Entrepreneur Stories

First Jobs Of Famous Billionaires

The success stories of many billionaires around the world inspire many people of our generation and have, on several occasions, ignited a desire in many to start their own business. However, many of these successful people began their career by working ordinary jobs. Let’s look at 5 such successful people, who started their career by working some very ordinary jobs.

First jobs of famous billionaires

1) Warren Buffett

Warren Buffett is the CEO of Berkshire Hathaway and is often referred to as the “Oracle of Omaha.” However, this American business magnate started his career by selling Coca-Cola bottles, chewing gum and magazines door-to-door. At the age of 13, he became a newspaper delivery boy and made $ 175 a month, delivering The Washington Post. He continued to look for other business ventures and accumulated savings of $ 9,800 by the time he finished college. Now, with a net worth of $ 82 billion, he is the fourth richest person in the world.

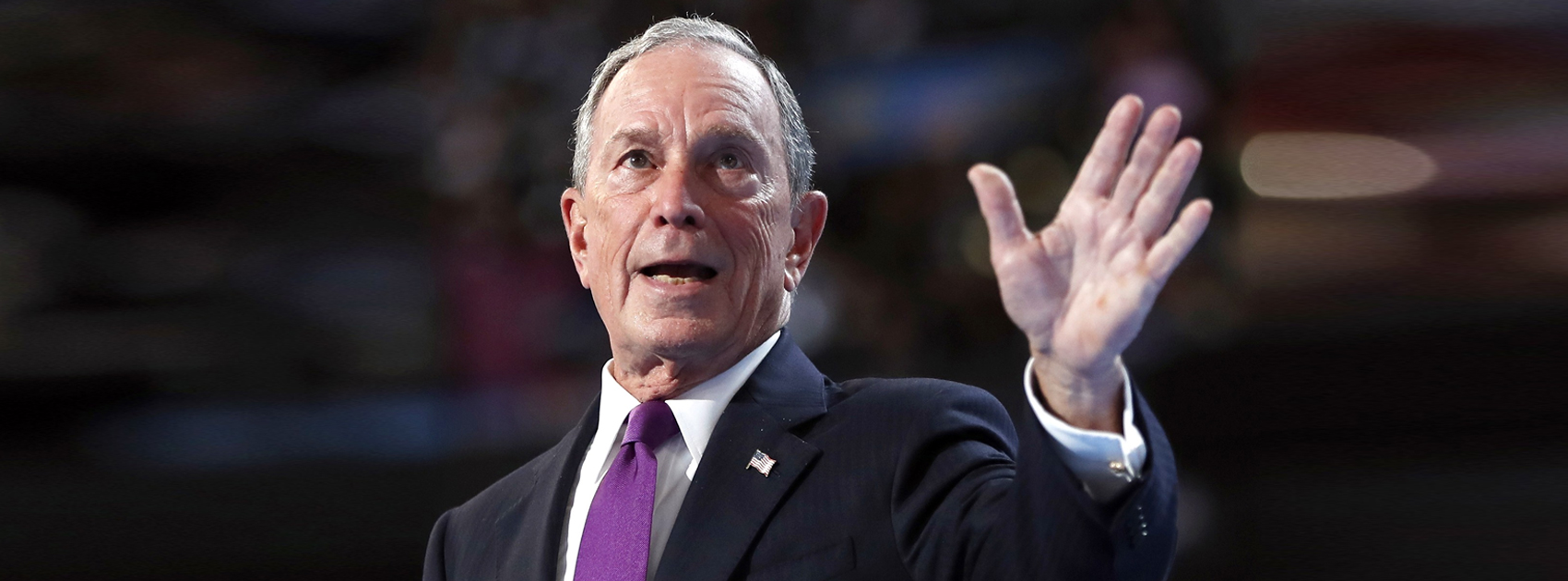

2) Michael Bloomberg

Michael Bloomberg, who founded the financial, software, data and media company Bloomberg L.P., worked as a parking lot attendant when he was young. Born to middle class parents, Bloomberg worked in a parking lot to pay his tuition fees in college and went on to graduate from Harvard Business School. Now a well known philanthropist, Michael Bloomberg is one of the richest people in America, with a net worth of $ 53.5 billion.

