Entrepreneur Stories

Apps That Should Have Done Well But Failed Miserably

Technology can either be a boon or a bane, depending on how it works for your business. When the .com bubble happened, several startups did really well instantly. However, when the inevitable popping of the bubble happened, a lot of these startups failed miserably. Over the years, while we have looked at case studies of different apps which succeeded, no one really thought of stopping and looking at the apps which failed. Here is looking at some really brilliant apps and startups that should have done well, but did miserably instead.

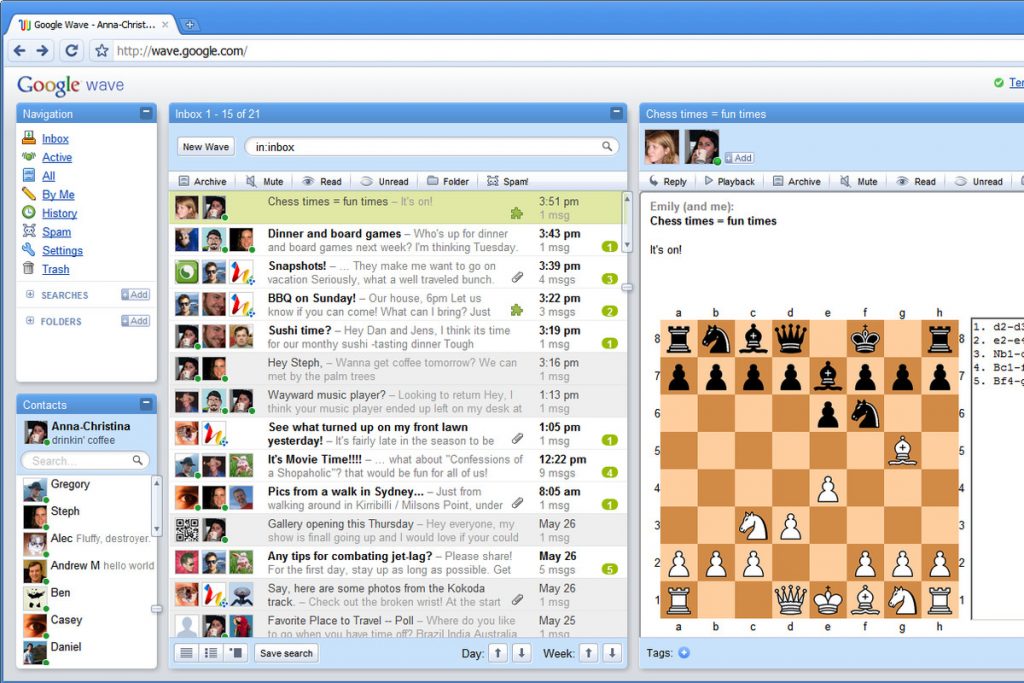

1. Google Wave

Google Wave, when it launched, was supposed to change the communication game forever. This app was created to help those people who thought communicating on the app store was extremely annoying. While on the front of things, this app looked exciting and promised a lot of change, it failed to make the right mark. A lot of things went wrong for Google Wave, the main reason being not a lot of people knew how the app functioned. Perhaps one of the major mistakes the makers did with this app was that they thought they could ride on the success of Google’s popularity. Unfortunately, Google Wave shut down six months after it came on the app store and clearly, their marketing strategy was not up to the mark!

