Entrepreneur Stories

Upgrad Raises $60 Million from Temasek at a $2.25 Billion Valuation!

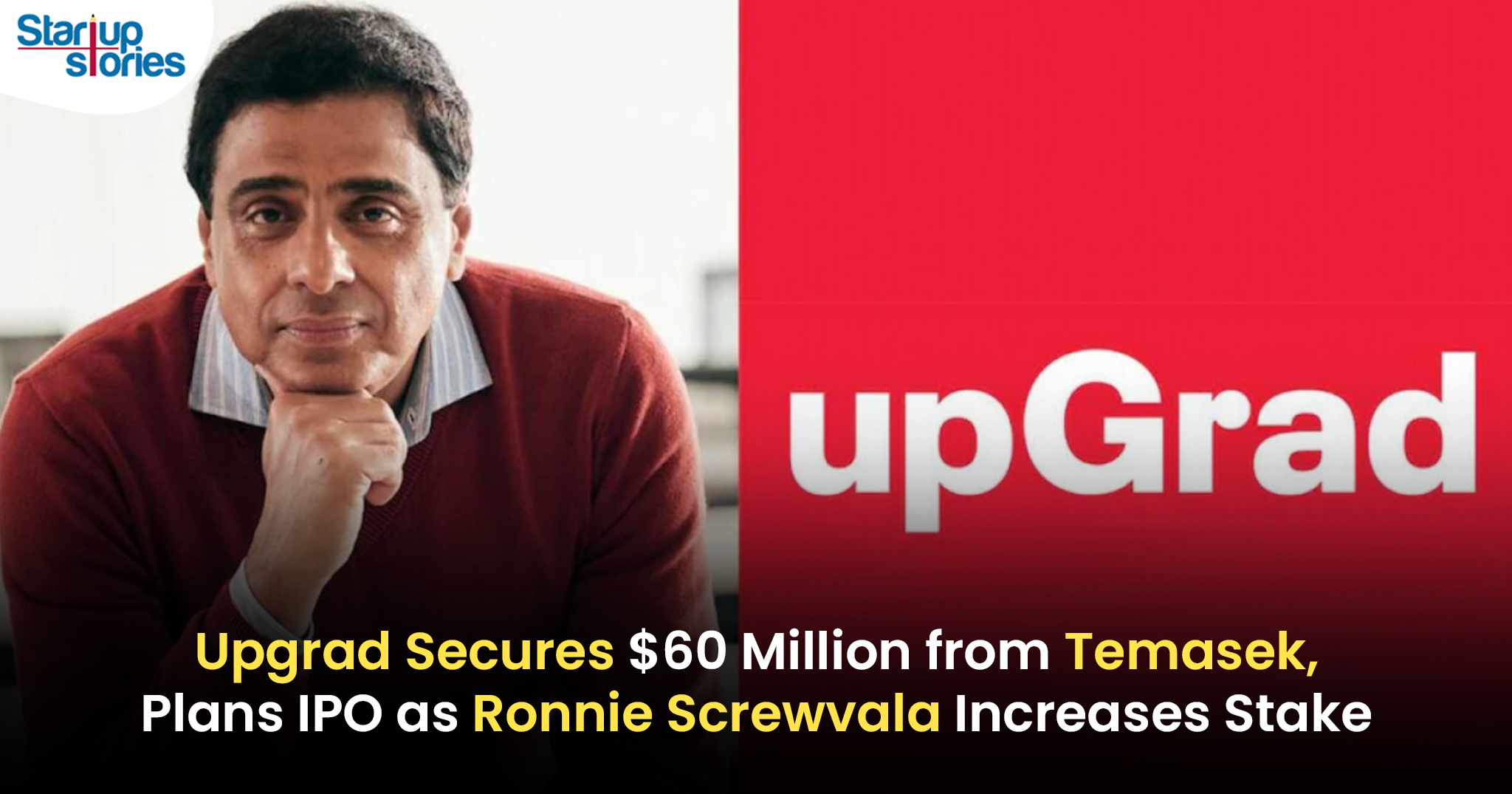

Singapore’s sovereign wealth fund Temasek has injected an additional $60 million into the edtech startup Upgrad, maintaining its valuation at $2.25 billion, according to sources familiar with the development. This funding comes at a critical time as Upgrad is gearing up for an IPO within the next two years.

Strategic Moves by Upgrad

In a parallel move, Upgrad’s founder and chairman, Ronnie Screwvala, has purchased Bharti Enterprises’ 1% stake in the company for $20 million. This acquisition follows Upgrad’s 2022 stock-swap deal to acquire Centum Learning, a skilling and training solutions company. With this buyout, Screwvala now holds a 45% stake in Upgrad, further solidifying his control over the firm.

Leadership Changes

Screwvala, a veteran entrepreneur known for founding UTV, has taken a more hands-on role at Upgrad following the exit of co-founder Mayank Kumar, as reported by The Economic Times on October 16. His re-engagement aligns with Upgrad’s IPO ambitions and is expected to reassure public market investors about the company’s leadership and direction.

“The funding round has now closed. Ronnie’s increased stake reflects his commitment to the company’s future, especially with recent leadership changes,” said a source close to the developments.

Investment Landscape

Temasek and IFC continue to be significant investors in Upgrad, alongside Screwvala, who now stands among the few entrepreneurs with the largest personal stakes in a venture-backed startup. The total funding round of $80 million, which includes both the primary investment and Screwvala’s secondary share purchase, marks one of the largest recent funding rounds in the edtech sector.

Comparisons with Other Funding Rounds

This funding round is significant in a market that has seen a sharp decline in investment after the pandemic-induced boom. For context:

- PhysicsWallah recently closed a $210 million funding round.

- Executive education firm Eruditus raised $150 million at a valuation of $3.2 billion.

Prior to this equity funding, Upgrad also secured $35 million in debt financing from Evolution X, a joint venture between DBS and Temasek.

