News

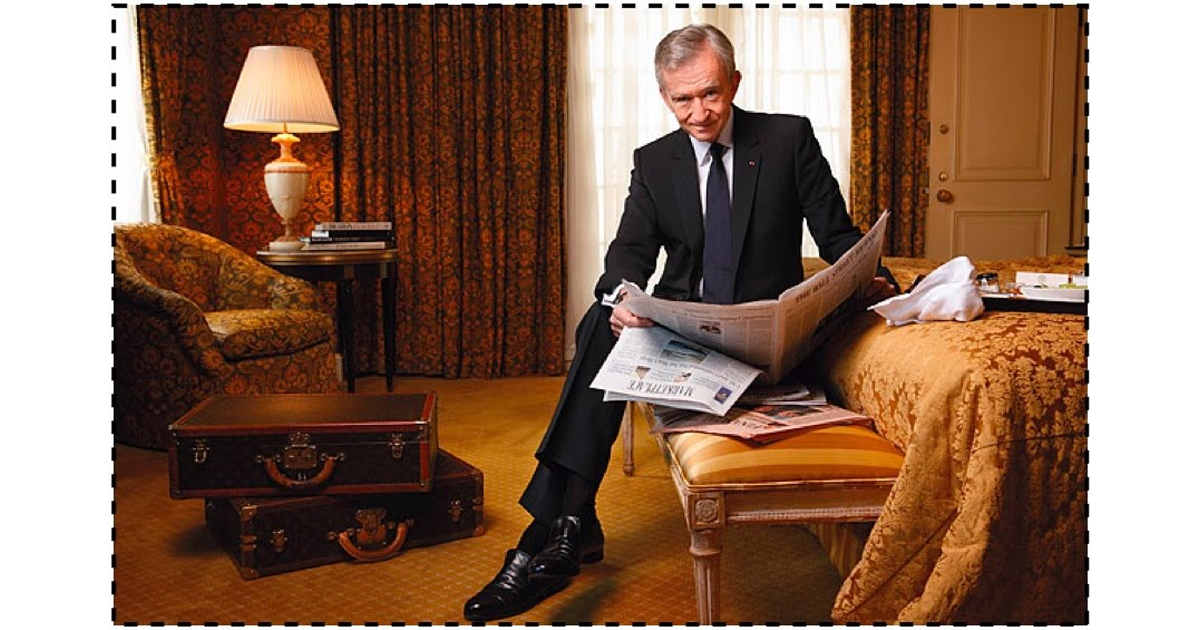

Bernard Arnault Becomes The Fourth Richest Man In The World

Capitalism’s global conquest continues as entrepreneurs around the globe mint fortunes in everything from cryptocurrencies to telecom to fashion. Louis Vuitton (LVMH) maker, Chairman and CEO, Bernard Arnault, has overtaken Zara founder, Amancio Ortega, to become the fourth richest man in the world! According to recent numbers, Amancio’s net worth stands at $ 70.7 billion! The last couple of months have had a lot of ups and downs for the filthily rich people of the world.

With the new numbers, this Frenchman is not only the fourth richest man in the world but is also the richest man in all of Europe. With around 2,208 billionaires from over 72 countries, including the first ever from Hungarian and Zimbabwe, this elite group is now worth around $ 9.1 trillion. This astounding number was marked up by 18% as compared to last year’s net worth!

Their average net worth is a record $ 4.1 billion. Americans lead the way with a record 585 billionaires, closely followed by China, with 373 billionaires. Centi billionaire Jeff Bezos secures the list’s top spot for the first time, becoming the only person to appear on the list with a 12 figure fortune. Bezon’s fortune leapt up by more than $ 39 million, moving Bill Gates to the second position.

The list has 259 newcomers on the list including the first ever cryptocurrency billionaires, two Canadians whose toy company is right behind Hatchimals and PAW Patrol, two Americans who founded the online retailer Wayfair and a 35 year old heiress who runs In N Out Burger. With Bernard Arnault joining the ranks, there is a definite change in the way the world is growing. The year 2018 is clearly progressing towards innovation, progression and excellence.

