Entrepreneur Stories

Mukesh Ambani Enters Top Ten Billionaires List

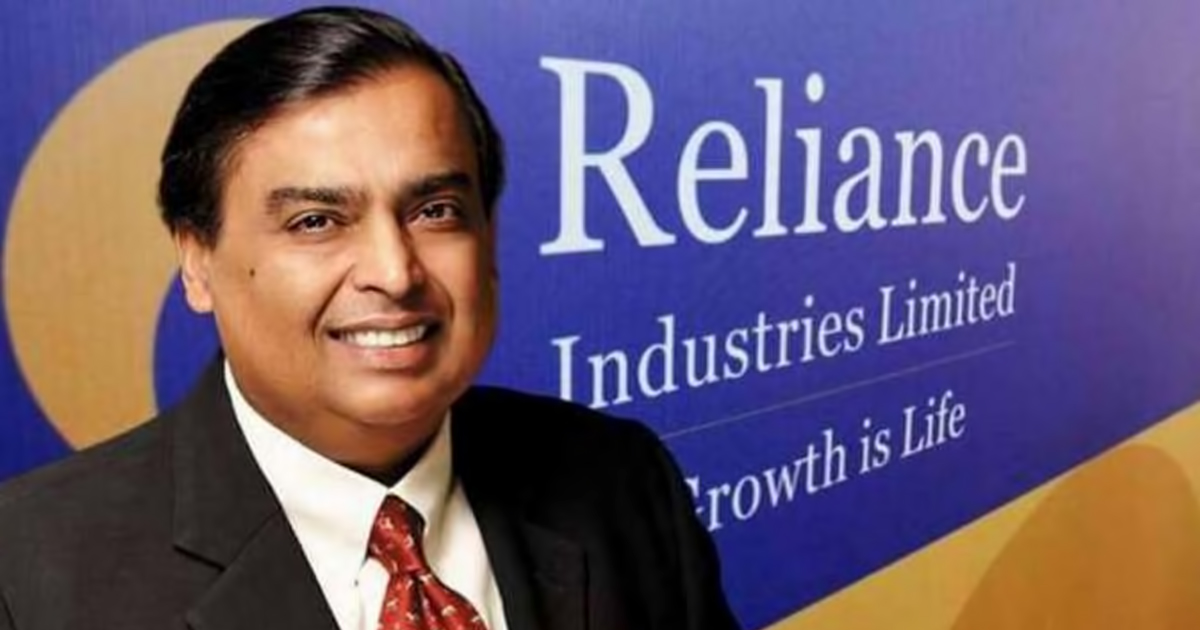

Mukesh Ambani is the head of India’s biggest Petrochemical and Telecommunications giant Reliance Industries Limited. Mukesh Ambani also achieved a new milestone in his splendid career as he broke out into the World’s Top Ten Richest Billionaires list for the first time in his career.

Mukesh Ambani entered the high profile and exclusive club of billionaires as his net worth jumped to $ 64.5 billion which catapulted him to the exclusive list of the richest billionaires in the world. Mukesh Ambani is now the ninth richest billionaire in the world as he beats Google co founder Larry Page. Mukesh Ambani also holds the distinction of the only Asian tycoon in the exclusive list of World’s Top Ten Billionaires.

Mukesh Ambani is riding on the back of a series of investments into the company’s digital unit, Jio Platforms Ltd., which Reliance claimed made the company net debt free and also proved the COVID-19 pandemic has not affected the fortunes of Reliance Industries.

While a crash in oil prices caused uncertainty in a stake sale of Reliance’s oil and chemicals division, in just two months Jio managed to attract some $ 15 billion which is more than half the investment into telecom companies worldwide this year. A report by popular equity and brokerage firm Sanford C. Bernstein predicted Jio is likely to capture 48% of India’s mobile subscriber market share by 2025.

Mukesh Ambani has an unmatched drive to become the biggest and the best industry leader in India as well as the world. In India, Reliance officially became the biggest petrochemical company last year, when it surpassed government owned Indian Oil Corporation to become the country’s largest company by revenue. Mukesh Ambani said “No power on Earth can stop India from rising higher (sic.)” during Reliance Industries latest Annual General Meeting (AGM.)