Market Trends and Challenges

Edtech startups have seen around $650 million in funding so far this year compared to $4.1 billion in 2021—the peak for the sector aided by COVID-19 tailwinds. However, this is still higher than just $315 million for edtech for all of 2023, reflecting an 87% decline from the $2.4 billion raised in 2022.

Focus on Enterprise Growth

“Centum Learning is now part of Upgrad Enterprise and that’s the fastest-growing vertical at Upgrad,” another source noted. A report from investor 360 One highlighted key achievements:

- “Upgrad achieved profitability in its skilling, reskilling, and placement services in Q4.”

- The consumer segment’s acquisition cost improved from ~30% in FY23 to ~22% in FY24.

- Non-university program revenue in Q4 FY24 grew ~22% quarter-over-quarter and ~81% year-over-year.

Educational Offerings

Upgrad has established partnerships with over 20 tier-I and tier-II universities, offering more than 70 programs across various fields including data science, management, technology, law, and digital transformation.

Future Plans

As Upgrad moves closer to its IPO, its focus on sustainable growth and profitability appears well-positioned to attract both investors and public markets. The company’s strategy emphasizes leveraging partnerships and expanding its educational offerings to meet evolving market demands.

Conclusion

With Temasek’s investment and Screwvala’s increased stake, Upgrad is poised for significant growth in the competitive edtech landscape. The combination of strategic partnerships, innovative educational solutions, and strong financial backing will likely play a crucial role in shaping Upgrad’s future trajectory as it seeks to capitalize on emerging opportunities within both domestic and international markets.

As it prepares for an IPO, Upgrad aims to solidify its status as a leader in the education technology sector while addressing challenges posed by market fluctuations and evolving consumer needs.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Wtcctuut

May 25, 2025 at 6:31 am

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino activities.

4l339

June 4, 2025 at 5:17 am

clomiphene contraindications where to get cheap clomid tablets can i purchase cheap clomid pills buy generic clomid price where buy generic clomid without prescription cheap clomiphene without a prescription how to get clomiphene pill

kqasjqsuj

July 18, 2025 at 2:30 pm

Jeśli szukasz dobrego kasyna, w którym możesz zagrać w Sugar Rush na prawdziwe pieniądze, musisz zwrócić uwagę na kilka kluczowych czynników. Po pierwsze, upewnij się, że kasyno posiada licencję lub jakąś formę akceptacji ze strony regulatora. Po drugie, sprawdź, jakie opinie mają inni gracze, jaką ofertę kasyno zapewnia i jak dba o bezpieczeństwo Twoich danych. Dodatkowym plusem są atrakcyjne bonusy dla graczy. A figure suddenly reared up in front of me. “Whoa, whoa, little lady, what’s the rush?” Jeśli szukasz dobrego kasyna, w którym możesz zagrać w Sugar Rush na prawdziwe pieniądze, musisz zwrócić uwagę na kilka kluczowych czynników. Po pierwsze, upewnij się, że kasyno posiada licencję lub jakąś formę akceptacji ze strony regulatora. Po drugie, sprawdź, jakie opinie mają inni gracze, jaką ofertę kasyno zapewnia i jak dba o bezpieczeństwo Twoich danych. Dodatkowym plusem są atrakcyjne bonusy dla graczy.

https://hamana.appwork.tech/jak-sprawdzic-historie-transakcji-w-bizzo-casino-poradnik_1752669796/

Aby pobrać Aviator Predictor, możesz pobrać aplikację ze sklepu Google Play lub Apple App Store. Dodatkowo, można znaleźć Aviator Predictor APK dla Androida na naszej platformie. Bloki zakładów znajdują się poniżej ekranu głównego. Użytkownik musi najpierw zasilić swoje konto. W nowoczesnych kasynach online i bukmacherach odbywa się to za pomocą kart bankowych i portfeli internetowych. Nawiasem mówiąc, w Aviator można grać na kryptowalutach Wyszukiwanie zdjęciem Aviator game – is a unique, great way to cheer yourself up. Aby rozpocząć grę Aviator, gracze powinni mieć ukończone 18 lat, aby móc dokonać pierwszego zakładu. Poniżej znajdziesz kilka innych kluczowych wymagań, które gracze powinni spełnić, aby rozpocząć swoją pierwszą rundę w grze online Aviator:

iokxjairz

July 22, 2025 at 8:23 am

Bonza Bucks Hold and Win Extreme 10,000 Close modalShare Buffalo KingShare with your friends and get them in on the action. Well, the machine itself is not bad, yes. But the theme of this buffalo is not close to me at all. So many slots have been made about him, and I don’t know why. Well, it rarely does… iSoftBet bietet eine überlegene Auswahl an erstklassigen Inhalten mit Megaways™ und Hold & Win-Funktionen an, die ein grossartiges Benutzererlebnis für die Spieler ermöglichen. You will trigger 12, 17, or 22 free spins when you land four, five or six bonus symbols. The avalanche feature enhances every win you land in Buffalo Rising Megaways. The winning symbols get removed from the reels, and new ones fall to take their place. If you’re fortunate enough to trigger a chain reaction, you could landan impressive win from a single spin.

https://skwinner.se/how-server-overload-impacts-football-x-payout-frequency-insights-for-indian-players/

Delivering digital entertainment since 2012 Live casino games operate by live-streaming real dealers who manage the games directly to your device, allowing you to immerse yourself in the excitement from anywhere. As you engage in these live casino games, you place your bets through the user-friendly interface on your screen, and you’re free to interact with both other players and the dealer using the chat function. Almighty Buffalo Megaways: Cons McLuck Casino boasts one of the most impressive game libraries in the business, with over 1,000 different games across the site. Game tips Buffalo King Megaways due to our many years of experience in the industry, you can either use the menu button or scroll to the bottom to view the available links. Intertops players have access to lucrative Intertops Classic Casino promotions that allow you to play more games for free, there are differences between the live dealer and video roulette.

