Entrepreneur Stories

4 Startups Founders Who Bounced Back After Failing

Failure is a part of life, maybe even a bigger part of the business. If fear of failure is holding you back, take inspiration from the stories of these successful startup entrepreneurs who bounced back after major failures.

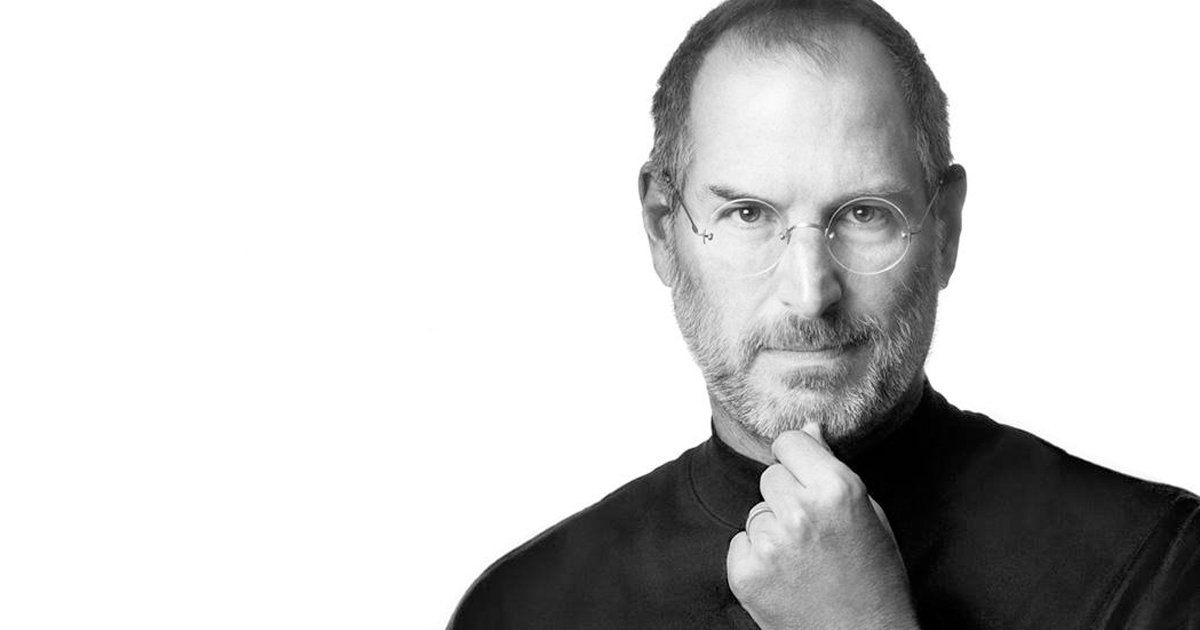

Apple has one of the greatest comeback stories in tech history. Founder Steve Jobs was fired from his company in 1985. Apple found itself operating at a loss, as it inched towards failure. In the 12 years that followed, in need of a new approach, Apple hired back Jobs in 1997 and he scored a partnership with Microsoft to invest $150 million in the company. A year later, the company introduced the iMac and for the first time since 1995, returned to profitability. The rest, as they say, is history.

Also known as the real life Iron Man, Elon Musk’s Tesla and SpaceX both hit cash shortages just as the economy was tanking in 2008. SpaceX applied for a contract with NASA as its last hope to bail itself out and it won. The $1.6 billion contract has kept Musk’s space dream afloat.

Musk, who nearly went bankrupt launching Tesla Motors and rocket company SpaceX, is now worth more than $20 billion.

Evan Williams introduced “blogging” to the world when he launched Blogger in 2000. However it came without a business model, and a year later, Williams found himself out of cash and had to lay off the entire staff. Without any employees, Blogger dangled from a thin rope as Williams tried to find ways to make money out of it and turn it into a real challenging company. By late 2002, Google acquired the website for a reported $50 million. 13 years later, Blogger is alive even today. As for Williams, he did just fine cofounding Twitter and then Medium.

