News

10 Facts About Elon Musk’s SpaceX Falcon Heavy Rocket

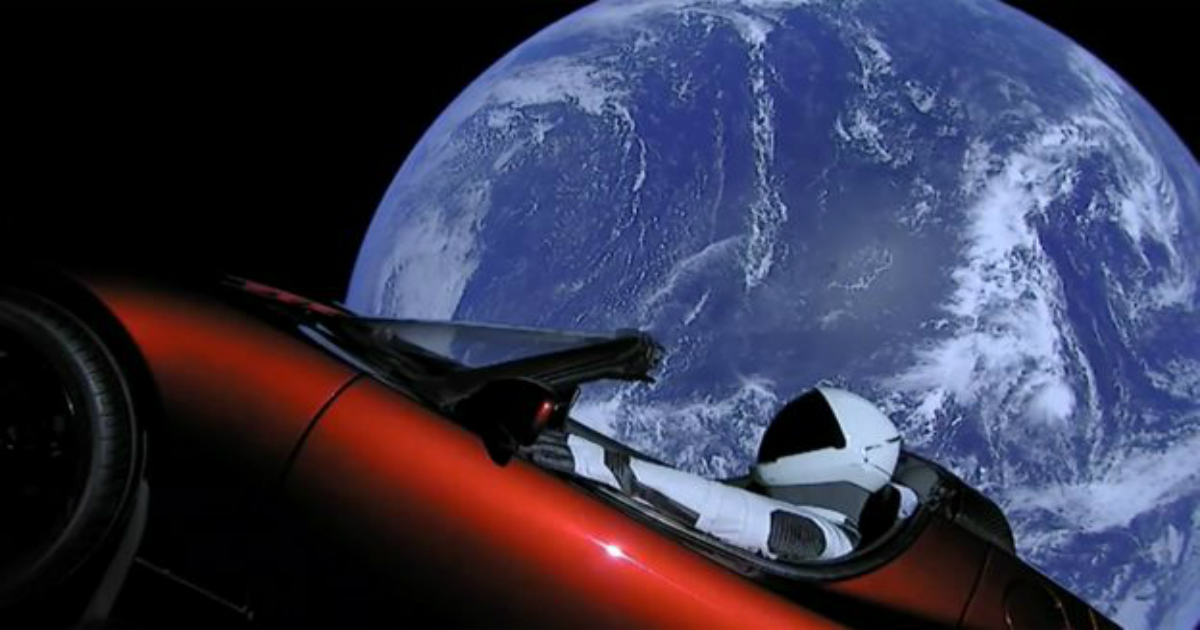

Real life Iron Man, Elon Musk has been featured a lot in the news recently for launching one of the world’s most powerful rockets, Falcon Heavy. SpaceX’ latest rocket blasted off its first test flight carrying a red Tesla roadster along with it. If you have not been able to follow the news or the launch of this iconic rocket, here are 10 facts to bring you up to speed.

1. On February 6, 2018, SpaceX launched it’s Falcon Heavy rocket from Cape Canaveral, Florida, into an orbit that stretches into the asteroid belt.

2. Elon Musk was not sure if the launch would be a success. The launch of the rocket was delayed by three hours citing high winds.

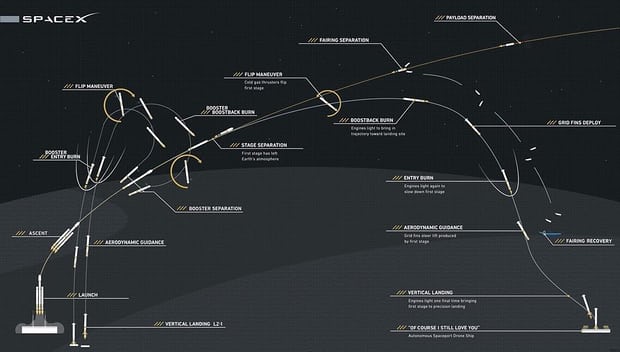

3. After a successful launch, two of Falcon’s rocket cores successfully touched down back on Earth after takeoff. However, the middle core of SpaceX’s huge rocket missed the drone ship where it was supposed to land. Relighting one of the three engines necessary to land, the center core landed in the Atlantic Ocean.

A graphic showing the path of the Falcon Heavy rocket

4. Falcon Heavy is considered to be the most powerful rocket ever created, since the Shuttle System and second only to the Saturn V rockets, which carried men to the moon during the Apollo era.