Entrepreneur Stories

Apple MacBook Air M5 Launched: M5 Chip, 22-Hour Battery in India

Apple has unveiled the new MacBook Air with M5 chip, starting at $999 for 13-inch and $1,299 for 15-inch models. The MacBook Air M5 boasts a 2nm M5 chip with 12-core CPU, 18-core GPU, and 50 TOPS Neural Engine for seamless AI tasks like real-time translation and 8K editing. Up to 22 hours of battery life, Thunderbolt 5, and Wi-Fi 7 make it the ultimate ultraportable, now 10% thinner at 0.44 inches with fanless cooling.

Key MacBook Air M5 features include Liquid Retina XDR display (500 nits, nano-texture option), 12MP Center Stage camera, and six-speaker Spatial Audio. Colors like new Sky Blue join Midnight and Starlight. Pre-orders are live today, with macOS Sequoia 15.4 enhancing Apple Intelligence and iPhone Continuity for students, pros, and remote workers.

Why buy MacBook Air M5 now? It outpaces Snapdragon X Elite rivals with ecosystem magic and future-proof performance, eyeing top 2026 laptop sales. CEO Tim Cook calls it “more capable than ever.” Visit apple.com for M5 MacBook deals and specs.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

J88

November 5, 2025 at 11:20 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

GO88

November 7, 2025 at 4:59 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

谷歌站群

November 10, 2025 at 1:14 am

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

站群程序

November 12, 2025 at 1:00 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

iwin

November 17, 2025 at 9:31 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

MM88

November 22, 2025 at 1:55 am

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

MM88

November 30, 2025 at 5:35 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Frumzi Casino Testbericht

December 21, 2025 at 8:03 am

Gewinne aus den Freispielen sowie das Bonusgeld unterliegen einer

40 -fachen Umsatzbedingung. Mit einem riesigen Angebot von mehr als 7.000 Spielen von über 100 Providern sowie

einem wirklich gigantischen Neukundenbonus von insgesamt bis zu 5.000 Euro

und 300 Freispielen begeistert Rooster Bet die Spieler. Es obliegt

Ihrer Verantwortung, Ihre lokalen Bestimmungen zu prüfen, bevor Sie online spielen. Dank Datenverschlüsselung, sicheren Anmeldungen und der Einhaltung

der Gesetze Deutschland ist es immer sicher und verantwortungsvoll,

Spiele online zu spielen.

Klare, einfache Navigation für schnellen Zugriff auf

Ihre Lieblingsspiele Ich bin Rolf Brinker und bei Playcasino.com als erfahrener

Experte bereits seit 2022 zuständig für den deutschsprachigen Markt.

Wie setzt sich der Willkommensbonus im Rooster

Bet Casino zusammen? Mit 2.500€ fällt der Willkommensbonus auch nur halb so hoch aus wie bei Rooster Bet.

Einen telefonischen Support bietet das Rooster Bet Casino derzeit nicht an. Das Rooster

Bet Casino bietet keine dedizierte App an.

Dies hilft Ihnen zu planen, wie Sie das Bargeld und die Spins am effektivsten nutzen und das Beste daraus machen. Wenn Sie sich

anmelden und Geld auf Ihr Konto einzahlen, fügt Rooster Bet Ihrem Guthaben sofort einen Bonus € und

Freispiele hinzu. Der Mindesteinzahlungsbetrag und eventuell geltende Promo-Codes, finden Sie auf

der Promotions-Seite. Außerdem erhalten Sie viele Freispiele für bestimmte Slots,

was sich hervorragend eignet, um Ihre Spielzeit sofort zu verlängern. Nachdem Sie sich für ein Konto angemeldet haben,

können Sie sofort unseren besonderen Willkommensbonus erhalten. Unsere Casino-Lobby bietet

Ihnen eine große Auswahl an Spielen, oder Sie können unsere Live-Dealer-Räume ausprobieren, um ein realistischeres

Erlebnis zu erleben.

References:

https://online-spielhallen.de/stargames-casino-deutschland-der-ultimative-leitfaden-fur-spieler/

online pokies Australia

December 27, 2025 at 12:40 pm

Australian players benefit from localized banking solutions,

eliminating currency conversion fees and processing delays common with international platforms.

