Stories

Thomas Edison Unknown Facts

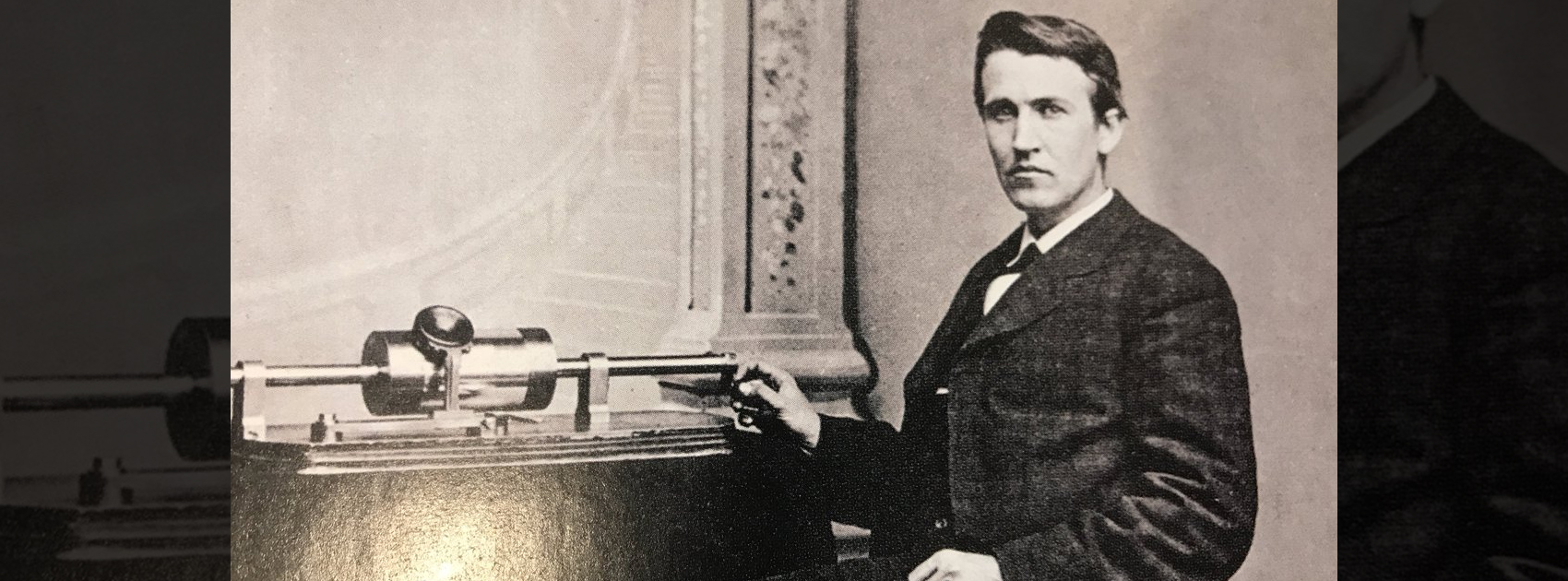

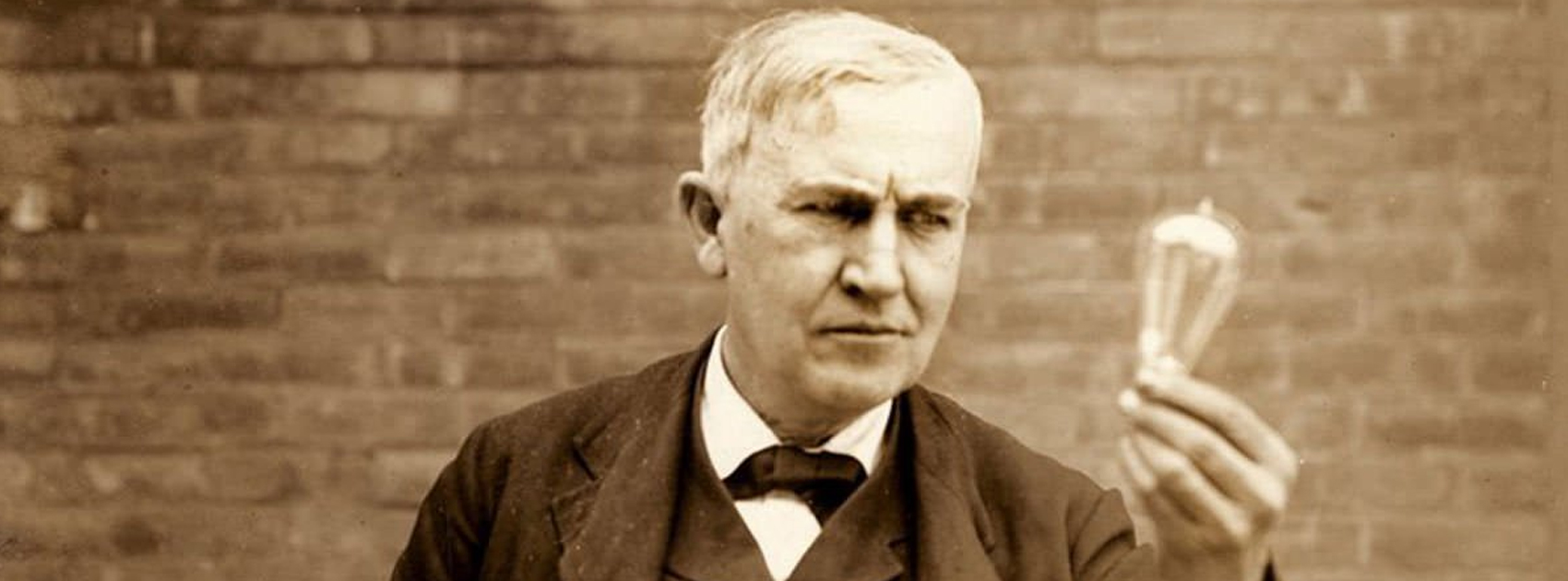

Thomas Alva Edison is considered one of the greatest inventors of the world. From the invention of light bulbs, to developing devices capable of recording sound, this renowned scientist has done it all. Let’s look at some unknown facts about Thomas Alva Edison.

Unknown facts about Thomas Alva Edison

1) As a child, Edison had an unusually broad forehead and a head which was considered larger than an average human’s.

2) He did not have any formal education as a child. As a hyperactive child, Edison’s teachers were not able to handle him properly, which led his mother to remove him from school and tutor him at home until the age of 11.

3) As an avid fan of Shakespeare, Edison once wanted to be an actor, however, he soon gave up on the idea because of his extreme shyness in front of crowds.

4)Edison published his own newspaper, the Grand Trunk Herald, at the age of 13. He used to publish up to date stories and the newspaper soon became a hit.

5) Edison once made a device which could kill cockroaches using electricity.

6) One of his biggest failures as an inventor was when he tried to invent a device to separate ore from rock and lost millions in the process.

7) Two of Edison’s children were nicknamed “Dot” and “Dash,” in honour of his telegraph days.

8) He used over 2,500 books to keep a record of his progress on thousands of inventions.

With more than 512 patents under his name, Thomas Alva Edison was also the first scientist to employ a team of researchers under him. A scientist turned entrepreneur, Edison is an inspiration to many scientists.

Which fact about Thomas Alva Edison surprised you the most? Comment below and let us know.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Videos

Larry Page: The Visionary Co-Founder Behind Google’s Global Success

Larry Page is a visionary technology entrepreneur and co-founder of Google, one of the world’s most influential companies. Born in 1973 in Michigan, Page grew up surrounded by computer technology, which inspired his passion for innovation from an early age. He studied computer engineering at the University of Michigan and later pursued his PhD at Stanford University, where he developed the revolutionary PageRank algorithm with Sergey Brin. This technology fundamentally changed the way search engines rank websites, making Google the most accurate and popular search engine globally.