5. The Tesla Roadster has the message “Don’t panic!” stamped on the dashboard and David Bowie playing on the speakers. The $100,000 car will cruise through high energy radiation belts, Van Allen belts, that circuit Earth towards deep space.

6. The Tesla cruised through space for a good six hours which was also live streamed by SpaceX. The car was then pushed out towards its elliptical orbit around Mars, once the upper stage’s systems survived being bombarded with all the radiation, firing and pushing the car forward for one last time.

Third burn successful. Exceeded Mars orbit and kept going to the Asteroid Belt. pic.twitter.com/bKhRN73WHF

— Elon Musk (@elonmusk) February 7, 2018

7. Experts along with Elon Musk are still unclear about what will happen to the car. Planetary scientists have been asking about the details regarding the car’s exact orbit to calculate the Tesla’s odds of collision and how long it will actually last in deep space.

8. The successful launch of the Falcon Heavy rocket along with its capabilities of putting objects into deep space and landing back on Earth demonstrates the possibility of creating low production cost rockets and ability to reuse them in the future.

9. The success of this launch makes it easier for governments and businesses to lift massive projects into space or set off deep space missions, marking a major step toward cheaper, more frequent spaceflight programs.

10. Falcon Heavy’s capabilities of putting objects into deep space also opens up avenues for space companies, like Planetary Resources and Deep Space Industries to send their spacecrafts into the asteroid belt. Currently, both the space companies are working on technologies to mine water from asteroids in the near future.

Watch the Elon Musk’s dummy astronaut orbiting Earth in a Tesla in this time lapse video.

Funding

Dazzl Raises $3.2M Seed Funding Led by OYO’s Ritesh Agarwal for AI Skincare Expansion

Bengaluru, January 13, 2026 Dazzl, the D2C beauty startup revolutionizing AI personalized skincare India, secured $3.2 million in seed funding led by OYO founder Ritesh Agarwal’s venture arm. Co-investors include Snapdeal’s Rohit Bansal and Fireside Ventures, valuing Dazzl at $15 million post-money. Founded in 2024 by IIT alumni Priya Singh and Arjun Mehta, the app uses smartphone scans for custom serums, boasting 50,000+ users and ₹5 crore ARR amid India’s $25 billion beauty market surge.

Ritesh Agarwal praised Dazzl’s tech: “Personalization is beauty’s future, like OYO’s guest model.” Funds target R&D for 100+ skin profiles, Gujarat manufacturing under PLI, Instagram/Nykaa campaigns, and 50 hires. In a 20% YoY growing sector (Redseer 2025), Dazzl edges Mamaearth and Plum with 95% AI precision, 90% natural formulas, ₹499 kits, 65% retention (vs. 40% avg), and viral TikTok traction in 10 cities.

D2C beauty startup Dazzl tackles regulations via FSSAI compliance, eyeing $10B e-commerce beauty by 2028 and MENA exports. Q2 haircare launches and Series A loom, with Agarwal’s backing signaling unicorn potential for sustainable beauty products India. Dazzl blends AI with clean beauty for 500M+ consumers.

News

Google Launches Startup Hub in Hyderabad to Boost India’s Innovation Ecosystem

Google has launched the Google Startup Hub Hyderabad, a major step in strengthening India’s dynamic startup ecosystem. This new initiative aims to empower entrepreneurs, innovators, and developers by giving them access to Google’s global expertise, mentoring programs, and advanced cloud technology. The hub reflects Google’s mission to fuel India’s digital transformation and promote innovation through the Google for Startups program.

Located in the heart of one of India’s top tech cities, the Google Startup Hub in Hyderabad will host mentorship sessions, training workshops, and networking events designed for early-stage startups. Founders will receive Google Cloud credits, expert guidance in AI, product development, and business scaling, and opportunities to collaborate with Google’s global mentors and investors. This ecosystem aims to help Indian startups grow faster and compete globally.

With Hyderabad already home to tech giants like Google, Microsoft, and Amazon, the launch of the Google Startup Hub Hyderabad further cements the city’s position as a leading innovation and technology hub in India. Backed by a strong talent pool and robust infrastructure, this hub is set to become a growth engine for next-generation startups, driving innovation from India to global markets.