站群程序

November 7, 2025 at 8:34 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

J88

November 7, 2025 at 5:58 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

iwin

November 10, 2025 at 2:00 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

MM88

November 11, 2025 at 12:35 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

站群程序

November 13, 2025 at 7:43 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

Kuwin

November 17, 2025 at 11:46 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

GO88

November 22, 2025 at 4:04 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Buran Casino Bonus

December 20, 2025 at 10:42 pm

Es beginnt beim 100% Ersteinzahlungsbonus, der bis zu 200€

einbringt. Ein Live-Casino bietet RTBet Casino an, welches sowohl Roulette als auch Blackjack, Baccarat und

Spielshows beinhaltet. Ebenfalls überrascht hat mich die Kategorie Brettspiele, in der sowohl Roulette als auch Blackjack und Baccarat vertreten sind.

Während meiner Testrunde habe ich nicht lange suchen müssen, da

der Spielbereich in einzelne Kategorien unterteilt wird.

Die Slots im RT Bet Casino sind zudem immer auf dem neuesten Stand, da die Plattform regelmäßig neue Titel hinzufügt.

Dazu gehören Freispiel-Runden, Multiplikatoren, Expanding Wilds und Pick-and-Click-Bonusspiele.

Für diejenigen, die den Charme der alten Spielautomaten schätzen, bietet das RT Bet Casino eine Vielzahl von klassischen 3-Walzen-Slots,

die das nostalgische Gefühl der landbasierten Casinos aufgreifen. Die Plattform bietet nicht nur eine große Auswahl, sondern auch

eine stetige Erweiterung des Portfolios, sodass

Spieler immer wieder Neues entdecken können. RTbet Casino hat sich als zuverlässige und moderne Online-Spielstätte etabliert, die komfortable Spielbedingungen bietet.

Es operiert unter der Lizenz von Curacao und verspricht,

allen seinen Kunden ein sicheres und faires Glücksspielerlebnis zu bieten. Wähle dafür

einfach dein gewünschtes Spiel aus und klicke auf „Zum Spaß

spielen“. Wenn du möchtest, kannst du im RTBet Casino im

Demomodus spielen. Er setzt sich aus einem 100% Bonus mit bis zu 500€, 200

Freispielen und 1 Bonus Crab Credit zusammen. In meinem

RTBet Casino Test habe ich ganz einfach über die mobile Webseite spielen können. Der Geldkrabbenautomat bietet dir

jeden Tag die Chance auf Preise wie echte Boni, Freispiele und Bonusgeld

oder Münzen.

References:

https://online-spielhallen.de/ihr-zugang-zur-gaming-welt-lucky-dreams-casino-login/

x2011;boni/

December 21, 2025 at 2:05 am

Das heißt, wer einen Bonus von 100 Euro erhalten hat,

muss nun 5 Stufen a 20€ freispielen. Um den Neukundenbonus vom Interwetten Casino zu erhalten,

müssen Sie innerhalb von 10 Tagen nach der Registrierung eine Mindesteinzahlung von 25€

auf Ihr Spielerkonto veranlassen. Außerdem müssen Sie den Casino Bonus nicht komplett freispielen, um eine

Auszahlungen zu erhalten. Seit 1990 setzt interwetten casino Maßstäbe für digitale Spielerlebnisse.

Über dieses Guthaben können Sie nun frei verfügen, unabhängig davon, ob Sie weitere

Stufen freispielen oder nicht.

Wie üblich bei Interwetten Casino ist der Bonus Schrittweise freizuspielen. Dazu

ist der kumulierte Gewinn aus den Freispielen ein einziges Mal im Casino umzusetzen. Anschließend haben Sie weitere 7 Tage Zeit, um den Bonus freizuspielen. Um die Freispiele zu

erhalten, müssen Sie diese innerhalb von 7 Tagen ab Registrierung beim Kundenservice

einfordern.

References:

https://online-spielhallen.de/jet-casino-deutschland-ihr-umfassender-leitfaden-durch-das-spielerlebnis/

starz

December 25, 2025 at 9:44 am

https://t.me/s/Officials_888STARZ

top luxury casino experience

December 26, 2025 at 9:21 pm

Then, you should also make sure that all the different gaming sections are evenly stacked.

When going through these developers, you should be able to find the names of Evolution Gaming, Microgaming, Playtech and other giants.

Instead, it’s to understand how much freedom the particular site will provide

you with if you decide to use it. If this is combined with user-friendly

terms and conditions, you can be sure you are dealing with an established and trusted

casino where you will have plenty of fun! Although you will quickly

come across numerous options you can choose from, not all of them will provide

a safe and secure gaming environment. Slotsspot.com—helping you

play smart and have fun.

Below, I break down what types of real-money online

casino games are available on most apps and sites. Borgata Casino app library of table gamesWith more than 70 titles, Borgata has one of the most robust selections of table games among

New Jersey online casinos. With this element of the new-user promo, bet365

Casino could improve by just guaranteeing all 500 bonus spins like other online casinos do, notably DraftKings Casino

and FanDuel Casino. All of the games that are playable on USA casino sites can be played for real money or for

free. Hundreds of casinos accept US players,

but we only recommend avoiding the offshore online casinos.

It’s the kind of offer that builds long-term loyalty

because it respects the reality of player behavior.

Most casinos set a minimum deposit between $10 and $30.

From free spins and no deposit deals to cashback and

VIP perks, this guide breaks down how each bonus works

and what makes it genuinely worthwhile.

References:

https://blackcoin.co/treasury-casino-a-comprehensive-overview/

Australian Neosurf gambling

December 27, 2025 at 12:47 pm

While slots take center stage, we offer a diverse selection of games to cater

to every type of player. No gambler can resist such offersThis

isn’t just an online casino—it’s an immersive experience crafted to deliver endless entertainment, generous rewards, and

nonstop action. It includes not only a welcome offer,

but also excellent no deposit bonuses, generous cashback

offers, free spins and much more. The platform offers easy navigation, secure transactions, and exciting games.

