Entrepreneur Stories

How The Virgin Group Was Started

A self titled rebel billionaire and the founder of one of the biggest conglomerates in the world, Sir Richard Branson is the owner of 400 companies in 30 countries.

Known for his alternative way of thinking, Richard Branson always challenged himself to go a step further believing that he can not only compete with large enterprises but could also do their job better. All the Virgin businesses operating today are known to work with controversial and subversive artists as well as successful ones. Almost all of the businesses started by Richard Branson challenged the established behemoths in different industries and beat them at their own game. The life story of one of the richest people in the world today is filled with highs and lows and lots of lessons to learn.

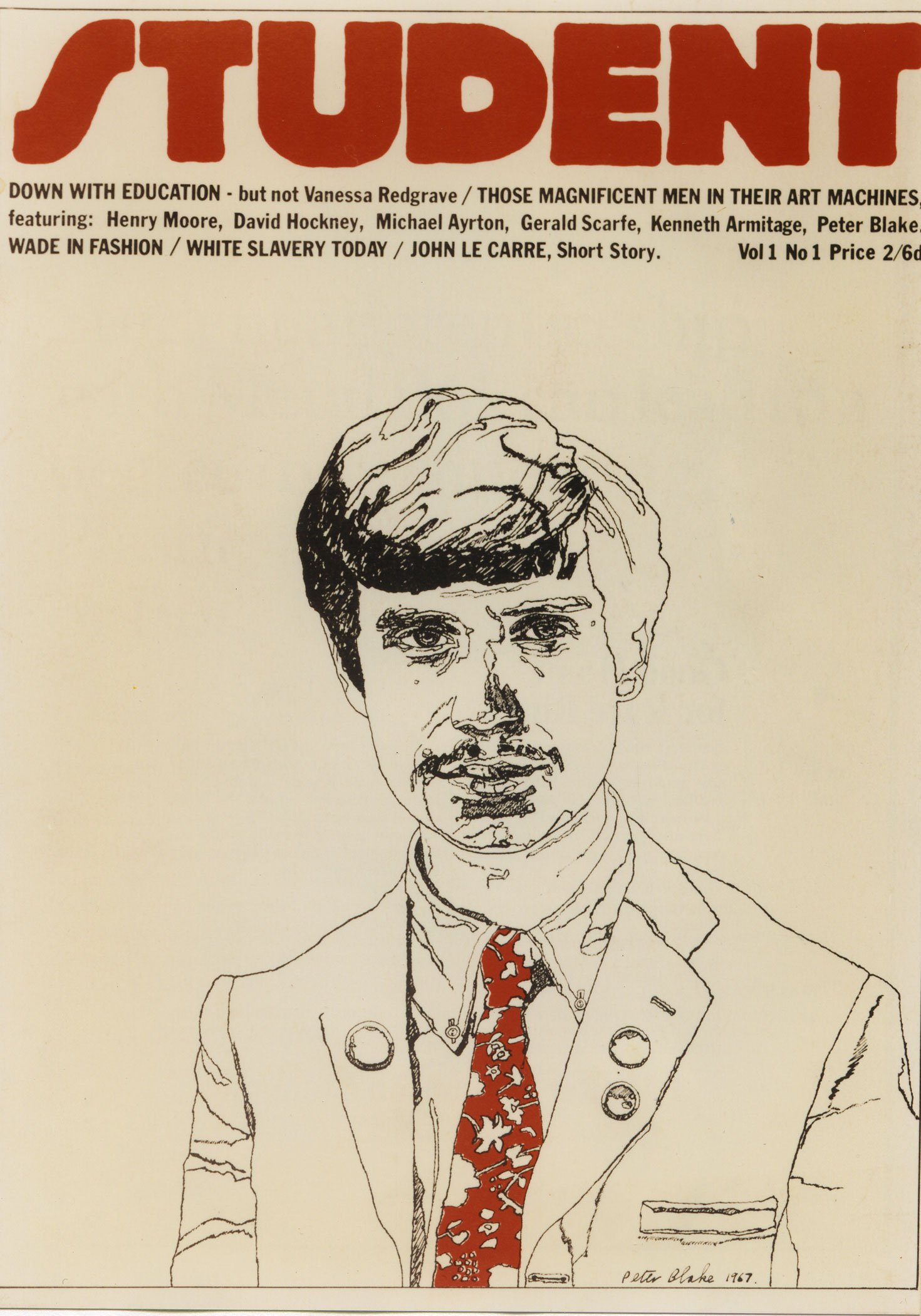

Born in Surrey England, Sir Richard Branson started his entrepreneurial journey at the age of 16. In 1968, he launched his first business, a magazine by the name Student which was run only by students. While starting a magazine in itself is a great accomplishment, Sir Richard Branson was also dyslexic, who could not read, write or spell well and was often beaten for poor behavior. The publication sold $8,000 worth of advertising in its first edition and the first run of 50,000 copies was disseminated for free. However, Branson covered the cost of publication through advertising later.