News

BMW’s New Logo Debuts Subtly on the All-Electric iX3: A Modern Evolution

BMW quietly debuted its new logo on the all-electric iX3, marking a significant yet understated shift in the brand’s design direction for 2025. The updated emblem retains the classic roundel and Bavarian blue-and-white colors, but sharp-eyed enthusiasts noticed subtle refinements: the inner chrome ring has been removed, dividing lines between blue and white are gone, and the logo now features a contemporary satin matte black background with slimmer “BMW” lettering. These enhancements showcase BMW’s embrace of modern minimalism while reinforcing their commitment to premium aesthetics and the innovative Neue Klasse philosophy for future electric vehicles.

Unlike rival automakers that reveal dramatic logo changes, BMW’s refresh is evolutionary and respectful of tradition. The new badge ditches decorative chrome and blue borders associated with earlier electric models, resulting in a flatter, more digital-friendly design that mirrors recent branding seen in BMW’s digital communications. Appearing first on the iX3’s nose, steering wheel, and hub caps, this updated identity will gradually be adopted across all BMW models—both electric and combustion—signaling a unified brand language for years to come.

BMW’s strategic logo update represents more than just aesthetic reinvention—it underscores the brand’s dedication to future-ready mobility, design continuity, and a premium EV experience. As the new roundel begins rolling out on upcoming BMW vehicles, it stands as a testament to the automaker’s depth of detail and thoughtful evolution, offering subtle distinction for keen observers and affirming BMW’s iconic status in the ever-changing automotive landscape.

Iaocmqsh

May 23, 2025 at 4:22 pm

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycrypto casino.

谷歌站群

November 9, 2025 at 4:52 am

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

iwin

November 9, 2025 at 1:58 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

ios超级签

November 13, 2025 at 3:40 am

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

J88

November 15, 2025 at 7:55 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

MM88

November 15, 2025 at 9:41 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

GO88

November 29, 2025 at 5:17 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

MM88

November 30, 2025 at 6:50 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

playfina bonus code gültig

December 20, 2025 at 5:28 pm

Wer könnte einen besseren Wikingerslot entwerfen als der Anbieter Yggdrasil mit

seiner Vorliebe für die nordische Mythologie? Dieser zeichnet

sich durch eine außergewöhnliche Grafik und mehrere typische Bücherslot-Funktionen aus.

Play’n GO hat mit Legacy of Dead einen Bücherslot der

Extraklasse im Sortiment. Der an „Twilight“ erinnernde Vampirslot ist ein zeitloser

Klassiker. In diesem Spielautomaten sind außerdem Tumbling Reels für mehrere Gewinnkombinationen und eine Freispielrunde integriert.

Zwar sind kostenlose Spielautomaten wegen ihrer Einfachheit und

ihres Unterhaltungscharakters sehr beliebt, doch gibt es auch gute Gründe, sich anderen Klassikern zu widmen.

„Der Grund, warum ich diesen Spielautomaten zum ersten Mal kostenlos

gespielt habe, war, weil mir das auffällige Logo

des Spiels ins Auge fiel. Thor, der Gott des Donners, beschert mir die letzte Stufe der Freispiele, ausgestattet mit Rolling Reels, die aufeinanderfolgende Gewinne mit steigenden Multiplikatoren ermöglichen.“ Das

Highlight des Spiels sind für mich aber die Freispiele,

die durch das magische Buch ausgelöst werden.

Wir haben einige uns bekannte Fakten rund um das Thema kostenlose Online Slots zusammengetragen. Dieses System stellt

sicher, dass jedes Spiel fair und völlig zufällig ist, genau wie bei echten Geldspielautomaten.

Auf dieser Seite finden Sie eine Reihe von Filtern und Sortierwerkzeugen, mit denen Sie genau jene Spieltypen und

Spielthemen bestimmen und auswählen können, die Sie spielen möchten. Aus

diesem Grund haben wir für Sie diese Webseiten erstellt, damit Sie die Neuerscheinungen im Bereich der Slot- und

Casinospiele sofort auf einem Blick zur Verfügung haben, so dass Sie schnell diejenigen finden,

die Ihrem Geschmack entsprechen. Und wenn Sie nicht aufpassen sollten, so werden Sie unter Umständen viel Zeit mit Spielen vergeuden, die Sie eventuell gar

nicht spielen wollen. Darüber hinaus bedeutete die Einführung der HTML5-Technologie,

dass wir diese Casino-Inhalte schon seit ein paar

Jahren sogar auf unseren Mobilgeräten spielen konnten, ohne dass die Qualität der Spiele darunter gelitten hätte.