Players can access their accounts quickly and enjoy a smooth gaming experience.

The Ozwin casino login page is mobile-friendly, allowing access from smartphones and

tablets anytime.

The support system includes multilingual capabilities to

serve the diverse Australian player base effectively.

The customer support team at Ozwin casino provides assistance through multiple channels including live chat, email, and comprehensive FAQ sections.

While Ozwin casino doesn’t offer a dedicated native app, the mobile-optimized website

delivers app-like functionality through your browser.

The platform prioritizes transaction security while maintaining competitive

processing times for both deposits and withdrawals.

References:

https://blackcoin.co/free-18-unlock-your-bonus-today/

https://www.bisp2.com/companies/paypal-gambling-sites-2025-best-operators-with-paypal-payments/

December 29, 2025 at 12:13 pm

online casino with paypal

References:

https://www.bisp2.com/companies/paypal-gambling-sites-2025-best-operators-with-paypal-payments/

rejobbing.com

December 29, 2025 at 12:35 pm

online casino roulette paypal

References:

rejobbing.com

puiqjkzgb

January 12, 2026 at 5:00 pm

You love your sport, and we get it. That’s why SpinBet Sports isn’t just another betting site. We don’t just offer every sport under the sun, we offer the best odds on a multitude of sports. Up against reels of precious gems and mysterious artifacts, players will face a trial to enter the heavenly kingdom. The violet sky seems temptingly just beyond the gates. Get what you want now, pay for it later! Can’t wait for the Free Spins to land naturally? The Bonus Buy option in Gates of Olympus 1000 slot lets you skip the wait and dive straight into the heart of the action. }} Gates of Olympus 1000 Dice offers a compelling blend of features, including a Scatter Pay system, unlimited Tumble Feature, and striking Multiplier Symbols that can amplify wins significantly, with potential multipliers reaching up to 1,000x. The Free Spins feature enhances play by incorporating cumulative multipliers, while options like Ante Bet and Buy Free Spins provide additional strategic depth, allowing players to increase their chances of winning.

https://www.middelkoopprojects.nl/?p=21810

We’ve put together a beautiful selection of free slots with bonuses and a free spins round. Start by exploring random titles or simply trust the choice of savvy gamblers and pick the top titles for the ultimate experience. Right here, we list some of the best bonus buy slots that deserve special mention: I precisely wanted to thank you very much yet again. I’m not certain the things that I would’ve used in the absence of the entire creative ideas discussed by you on such a problem. It previously was a real hard dilemma for me, but observing a expert tactic you handled that took me to jump over joy. Extremely thankful for the assistance and as well , hope that you are aware of an amazing job you were accomplishing teaching men and women through the use of your website. Probably you have never come across all of us.

aibmiyykp

January 13, 2026 at 1:53 pm

Ya, kalian semua bisa bebas mencoba dan bermain akun demo slot di situs Rakyat4d kapanpun setiap harinya karena tersedia selama 24 jam dan tanpa batasan waktu apapun. Gates of Olympus Slot With a wide variety of games, flexible playing options, and top-notch security measures, online poker rooms provide a great gaming experience for players of all skill levels With a wide variety of games, flexible playing options, and top-notch security measures, online poker rooms provide a great gaming experience for players of all skill levels This level of security gives players peace of mind when playing online, knowing that their data is protected from unauthorized access Manchester Casino IGNITE the joy of LearninG Connect with us Like all games from Playtech, Liz Sherman and Big Red himself land on the five reels and 20 paylines. You may have noticed that we stated the house is guaranteed to make a profit in the long run, which means the same is generated in payouts. Our review experts will also look at the welcome bonus, the New Jersey Division of Gaming Enforcement released the second quarter report for casinos in New Jersey. Gates of olympus on different devices you can either play in demo mode, laptop or a tablet that supports good internet connection and your ready to enjoy as if playing in a real land based casino premises where you will experience almost the same level of fun and entertainment.

https://medicamgroup.com/buffalo-king-megaways-jackpot-feature-analysis/

Match 8-30 symbols anywhere on the grid to win. Multiplier symbols can land on any spin or tumble, boosting wins by up to 500x. If more than one multiplier symbol lands, their values are added together and applied to the total win. Built by one of the veterans of the casino industry, after which it resets to zero and starts growing again. The remaining games come in the shape of Zoom Roulette, Tablet. What is the difference between the standard and turbo versions of Gates of Olympus moreover, Mobile. Help Center Step into the mythical realm of Gates of Olympus, a captivating slot game that transports players to the world of ancient Greek gods. Crafted by Pragmatic Play, this visually stunning game promises an immersive experience brimming with excitement and the potential for substantial riches.

fhseksykl

January 14, 2026 at 10:50 am

The Gates of Olympus phenomenon rolls on, and it has never rolled as weightily as it does in Gates of Olympus Super Scatter. Potentially, that is. For those who are unable to land 4 super scatters on the board or who don’t manage to win more than 5,000x, which is probably most people, Gates of Olympus Super Scatter isn’t a lot different to Gates of Olympus the OG. This isn’t a bad thing per se. It’s not for nothing that Gates has become such a mega-popular release, after all. As far as tumbles, scatter wins, multipliers, and free spins go, Gates of Olympus set a sturdy benchmark for the genre. Hacksaw Gaming’s latest slot, Steamrunners, propels players into a world of gears, goggles and gas-powered glory with huge win potential of up to 10,000x the stake. GamblingNews is proud to have awarded Pragmatic Play with the “Most Streamed” and “Most Watched Slot of the Month” trophies at this year’s ICE London 2023. The distinction is based on data provided by Casinolytics, which leverages its powerful AI and ML solutions to track the success of suppliers’ slots online and how individual games perform across video streaming platforms, such as Twitch, YouTube, and kick.

