Latest News

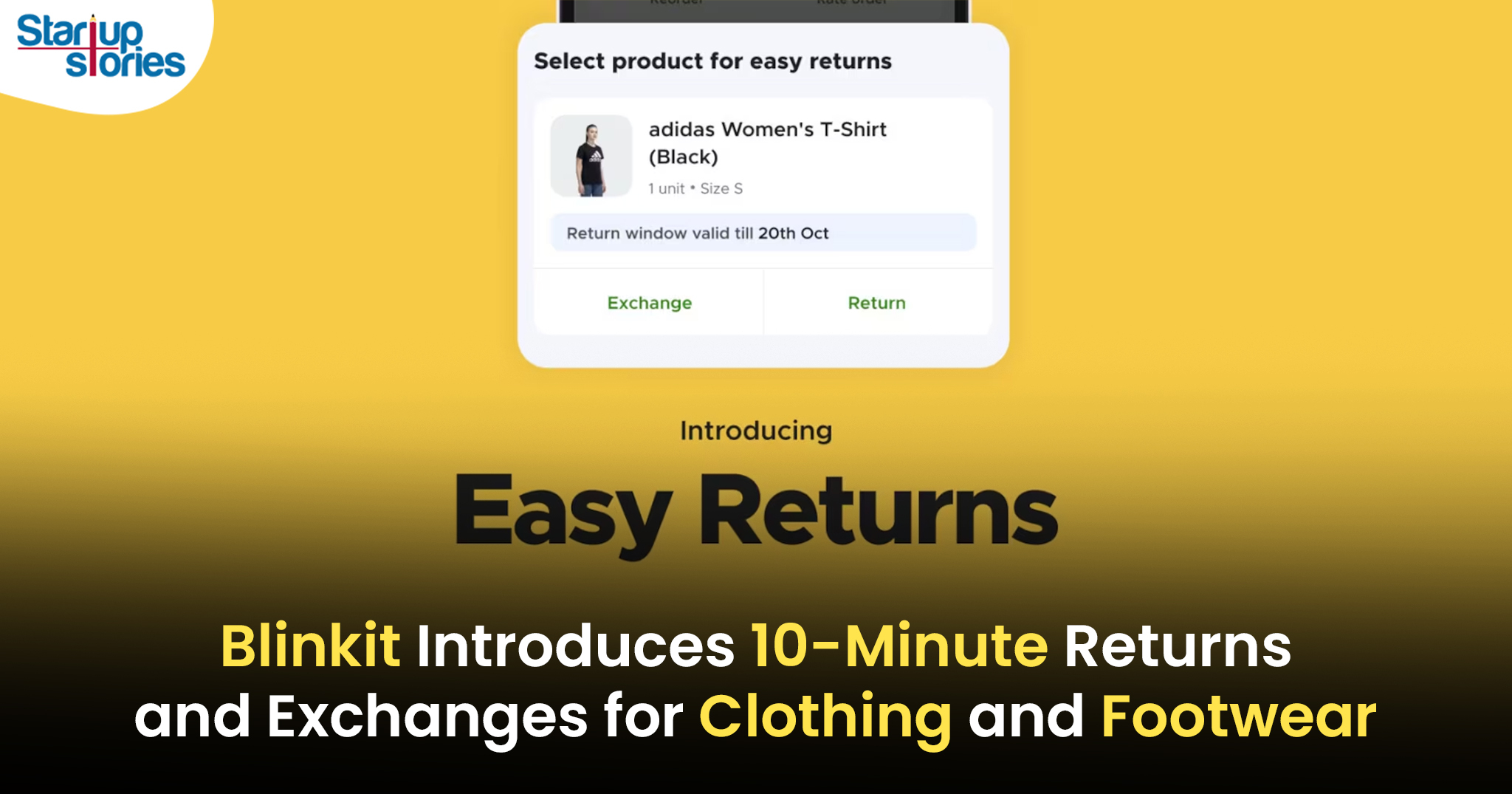

Blinkit Launches 10-Minute Returns and Exchanges for Clothing and Footwear!

Blinkit, known for pioneering 10-minute grocery delivery, has now extended its rapid service model to returns and exchanges. The company has introduced 10-minute returns and exchanges for categories like clothing and footwear, aiming to resolve size or fit-related issues quickly and effortlessly for customers.

