Latest News

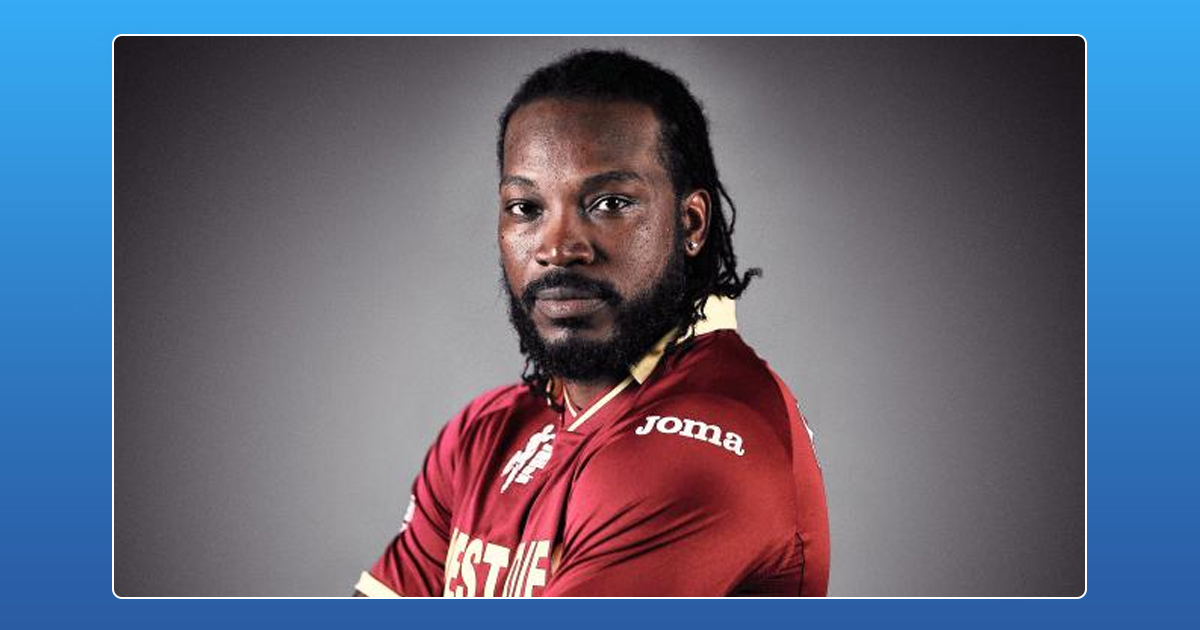

West Indies Cricketer Chris Gayle Invests In AR Startup FlippAR

Known as the most destructive batsman ever, Chris Gayle made a comeback to One Day International (ODI) cricket after a 931 days sabbatical. Along with a grand return to cricket, Gayle has also made a grand entry into the startup ecosystem. The international cricket star has reportedly picked up a minority stake in Bengaluru based augmented reality startup FlippAR.

The former captain will also be endorsing the company along with being a minority stakeholder, although the amount invested by the cricketer has not been revealed. FlippAR was founded by Vivek Jain in January 2016 which provides augmented reality development services to various companies. The app allows users to unlock stories from buildings, monuments and statues from the most popular tourist destinations in Bengaluru such as Lal Bagh, Cubbon Park and MG Road. The company, run by Movingup Products Pvt., Ltd., has a subscription based revenue model which competes with London based visual discovery app Blippar.

The startup, accelerated by the France based program NUMA, was one of the eight startups selected by the Karnataka Government to receive a grant of Rs. 5 lakhs in March. The six employees team currently works for customers in the 16 to 24 age bracket. Gayle will be featuring in a couple of new campaigns that are to be launched soon.

Serial entrepreneur and founder Vivek Jain is an IIM Ahmedabad graduate with over 13 years of experience in the information technology sector. He was also the CEO of the services outsourcing startup StrApp Business Solutions Pvt., Ltd.

This marks the second investment by Chris Gayle in the Indian startup ecosystem. He previously invested in the virtual gaming firm IONA Entertainment also based in Bengaluru, two months ago. Indian startup ecosystem has garnered a lot of interest from multiple Indian cricketers as well. Yuvraj Singh has been actively participating in the startup ecosystem through his investment fund YouWeCan Ventures. Former Indian Captain Sourav Ganguly has also invested in Mumbai based video content discovery platform Flickstree.

