Entrepreneur Stories

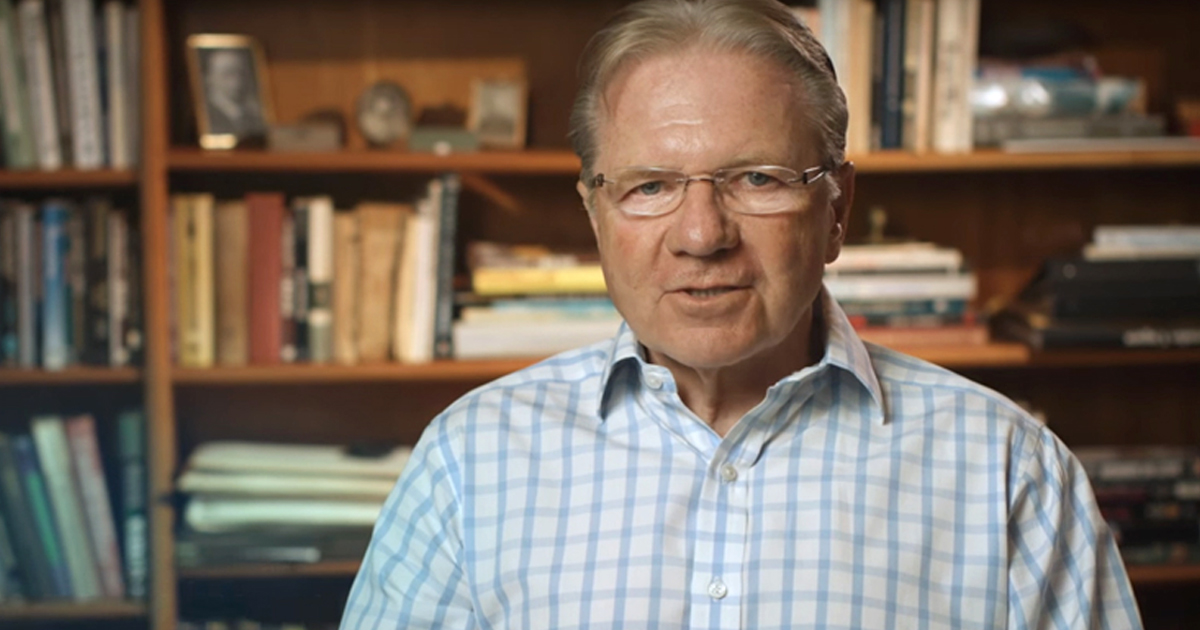

Meet Thomas Peterffy: His Journey From A Poor Immigrant To A Multi-Billionaire

You may know Thomas Peterffy as a Founder, Chairman, and CEO of Interactive Brokers Group, Inc., but what is unknown to the world is the fact that he was a refugee who migrated from place to place in search of a better future.

Thomas was Born in 1944 in Hungary, in a hospital basement during a Russian air raid. The harsh Soviet rule in Hungary made many people leave the place and move in search of a better life. Thomas and his father Perenc Peterffy were among them.

His father who was living with his second wife found it hard to accommodate his son. He gave Thomas a 100 dollars and asked to him to make his living. There began his journey from being penniless to being one of the world’s wealthiest person.

The young immigrant Thomas was not so good at speaking English, left his engineering studies and emigrated to the United States as a refugee in 1965. He moved to the New York City and earned a bachelor’s degree from Clark University.

He began his career as an architectural draftsman in the US. It was in this firm, he programmed a newly purchased computer, which ultimately shaped his future. Eventually, he left this career as a designer of software and bought a seat on the American Stock Exchange to trade equity options. He consistently replaced manual processes with more efficient automated ones.

He made a major change by introducing handheld computers onto the trading floors in early 1980’s. He founded his first company T.P. & Co in 1978 and his second venture was Timber Hill Inc., in 1982. In 2001, he named Timer Hill Group to Interactive Brokers Group LLC. The company’s headquarters is now located in Greenwich, now logs in over one million trades per day.

According to Forbes reports, the net worth of Thomas Peterffy estimates around $16 billion and this makes him stand as the 32nd richest man in the US. And he is fondly known as “The Father Of High-Speed Trading.”

During the 2016 Presidential Elections, Thomas Peterffy donated $100,000 to the campaign of Republican nominee Donald Trump. He said: “This election will determine the course of this country for a long time into the future.”

