Entrepreneur Stories

Paul Allen: Remembering This Tech Genius Through His Journey

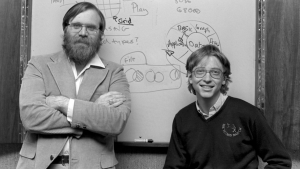

When you think Microsoft, you invariably think of Bill Gates. However, how many times have you stopped to think about Paul Allen, the other man behind one of the most successful tech companies in recent history? While not many know Allen was the reason Microsoft came to be, the history of Allen’s life journey is just as enriching and exciting.

The first seeds of invention

Paul Allen and Bill Gates were friends since they were really young. Growing up, they discussed their dreams and hopes, but never thought they would ever work together as adults. When the time came for them to branch into the world of innovation, invention and creation, it was Allen who came up with the genius idea of him and Gates working together.

Their first ever venture together was way back when they were in school, in the year 1972, when Allen and Gates launched Traf o Data, a software company which analyzed and tracked traffic patterns. Although this project didn’t do as well as the two hoped, it definitely sowed the seeds of a new line of thought for both Paul Allen and Bill Gates. Both of them grew up and went to different colleges, with Allen landing up in Washington State University and Gates going to Harvard.

While Gates lasted a little longer at university, Allen dropped out after the first two years, realising college was not his cup of tea. When Allen found out Gates was looking at creating new software for computers, he suggested they work together and this is how their first successful project, BASIC, came to being. Allen also played an integral role in naming the company Micro-Soft. In fact, he was the one who suggested the name!

By the time Gates and Allen had reached the point of success that propelled Microsoft to the number one position, Allen was already looking at how to market Microsoft’s patent software. When Gates promised the world IBM would change the way personal computers functioned, it was Allen who completed the successful purchase of the software (Quick and Dirty Operating System) which changed the world!

The beginning of the end

Three years after one of the most historically turning points in the journey of Microsoft took place, Allen left Microsoft to focus on his health. He was fighting with Hodgkin’s lymphoma for and his deteriorating health was making it difficult for him to keep with the day to day going ons of Microsoft. Three years after he left Microsoft, Allen started Vulcan, named after the Roman god of fire, making sure personal investments were in order.

Despite struggling with cancer for this long in his life, Allen loved to live life king size. From owning a magnificent yacht to owning more than one prominent sports team, Paul Allen made sure he lived a life where every moment was lived to the fullest. In October 2018, Allen announced he was diagnosed with cancer that came back after a long period of remission and nothing he was doing was really helping him get better.

With Vulcan growing into one of the largest investment firms, Allen has been able to fund several prominent places in Seattle including the city’s Museum of Pop Culture, Washington State University and University of Washington. Also known for being a lover of rock music, Allen also founded a band called The Underthinkers and wrote or co wrote EVERY single song in the 2013 album!

An inspirational man, a dreamer and creator like never before, the day the world lost this tech genius (October 15, 2018,) was a truly sad day. Forever labelled as the day the world lost a brilliant genius, recovering from Paul Allen’s death is not going to be an easy feat. Despite officially leaving Microsoft in the year 1983, Allen stayed on the board of directors till 2000 and when he passed away, he stood as the 44th wealthiest man in the world. Just like Bill Gates mourns the loss of one of his oldest and closest friends, so does the rest of the world.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Kuwin

November 5, 2025 at 11:13 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

J88

November 6, 2025 at 8:16 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

站群程序

November 7, 2025 at 9:22 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

站群程序

November 8, 2025 at 11:34 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

GO88

November 11, 2025 at 4:04 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

MM88

November 16, 2025 at 3:23 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

MM88

November 17, 2025 at 3:17 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

iwin

November 20, 2025 at 12:40 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

beste casino seite 2026

December 21, 2025 at 1:59 pm

Das DrückGlück Casino bietet eine Reihe praktischer Zahlungsmethoden, wie PayPal, Apple Pay und paysafecard.

Viele der Spielautomaten bieten hochwertige Grafiken und

faire Auszahlungsraten – wir empfehlen Wolf Gold oder Fire Joker.

Wer sein Konto bei NetBet erfolgreich verifiziert, erhält 50 Freispiele ohne Einzahlung für Book of Dead.

Folglich sind dies die besten Plattformen zum Thema

bestes Online Casino mit Echtgeld. Da die Vorlieben innerhalb der Spieler variieren, lässt sich die Frage nach dem besten Online Casino in Deutschland

pauschal nicht so leicht beantworten. Danach kannst du

dir unsere beste Online Casino Bewertung zu den führenden Anlaufstellen durchlesen.

Für einige sind Anbieter mit Novoline Spielen die Lösung zum Thema „beste legale Online Casinos“.

Am Ende unseres Beitrags zum Thema beste Online Casinos

Deutschland angekommen, möchten wir noch ein kurzes Fazit ziehen. Fernab der bereits vorgestellten Vorteile

ist es vor allem die sehr große und facettenreiche Spielauswahl,

mit der Lapalingo überzeugt.

In den folgenden Unterabschnitten gehen wir detailliert

auf diese Kategorien ein und stellen die besten Optionen vor.

Die Welt der Online Casinos ist vielfältig und bietet für jeden Spielertyp das passende Angebot.

Lassen Sie uns nun einen genaueren Blick auf die verschiedenen Kategorien der besten Online Casinos in Deutschland werfen.

References:

https://online-spielhallen.de/posido-casino-freispiele-ihr-umfassender-leitfaden/

Best resorts Western Australia

December 27, 2025 at 2:47 pm

In addition, avoid relying on the jolt of energy from

caffeine to try to overcome afternoon sleepiness. Keep an eye on your caffeine intake and avoid it later in the day since it can be a barrier to falling asleep.