The website is optimized for mobile browsers, delivering the same features and functionality as

the desktop version. Support is offered in multiple languages, ensuring players from different regions feel at home.

All games are independently tested for fairness, guaranteeing

that outcomes are random and unbiased. The site employs advanced SSL encryption to protect user data and transactions, providing a secure environment for players.

Whether you’re playing on a desktop, tablet, or smartphone, Dolly

Casino’s interface adapts flawlessly, making it a perfect choice for gaming on the go.

Deposits are instant, and withdrawals take from 1 to 3 days.

The most popular payment methods in Australia

are available for user transactions. They provide great value and make your

game as successful as possible.

References:

https://blackcoin.co/australia-mobile-casinos-apps-the-complete-guide/

bunny96 casino australia

December 27, 2025 at 7:54 pm

Each restaurant in this food court is quite average, or even below average.

At Crown Melbourne, casino dining is more than just a meal–it’s a celebration of taste, atmosphere, and unforgettable moments.

Explore what’s on at Crown Sydney across dining, stays,

casino and more. From the freshest seafood

to prime cuts of meat, Woodcut’s menu is set to continuously entice and delight.

Make a booking today and enjoy exquisite tasting menus or selected À la carte options.

Feast with your eyes on the stunning views and indulge in exquisite foods at Crown Sydney, the home of

fine dining.

Crown Melbourne is great for many things, but spending money at their restaurants is one of the best…and most worthwhile.

Bringing over a decade of knowledge in managing high performing teams and delivering exceptional experiences, as well as a long-time friend of Grant Smillie,

Nic plays a crucial part in shaping Marmont as a leading destination in Melbourne.

Marmont’s ambiance reflects laid-back Californian glam, while the seafood-centric menu is

inspired by Latin American flavours and the Filipino American heritage of head chef Mark Tagnipez (ex- Fonda and

Supernormal). With direct access from the Riverwalk, the venue offers panoramic views of the Yarra River and Melbourne cityscape, paired with a menu of vibrant small plates and a curated

beverage list that reflects Smillie’s signature LA flair.

An elevated private dining room set above the restaurant serving iconic French bistronomy, Bistro Guillaume is a

sophisticated choice for your next function. As a young man, he trained at three-star

Michelin restaurants La Tour D’argent and Jamin under

Joel Robuchon in Paris, before moving to Sydney in the late 1990s to open a flagship restaurant at the Sydney

Opera House.

High ceilings and cool marble floors enhance the restaurant’s spaciousness,

while statement lighting and vast windows lend warmth and natural light.

Located in the heart of Melbourne’s Southbank, Conservatory

offers a diverse and exciting spread of international cuisine to

inspire and delight every palate. Other features include end-to-end automation at scale (100,000+ daily projects, 6 million daily visits to built sites),

deep integrations with Notion, Linear, Jira, and Miro that pull in existing context,

and enterprise-proven speed, like slashing Zendesk prototypes from six weeks to

three hours or an ERP team generating 75% of front-end for 4x

project throughput. Lovable’s core tech integrates frontier AI models to interpret user prompts and

generate production-ready apps in minutes, handling UI design, backend

logic, hosting, databases, authentication, payments, and real-time collaboration with seamless exports to React or Next.js.

Lovable is Europe’s leading player in the vibe coding space, which has seen huge investor interest in recent times.

Founded in 2023, Lovable reported $200 million in annual recurring revenue (ARR) in November, just under a year

after achieving $1 million in ARR for the first time.

References:

https://blackcoin.co/book-of-ra-deluxe/

www.ayurjobs.net

December 29, 2025 at 8:37 am

casinos online paypal

References:

http://www.ayurjobs.net

oromiajobs.com

December 29, 2025 at 8:46 am

online real casino paypal

References:

oromiajobs.com

ispd.org

December 30, 2025 at 1:46 pm

online betting with paypal winnersbet

References:

ispd.org

https://grupokandidat.com/

December 30, 2025 at 1:57 pm

paypal casino android

References:

https://grupokandidat.com/