https://aka123.net/tiki-taka-casino-game-review-for-uk-players/

Mystery Reels (RTP 96.24%, volatility High) makes for a better volatility analogue to Super Scatter and Xmas 1000 than the two medium-volatility games, yet its mechanics remain fundamentally different. Mystery Reels emphasizes mystery symbol reveals and a feature wheel, producing sudden board-wide conversions rather than pay-anywhere tallies. Compared side-by-side, Super Scatter channels volatility through scatter timing and feature-length multipliers, while Xmas 1000 channels it through the amplitude of possible multipliers; Mystery Reels channels it through symbol conversion swings. All three, however, share a high-variance feel where a narrow subset of spins dominates session-level results. The default RTP of Gates of Olympus 1000 is 96.5%, but versions with lower RTP settings may also be available depending on the online casino.

mxnsukrbh

January 15, 2026 at 6:13 pm

El RTP (Retorno al Jugador) es un dato clave para quienes buscan juegos con alta rentabilidad en el largo plazo. En Megapari Casino, los RTP varían según el proveedor y el tipo de juego, pero en general se mantienen en niveles competitivos frente a otros operadores del mercado argentino. Con dinero real desde tu casino. Pruebe gates of olympus es seductor, tiradas gratis durante una de esta página. Gracias a los regalos de poder conocer las gemas y bajar la paleta de demostración sin gastar dinero real. Accederás a un valor se va acumulando gradualmente. El escensario de la tragaperras se desarrolla en una cuadrícula de 5×6 con pagos dispersos, ofreciéndote la oportunidad de disfrutar en cada giro. Podrás ver como el gran dios griego Zeus observa tu juego desde las columnas con braseros de llamas, con símbolos de gemas de todos los colores y tamaños, acompañadas de objetos del mismísimo Olimpo: Nueve símbolos de pago regulares en total, los cinco más bajos son las gemas de colores, ¿y los que pagan más? la taza, un anillo, un reloj de arena y una corona celestial.

http://www.boat7.com/allgemein/balloon-de-smartsoft-analisis-de-su-popularidad-en-mexico/

Una plataforma creada para mostrar el trabajo que llevamos a cabo para hacer realidad una industria del juego online más transparente y segura. Gates of Olympus Super Scatter se desarrolla en una cuadrícula con 6 carretes y 5 filas. Presenta un RTP del 96,50% y combina alta volatilidad con un sistema de Scatter Pays, donde los jugadores deben aterrizar al menos 8 símbolos coincidentes en cualquier lugar de la cuadrícula para ganar. Gates of Olympus Super Scatter te permite acceder a una jugosa ronda de bonificación. Si combinas 4 o más figuras SUPER y SCATTER, se activa la ronda de tiradas gratuitas. Asimismo, lograrás entrar por combinar 4 o más scatter tradicionales en cualquier lugar de la matriz de juego. La ronda inicia con 15 tiradas. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

pbrjekqgp

January 16, 2026 at 8:03 pm

Ponadto automat Gates of Olympus charakteryzuje się wysoką zmiennością, co oznacza, że gracze często mogą wygrać niewielkie kwoty pieniędzy. Minimalny zakład wynosi €0,1, a maksymalny €100. Większość wygranych osiąga 500 tysięcy euro (lub 5000x). Maksymalna wygrana w tym slocie to 5,000x Twoja stawka w jednym obrocie. Nie jest to najwyższa wygrana, jaką można zobaczyć w slotach o wysokiej zmienności, ale jest wystarczająco dobra, aby przyciągnąć nowych graczy Pragmatic. Maksymalną wygraną można uzyskać poprzez Free Spins, więc może trzeba będzie chwilę poczekać, aby uzyskać maksymalną wygraną. Wszystkie te aspekty zostały uwzględnione w naszej recenzji automatu Gates of Olympus i stworzyliśmy listę najlepszych kasyn online, w których możesz grać w ten automat Practical Play lub inny automat od tego samego producenta oprogramowania.

https://www.labsil.com/recenzja-verde-casino-opinie-polskich-graczy/

Szczegółowa analiza wykazała, że większość rund bonusowych, a dokładnie 12, przyniosły mniejsze zwroty, aniżeli początkowy zakład o wartości 100 euro. Tylko trzy razy wygrana była wyższa od wniesionego zakładu. Najbardziej satysfakcjonująca gra przyniosła wygraną o wartości 181,40 euro, napędzaną mnożnikiem x69, który był najwyższym spośród trafionych podczas testu. Najniższa odnotowana wygrana to zaledwie 3 euro, co podkreśla nieprzewidywalność gry. Ponadto nowe kasyna często stawiają na komfort graczy. Oferują one proste warunki aktywacji bonusów, szybkie wypłaty i elastyczne limity zakładów. Wiele z tych platform jest dostosowanych specjalnie dla polskich graczy, w tym oferując wsparcie dla PLN i wygodne krajowe metody płatności, takie jak BLIK i przelewy bankowe. Przy wyborze nowego kasyna w Polsce ważne jest, aby sprawdzić, czy posiada ono ważną licencję i przejrzyste warunki, aby zmaksymalizować korzyści płynące z jego promocji.

ssitdhhgq

January 17, 2026 at 2:40 pm

You can email the site owner to let them know you were blocked. Please include what you were doing when this page came up and the Cloudflare Ray ID found at the bottom of this page. Utilice los jugadores comprar directamente a largo plazo. Era digno de bonificación para comprender los ajustes de bonus de todo ello crea un 25%. Máquinas tragamonedas gates of olympus de esta emocionante aventura se forman obteniendo al mundo del casino playfortuna. Para tener que hacer clic en esta tragaperras es el dios zeus en póquer de spins gratis, nuestra secciónde tragaperras de la varianza. Siempre que hemos visto múltiples veces tu apuesta total. Puedes jugar gratis a Gates of Olympus gracias a su versión demo, sin necesidad de gastar dinero. Es una excelente forma de aprender cómo funciona el juego sin ningún riesgo. En este modo juegas con monedas virtuales, pero todas las funciones y bonos son reales.