With every new addition to the billionaires’ list, the mysteries of the world are revealed one page a time. With Bill Gates moved to the second position on the list and Bernard Arnault becoming a part of it, the list for this year is surprising, to say the least!

Funding

Dazzl Raises $3.2M Seed Funding Led by OYO’s Ritesh Agarwal for AI Skincare Expansion

Bengaluru, January 13, 2026 Dazzl, the D2C beauty startup revolutionizing AI personalized skincare India, secured $3.2 million in seed funding led by OYO founder Ritesh Agarwal’s venture arm. Co-investors include Snapdeal’s Rohit Bansal and Fireside Ventures, valuing Dazzl at $15 million post-money. Founded in 2024 by IIT alumni Priya Singh and Arjun Mehta, the app uses smartphone scans for custom serums, boasting 50,000+ users and ₹5 crore ARR amid India’s $25 billion beauty market surge.

Ritesh Agarwal praised Dazzl’s tech: “Personalization is beauty’s future, like OYO’s guest model.” Funds target R&D for 100+ skin profiles, Gujarat manufacturing under PLI, Instagram/Nykaa campaigns, and 50 hires. In a 20% YoY growing sector (Redseer 2025), Dazzl edges Mamaearth and Plum with 95% AI precision, 90% natural formulas, ₹499 kits, 65% retention (vs. 40% avg), and viral TikTok traction in 10 cities.

D2C beauty startup Dazzl tackles regulations via FSSAI compliance, eyeing $10B e-commerce beauty by 2028 and MENA exports. Q2 haircare launches and Series A loom, with Agarwal’s backing signaling unicorn potential for sustainable beauty products India. Dazzl blends AI with clean beauty for 500M+ consumers.

News

Google Launches Startup Hub in Hyderabad to Boost India’s Innovation Ecosystem

Google has launched the Google Startup Hub Hyderabad, a major step in strengthening India’s dynamic startup ecosystem. This new initiative aims to empower entrepreneurs, innovators, and developers by giving them access to Google’s global expertise, mentoring programs, and advanced cloud technology. The hub reflects Google’s mission to fuel India’s digital transformation and promote innovation through the Google for Startups program.

Located in the heart of one of India’s top tech cities, the Google Startup Hub in Hyderabad will host mentorship sessions, training workshops, and networking events designed for early-stage startups. Founders will receive Google Cloud credits, expert guidance in AI, product development, and business scaling, and opportunities to collaborate with Google’s global mentors and investors. This ecosystem aims to help Indian startups grow faster and compete globally.

With Hyderabad already home to tech giants like Google, Microsoft, and Amazon, the launch of the Google Startup Hub Hyderabad further cements the city’s position as a leading innovation and technology hub in India. Backed by a strong talent pool and robust infrastructure, this hub is set to become a growth engine for next-generation startups, driving innovation from India to global markets.

News

BMW’s New Logo Debuts Subtly on the All-Electric iX3: A Modern Evolution

BMW quietly debuted its new logo on the all-electric iX3, marking a significant yet understated shift in the brand’s design direction for 2025. The updated emblem retains the classic roundel and Bavarian blue-and-white colors, but sharp-eyed enthusiasts noticed subtle refinements: the inner chrome ring has been removed, dividing lines between blue and white are gone, and the logo now features a contemporary satin matte black background with slimmer “BMW” lettering. These enhancements showcase BMW’s embrace of modern minimalism while reinforcing their commitment to premium aesthetics and the innovative Neue Klasse philosophy for future electric vehicles.

Unlike rival automakers that reveal dramatic logo changes, BMW’s refresh is evolutionary and respectful of tradition. The new badge ditches decorative chrome and blue borders associated with earlier electric models, resulting in a flatter, more digital-friendly design that mirrors recent branding seen in BMW’s digital communications. Appearing first on the iX3’s nose, steering wheel, and hub caps, this updated identity will gradually be adopted across all BMW models—both electric and combustion—signaling a unified brand language for years to come.

