News

Google Job Search Feature Comes To India

Technology giant Google announced the launch of another India focused product, making it easier for users to search for jobs in India. In a blog post, the company announced their latest job search feature for India under the Google Jobs feature.

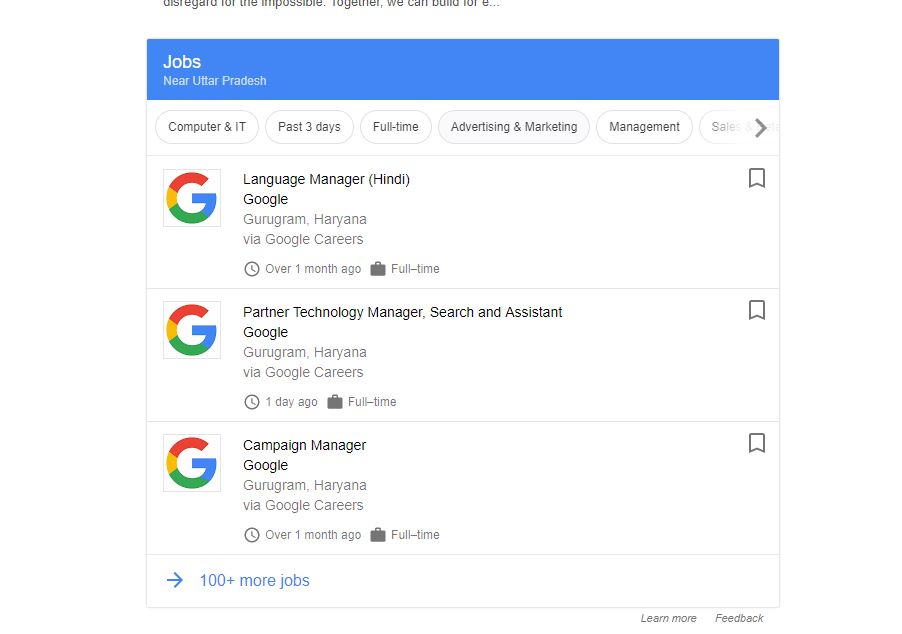

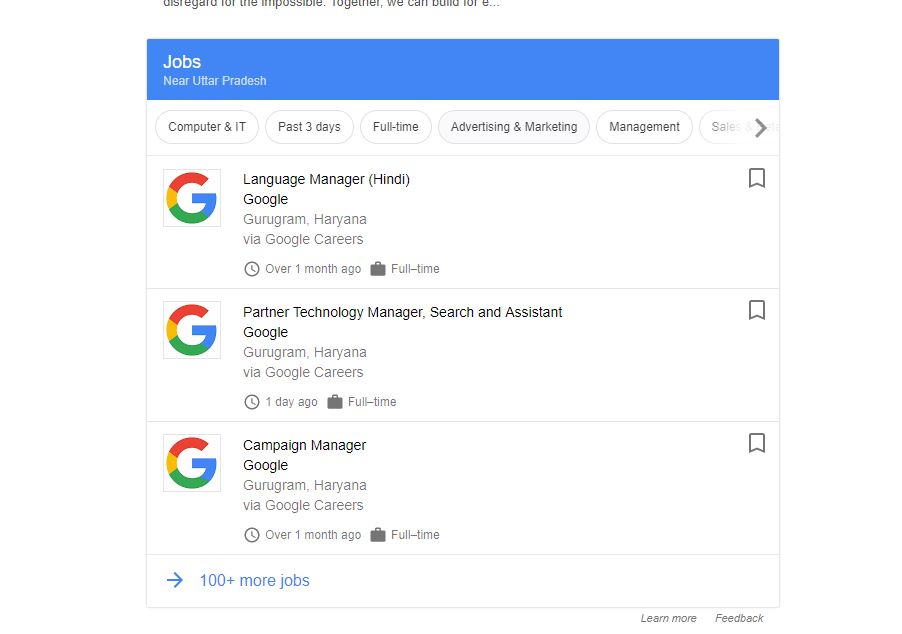

In the blog post, the company added, “Now we’re bringing job search to India. With this new experience, we aim to connect Indians to numerous opportunities across the country. No matter who you are or what kind of job you’re looking for, it will now be easier to find job postings that match your needs and skills.” Under this feature, users will be able to see in depth results of relevant job opportunities from across the web when users search for “jobs near me,” “jobs for freshers,” or similar job seeking queries.

Google also partnered with a number of organizations from across the industry including IBM Talent Management Solutions, LinkedIn, QuikrJobs and TimesJobs among others for this purpose. The tech giant aims to add a new functionality to the search engine to show a comprehensive listing of jobs on the results page.

With a roster of over a million listings, from some 90,000 employers nationwide, the company claims its tool can help job seekers at every level, from recent college grads to experienced managers. Users can click on the listings to bring up more information about the company and the job role, as well as links to apply for the said role on various platforms.

The search results can also be narrowed down to fewer and more relevant listings by adding filters such as preferred title, location and contract type. “We’ll continue to add relevant filters, and surface more pertinent job related information in the future. This new jobs search experience will be available in English on the Search app on Android and iOS, in Google search on the desktop and mobile,” the company further added.