Latest News

₹290 Crore Boost: Rozana’s Series B Funding Scales Rural Retail Network Nationwide

Rozana, India’s leading rural retail platform, has secured ₹290 crore ($35 million) in a Series B funding round led by Bertelsmann India Investments (BII), with participation from Omidyar Network India, Vivid Capital, and Tana Investment Holding. This Rozana funding brings its total capital to over ₹500 crore, fueling hyperlocal expansion in underserved rural markets. Founded in 2021 by brothers Prashant and Prateek Chauhan, the startup’s phygital model blends micro-stores, app-based ordering, and last-mile delivery to connect 5 million+ users in 12 states with brands like ITC and HUL.

The ₹290 crore investment will supercharge Rozana’s rural omnichannel retail strategy, targeting 5x growth in 18 months. Plans include adding 5,000 micro-stores in Uttar Pradesh, Bihar, and Rajasthan; AI-powered inventory tech; and new categories like groceries and electronics. By empowering 20,000+ rural micro-entrepreneurs, Rozana taps into India’s $700 billion rural retail boom, where smartphone penetration and UPI drive 12% annual growth.

This Rozana Series B milestone positions it as a frontrunner against rivals like Ninjacart, eyeing unicorn status by 2028 amid ONDC tailwinds. CEO Prashant Chauhan emphasized, “We’re building rural prosperity through accessible premium brands.” For more on Rozana funding news and rural retail trends, stay updated on India’s startup ecosystem.

Latest News

Peak XV New Funds: $1.3B Commitment for India Startup Surge 2026

Peak XV Partners has launched three new funds totaling $1.3 billion, targeting India’s booming startup ecosystem. The lineup features the $600M Surge fund (8th edition) for early-stage ventures, a $300M Growth Fund for Series B+ scaling, and a $400M Acceleration Fund for rapid portfolio expansion. This commitment arrives as India’s VC inflows rebound, with AI and fintech leading 2026 trends.

These funds build on Peak XV’s legacy of backing unicorns like Zomato and Pine Labs, offering founders capital plus strategic guidance amid post-winter recovery. Early-stage deals surged 20% last year per Tracxn, positioning Peak XV to fuel the next wave of innovation in SaaS, climate tech, and consumer plays.

For startups eyeing Peak XV new funds or Surge fund 2026 applications, this signals prime opportunities. Investors and marketers should watch for deployment updates India remains a global VC hotspot.

Latest News

D2C Brand Neeman’s Raises $4 Million for Tier 2/3 Store Expansion & Eco-Friendly Shoes

Hyderabad, January 13, 2026 Neeman’s, India’s leading D2C footwear brand famed for sustainable shoes and patented PIXLL® technology, has raised $4 million from existing investors. This funding boosts its cumulative capital past $10 million since 2015, with a post-money valuation nearing $50 million. CEO Vijay Chahoria emphasized offline retail as the “next frontier,” planning 50+ new stores in Tier 2/3 cities like Jaipur and Lucknow to blend eco-friendly innovation with hands-on customer experiences.

In India’s booming D2C ecosystem where footwear sales hit ₹1.2 lakh crore in 2025 Neeman’s targets hybrid retail amid high online CAC and 25-30% returns. Backed by vegan, machine-washable shoes priced ₹2,000-4,000, the brand leverages PIXLL® (5x more breathable than leather) for carbon-neutral comfort. Recent 5x revenue growth to ₹100 crore ARR, 1M+ pairs sold via Myntra and stores, and awards at India D2C Summit 2025 position it ahead of rivals like Paaduks.

Neeman’s offline expansion India eyes the $15B sustainable footwear market by 2028, fueled by PLI schemes, Gen Z’s 70% eco-preference (Nielsen), and Southeast Asia exports. Challenges like real estate costs are offset by data-driven inventory and omnichannel QR tech. Watch for Q1 2026 launches in Hyderabad and Bengaluru redefining D2C success through authentic, “Wear the Change” branding.

J88

November 6, 2025 at 1:46 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

谷歌蜘蛛池

November 7, 2025 at 3:55 am

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

Kuwin

November 10, 2025 at 2:43 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

站群程序

November 11, 2025 at 4:12 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

iwin

November 15, 2025 at 6:25 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

MM88

November 17, 2025 at 9:45 am

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

GO88

November 20, 2025 at 6:31 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

MM88

November 26, 2025 at 8:24 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.