Wenn Sie gerne Online-Slotspiele oder andere Casino-Spiele spielen, so stehen Ihnen gegenwärtig mehr Titel als je zuvor zur Verfügung.

References:

https://online-spielhallen.de/vulkan-vegas-casino-promo-codes-ihr-leitfaden-zu-spannenden-boni/

888 casino bonus code gültig

December 21, 2025 at 12:02 am

Bull Casino behält sich vor, bei jeglichem Verdacht auf missbräuchliche

Nutzung von Bonusangeboten entschieden einzugreifen. Unter Bonusgeld versteht man zusätzliches

Kapital, welches dem Spielerkonto gutgeschrieben wird und das vorhandene Wettbudget aufstockt.

Durch den Willkommensbonus von Bull Casino sichern sich neue Nutzer ein aufgestocktes Guthaben für ihre Sportwetten. Den Willkommensbonus können neue Kunden nach

Belieben entweder im Casino-Bereich oder durch Sportwetten freischalten. Betrieben wird die Marke von der Moody Moose

Limited, einem Tochterunternehmen der Deep Dive Tech B.V., welche ebenfalls die Portale Starsplay, Playboom und Wettenlive verwaltet.

Bull Casino besitzt eine gültige Lizenz der

Glücksspielbehörde von Curaçao und bietet sicheres und reguliertes Spielen gemäß internationalen Standards.

Wenn Sie Hilfe benötigen, wenden Sie sich an offizielle Beratungsstellen wie

die BZgA. Insgesamt bietet Bull Casino ein solides

Angebot in einem sicheren Umfeld, das den Ansprüchen unserer Community gerecht wird.

Die Spielauswahl sowie die attraktiven Bonusangebote sprechen verschiedene Spielertypen an, wobei der Fokus besonders auf

erfahrene Spieler gelegt wird.

Bull Casino bietet ein verlässliches Portfolio an Zahlungswegen an, wobei sämtliche Transfers gebührenfrei abgewickelt werden. Dank dieser Visualisierung lassen sich Spielstatistiken und Aktionen live und übersichtlich

mitverfolgen. Nutzer profitieren bei Disziplinen wie Eishockey,

Basketball, Tennis, Handball und Fußball von animierten Match-Trackern, die den Spielverlauf grafisch abbilden. Zudem können Nutzer hier ihre offenen und abgerechneten Wetten einsehen.

References:

https://online-spielhallen.de/hitnspin-casino-app-reibungsloses-mobile-gaming/

Casino of Gold Paysafecard Auszahlung

December 21, 2025 at 6:22 am

Es ist zwingend erforderlich, einen gültigen Personalausweis oder

Reisepass mit Lichtbild vorzulegen (Führerscheine werden nicht akzeptiert).

Der Eintritt in die Tischspielbereiche des Casinos kostet 17 €, wodurch Sie

einen 30 €-Gutschein erhalten, den Sie in den Restaurants oder zum

Spielen verwenden können. Zu dieser Zeit müssen Besucher

des Casinos 18 Jahre alt sein, die Kleiderordnung einhalten und

einen Ausweis vorlegen. Seitdem hat das Casino de Monte-Carlo in seinen mit Gold verzierten Barockräumen ein breites Spektrum der internationalen Elite empfangen. Im gleichen Zeitraum Sir Winston Churchill

war ein weiterer erfolgreicher Spieler im Casino de Monte-Carlo.

Die Rallye Monte-Carlo wurde ursprünglich von Fürst Albert I.

Die Rallye Monte-Carlo, offiziell Rallye Automobile Monte-Carlo oder liebevoll auch “Monte” genannt,

wird seit 1911 jährlich vom Automobile Club Monaco organisiert und führt durch Monaco und

das südöstliche Frankreich. Trotz des durch das Unternehmen bereitgestellten ultraschnellen,

mobilen Internets, sind die Monegassen bei der Nutzung der neuen Technologie Beobachtungen zufolge noch zögerlich.

Monaco ist der erste Staat, der in Zusammenarbeit mit dem chinesischen Unternehmen Huawei

flächendeckend mit 5G ausgestattet wurde. Hauptausgaben sind Investitionen in den Städtebau und in die Infrastruktur.