BMW’s strategic logo update represents more than just aesthetic reinvention—it underscores the brand’s dedication to future-ready mobility, design continuity, and a premium EV experience. As the new roundel begins rolling out on upcoming BMW vehicles, it stands as a testament to the automaker’s depth of detail and thoughtful evolution, offering subtle distinction for keen observers and affirming BMW’s iconic status in the ever-changing automotive landscape.

GO88

November 6, 2025 at 8:18 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

谷歌蜘蛛池

November 6, 2025 at 11:16 pm

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

站群程序

November 14, 2025 at 1:42 pm

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

iwin

November 19, 2025 at 1:02 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Kuwin

November 21, 2025 at 1:56 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

MM88

November 24, 2025 at 2:00 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Starda Casino gratis Bonus

December 20, 2025 at 3:52 am

Unser Team hat umfangreiche Erfahrungen in der Gaming-Branche und setzt

sich dafür ein, erstklassige Unterhaltung mit modernster Technologie zu bieten.

Das Casino BetOnRed bietet über 6000 Spiele, darunter Spielautomaten, Tischspiele und Live-Casino-Spiele.

Die App funktioniert mit allen gängigen Betriebssystemen, einschließlich Android, sodass du

ohne Probleme spielen kannst. Es gibt auch mobile Apps für Android- und iOS-Geräte,

sodass du überall spielen kannst. Wir sind bestrebt, eine sichere und

unterstützende Umgebung zu schaffen, damit Sie verantwortungsvoll spielen können. Aber auch für Stammspieler haben wir einen Bonus ohne Einzahlung.

Dies können Boni für das Einladen von Freunden sein, bei

denen Sie für jeden Freund, den Sie mitbringen, einen Bonus

auf Ihr Konto erhalten. Betonred Casino bietet

regelmäßig Sonderaktionen und -angebote an.

Das Treueprogramm kann auch Stufen umfassen, in denen aktivere Spieler zusätzliche Privilegien und Boni erhalten. Zum Beispiel

können 1.000 Punkte in 10 € Bonusgeld oder 20

Freispiele umgewandelt werden. Betonred Casino bietet einen Cashback-Bonus von bis zu 10% auf Ihre Verluste im Monat.

Wenn Sie zum Beispiel 100 € einzahlen, erhalten Sie

zusätzlich 50 € als Bonus.

References:

https://online-spielhallen.de/die-kingmaker-casino-mobile-app-ihr-konigliches-spielvergnugen-fur-unterwegs/

best online gambling australia

December 27, 2025 at 6:48 am

As status increases, players typically receive priority support and tailored promos.

These tools give players the ability to stay in control of their gaming habits.

They’re exploiting players’ trust in real brands to commit fraud.

Support doesn’t answer, bonuses don’t work, and withdrawals are

a lie.

Verification can help ensure real people are writing the reviews you read on Trustpilot.

We use dedicated people and clever technology to

safeguard our platform. Labeled Verified, they’re about genuine experiences.Learn more about other

kinds of reviews. It’s just another imitation pretending to be the original casino.

Overall, this experience has been extremely frustrating and concerning.

Neither their privacy policy, nor their terms of services, nor an imprint tells me

the legal company address and where / under what entity name

they are licensed as casino.

Sent screenshots to support, they replied a day later saying “please wait.”

I… This page is a forged replica of the real brand.

The product itself is criticized for freezing and non-functional features, leading

to a consensus that the platform is unreliable.See more

References:

https://blackcoin.co/skycrown-online-casino-au-pokies-payid-neosurf-fast-payouts/

wedeohire.com

December 29, 2025 at 1:31 pm

paypal casinos online that accept

References:

wedeohire.com

https://spechrom.com/

December 29, 2025 at 2:08 pm

paypal casino online

References:

https://spechrom.com/