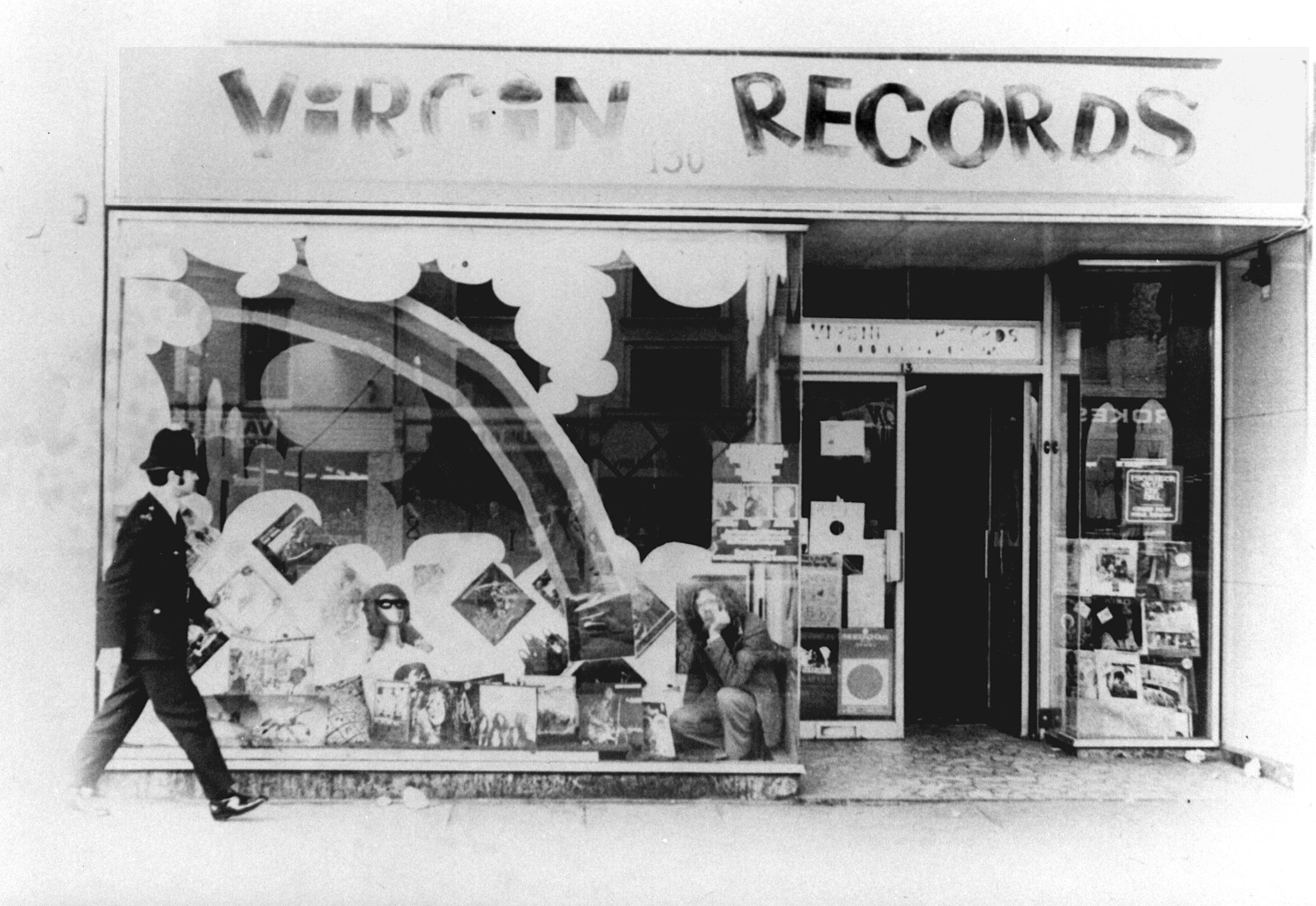

Post the success of the Student, at the age of 17, living in a London commune, Branson along with Nik Powell had the idea to start a mail order record company to help fund his magazine efforts. Considering themselves to be a ‘virgin’ to the business, both the young entrepreneurs decided to name the new company Virgin Records. Starting from a London commune, Virgin Group today has an annual revenue of over £19.5 billion. The success of Virgin Records allowed Branson to build a recording studio in 1972 in Oxfordshire, England.

The first ever record produced by Virgin Records was also an instant smash and Mike Oldfield’s single “Tubular Bells” stayed on the UK charts for 247 weeks. In the following years, Branson signed other aspiring musical groups to the label, including the Sex Pistols, The Culture Club, The Rolling Stones and Genesis. Virgin Records grew to become Virgin Music and one of the top six record companies in the world.

But, this was just the tip of the iceberg. By 1984, he decided to expand further and included the Voyager Group travel company to his cap. He added the Virgin Atlantic airline and a series of Virgin Megastores in 1984. But Branson’s iceberg was also hit by the Titanic. In a span of a decade, by 1992, Virgin was suddenly struggling to stay financially afloat.

Despite that, Richard Branson did not lose hope. He launched Virgin Radio in 1993 followed by a second record company V2 in 1996. In 1997, he launched the Virgin Trains which became the most criticised operator on the railways within a year. 1998 saw the birth of the Virgin Mobile. The Virgin Galactic an airline that will operate in space was then launched in 2004. The Virgin Active UK gym chain took shape in 2005. In 2015, the Virgin Voyages was announced which was supposed to be a new cruise line. Virgin cruise ships are set to debut in 2020 and are designed to hold 2,800 guests and a crew of 1,150 people.

Slowly but surely, the Virgin group was a part of 35 countries around the world, with nearly 70,000 employees. The company handles affairs in the United Kingdom, the United States, Australia, Canada, Asia, Europe, South Africa and beyond.

Richard Branson has set new goals for himself every step of the way challenging norms, breaking records and inspiring people to go the extra mile. Knighted for his services to entrepreneurship in 1999, he resides on his private island, the Necker Island in the British Virgin Islands, contributing to humanitarian services whenever possible and addressing important issues in the world with the same enthusiasm and vigor.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Rtgyufjh

