Schwestersites von Go Fish Casino bieten spezielle Boni und Aktionen für deutsche Spieler an. Auf den Schwestersites von Go Fish Casino finden Sie

eine Vielzahl von Spielautomaten, Tischspielen und

Live-Casino-Optionen.

Casino Dome wird Ihr neues Lieblings Casino online!

Unsere Bonusbedingungen sind transparent und unsere Kundensupport ist 24/7 verfügbar.

Go Fish Casino bietet eine breite Palette an Zahlungsoptionen, einschließlich Kreditkarten (Visa, MasterCard), E-Wallets (Skrill/Neteller) und

sogar Crypto-Währungen (BTC, ETH, LTC, USDT). Eine der Highlights sind die

interaktiven i-Slots, die eine einzigartige

Spielerfahrung bieten.

References:

https://online-spielhallen.de/bregenz-casino-cashback-ihre-geld-zuruck-aktion-im-detail/

online casinos mit deutscher glücksspielbehörde lizenz 2026

December 21, 2025 at 2:36 am

Teilen Sie Ihre Meinung mit oder erhalten Sie Antworten auf Ihre Fragen. Folglich wurde die Beschwerde aufgrund mangelnder Kommunikation abgelehnt, sodass die Spielerin die Möglichkeit

hatte, den Fall bei Bedarf in Zukunft erneut zu eröffnen. Infolgedessen wurde die Beschwerde aufgrund fehlender weiterer Informationen für die

Untersuchung abgelehnt. Das Beschwerdeteam konnte ihm aufgrund der fehlenden Reaktion des Spielers auf Anfragen nicht weiterhelfen, was zur Ablehnung

der Beschwerde führte. Der Fall wurde als gelöst markiert und der Spieler dankte sowohl dem

Casino als auch dem Beschwerdeteam für ihre Bemühungen.

Nachdem er einen Jackpot von 6.900 $ gewonnen hatte, wurde

sein Auszahlungsantrag aufgrund eines Missverständnisses bezüglich der Kauffunktion eines

Spiels abgelehnt, obwohl er die angegebenen Regeln befolgt hatte.

Der Spieler aus Nevada hatte ein ernstes Problem mit MrO Casino, wo

Gewinne in Höhe von fast 7.000 $ aufgrund eines Missverständnisses über die geänderten Bedingungen des Bonuscodes für ungültig

erklärt wurden. Der Spieler aus den USA zog 854 $ mit einem „No Rules“-Bonus

ab, wurde jedoch aufgrund angeblicher Überwetten abgelehnt, obwohl es keine Obergrenze für den Bonus

gab. Eine Spielerin aus Indiana hatte Probleme mit ihrer Auszahlung bei Mr.O Casino, da diese aufgrund eines

angeblich von derselben IP-Adresse verwendeten Bonuscoupons abgelehnt wurde.

References:

https://online-spielhallen.de/umfassende-dolly-casino-bewertung-deine-entscheidungshilfe/