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

MichaelMof

July 12, 2025 at 4:42 am

[url=https://joyorganics.com/collections/softgels ]cbd soft gels[/url] are a helpful and enjoyable street to take cannabidiol without the high. Numberless people use them to facility stress, repair rest, or promote overall wellness. The effects usually originate within 30–60 minutes and can matrix looking for several hours. You’ll reveal options with melatonin, vitamins, vegan ingredients, or no added sugar. They loosely transpire b emerge in a range of flavors and strengths. It’s most to start with a worthless amount and everlastingly check representing third-party lab testing to insure rank and safety.

DannyJek

July 15, 2025 at 3:59 pm

https://joyorganics.com/products/delta-9-gummies-blackberry-lime are a convenient and enjoyable way to quarter cannabidiol without the high. Assorted people abhor them to ease emphasis, increase rest, or stand up for blanket wellness. The effects most often upon within 30–60 minutes and can mould in compensation several hours. You’ll spot options with melatonin, vitamins, vegan ingredients, or no added sugar. They move in a stretch of flavors and strengths. It’s foremost to start with a critical dose and every time confirm looking for third-party lab testing to ensure distinction and safety.

站群程序

November 7, 2025 at 2:47 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

谷歌外推

November 9, 2025 at 7:41 am

采用高效谷歌外推策略,快速提升网站在搜索引擎中的可见性与权重。谷歌外推

J88

November 13, 2025 at 10:00 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

谷歌站群

November 14, 2025 at 10:39 am

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

MM88

November 15, 2025 at 8:18 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Kuwin

November 16, 2025 at 1:45 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

iwin

November 29, 2025 at 12:47 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

GO88

November 29, 2025 at 5:45 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Wöchentlicher Casino Cashback

December 20, 2025 at 2:22 am

Insgesamt kannst du über CasinoTopsOnline bis zu stolze 2.155

Freispiele ohne Einzahlung bekommen. Der wahre „Preis“

der Freispiele Deinen Bonus ohne Einzahlung kannst du im Casino

mit wenigen Schritten aktivieren und nutzen. Dank der

100 Freispiele ohne Einzahlung kannst du das mobile Angebot risikolos als neuer Spieler testen. 20 Freispiele schnappst

du dir in der App mit dem Code ROLLINO20 als neuer Spieler ohne Einzahlung.

Dieser Bonus mit geringem Risiko gibt dir Probezeit, um alles auszuprobieren,

was das Casino zu bieten hat.

Suchen Sie nach Boni mit einer großzügigen Anzahl an Freispielen für beliebte Slot-Titel.

Die besten Boni bieten oft auch zusätzliche Belohnungen wie Freispiele oder Cashback-Angebote.

Indem Spieler die Regeln sorgfältig lesen und verstehen, können sie das Bonusgeld effektiv nutzen, um ihre

Gewinnchancen zu maximieren. Dies bedeutet, dass selbst

wenn Spieler mehr als den angegebenen Betrag mit Bonusgeldern gewinnen, nur bis zu diesem

Limit ausgezahlt werden kann. Zeitliche Beschränkungen spielen bei

Casino Boni eine zentrale Rolle.

Freispiele sind der Schlüssel zum kostenlosen Spielen von Casinospielen. Daher nutzen sie Bonusangebote,

um Spieler an ihre Slots zu locken. Natürlich gibt es

diesen Bonus auch in Form von Freispielen, Geldgeschenken oder auch Sachpreisen.

References:

https://online-spielhallen.de/irwin-casino-deutschland-ihr-tor-zur-online-glucksspielwelt/

Casino Experience

December 27, 2025 at 1:19 am

We provide comprehensive responsible gambling tools to help players

maintain control over their gaming activities. Our live casino games use certified random number generators and are streamed in real-time from licensed studios.

Our responsible gambling framework includes multiple self-management

tools to help players maintain control over their gaming activities.

Level Up Casino provides dedicated mobile applications for

both iOS and Android platforms with over 7,000 games from 40+ software

providers. Self-exclusion options, deposit limits, and cooling-off periods show genuine player protection commitment.

Moreover, it is not necessary to use the application for mobile devices,

the best mobile casino experience is guaranteed

through a web browser. Find real treasures, Australian favourite

pokies, sign in to Level Up casino to have the best gaming experience.

These apps are optimized for performance and include all the functionalities of the desktop

version, allowing players to enjoy uninterrupted gaming on the go.

The support team is professional and responsive,

ensuring players receive prompt and helpful solutions.

https://casjobs.in/employer/paypal-casinos-2025-best-casino-sites-that-accept-paypal

December 29, 2025 at 12:32 pm

online casino with paypal

References:

https://casjobs.in/employer/paypal-casinos-2025-best-casino-sites-that-accept-paypal

https://jobsonly.in/

December 29, 2025 at 1:07 pm

online slots uk paypal

References:

https://jobsonly.in/