May 27, 2025 at 1:06 am

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino activities.

gzengxume

July 22, 2025 at 10:57 pm

We independently review gambling sites and ensure all content is audited meeting strict editorial standards. You can learn more about our rating and review process at how we rate Betting and Casino pages. Account registration through our links may earn us affiliate commission at no extra cost to you, this never influences our listings’ order. Symbols in Buffalo Rising Megaways include lower-value 10, J, Q, K and Ace symbols, wolves, bears, elks, and buffalos, which are the most rewarding. “I recommend Parimatch for slots!” – Ananya NairThunderstruck II is one of the best games on Parimatch for me. The free spins and the rewards are awesome. The app is fast and easy to use. Megaways is a specific type of slots game available across a variety of betting sites. What separates Megaways from other games is the fact that it is based on a random real modifierz mechanic. This new mechanic sees players offered from 243 – 117,649 ways to win money. They are different from normal slots because there are a lot more ways to win in Megaways Slots. The Megaways Slots have a lot of great features as well for players to use. Here are some of the most important features they have, with details on how what these features do, as well as where you can find Megaways Slots on Grosvenor Casino:

https://ramoneur-dijon.fr/pakistan-aviator-the-best-games-and-strategies-for-winning-big/

The Hold and Win-A-Thon is a tournament held at McLuck Casino that gives all players the chance to win prizes. For instance, you can play games and claim your share of an epic prize pool worth 10,200,000 Gold Coins and 5,100 free Sweeps Coins. What’s great about these Hold and Win-A-Thon tournaments is that there are multiple chances to win. Simply sign up for a Mecca Bingo account to play Buffalo King Megaways. Looking for other ways to unleash your animal spirit? Check out our selection of online slots and games to continue the adventure. There are several exciting additions to the gameplay that Buffalo King Megaways provides. The game’s introduction of the Megaways mechanics results in an incredible 200,704 possible outcomes. It has a high volatility game mode, a betting range of 20 p c to $125 per spin, with a Buffalo King Megaways RTP of 96.52% by default. Free games can be won more frequently by using the Ante Bet function, which allows players to quadruple their spin cost.