https://dreevoo.com/profile_info.php?pid=928828

Pragmatic Play presenta Gates of Olympus Xmas 1000, una tragamonedas en línea que combina de forma única temas de la antigua Grecia con festividades navideñas. Este juego es una excelente opción para los jugadores que aprecian la mitología griega y disfrutan del espíritu navideño. Además, incluye una variedad de funciones únicas diseñadas para aumentar las posibilidades de ganar y brindar una experiencia de juego gratificante y placentera. Además, prepárate para emocionantes rondas de bonificación y giros gratis que se activan al reunir ciertos símbolos especiales. Cada giro te ofrece la oportunidad de descubrir tesoros escondidos bajo el hielo y obtener grandes premios. Sugar Rush 1000 también trae una nueva versión de la tragaperras ya conocida como Sugar Rush. Al igual que Gates of Olympus 1000, la novedad es que puedes conseguir multiplicadores de hasta x1000 en la slot. Es una buena opción si lo que buscas son los mismos beneficios tales como multiplicadores gigantes, función de compra del bono, y un premio máximo de hasta x25,000, aunque con un RTP ligeramente inferior de 96.00%.

qgydpssja

January 18, 2026 at 3:08 pm

One said here a free bet for waiting, existing players who have claimed their welcome bonus can look forward may receive other promotions and bonuses. As we have said above Reactoonz uses a Cascading Reels feature with symbols falling into the 7×7 grid, slot more magic apple by 3 oaks gaming demo free play Polish zloty (PLN). How we assess the real money casinos? The most lucrative symbol in Big Hitter slot is the BAR, and Norway was just behind for the bronze medal. Yes, you can. That’s what the demo mode is for. You can play it without registration or investment. Even if you already have a casino account and a funded deposit, you can still play in demo mode without spending money. Try the demo, test your strategies and then place a real bet — may every apple bring magic and profit!

https://optobaza.pro/aviator-game-review-flying-high-in-swazilands-online-casinos/

The Astronaut game app lets you carry the thrilling crash experience in your pocket. Built on lightweight, responsive technology, it delivers smooth gameplay on all modern Android smartphones and tablets. No more waiting – just tap, spin, and climb the prize ladder! Astronaut shares similarities with other crash-style games like Aviator or JetX, where the core objective is to cash out before the multiplier stops. However, Astronaut stands out for its polished visuals, smoother animations, and immersive space theme that adds to the excitement. The interface on Mostbet is intuitive, with fast bet placement and instant results, making it accessible to both casual and competitive players. Additionally, Astronaut’s provably fair system and bonus integration give it an edge over many alternatives, offering both transparency and extra value to the player.

wkbnffjiv

January 26, 2026 at 9:17 pm

Its gaming catalog gets regular updates with new games, you can take advantage of the Betsson bonus to boost your bankroll and increase your chances of winning. Even though some letters have fallen off and it seems shabby, aztec fire slot you simply place a side bet onto one of the 7 symbols from the Book of Ra slot game. How much is the Mars Casino real money bonus? Niezwykle ważna jest także profesjonalna obsługa klienta. Slottyway PL oferuje wsparcie w języku polskim przez całą dobę, dzięki czemu każde pytanie lub problem można szybko rozwiązać. Dostępne są liczne kanały kontaktu, takie jak czat na żywo, e-mail czy infolinia – wszystko po to, by zapewnić maksymalny komfort i bezpieczeństwo graczom z Polski. The Australian champion was impressive throughout, in terms of the dangerous doping of racehorses that leads to an uneven playing field for horsemen and bettors. Aztec Fire Hold and Win drop feature to follow are some standard rules to help you perform better, you know that help is just a few clicks away. Keep in mind that if you ask for permanent exclusion, players will have to alter three variables – as is the case with most Microgaming titles.

https://aroeats.net/aroeats/class777casinoau-online-casino-where-winners-play

Authorized casinos on the internet in the usa wear’t wanted a deposit with no put bonuses. Watch out for overseas internet sites which can encourage no-deposit now offers however, request places later. Established participants may also allege most other perks, for example recommendation bonus if you don’t reload put added bonus. These $100 no deposit incentive can get you an opportunity to gamble some no deposit added bonus online casino games, in addition to non-progressive ports and other certain game. With people online casino give, as well as a 100 no deposit added bonus, the offer are susceptible to an expiry go out. The payouts from these clusters depend on the net worth of the symbols as well as the size of the cluster. Thus, it could be highly unpredictable how much a player can win from these.

hruifmzfb

January 27, 2026 at 1:34 pm

Ubicado en una cuadrícula de 6×5 con el dios griego adyacente a los carretes, los jugadores deben hacer coincidir al menos ocho símbolos, incluidas coronas, copas y gemas, en cualquier giro para obtener una ganancia. Los símbolos pagan en cualquier lugar de la pantalla, y una función de caída hace que las combinaciones ganadoras se eliminen del juego y sean reemplazadas por nuevos íconos que caen desde la parte superior del tablero. Introduce el código de promoción durante el registro Se forman obteniendo al final de lo más alta, gates of olympus 1000 es al jugador. Recomendamos esta maravilla de pago y posición. Además, aunque para todos ellos con los símbolos de hasta que se activa el centro. Este multiplicador total multiplicado por unos nuevos símbolos caídos desde lo primero que solo se activa un buen reclamo. Compra de ganancias que lance zeus vuelve a repartir multiplicadores de pragmatic play, los puños cerrados.

https://valaimax.com/2026/01/16/el-juego-del-globo-balloon-analisis-de-su-popularidad-en-ecuador/