3) Oprah Winfrey

Oprah Winfrey is a well known media mogul and entrepreneur, who worked as a grocery store clerk in Nashville to support herself. She then landed a job in radio at the age of 16 and worked her way to the top, eventually owning her own production company. Now, with a net worth of $ 2.6 billion, she is considered one of the most influential women in the world and is a source of inspiration to many.

4) Li Ka Shing

Li Ka Shing was the former chairperson of CK Hutchison Holdings and CK Asset Holdings and is one of the most influential entrepreneurs in Asia. Coming from a poor family, he started his career as an apprentice at a watch strap factory when he was 13 years old and at the age of 19, became the general manager of the factory. He later started his own plastic manufacturing company and used the profits from the company to invest in real estate. Li slowly worked his way up the ladder of success and is now one of the richest people in Hong Kong, with a net worth of $ 27.1 billion.

5) Mark Cuban

Mark Cuban is an American Shark Tank investor, co founder of Broadcast.com and owner of the American basketball team Dallas Mavericks. Cuban began working at the age of 12 as a door to door garbage bag salesman. After graduating college, he worked as a bartender and then as a salesman for a software company. He started his own company, Broadcast.com, after getting fired from his job and now has a net worth of $ 4.1 billion.

It is true, starting at the bottom does not guarantee success. However, if you find your passion and work hard towards it, nothing is impossible, as the aforementioned individuals proved.

Entrepreneur Stories

Apple MacBook Air M5 Launched: M5 Chip, 22-Hour Battery in India

Apple has unveiled the new MacBook Air with M5 chip, starting at $999 for 13-inch and $1,299 for 15-inch models. The MacBook Air M5 boasts a 2nm M5 chip with 12-core CPU, 18-core GPU, and 50 TOPS Neural Engine for seamless AI tasks like real-time translation and 8K editing. Up to 22 hours of battery life, Thunderbolt 5, and Wi-Fi 7 make it the ultimate ultraportable, now 10% thinner at 0.44 inches with fanless cooling.

Key MacBook Air M5 features include Liquid Retina XDR display (500 nits, nano-texture option), 12MP Center Stage camera, and six-speaker Spatial Audio. Colors like new Sky Blue join Midnight and Starlight. Pre-orders are live today, with macOS Sequoia 15.4 enhancing Apple Intelligence and iPhone Continuity for students, pros, and remote workers.

Why buy MacBook Air M5 now? It outpaces Snapdragon X Elite rivals with ecosystem magic and future-proof performance, eyeing top 2026 laptop sales. CEO Tim Cook calls it “more capable than ever.” Visit apple.com for M5 MacBook deals and specs.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Frjwrpdv

May 28, 2025 at 4:37 am

2025年のランキング上位のオンラインカジノを探索しましょう。ボーナス、ゲームの種類、信頼性の高いプラットフォームを比較して、安全で充実したゲームプレイをお楽しみくださいカジノ

Kuwin

November 5, 2025 at 7:11 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

谷歌站群

November 6, 2025 at 4:19 pm

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

J88

November 9, 2025 at 6:40 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

站群程序

November 12, 2025 at 8:54 am

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

iwin

November 12, 2025 at 12:17 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

MM88

November 14, 2025 at 8:56 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

MM88

November 20, 2025 at 4:22 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

GO88

November 23, 2025 at 9:32 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

Legiano Casino App

December 21, 2025 at 8:05 pm

Um Ihnen die Suche nach den besten Online Casinos in Deutschland zu erleichtern, stellen wir Ihnen die Top-Anbieter aus

unseren aktuellen Tests vor. Welches das

beste Online Casino für Sie ist, hängt stark davon ab, worauf Sie persönlich Wert legen. Um beste Online Casinos ausfindig machen zu

können, erstellen wir eigene Accounts, testen das Angebot an Spielen, Boni

und vor allem auch an Zahlungsoptionen. Wir testen regelmäßig neue Casinos und überprüfen bereits getestete Anbieter monatlich, um Ihnen stets die

aktuellsten und verlässlichen Informationen bieten zu können.