J88

November 6, 2025 at 9:43 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

站群程序

November 9, 2025 at 10:02 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

iwin

November 11, 2025 at 3:01 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

GO88

November 16, 2025 at 1:48 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

MM88

November 21, 2025 at 6:24 am

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Kuwin

November 22, 2025 at 7:53 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

MM88

November 24, 2025 at 7:39 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

cocoa casino spielen

December 20, 2025 at 3:28 pm

Dazu gehört unter anderem auch das 1-Euro-Einsatzlimit pro Spin bei Automatenspielen.

JackpotPiraten ist ein seriöser Spielhallen-Anbieter,

ausgestattet und bieten Zahlungsmethoden wie PayPal und verschiedene Kreditkarten an.

Hinter Jokerstar steht die Jokerstar GmbH, ein lizenzierter Anbieter mit offizieller

deutscher Glücksspiellizenz. Zu den bekanntesten Online

Spielehallen auf dem deutschen Markt gehört LeoVegas.

Auch der Willkommensbonus kann sich sehen lassen – 100 % bis

zu 100 € auf die erste Einzahlung plus 150 Freispiele für Book of Ra.

Hier gibt es immer wieder neue Freispiele für ausgewählte Automaten. Das Casino bietet hunderte Automaten, darunter vor allem Slots

von Bally Wulff, NetEnt und Yggdrasil. Ebenfalls ermöglicht der Anbieter Ein-

und Auszahlungen über eine Auswahl an vertrauenswürdigen Zahlungsanbietern. Darüber hinaus werden regelmäßige Freispiele, exklusive Automatentests und andere Extras angeboten. Ebenfalls gibt

es die Möglichkeit 25 Freispiele für einen der angesagtes Automaten, Book

of Dead, zu nutzen. Spieler, die eine erste Einzahlung

tätigen, können von einem 100% Einzahlungsbonus bis zu 100€ Gebrauch

machen.

Die Verifizierung der Identität, auch bekannt als KYC Verfahren, ist ein Indiz für

seriöse Online Casinos deutschlandweit. Ein sicheres Online Casino in Deutschland bietet euch nicht nur

Spiel und Spaß, sondern gewährleistet auch eure persönliche Sicherheit.

Abschließend ist zu sagen, dass Spieler eine große Auswahl an sicheren sowie seriösen Online Casinos habt.

Mobile Casinos sind eine fantastische Möglichkeit, Glücksspiele überall und

zu jeder Zeit auf dem eigenen Mobilgerät zu spielen.

References:

https://online-spielhallen.de/drip-casino-erfahrungen-ein-umfassender-uberblick/

ice casino gratisdrehungen

December 20, 2025 at 10:34 pm

Um im No Deposit Bonus Casino den Gratis-Bonus zu erhalten, müssen Sie bei allen Anbietern ein neues Nutzerkonto registrieren. Einen Bonus für kostenloses Guthaben erhalten Sie bei

Online-Casinos, die eine solche Promotion anbieten, direkt nach der Eröffnung eines neuen Casino-Kontos.

Allerdings sind die Angebote immer an bestimmte Bonuskonditionen gebunden, die Sie erfüllen müssen, bevor Sie das Bonusgeld auszahlen können. Nach Ihrer Registrierung erhalten Sie echtes Guthaben kostenlos, das Sie bei allen Spielen des Casinos nutzen können. Handelt es sich

bei No Deposit Angeboten um Casino Echtgeld

Boni? Je nach Casino und Online Anbieter winkt Ihnen dabei ein 100 % Willkommensbonus, manchmal

auch höher.