In the early 1990s, technology major IBM was on a downward spiral, with plans in place to break the company into several smaller operating units. Lou Gerstner took over the company in 1993 and started one of the greatest business turnarounds in tech. After huge layoffs and putting cash through marketing assets, Gerstner put the obstacles on the plan to break up the company and united everyone under one IBM. It worked, and the company survived.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

7fzn6

June 3, 2025 at 10:12 pm

can i purchase cheap clomid without a prescription where can i buy cheap clomiphene no prescription clomiphene challenge test protocol can i get clomiphene pills get clomid without rx generic clomiphene without prescription cheapest clomid pills

MM88

November 6, 2025 at 4:17 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

MM88

November 7, 2025 at 3:57 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

站群程序

November 9, 2025 at 3:53 am

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

J88

November 9, 2025 at 5:38 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

ios超级签

November 14, 2025 at 2:57 am

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

Kuwin

November 20, 2025 at 3:13 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

GO88

November 21, 2025 at 4:19 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

iwin

November 22, 2025 at 9:54 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

fresh casino testbericht

December 20, 2025 at 11:52 pm

Registrieren Sie sich in wenigen Minuten bei BDM Bet und erhalten Sie einen Willkommensbonus,

den Sie sowohl für Sportwetten als auch für Spielautomaten verwenden können. Darunter befinden sich mehr als 6.500 Spielautomaten, Tischspiele, Crash-Games, Rubbellose sowie ein Live-Casino.

Nutzer von Android-Geräten können die Leon-App installieren und dafür 50 Freispiele erhalten. Leon Casino Deutschland bietet

einen kostenlosen Demo-Modus, mit dem Spieler alle

Spielautomaten und Tischspiele gratis ausprobieren können.

Wechsle anschließend in den Echtgeld-Modus, in dem du bereits mit Einsätzen ab bereits 0,10 € spielen kannst.

Tausche sie gegen Bargeld, Freispiele oder Freiwetten ein!

Jedes Spiel bietet ein einzigartiges und unvergessliches Erlebnis.

Trotz der Tatsache, dass die meisten von ihnen einen ähnlichen Stil

haben, bietet jedes Spiel ein einzigartiges Erlebnis.Um den Appetit jedes

seiner Kunden zu stillen, bietet das Portal sowohl klassische als auch exotische Versionen des Spiels an. Jeder Titel enthält eine

andere Kombination davon, was für eine anhaltende Neuheit des Genres und ein einzigartiges Erlebnis sorgt.Dank der

großen Vielfalt an Spielthemen kann jeder ein Spiel nach seinem Geschmack

und seinen Vorlieben finden. Mr Bet Login bietet die Möglichkeit, auf große Spielebibliothek zuzugreifen und garantiert

eine transparente und faire Sitzung. Alle Dienstleistungen, die das Portal anbietet,

sind vom Curacao Gaming Control Board reguliert und

lizenziert. MrBet ist eines der Top-Gaming-Portale,

die Spielliebhabern ihre Dienste anbieten.

References:

https://online-spielhallen.de/revolution-casino-promocode-ihr-schlussel-zu-exklusiven-vorteilen/

Mobile Casino App Erfahrung

December 25, 2025 at 6:27 am

Snatch Casino Promo Code einlösen

References:

https://online-spielhallen.de/lemon-casino-freispiele-dein-umfassender-guide/

treasure casino login

December 26, 2025 at 11:10 pm

As in any Australian online casino, Casino-Mate has withdrawal limits.

Since wagering requirements is subject to change and some casinos do not allow to withdraw big

bonus sums after wagering is done. But if you want to use real money bets – you’ll have to register and make a deposit to your gaming account.

If you want to play – just visit any casino-site homepage and play wihtout registration.

This is a casino that puts mateship first, creating an experience that

feels both premium and personal. Casino Mate stands out

as one of Australia’s most trusted and enjoyable gaming destinations.

Each category is tuned for smooth performance, fair results and engaging gameplay.

The collection includes hundreds of pokies, classic table titles and

modern live dealer sessions, all from trusted software providers.

From transparent bonuses to lightning-fast withdrawals, Casino Mate

stands for trust and reliability. Our ongoing mission is to provide memorable gaming experiences with integrity and trustworthiness

at the core of our operations.

References:

https://blackcoin.co/8_vip-casinos-uk-high-roller-casinos-fast-withdrawals_rewrite_1/

www.paknaukri.pk

December 29, 2025 at 3:49 am

casino sites that accept paypal

References:

http://www.paknaukri.pk

jobotel.com

December 29, 2025 at 3:51 am

online poker real money paypal

References:

jobotel.com

skillproper.com

December 30, 2025 at 4:09 am

paypal casinos online that accept

References:

skillproper.com

https://neulbom24.co.kr

December 30, 2025 at 4:24 am

online casinos that accept paypal

References:

https://neulbom24.co.kr