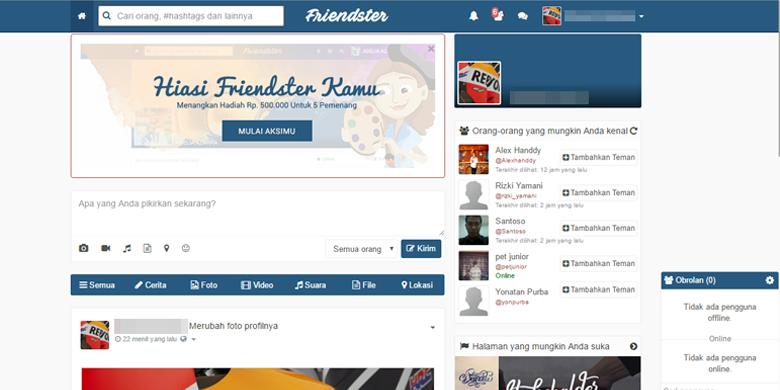

2. Friendster

Credited to be one of the first social media platforms similar to the ones we see today, Friendster came to be in the year 2002. Founded a year before Tom Anderson created MySpace, Friendster secured close to $ 50 million funding from the time of its inception. Friendster grew in popularity because it connected friends to each other and did not let you connect with anonymous people. However, it failed because the makers did not want to ride with the times and kept their user experience to a very basic level. If they had capitalised on the trends at the time, Friendster would have grown to be a really huge success. In fact, when they were at their peak, they had even gotten an offer from Google for a buyout of $ 30 million and had they accepted the buyout, the world of social media would have been quite different today.

3. GovWorks.com

When GovWorks.com was founded, it was created with the aim of making everyone’s (from government officials’ to citizens’) lives easier. From letting government officials track their daily activities to letting citizens pay their bills, book tickets and look up information about their city, GovWorks.com had everything in place for the making of a really great connector! However, GovWorks.com failed only 3 years after its inception. Growing from a team of only 8 people in the year 1998, this platform had 250 employees when things started going bad. Disagreements and power struggles within the management, along with the lack of elimination of the software’s bugs caused the failure of this innovative platform.

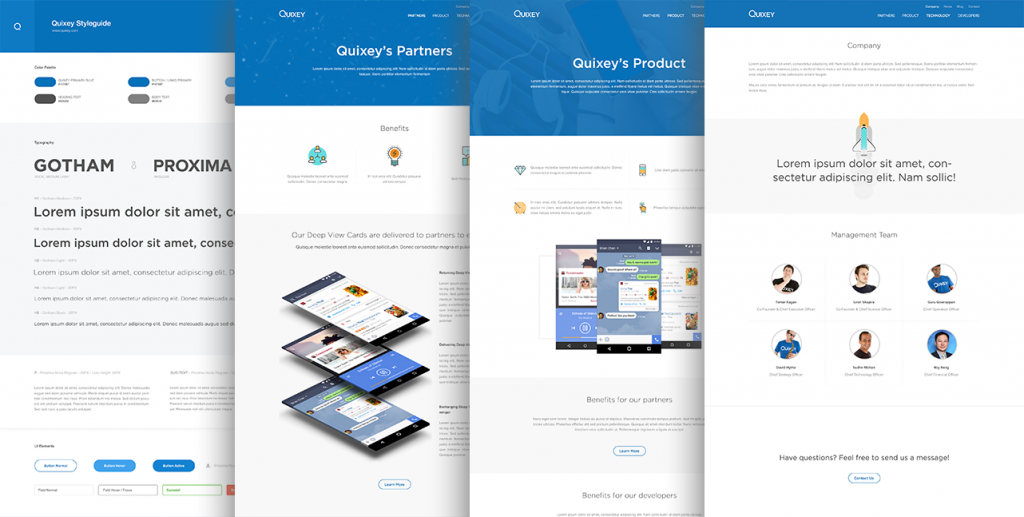

4. Quixey

An example of another app that failed despite receiving a lot of funding, Quixey’s downfall was the perfect example of an app that failed because it got too arrogant with its position in the market. Quixey was designed to become the digital assistant of today, with the main aim of allowing users to find content on the different apps installed on their phones. Immediately after the launch, Quixey raised $ 50 million from Alibaba in a series C funding round. However, once Alibaba’s Initial Public Offering (IPO) went through in September 2014, the e commerce platform started reevaluating its interest in Quixey and decided it wanted out. This is when trouble started brewing and Quixey went under the gun. A couple of years later, with no investments coming through and debt piling up, Quixey was forced to downsize, eventually leading to liquidation.

5. Colour

Aimed to be an innovative photo sharing app between friends and strangers alike, Colour was an extremely innovative app at a time when people were running on the wave of rip offs. With just the right amount of funding to back its idea, a creatively designed website and users waiting to try the new app out, Colour had it all. However, right after it launched, users started realising there was something off with this photo sharing app. Lack of privacy functions and a poorly designed interface were the primary reasons for the growing wave of disappointment in the users. However, instead of trying to fix the bugs, the app came back as an app that let users live stream videos from Facebook. Unfortunately for the makers, while the idea was innovative, the damage from earlier was too great and no one wanted to accept the new change. The lesson here? Fix what is broken and do not try new things till you know it is going to work for sure!