The journey of Larry Page and Google began in 1998 when they officially launched the search engine from a small garage. Leveraging their unique algorithm, Google quickly surpassed competitors due to its ability to deliver highly relevant search results, transforming internet search forever. Under Larry Page’s leadership as CEO, Google expanded beyond search to launch groundbreaking products including YouTube, Gmail, and Google Maps, turning it into a global tech powerhouse that shapes how we access and interact with information online.

Larry Page later became the CEO of Google’s parent company, Alphabet Inc., driving innovation and investment in next-generation technologies such as artificial intelligence, autonomous vehicles, and healthcare solutions. His visionary leadership and commitment to technological advancement have cemented his legacy as one of the most influential figures in the tech industry. Today, Larry Page remains a key influencer in shaping the future of technology and digital innovation worldwide.

iwin

November 6, 2025 at 7:45 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

J88

November 7, 2025 at 9:12 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

谷歌站群

November 7, 2025 at 5:06 pm

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

站群程序

November 11, 2025 at 2:12 am

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

Kuwin

November 11, 2025 at 3:12 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

ios超级签

November 13, 2025 at 2:39 am

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

MM88

November 18, 2025 at 4:42 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

GO88

November 29, 2025 at 7:54 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

MM88

November 29, 2025 at 5:15 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Rocketplay Casino Konto erstellen

December 21, 2025 at 9:24 am

Als die Leineweber arbeitslos wurden, griffen sie zum Tabakblatt.

Gekocht wurde ein Ruhrpottklassiker per excellence – Pfefferpotthast

– aus dem „Original Ruhrpott“Kochbuch meiner Mutter und mir.