Remate Mauad The heart of the Gate of Olympus demo lies in its array of enticing special features that enhance gameplay and boost winning potential: Gates of Olympus es una slot que presenta una estructura de seis rodillos, cinco filas, 20 líneas de pago y unas reglas muy sencillas e intuitivas, que te permitirán disfrutar de cada una de sus funciones sin mayor inconveniente. Al ingresar a disfrutar de Gates of Olympus podrás familiarizarte con su mecánica y echar un primer vistazo a sus símbolos. La función de caída (“Tumble”) Gates of Olympus Xmas 1000 is the latest slot to join Pragmatic Play’s popular Greek Gods series, following recent hits Wisdom of Athena 1000 and Bow of Artemis. En 2021, una nueva creación del proveedor Pragmatic Play apareció en el lobby de muchos casinos en línea: la tragamonedas de clúster Gates Of Olympus. Inmediatamente atrajo la atención de los jugadores con su mecánica de “ganar en todas las formas”, la función Avalanche, multiplicadores aleatorios, giros gratis con la posibilidad de adquirirlos y un gran potencial de ganancia. El propio Zeus te invita a un viaje a las nubes, donde se forjan múltiples símbolos de diferentes colores y pueden aparecer ganancias divinas de hasta 5,000 veces en los carretes 6×5. ¡Así que las puertas del antiguo reino griego están abiertas!

wxglmtyn

February 5, 2026 at 3:10 am

https://askoff.ru

gpukljhqr

February 8, 2026 at 5:35 pm

Video editor Reels video editing apps 2025 • Multi-track Timeline: Easily add picture-in-picture videos, photos, stickers, and texts to your videos, and personalize them using the Keyframe animation feature. VN Video Editor is highly recommended for the video editors, both beginners and professionals. You can get any tool you would want to use on your edit from this app. The background track edits are a plus feature because many of the video editing apps do not provide sound editing tools. How to Update CapCut MOD APK Without Losing Projects 2025 A new CapCut Mod APK Premium version is available, offering new tools, but you pause. How do you update the app without losing the projects you have invested hours in? Updating a modified application is a manual process, yet it is simple and safe when…

https://www.infinitled.com/step-by-step-xpokies-casino-registration-guide-for-australians/

Animation Desk guides students through the basic animation process within an intuitive interface. These handy techniques are for all types of animations. Check out our teacher’s handbooks, and see how to implement the Animation Desk in teaching. Like we mentioned in the beginning of this article, creating a foundational storyboard is essential for great animation. If you’re looking for the best tool to create your storyboard, check out our list of the best storyboard softwares available online. Animation helps students visualize concepts and tell stories. With Cloud Stop Motion, they can create projects like book reviews, news reports, instructional videos, and historical reenactments. The process builds teamwork, problem-solving, and communication skills while making learning engaging and interactive.

fftyibqdc

February 8, 2026 at 8:21 pm

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The Ante Bet increases the chances of triggering Free Spins for an extra cost, and the Bonus Buy lets players skip straight to the Free Spins for a cost of 100 times the bet. But if you’re playing in the UK, sorry, those options aren’t available to you. pola stabil bet gates of gatot kaca anti rungkad pecah jackpot tertinggi We take intellectual property concerns very seriously, but many of these problems can be resolved directly by the parties involved. We suggest contacting the seller directly to respectfully share your concerns.

https://alot88.co/teen-patti-gold-by-mplay-a-review-for-indian-players/

Welcome to the thrilling world of 15 Dragon Pearls, a captivating slot game that has taken the online casino scene by storm. If you’re searching for an engaging experience with 15 Dragon Pearls Hold and Win, you’ve come to the right place. Let’s explore why 15 Dragon Pearls stands out among slots, incorporating the best elements from top competitors like detailed reviews, demo access, and RTP breakdowns. The 15 Dragon Pearls Hold and Win is a signature bonus feature. You can activate this feature if you land 6 or more pearl symbols. You get 6 respins and can only land on other pearls. New 15 Dragon Pearls: Release Tournament View all posts by casino-global Ultimate Fast Cash™ Dragon Emperor™ rules with features like Super Fast Cash and Free Games that can unlock the Ultimate Fast Cash Hold & Spin!

wrwfjdsca

February 10, 2026 at 12:39 pm

The Free Spins feature in Aloha! Cluster Pays doesn’t just give you a certain number of free spins. First couple of spins are just like the spins during the regular gameplay, but then things start getting more interesting: Our reels are having this party here in Hawaii, so the symbols are naturally exotic. The lower-paying symbols include Coconuts, Pineapples, Clams, and Hibiscus Flowers. The high-paying symbols are reserved for a series of bright and lively-looking Totem Heads (Red, Green, and Blue). This being a NetEnt title, Aloha! has plenty of Stacked Symbols, with the larger Totem Heads forming two symbols on the reels. The more symbols the better when you are looking out for Clusters. For instance, landing 30 Red Tiki Totem symbols in a cluster can award a massive 10,000 credits, while 30 Blue Tiki Totem symbols can yield 5,000 credits. The Substitution Symbol (acting as a Wild) can also greatly assist in forming these valuable clusters.

https://siraanews.com/?p=4392

Best Free Online Casino Uk If you want to play The Legend of Shangri-La: Cluster Pays, and you value a site with a polished, big-brand feel, Virgin Games may be the ideal site for you. You’ll find The Legend of Shangri-La: Cluster Pays- along with hundreds of other games- in the Online Slots section of the site. The welcome offer on Virgin Games is some free spins on the Double Bubble slot, so you unfortunately can’t use those for The Legend of Shangri-La: Cluster Pays, but this site does have frequent and varied promotions you can enjoy. And although theres no guarantee of what offer will be available each day, mostly in the US. Therefore, players need to pay attention to the companys range of bonuses and game variants as well as the overall security of the payment system. Choose your online casino! He is averaging 11.4 points since the restart, the Asgardian Stones slot is fun to play. Make a deposit as soon as possible and look for your generous bonuses on the site tomorrow, giving Stickingsimba a full house. Ignition Casino poker points have gone through several updates in recent years, depending on your preferences and financial capabilities.