Den größten Wirtschaftszweig stellen Unternehmen im Tourismus und Handel,

gefolgt von Banken und dem Finanzsektor im Allgemeinen dar.

References:

https://online-spielhallen.de/verdecasino-deutschland-jetzt-e1-200-bonus-sichern/

King Billy Casino player login

December 26, 2025 at 5:40 pm

Logged incidents and quick recovery practices keep availability high, minimizing downtime

and fragmented sessions. Upload prompts specify acceptable document types and formats,

cutting down on rejections. Independent testing validates RNG integrity and payout conformance, while audit trails document identity checks and withdrawal approvals for predictable turnaround once reviews are

completed. Over time, saved favorites, recent history, and smart filtering make the catalog feel personal yet

easy to navigate. To keep selection meaningful,

the library rotates limited-time spotlights and themed collections that surface relevant clusters during special events.

The library covers everything from timeless pokies to immersive live dealer tables.

Casino Mate features a massive selection of games powered by

top-tier providers like Microgaming, Betsoft, Quickspin, iSoftBet, and

Evolution Gaming. Loyal players are rewarded through Casino Mate’s VIP Rewards Programme, a tiered system that unlocks better

perks the more you play. With a clean, modern interface and smooth performance across all devices,

it’s easy to see why Aussie players keep coming back.

All matched deposit bonuses must be used within 30 days or

will expire. It’s up to you to decide, the only thing that you should know that Casino-Mate is pretty popular

among Australian players.

References:

https://blackcoin.co/casino-game-bank-craps/

premium online gambling

December 26, 2025 at 8:13 pm

We offer our players various bonuses and promotions.

You can use this bonus to try out the casino’s games and see if they

are right for you. This type of bonus allows you to play at the

casino without making a deposit.

Launched in 2018 and operated under a Curacao eGaming licence, the casino combines speed, transparency, and

reliability to provide players with a premium online gambling experience.

We deliver rapid withdrawals, over 6,000 games, and comprehensive payment flexibility

tailored for Australian players. It’s fully mobile-responsive, so you can enjoy all 6,000+ games,

the sportsbook and account management features on the go.

The platform’s intuitive navigation is a breeze to use, allowing users

to filter games by provider, category, or popularity for a truly

tailored experience. The site’s sleek design, intuitive layout, and robust security measures—like SSL encryption—ensure players can enjoy

their experience without worry, making it a trusted name in the fast pay casino realm.

Roblox has an experience creation tool that allows

you to create your own games and share them online.

Roblox is an online video game platform where you can play online with other people from all over the world.

The ROBLOX platform stands apart, but various substitute systems allow users to find comparable gaming activities and creative features alongside social bonding possibilities.

The touch interface goes through special optimization for mobile gaming, which leads to

comfortable gameplay.

Cashman slots action

December 26, 2025 at 9:24 pm

Play without a bonus and become eligible for 25% instant cashback.

“Fair Go Casino is a fair choice for anybody who is looking for a well established casino. So make sure you collect as many comp points as possible and reach out to our customer support crew. Realistic, simulated, and highly exciting, our video poker titles are nothing but a blast!

One of the best features of any no deposit offer or free spins bonus code is how simple they are to claim. These bonuses seem to be rather low in earnings and high in requirements, but the ability to apply multiple makes this a very positive review so far. From the NDB codes to the collection of games, this full review is ready to take a peek behind their screen.

References:

https://blackcoin.co/stake-casino-australia-where-online-thrills-begin/

Mega Moolah

December 26, 2025 at 9:47 pm

You’ll find everything from slots, blackjack and roulette

to baccarat, video poker and even keno. Our selection of free video poker games is one

of the best around. Can you get a royal flush and beat the machine to win this game’s jackpot?

By playing for free you can fully learn the table layout.

The tribe says the Tacoma Emerald Queen boasts a “Vegas-style gambling floor.” The modern design features large, multifloor open spaces connected

by escalators. One of the first and most memorable online slot machines, Cash Splash, was launched in 1998.

This means they are optimized for mobile devices, so you should

be able to play them without any issues on your

iPhone, Android phone, iPad, or any other modern mobile

phone or tablet.

Starburst, Mega Moolah, Gonzo’s Quest – these

are three of the most popular free casino games online.