Both the desktop and the Android versions of the search engine have been integrated with the new tool along with an open source framework called Open Documentation. All third party job search platforms and direct employers, big or small can make their job openings discoverable through the Open Documentation framework. At present, the Indian online job market is showing healthy growth with 63% of people slated to access online job postings and more than 50% of job related queries originating from mobile users.

Funding

Dazzl Raises $3.2M Seed Funding Led by OYO’s Ritesh Agarwal for AI Skincare Expansion

Bengaluru, January 13, 2026 Dazzl, the D2C beauty startup revolutionizing AI personalized skincare India, secured $3.2 million in seed funding led by OYO founder Ritesh Agarwal’s venture arm. Co-investors include Snapdeal’s Rohit Bansal and Fireside Ventures, valuing Dazzl at $15 million post-money. Founded in 2024 by IIT alumni Priya Singh and Arjun Mehta, the app uses smartphone scans for custom serums, boasting 50,000+ users and ₹5 crore ARR amid India’s $25 billion beauty market surge.

Ritesh Agarwal praised Dazzl’s tech: “Personalization is beauty’s future, like OYO’s guest model.” Funds target R&D for 100+ skin profiles, Gujarat manufacturing under PLI, Instagram/Nykaa campaigns, and 50 hires. In a 20% YoY growing sector (Redseer 2025), Dazzl edges Mamaearth and Plum with 95% AI precision, 90% natural formulas, ₹499 kits, 65% retention (vs. 40% avg), and viral TikTok traction in 10 cities.

D2C beauty startup Dazzl tackles regulations via FSSAI compliance, eyeing $10B e-commerce beauty by 2028 and MENA exports. Q2 haircare launches and Series A loom, with Agarwal’s backing signaling unicorn potential for sustainable beauty products India. Dazzl blends AI with clean beauty for 500M+ consumers.

News

Google Launches Startup Hub in Hyderabad to Boost India’s Innovation Ecosystem

Google has launched the Google Startup Hub Hyderabad, a major step in strengthening India’s dynamic startup ecosystem. This new initiative aims to empower entrepreneurs, innovators, and developers by giving them access to Google’s global expertise, mentoring programs, and advanced cloud technology. The hub reflects Google’s mission to fuel India’s digital transformation and promote innovation through the Google for Startups program.

Located in the heart of one of India’s top tech cities, the Google Startup Hub in Hyderabad will host mentorship sessions, training workshops, and networking events designed for early-stage startups. Founders will receive Google Cloud credits, expert guidance in AI, product development, and business scaling, and opportunities to collaborate with Google’s global mentors and investors. This ecosystem aims to help Indian startups grow faster and compete globally.

With Hyderabad already home to tech giants like Google, Microsoft, and Amazon, the launch of the Google Startup Hub Hyderabad further cements the city’s position as a leading innovation and technology hub in India. Backed by a strong talent pool and robust infrastructure, this hub is set to become a growth engine for next-generation startups, driving innovation from India to global markets.

News

BMW’s New Logo Debuts Subtly on the All-Electric iX3: A Modern Evolution

BMW quietly debuted its new logo on the all-electric iX3, marking a significant yet understated shift in the brand’s design direction for 2025. The updated emblem retains the classic roundel and Bavarian blue-and-white colors, but sharp-eyed enthusiasts noticed subtle refinements: the inner chrome ring has been removed, dividing lines between blue and white are gone, and the logo now features a contemporary satin matte black background with slimmer “BMW” lettering. These enhancements showcase BMW’s embrace of modern minimalism while reinforcing their commitment to premium aesthetics and the innovative Neue Klasse philosophy for future electric vehicles.

Unlike rival automakers that reveal dramatic logo changes, BMW’s refresh is evolutionary and respectful of tradition. The new badge ditches decorative chrome and blue borders associated with earlier electric models, resulting in a flatter, more digital-friendly design that mirrors recent branding seen in BMW’s digital communications. Appearing first on the iX3’s nose, steering wheel, and hub caps, this updated identity will gradually be adopted across all BMW models—both electric and combustion—signaling a unified brand language for years to come.

BMW’s strategic logo update represents more than just aesthetic reinvention—it underscores the brand’s dedication to future-ready mobility, design continuity, and a premium EV experience. As the new roundel begins rolling out on upcoming BMW vehicles, it stands as a testament to the automaker’s depth of detail and thoughtful evolution, offering subtle distinction for keen observers and affirming BMW’s iconic status in the ever-changing automotive landscape.

MM88

November 7, 2025 at 10:36 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Kuwin

November 8, 2025 at 6:42 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

站群程序

November 11, 2025 at 5:30 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

谷歌外推

November 14, 2025 at 11:02 am

采用高效谷歌外推策略,快速提升网站在搜索引擎中的可见性与权重。谷歌外推

iwin

November 20, 2025 at 12:19 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

MM88

November 22, 2025 at 12:32 am

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

J88

November 24, 2025 at 7:02 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

chanced casino

December 19, 2025 at 2:51 am

chanced casino chanced casino