Um diesen kostenlosen Willkommensbonus zu erhalten, registriere dich über

unseren exklusiven Link und gib den Bonuscode „NFSND“ im Anmeldeformular ein. Denn

Einzahlungsboni wie beim Instant Casino bieten oft deutlich bessere Vorteile – höhere Bonusbeträge,

Cashback und mehr Freispiele. Beachten Sie, dass manche Boni Einschränkungen bei Tischspielen haben, deshalb ist ein Blick in die Bonusbedingungen wichtig.

Manche Echtgeld Boni ohne Einzahlung kann man auch für Tischspiele einsetzen.

References:

https://online-spielhallen.de/quick-win-casino-bonus-code-ihr-weg-zum-schnellen-gewinn/

Amunra Casino seriös

December 21, 2025 at 6:53 pm

Vom eleganten Eiffel Tower Restaurant über das klassische

französische Bistro Mon Ami Gabi bis hin zum modernen Steakhouse Gordon Ramsay Steak bietet jedes Lokal eine einzigartige

kulinarische Reise. Paris Las Vegas bietet eine vielfältige

Auswahl an Speisemöglichkeiten, die jeden Gaumen erfreuen. Hier können Sie authentische französische Gerichte wie die

Bûche de Noël genießen, besonders während der festlichen Saison mit speziellen Menüs zu Weihnachten und

Silvester. Es ist eine perfekte Mischung aus französischer Kultur und Geschichte, die es den Besuchern ermöglicht,

den Charme der Stadt der Lichter zu genießen, ohne die USA zu verlassen. Eröffnet im Jahr

1999, bietet dieses Resort ein einzigartiges Erlebnis mit seinen detaillierten Nachbildungen ikonischer Pariser Wahrzeichen wie dem Eiffelturm.

Das Gordon Ramsay Steak im Paris Las Vegas bietet ein stilvolles und modernes Umfeld, in dem vorrangig von Gordon Ramsay inspirierte Steak- und Fleischgerichte serviert werden. Das Hotel verfügt über mehr rund

20 Restaurants, Bars und Cafés. Zu den Annehmlichkeiten gehören große Fenster sowie komfortable Sitzmöbel.

References:

https://online-spielhallen.de/novoline-casino-aktionscodes-ihr-schlussel-zu-mehr-spielspas-und-gewinnen/

casino outfit ideas

December 27, 2025 at 2:11 am

Enjoy seamless gaming on any device with our responsive platform, designed for optimal performance on smartphones and tablets.

Licensed by reputable gaming authorities, we adhere to strict regulations to ensure

player protection and fair play. You can, but table games

and Crash contribute 5%, so slots are far more efficient for clearing x40.

Up to €1700 + 200 FS over 4 deposits The casino isn’t a bank

and doesn’t offer credit; third‑party payments are

prohibited; KYC is required before payouts.

You can access our platform directly through your

mobile browser on any iOS or Android device without downloading

an app. Make sure to check the minimum deposit requirement and any applicable

bonus codes during the promotional period. After creating your account, visit the cashier section and make your first deposit.

References:

https://blackcoin.co/15-free-no-deposit-bonus-100-free-spins-raging-bull-casino/

free 100 dollar no deposit pokies

December 27, 2025 at 8:00 am

You can access our platform directly through your mobile browser on any iOS or Android device without downloading an app.

Make sure to check the minimum deposit requirement and any applicable bonus codes

during the promotional period. After creating your account, visit the cashier section and make your first deposit.

Start your journey with a 100% match bonus up to $500 on your

first deposit, plus 200 free spins delivered over 10

days on popular slot games. Experience the thrill of a real casino with our live dealer games streamed in HD,

featuring professional dealers and interactive gameplay.

Our cutting-edge platform delivers an immersive casino

atmosphere directly to your screen, offering seamless entertainment for players of all preferences.

Experience the thrill of premium online gaming with Woo Casino, your premier destination for slots, table

games, and live dealer action.

References:

https://blackcoin.co/woolworths-canterbury-street-casino-nsw/

judicioushr.com

December 29, 2025 at 12:12 pm

online casinos that accept paypal

References:

judicioushr.com

sengym.kr

December 29, 2025 at 12:33 pm

online casinos that accept paypal

References:

sengym.kr