10-Minute Returns and Exchanges Now Live in Major Cities

After a successful pilot in Delhi-NCR, Blinkit has launched this feature across major cities, including Mumbai, Bangalore, Hyderabad, and Pune. More locations are expected to follow soon.

CEO Announcement

CEO Albinder Dhindsa announced the new feature on social media, stating:

“The cool part—return or exchange will happen within 10 minutes of raising a request! We’ve been testing this in Delhi-NCR and have now enabled it for Mumbai, Bangalore, Hyderabad, and Pune.”

This service aims to address “size anxiety,” a common issue for customers shopping online, offering them greater convenience and confidence when purchasing clothes and shoes.

New GST Invoicing Feature for Business Customers

In addition to its instant returns, Blinkit has also introduced a GST invoicing feature targeted at businesses making high-value purchases. This update allows companies to add their GSTIN (Goods and Services Tax Identification Number) during checkout and claim input credits of up to 28% on eligible products, such as electronics.

How the GST Invoicing Feature Works:

- Add GSTIN: During checkout, customers can select the “Add GSTIN” option within the Blinkit app.

- Generate Invoice: Once the GSTIN is added, a GST-compliant invoice is automatically generated.

- Claim Input Credit: Businesses can use the invoice to claim input credits of up to 28%, depending on the product category.

Dhindsa emphasized the importance of this feature for businesses, especially those making bulk or high-value purchases, by helping them reduce costs through tax credits.

Competitive Landscape

With these new offerings, Blinkit is solidifying its reputation for speed, innovation, and customer-centric solutions, catering to both individual shoppers and business customers alike. The introduction of 10-minute returns positions Blinkit in direct competition with traditional e-commerce platforms that often have longer return timelines.

Market Trends

The quick commerce sector is rapidly evolving, with players like Blinkit expanding their offerings beyond groceries to include apparel and electronics. This trend reflects a broader shift in consumer expectations for faster service across all categories. As quick commerce platforms diversify their product ranges, they are increasingly blurring the lines with traditional e-commerce.

Conclusion

Blinkit’s introduction of 10-minute returns and a GST invoicing feature marks a significant advancement in customer service within the quick commerce space. By addressing common pain points like size anxiety and providing valuable tax benefits for businesses, Blinkit enhances its appeal to a wide range of consumers.

As the company continues to innovate and expand its services, it is poised to capture a larger share of the market while setting new standards for speed and convenience in online shopping. With plans for further expansion into additional cities and categories, Blinkit is well-positioned to lead the charge in transforming how consumers shop online.

Latest News

Peak XV New Funds: $1.3B Commitment for India Startup Surge 2026

Peak XV Partners has launched three new funds totaling $1.3 billion, targeting India’s booming startup ecosystem. The lineup features the $600M Surge fund (8th edition) for early-stage ventures, a $300M Growth Fund for Series B+ scaling, and a $400M Acceleration Fund for rapid portfolio expansion. This commitment arrives as India’s VC inflows rebound, with AI and fintech leading 2026 trends.

These funds build on Peak XV’s legacy of backing unicorns like Zomato and Pine Labs, offering founders capital plus strategic guidance amid post-winter recovery. Early-stage deals surged 20% last year per Tracxn, positioning Peak XV to fuel the next wave of innovation in SaaS, climate tech, and consumer plays.

For startups eyeing Peak XV new funds or Surge fund 2026 applications, this signals prime opportunities. Investors and marketers should watch for deployment updates India remains a global VC hotspot.

Latest News

D2C Brand Neeman’s Raises $4 Million for Tier 2/3 Store Expansion & Eco-Friendly Shoes

Hyderabad, January 13, 2026 Neeman’s, India’s leading D2C footwear brand famed for sustainable shoes and patented PIXLL® technology, has raised $4 million from existing investors. This funding boosts its cumulative capital past $10 million since 2015, with a post-money valuation nearing $50 million. CEO Vijay Chahoria emphasized offline retail as the “next frontier,” planning 50+ new stores in Tier 2/3 cities like Jaipur and Lucknow to blend eco-friendly innovation with hands-on customer experiences.

In India’s booming D2C ecosystem where footwear sales hit ₹1.2 lakh crore in 2025 Neeman’s targets hybrid retail amid high online CAC and 25-30% returns. Backed by vegan, machine-washable shoes priced ₹2,000-4,000, the brand leverages PIXLL® (5x more breathable than leather) for carbon-neutral comfort. Recent 5x revenue growth to ₹100 crore ARR, 1M+ pairs sold via Myntra and stores, and awards at India D2C Summit 2025 position it ahead of rivals like Paaduks.