Vor wenigen Wochen konnte ich einen wahrlich aufregenden und schlichtweg unvergesslichen Tag mit einem tollen Fernsehteam

und einem köstlichen Rezept in meiner kleinen Küche verbringen. Anlässlich der illustren Gästeschar erwarten die Merkur Spielbanken Pressevertreter, darunter Journalisten der

People-Magazine, von Fotoagenturen und TV-Teams großer Sender.

Außerdem ist mit dem Sänger Isaak Guderian Deutschlands diesjähriger Eurovision Song Contest-Teilnehmer zu Gast.

Das aktive Engagement des Unternehmens für den bewussten Umgang mit Ressourcen sowie

die Natur und Umwelt bestehe seit vielen Jahren. Laut Lotterieanbieter als eines von fünf Pionier-Unternehmen aus dem Land.

Lotto Baden-Württemberg wurde mit dem Klimaschutzlabel BWzero

ausgezeichnet. Im kommenden Jahr steht das 25-jährige Jubiläum des Merkur Casino Bad Oeynhausen am Standort Werre-Park an – die Vorbereitungen für

das spektakuläre Fest sind bereits angelaufen.

Nachdem im Jahr 2016 bereits einen Verlust in Höhe von 2,9 Millionen Euro erzielt

wurde, meldete Westspiel im Jahr 2018 ein Minus von 1,2 Millionen Euro.

Insgesamt wurden die Bruttospielerträge (BSE) im Geschäftsjahr 2019 gesteigert.

Von Anfang der 1990er Jahre bis zum Jahr 2001 betrieb

Westspiel die Spielbank Kassel. Mit sechs Spielbanken, rund 1020 Mitarbeitern und knapp einer Million Besuchen jährlich war Westspiel im

Jahr 2019 das führende Branchenunternehmen in Deutschland.

References:

https://online-spielhallen.de/betano-casino-freispiele-ihr-schlussel-zu-kostenlosem-spielspas/

Royce Hotel Casino Clark

December 27, 2025 at 12:27 am

Create equitable learning environments that help students develop

knowledge with familiar apps essential to both academic

and future career success. Quickly design anything

for you and your family—birthday cards,

school flyers, budgets, social posts, videos, and more—no graphic design experience needed.

Anyone in your organization can quickly create documents,

presentations, and worksheets within a single, unified app experience.

Our Valet Parking service is available to all guests

staying at Wrest Point. Dial 75 on your in-room phone to arrange a meal in the privacy of your room.

Manual, automatic, family, luxury, sporty and larger 4WDs and people

mover vehicles are available.

Wrest Point Casino history is renowned for its extensive gaming options, catering to both casual

players and seasoned gamblers. This includes at our

restaurants, bars, accommodation, gaming machines and table games.

Choose from a range of house-made pastries or grab a toastie

or pizza and enjoy the iconic water views. Yes,

Wrest Point offers synchronized promotions that can benefit both in-person guests and online players through its loyalty and rewards program.

The online platform also includes live dealer games and progressive jackpots.

We partner with leading software developers such as NetEnt, Evolution Gaming,

and Microgaming to deliver an immersive gaming experience.

References:

https://blackcoin.co/true-fortune-casino-review/

Reef Hotel Casino features

December 27, 2025 at 3:47 pm

The Treasury is due to be replaced by the Queens

Wharf casino development sometime in 2022. Treasury Casino features

elite dining facilities, bars, accommodation, events rooms and of

course real money gambling. The Treasury is the no.1 gambling

venue in Brisbane and a well-know casino amongst Queensland punters.

Don’t miss the Brisbane Lions and the Brisbane Broncos final home games at the Gabba and

Suncorp Stadium in 2025! Combining the freshest local produce,

an open-plan kitchen, friendly staff and a cosy interior décor,

Kitchen at Treasury offers a warm and inviting experience any time of the day or night.

The Treasury Casino is an 18+ attraction that houses a three (3) level gaming

emporium of over 80 gaming tables and over 1300 gaming machines.

Insert a button and name it Button1. Once the user want to

save in the data source, use the collection to patch to the

data source. Hope this helps if you experience something similar!

Great, the gallery is showing the data collection as

expected!

The Treasury Casino has got a huge gambling floor and

hundreds of different games its customers can play.

Only you can decide how much time and money you want to spend on gambling at a casino.

Australian and Commonwealth online gaming regulations for Australia focus

on the casinos and their owners. Under the Interactive

Gambling Act, it’s fine for Aussies in Queensland and Brisbane to bet on their

favourite games online or play pokies without fear of prosecution. With the

revolution in online and mobile gambling only getting

faster Down Under, QLD players are right there betting and winning.

References:

https://blackcoin.co/jokaroom-login-australia-access-your-vip-casino-account/