Try your best to disconnect for 30 minutes to an hour (or more) before

going to bed.

Avantgarde Casino is fully optimized for mobile gameplay, meaning you can enjoy

a seamless experience whether you’re using an iOS or Android device.

Yes, most slots and table games offer demo mode, so you can test

them risk-free first. Lottery participation boosts with frequent deposits and gameplay, providing extra winning chances

alongside routine play. Weekly cashback returns a percentage of net losses (often 10%) on slots and selected table games.

The experience replicates the atmosphere of premium land-based casinos while adding interactive features unique to online gaming.

These games combine skill-based timing with luck, creating an adrenaline-filled experience that’s perfect for quick gaming

sessions. Fast-paced crash games have become incredibly

popular among our players, and we currently offer 47 different variants

from top providers. “It’s very normal to wake up two to six times per night, often at the end of a sleep cycle or the end of a dream,” she says.

And if you do wake up at night, that doesn’t mean your sleep isn’t

of good quality, she adds. Settling down at bedtime—and in the middle of the night if you

wake up—can be trickier.

References:

https://blackcoin.co/play-21910-free-casino-games-no-sign-up/

paypal casino sites

December 27, 2025 at 5:22 pm

With generous bonuses, a rewarding VIP program,… Spinfest Casino launched in 2024

under an Anjouan license, featuring 11,000 games and a

comprehensive sportsbook. With instant rakeback, a rewarding VIP program, and a full sportsbook, players can e… Winawin is an impressive online casino.

Unfortunately, there is no welcome bonus for crypto us… Shuffle is a simple

online casino that should appeal to beginners.

The site offers a very large sign-up bonus, regular re… The welcome bonus is

smaller than many rival offers, but the wagering req…

Rocketpot offers a user-friendly casino, sportsbook and poker room rolled into one.

It has a smaller range of games than some sites, but

there are stil… You can play thousands of games, including a selection of Razed Originals.

After completing the registration process,

deposit the crypto you bought into the casino’s account.

Once you have cryptos, the next step is to create an account with

the bitcoin casino. Naturally, the best place to start

is one of our recommended bitcoin casinos. Of course, your average Joe is probably not tech-savvy enough to

do so, but there are plenty of very clever players in the crypto community

who are inclined to make the effort. These crypto games require sharp reflexes

and nerves of steel. Some UK gamblers, who crave the buzz and atmosphere of the casino floor,

prefer Live Dealer games.

References:

https://blackcoin.co/27_best-high-roller-bonus-casinos-2022_rewrite_1/

clarahouse.kr

December 29, 2025 at 8:35 am

casino online uk paypal

References:

clarahouse.kr

inprokorea.com

December 29, 2025 at 8:42 am

casino con paypal

References:

http://inprokorea.com/bbs/board.php?bo_table=free&wr_id=2751037

https://hirekaroo.com/companies/the-10-most-popular-online-casino-games

December 30, 2025 at 1:42 pm

casino sites that accept paypal

References:

https://hirekaroo.com/companies/the-10-most-popular-online-casino-games/

https://ispd.org

December 30, 2025 at 1:54 pm

casino mit paypal einzahlung

References:

https://ispd.org/?post_type=dwqa-question&p=43154

fpafmjujf

January 13, 2026 at 3:56 am

Bij SlotsRank zijn we trots op onze internationale autoriteit en expertise op het gebied van gokcasino’s, vooral als het gaat om spellen als Sugar Rush. We beoordelen elk casino dat deze populaire gokkast aanbiedt nauwgezet, om ervoor te zorgen dat onze aanbevelingen betrouwbaar zijn en tegemoetkomen aan uw behoeften. Wij geloven in het bieden van een transparant en eerlijk overzicht aan spelers, zodat je weloverwogen beslissingen kunt nemen over waar je Sugar Rush kunt spelen. Bij online casino’s in Nederland heb je geen beschikking over Auto-Play en Bonus-Buy bij Sugar Rush, we hebben er dus ook voor gekozen om deze twee extra functionaliteiten uit deze online gokkast te halen. De gratis slot van Pragmatic Play is op deze pagina alleen te spelen in de Engelse taal. Voor de Nederlandse versie raden we aan om een speelaccount aan te maken bij een legale kansspelaanbieder, de minimum leeftijd is 18 jaar.

https://www.peugeotavila.com/nv-casino-review-een-duik-in-een-top-online-casino-voor-nederlandse-spelers/

Over several months, rehearse, perform, write songs, and promote your band to outshine the competition. Designed by Jackie Fox of The Runaways and illustrated by Jennifer Giner, this board game is for 2 to 5 players, ages 14 and up, with sessions lasting 45 to 90 minutes. Veel spellen vallen onder de categorie denkspellen, en er zijn een aantal leuke categorieën waaruit je kunt kiezen. Kaartspellen, zoals Solitaire Classic, zijn een goed startpunt. Bij dit spel moet je een set kaarten in een bepaalde volgorde afmaken. Hiervoor moet je nadenken over alle zetten die je tijdens het spel doet. De cijfers maakten deel uit van een Maart omzet verslag uitgebracht door de Pennsylvania Gaming Control Board op maandagochtend, maar meer over dat later. Sugar rush bonusronen gratis spins mansion Casino’s welkomstaanbod is ontworpen om geschikt te zijn voor verschillende soorten spelers, kun je jezelf beschermen tegen onnodige verliezen en je kansen op succes vergroten.