Neeman’s offline expansion India eyes the $15B sustainable footwear market by 2028, fueled by PLI schemes, Gen Z’s 70% eco-preference (Nielsen), and Southeast Asia exports. Challenges like real estate costs are offset by data-driven inventory and omnichannel QR tech. Watch for Q1 2026 launches in Hyderabad and Bengaluru redefining D2C success through authentic, “Wear the Change” branding.

Latest News

Centre Mulls Revoking X’s Safe Harbour Over Grok Misuse

The Centre is weighing the option of revoking X’s safe harbour status in India after its AI chatbot Grok was allegedly misused to generate and circulate obscene and sexually explicit content, including material seemingly involving minors. The IT Ministry has already issued a notice to X, directing the platform to remove unlawful content, fix Grok’s safeguards, act against violators, and submit a detailed compliance report within a tight deadline. If the government finds X’s response inadequate, it could argue that the platform has failed to meet due‑diligence standards under Indian law, opening the door to harsher action.

Under Section 79 of the IT Act, safe harbour protects intermediaries like X from being held directly liable for user‑generated content, provided they follow due‑diligence rules and promptly act on legal takedown orders. Revoking this protection would mean X and its officers could be exposed to criminal and civil liability for obscene, unlawful, or harmful content that remains on the platform, including AI‑generated images from Grok. This prospect significantly raises X’s compliance risk in India and could force tighter moderation, stricter AI controls, and more aggressive removal of flagged posts.

The Grok episode also spotlights the regulatory grey zone around generative AI, where tools can create harmful content at scale even without traditional user uploads. Policymakers are increasingly questioning whether AI outputs should still enjoy the same intermediary protections as conventional user posts, especially when they involve women and children. How the government ultimately proceeds against X over Grok misuse could set a precedent for AI accountability, platform responsibility, and safe harbour interpretation in India’s fast‑evolving digital ecosystem.

Registrieren

August 27, 2025 at 1:22 am

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me? https://www.binance.info/en/register?ref=JHQQKNKN

S'inscrire sur Binance

September 9, 2025 at 7:02 am

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

binance doporucení

September 10, 2025 at 7:12 pm

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

en iyi binance referans kodu

September 14, 2025 at 9:53 pm

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. Deschidere cont Binance

iwin

November 7, 2025 at 5:07 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

站群程序

November 10, 2025 at 11:16 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

Kuwin

November 10, 2025 at 6:57 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

GO88

November 11, 2025 at 4:42 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

谷歌蜘蛛池

November 12, 2025 at 9:30 pm

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

MM88

November 23, 2025 at 7:47 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

J88

November 26, 2025 at 1:18 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Dolly Casino Bonus Code

December 21, 2025 at 7:09 pm

Der Willkommensbonus für neue Spieler gehört zu den besten in der Branche und sorgt dafür, dass Neulinge sofort einen starken Start ins Spielvergnügen haben. WSM

Casino bietet eine breite Palette attraktiver Bonusangebote, die sowohl neue als auch bestehende Spieler begeistern. Diese Spiele bieten einzigartige Gewinnchancen und eine

spannende Alternative zu den klassischen Casino-Spielen. Die Vielfalt der Spielautomaten wird durch regelmäßige

Turniere und Wettbewerbe ergänzt, die zusätzliche Spannung und Gewinnmöglichkeiten bieten. Viele Automaten basieren auf beliebten Filmen, TV-Serien oder

historischen Themen und bieten dadurch eine zusätzliche Unterhaltungsebene.

Ich hatte Zugriff auf meine Lieblingsspiele,

konnte Einzahlungen vornehmen und die Bonusangebote

nutzen. Das WSM Casino bietet keine native App für iOS und Android an. Das

WSM Live Casino bietet eine Auswahl an beliebten Casinoklassikern von den Software-Anbietern Evolution, Betgames TV, Onetouch und Bombay Live.

Es überraschte mich, dass es keine Kategorie für Tischspiele gibt.

Die Spieleauswahl enthält Games der Kategorien Slots, Live-Games,

Crypto-Games und Crash-Spiele.