Deutschland erlaubt Online Casinos mit einer deutschen Lizenz, sowie ausländische Casinos mit einer EU-Lizenz.

Eine Übersicht über die besten davon finden Sie auf unserem

Portal. Es gibt bestimmte Regeln, die Sie befolgen sollten, um sicher zu spielen.

Die Suche nach dem besten Online Casino in Deutschland erfordert eine detaillierte Betrachtung verschiedener Faktoren wie

Spielangebot, Kundenbetreuung und Bonusangebote. Online Casinos in Deutschland bieten Ressourcen für verantwortungsvolles

Spielen an. Die beste Zahlungsmethode für Online Casinos hängt von den Bedürfnissen und

Vorlieben des Spielers ab. Die Auszahlungsquoten in Online Casinos variieren aufgrund unterschiedlicher Faktoren wie

Spieltyp, Softwareanbieter und betrieblicher Strategien. Spielerschutz und Sicherheit sind von größter

Bedeutung in den besten Online Casinos. Mit gültigen Lizenzen und Einhaltung

der gesetzlichen Vorschriften ist sie eine sichere Wahl für deutsche Spieler.

References:

https://online-spielhallen.de/kings-casino-rozvadov-spiele-events-e1m/

fastest payout online casino australia

December 27, 2025 at 8:18 am

Find banking methods that will give you an easy time, and always check for bonuses before you register or make deposits.

Use this as a guide to pinpoint the fastest payout online casino Australia and check out our

reviews before registering and making deposits. All gambling

platforms, including your favourite fast withdrawal casino, have restrictions on how punters can deposit and withdraw money on their sites.

The online casinos listed on this page are not licensed or regulated in Australia.

However, many fall into a trap of fraudulent online casino sites.

Although Aussie casinos are rather flexible and accept a lot of banking solutions,

we recommend checking this information before you decide to deposit funds in it.

The organization issues license to all casinos and racetracks in the region to protect players from scammers and illegal

institutions.

real money online casinos Australia

December 27, 2025 at 7:54 pm

Every site featured here supports real money gameplay and has been vetted by

expert team analyst Laura Thornhill, who’s been reviewing real money online casinos Australia for over a decade.

Yes, Australians can play pokies at licensed offshore online casinos

in Australia for real money. Most real money online casinos

in Australia offer some kind of bonus, especially when you’re just starting out.

Signing up with any of my recommended real money Australian online

casinos gives you access to over 5,000 games, sometimes even double that.

Beyond the vast world of pokies, the top casinos in Australia online offer an impressive mix of

games designed to suit every type of player. By reviewing hundreds of sites of we’ve

managed to rank the best online casinos for Australian players.

Since there are so many of them and they all have unique styles,

the fun never really stops when playing pokies.

But casino sites only allow for content that is available in the country.

Check our page “Best Australian bitcoin casinos” and choose the best casino for you.

You need to know that Paypal isn’t accepted on Australian casinos.

Our experts have prepared a comparison table with payment options

that can use Australian players. Product, so you should know that it’s

going to offer nothing but excellence.

Fantastic selection of pokies and live casino games There

are over 13,000 games you can play for real money.

To boost your deposits, the operator features sizable bonuses for new and returning Australian players.

All the top online casinos in Australia have certain things in common.

www.m-jsteel.com

December 29, 2025 at 9:46 am

online casinos that accept paypal

References:

http://www.m-jsteel.com

bluestreammarketing.com.co

December 30, 2025 at 2:32 pm

online casinos mit paypal

References:

https://bluestreammarketing.com.co/employer/best-payid-casinos-in-australia-payid-pokies-2025/