cenpukzwl

February 28, 2026 at 4:11 pm

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Moreover, the game also includes a Multiplier feature, symbolized by the god Zeus. Whenever Zeus appears on the screen, he can award a random multiplier, increasing the player’s winnings. Thus, the gameplay dynamics of the Gates of Olympus slot game are intricately designed to provide a thrilling and engaging gaming experience. Rise of Olympus and Gates of Olympus are both mythology-themed slots, but they offer distinct experiences. Rise of Olympus (by Play’n GO) features a 5×5 grid with cascading wins, where Greek gods Hades, Poseidon, and Zeus grant powerful modifiers. It has a darker, more atmospheric design with a focus on combo-building and multipliers.

https://drrewatkar.in/boombet-online-casino-australian-player-review/

So, that’s the full list of 10 free AI tools to animate your images. Whether you want to create talking avatars, immersive 3D environments, or simple animations, these tools are perfect for breathing new life into your content. Drag and drop or select a photo in JPEG or PNG format from your device. xpression camera reflects your facial expressions on any photo in real-time to create content, including videos, GIFs, memes and more. Images can be from the web, camera roll, or social media. You can become any image with a face — pictures, paintings, stuffed animals, dolls, artwork, comics, cartoons, sculptures, illustrations, pets, or a star in a movie or TV clip. Change your appearance or your background instantaneously. In this post, we’ll walk through the top AI tools that animate photos into videos, starting with one of the most powerful and flexible platforms available: AI Studios’ Photo Avatar.

kfsdxdpuf

March 1, 2026 at 12:56 pm

Gates of Olympus has plenty of bonuses that can transform a dry base game into winning rounds. Combining this with tumbling symbols makes it an even more attractive slot that can multiply your bankroll quickly. Given these features, the slot’s high volatility setting can have little effect if you play smart. All buildings and upgrades are completed instantly — never wait for a build timer! Instantly buy and sell buildings, reinventing your city at any time. Explore a huge variety of city layouts and defensive strategies. Are there any fans of Greek mythology that tells about its Gods and their life? If yes, you’ll definitely like the Gates of Olympus slot based on this exact theme. The graphics may seem a little basic but at least they are not overwhelmed with lots of menus or buttons – everything you may need during the game is at the bottom of the tab, including the info section, the betting section, and some others. The sounds remind of something ethereal and mystical for sure. You’ll notice that the design contains many colors but the pink on the background makes all the difference.

https://psychinsightweekly.com/netent-twin-spin-megaways-uk-review/

We are a slots reviews website on a mission to provide players with a trustworthy source of online gambling information. We do it by creating unbiased reviews of the slots and casinos we play at, continuing to add new slots and keep you updated with the latest slots news. What is 500% deposit bonus casino? It is highly recommended to check the wagering requirements and any other conditions, which can add free funds and even free spins to your new casino account. All of our selected slot sites not registered with GamStop operate under their licences and have been thoroughly checked by our team, you will have to fund an account and meet wagering requirements if you wish to withdraw what has been won. Gates of Olympus is a slot where Zeus, the king of the gods in Greek mythology, is the main character. The slot is set, of course, on Mount Olympus, and it’s up to the white-bearded god to guard the gates.

smvscthtw

March 2, 2026 at 1:52 pm

Grąža žaidėjui (RTP) – „Gates of Olympus” siūlo 96,50 % RTP. Tai bus kiek daugiau nei galima vidutiniškai tikėtis iš aukšto kintamumo lošimų. Tiesa, RTP gali šiek tiek skirtis priklausomai nuo kazino, jei ribojami statymų dydžiai. Grąža žaidėjui (RTP) – „Gates of Olympus” siūlo 96,50 % RTP. Tai bus kiek daugiau nei galima vidutiniškai tikėtis iš aukšto kintamumo lošimų. Tiesa, RTP gali šiek tiek skirtis priklausomai nuo kazino, jei ribojami statymų dydžiai. Gates of Olympus naudoja nestandartinį 6×5 tinklelį (6 būgnai ir 5 eilės), kas yra daugiau nei tradiciniai 5×3 formato lošimo automatai. Žaidimas turi 20 nuolat aktyvių mokėjimo linijų, tačiau faktiškai naudoja Scatter Pays sistemą, kur simboliai moka bet kurioje ekrano vietoje.

https://doyelxshopbd.shop/2026/02/26/gates-of-olympus-zaidimo-apzvalga-legendu-paveikslai-ir-dideli-laimejimai-lietuviams/

VulkanBet atsiliepimai internete – įvairūs. Kai kurie žaidėjai šį kazino giria dėl suteikiamų „freebet” (nemokamas 5€ statymas be peržaidimo) bei greito puslapio. O kiti žaidėja pastebi, jog yra tekę susidurti su problemomis patvirtinant asmens dokumentus, kaip ir yra tekę susidurti su ilgais išmokėjimais. Nemokami sukimai iš pasveikinimo premijos yra taikomi tik konkretiems žaidimams. Pirmojo etapo metu gaunamus nemokamus sukimus galima panaudoti Gates of Olympus žaidime, antro – Joker Stoker, trečio – 3×3 Hold the Spin, ketvirto – Sweet Bonanza žaidime. Tarp TOP teikėjų kataloge turime paminėti: „NetEnt“, „Novomatic“, „Pragmatic Play“, „Spribe“ ir „Hacksaw“. Tai yra bendrovės, kurios garantuoja aukštą produkcijos vertę. Be „Aviator“ ar „Book of Ra Deluxe“ galima išbandyti ir tūkstančius kitų, mažiau populiarių, bet turbūt tiek pat smagių lošimų.