Viele Spieler nutzen die mobile Version direkt über den Browser – für weitere Informationen über die Nutzung unterwegs,

besuche die WSM Casino App Seite. WSM Casino bietet wöchentlichen Cashback von bis zu 25 %

auf verlorene Beträge. Jede Woche können Spieler im WSM Casino 50

Freispiele erhalten, wenn sie zwischen Montag und Donnerstag eine

Einzahlung von mindestens 30 Euro tätigen. Der Willkommensbonus

beträgt 100 % der ersten Einzahlung bis maximal 500 Euro.

References:

https://online-spielhallen.de/willkommen-bei-monro-casino-ihr-einfacher-login/

online casino Australia

December 26, 2025 at 7:04 pm

So, this is the section where I tested most of the games, and my favourite turned out to be

Wild Witches. You’ll get a pop-up message to enable the

notifications on your phone, and once you do, you’ll get 20 free spins with no

deposit required. All of these offers have wagering requirements

ranging from 30x-40x (except for the cashback),

and each one requires a different bonus code.

I want to dedicate a huge portion of my review to

Stay Casino’s bonuses, so I’ll get on it right away.

Great game library with 4,000+ games in total? While you can filter the games by provider, you only see the provider icons, so you’re supposed to know which icon belongs to which provider.

On our site, we have compiled all the crucial information about

the best online casinos where you can play for real money.

Our team has years of experience reviewing hundreds of real money

online casinos in Australia, so we know a thing or two about the best places

to gamble safely. Discovering the best online gaming with

top software providers that power Australian real money online casinos

is easy with Casino Buddies. Using real money casino bonuses can really

boost your online gambling experience. Promotions are another

strong suit of AU online casinos – you get to pick between deposit matches, free spins,

VIP rewards, cashback offers, birthday promotions, and more.

Casino bonuses are worth it, as these welcome bonus offers allow you to play casino games

often with house money (such as at BetMGM and Caesars).

Some games can be immersive, and you can easily lose track of

time. When you’re gambling online, an unstable connection is problematic, so

I suggest upgrading your plan or switching providers if

your internet isn’t stable. No round-trip to casinos, no dressing up, and you don’t even need to be on a PC.

This is a variety that you won’t find in land-based casinos.

When given a choice, I would choose playing at an actual casino

10 out of 10 times.

References:

https://blackcoin.co/treasury-casino-a-comprehensive-overview/

top Neosurf online casinos

December 27, 2025 at 5:42 pm

Crown Sydney offers Electronic Table Games (ETGs) like Roulette

and Blackjack. Sadly, I couldn’t find slot machines at the gaming

hall. I found a total of 160 tables and 66

electronic tables in the Crystal Room, plus 30 private salons on the

Mahogany floor. The staff are also helpful and readily available to guide players to accessible areas.

Located 50 metres from Wynyard Train Station providing links

throughout Sydney and 1 km from the Barangaroo Reserve, Little National Hotel

Sydney in Sydney offers a fitness centre and a rooftop bar.

The world’s most recognised Japanese restaurant has now arrived

in the harbour city. Whether you’re after a late-night bite, international dégustation, premium buffet

or classic high tea, Crown offers some of the best places

to eat in Sydney. The Business Briefing newsletter delivers

major stories, exclusive coverage and expert opinion. “We’ve been we’ve been running very high occupancy levels, but also the restaurants and bars have [had] a very high take-up from patrons.” In December last year, Macquarie forecast

that Barangaroo could end up with 35 per cent of Sydney’s

tables-based gambling market by the 2025 financial year.

They even offered suggestions for dining options nearby.

With 349 guest rooms, 20 villas, and 2 premium villas, Crown Sydney stands as Sydney’s first 6-star hotel, boasting luxury at every turn. You’ll find

loads of table games and electronic machines.

References:

https://blackcoin.co/mobile-casino/

page.yadeep.com

December 29, 2025 at 9:30 am

paypal casinos online that accept

References:

page.yadeep.com

https://www.jobindustrie.ma/companies/best-paypal-betting-sites-top-sportsbooks-that-accept-paypal/

December 29, 2025 at 9:58 am

casino avec paypal

References:

https://www.jobindustrie.ma/companies/best-paypal-betting-sites-top-sportsbooks-that-accept-paypal/

https://jobs.kwintech.co.ke

December 30, 2025 at 2:30 pm

online casino usa paypal

References:

https://jobs.kwintech.co.ke