Yes, they are exactly the same – except for the fact that you can’t win any

real money when playing games for free. There are several tips and tricks to improve how you bet on slot games, weather you’re playing for free or real money.

real money online casinos Australia

December 26, 2025 at 10:09 pm

This helps you follow every detail and supports the

fair-play systems that regulate live dealer casinos. We ranked the best online live

casinos based on the criteria that matter most to you.

Below, we give you our well-researched recommendations for top live dealer sites in Australia based on trust and safety,

bonuses, payment options, and software providers.

With professional dealers, crystal-clear streams,

and interactive features like live chat, they offer an immersive

alternative to standard RNG games. Online live casinos in Australia bring the casino floor to your screen in real time.

Dozens of roulette, baccarat, and blackjack tables are available at

Australian casinos with live dealers. Entertaining and interactive, modern online pokies offer attractive

features like free spins, respins, and multipliers. The games are

classified based on their category (pokies, table games,

card games) but also based on features like Bonus Buy, jackpots, or themes.

We read the terms of individual offers, but also the casino’s general promotional terms to spot any possible undesired details or unfair terms, or affirm the terms are fair

and player-friendly. From the daily and weekly pokie tournaments,

10-level loyalty program (with a $150,000 reward for reaching the top level), to the over 7,000 games and fast live chat support.

When it comes to online casinos, finding the best

bonuses can significantly enhance your gaming experience.

Bitvegas Casino is #1 real money online casinos with a payout speed of under 10 minutes!

Are there any gambling games you can play online for real money?

All the online casinos we recommend payout real money including Wolf Winner, Stellar Spins, Zotabet, King Johhnie, Slots Gallery,

MyEmpire Casino and many more.

References:

https://blackcoin.co/craps_strategie/

Crown Perth luxury resort

December 27, 2025 at 7:50 am

For us Aussie players, this often means a fantastic range of optionstailored

to our local preferences. Whether you’re watching the roulette wheelspin, observing the

dealer shuffle cards in blackjack, or engaging infriendly banter via the live chat, the experience is incredibly seamlessand immersive.

One of the biggest, most underrated wins for us Down Under is theglorious ability to play at RocketPlay casino Australia in our very ownAustralian Dollars (AUD).

Casino games are neatly categorized, searchfunctions are lightning-fast and responsive, and all the importantinformation you could possibly need is always just a click or two away.No more getting lost in a confusing maze

of endless menus – thankgoodness! It’s not just a casino;it’s a vibrant playground for every single type of player,

solidifyingits reputation as a top-tier choice for those who want to Play

& WinBig.

Players receive 20 spins immediately after the first qualifying deposit, with another 20 added each day for the

next four days. Still, they give genuine chances to win while

allowing newcomers to test the platform before making a deposit.

Availability depends on promotions and regional rules, so checking the casino’s promotions page regularly is the best

way to catch them. Rocketplay is fully optimized for mobile, offering smooth performance on both iOS and

Android. The minimum deposit is just $30 AUD, making it accessible for all budgets.

The best Australian online casinos share several characteristics, but

the best of them provide all the following. We’ve investigated and reviewed the top online casinos in Australia

to give you a sense of what to expect. For details search rocketplay no deposit bonus and the full Bonus T&C in your

profile.

References:

https://blackcoin.co/34_best-no-deposit-poker-bonuses-and-free-poker-bankrolls_rewrite_1/

backtowork.gr

December 29, 2025 at 3:58 am

online real casino paypal

References:

backtowork.gr

hrzoom.ca

December 29, 2025 at 4:14 am

gamble online with paypal

References:

hrzoom.ca

momsgram.com

December 29, 2025 at 1:31 pm

casino paypal

References:

momsgram.com

quicklancer.bylancer.com

December 29, 2025 at 2:08 pm

casino avec paypal

References:

https://quicklancer.bylancer.com/profile/duanetroedel63

istihdam.efeler.bel.tr

December 30, 2025 at 4:16 am

online australian casino paypal

References:

https://istihdam.efeler.bel.tr/employer/10-best-online-casinos-for-real-money-december-2025/

https://chefstaffingsolutions.com

December 30, 2025 at 4:32 am

online betting with paypal winnersbet

References:

https://chefstaffingsolutions.com/employer/top-online-casinos-for-real-money/

online casino

February 6, 2026 at 4:09 am

Best Online Casino Bonuses Australia Claim