Apps fail all the time but what hurts the most is that if the road map for these apps were planned well, then they could have been massive successes right from the day they were launched!

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

MM88

November 6, 2025 at 3:02 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

MM88

November 7, 2025 at 8:45 am

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

谷歌站群

November 8, 2025 at 5:53 pm

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

站群程序

November 14, 2025 at 10:42 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

iwin

November 14, 2025 at 4:48 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

GO88

November 22, 2025 at 11:03 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

J88

December 1, 2025 at 11:50 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

ZetCasino Willkommensbonus Code

December 20, 2025 at 10:39 pm

Falls Dich nach dem Besuch der Spielbank Bad Zwischenahn die Abenteuerlust packt,

bietet die Region spannende Aktivitäten. Ob Du Glück im Spiel

suchst oder einfach einen stilvollen Abend genießen möchtest – die

Spielbank ist ein Muss in Deinem Sightseeing-Plan. In der malerischen Landschaft von Bad Zwischenahn gelegen, bietet die

Spielbank ein faszinierendes Erlebnis für alle Besucher.

Die Casinotag-Veranstaltung am Donnerstag bietet freien Eintritt sowie zusätzliche Gewinnchancen. Mit einer Mischung aus

traditionellen und modernen Spielmöglichkeiten bietet das Casino ein fesselndes Erlebnis für alle Besucher.

Die Spielauswahl ist umfassend und richtet sich sowohl an Anfänger als auch an erfahrene Spieler.

References:

https://online-spielhallen.de/top-10-spielbanken-casinos-in-deutschland-2025/

Australian Online Casino Login

December 27, 2025 at 7:38 am

Spark creativity and collaboration in any learning environment with a variety

of Microsoft 365 apps and free templates to choose from.

Your files and memories are secure in the cloud with 5GB of

storage for free and 1TB with a paid Microsoft 365 subscription. The Microsoft 365 Copilot app brings together your favorite apps and Copilot in one intuitive platform.

If I make one of the top 3 spots on a leaderboard and

unlock a badge, how long do I get to keep it?

Viewers are automatically enrolled in the top fans leaderboard.

Viewers earn points by actively engaging during the stream and the leaderboard displays the audience

ranking based on their total points.

The leaderboard offers a fun new way to connect with your favorite creators and other fans during live streams.

The top fans leaderboard reflects and ranks each viewer’s engagement in a live stream.

It is visible during live streams and ranks viewers based

on their engagement in a given live stream.

References:

https://blackcoin.co/ufo9-casino-your-place-to-play-your-way/

Pre-paid funerals NSW

December 27, 2025 at 8:12 pm

Always read the terms and conditions to understand

wagering requirements and game restrictions.

Enter the amount you wish to deposit and wait for the payment to process.

After verifying your account, head to the cashier or banking

section to make your first deposit. Once you’ve chosen a

casino, click their homepage “Sign Up” or “Register” button.

This company blends a love of gaming with in-depth knowledge of the field.

A little older than Pragmatic Play, BGaming really knows how to get the job done.

They can customize your gaming into any language and currency

in a few weeks. Moreover, their slot machines are playable in all major currencies.

Their gaming portfolio is unmatched with hundreds of titles available.

It offers a mobile-focused, regulated, and innovative multi-product portfolio.

References:

https://blackcoin.co/lucky-hunter-casino-a-comprehensive-review/

deepdiverse.online

December 29, 2025 at 10:08 am

paypal online casino

References:

deepdiverse.online

deepdiverse.online

December 29, 2025 at 10:09 am

paypal online casino

References:

deepdiverse.online

deepdiverse.online

December 29, 2025 at 10:10 am

paypal online casino

References:

deepdiverse.online

deepdiverse.online

December 29, 2025 at 10:12 am

paypal online casino

References:

deepdiverse.online

deepdiverse.online

December 29, 2025 at 10:13 am

paypal online casino

References:

deepdiverse.online

westorebd.com

December 29, 2025 at 12:03 pm

usa casino online paypal

References:

westorebd.com

ispd.org

December 30, 2025 at 2:35 pm

mobile casino paypal

References:

ispd.org