Funding

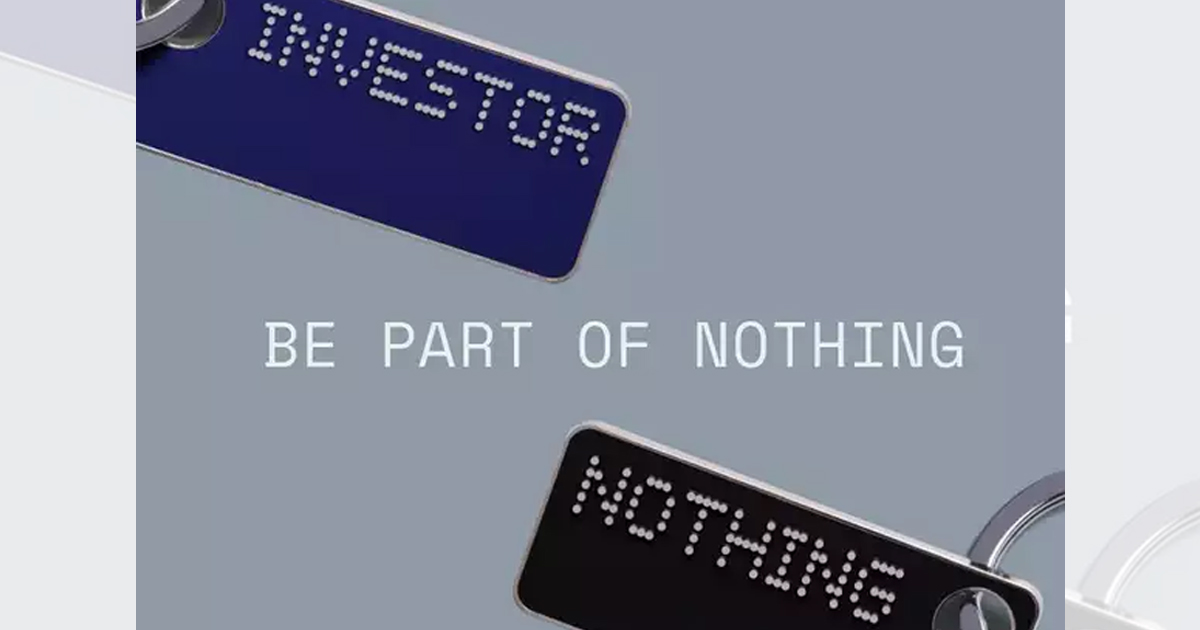

Carl Pei’s Nothing Invites Retail Investors

Carl Pei said the time came for him to leave OnePlus and focus on other interests, following which he resigned from OnePlus in October 2020. Since then, Pei had been working on his new startup in the audio hardware sector. Carl Pei unveiled the name of his startup which is now called as Nothing, on January 27th, 2021. Since the unveiling of Nothing, Pei’s startup has attracted a lot of attention from Silicon Valley and venture capitalists.

Carl Pei now seems to be emulating his success formula at OnePlus with his new startup Nothing. OnePlus is highly customer centric, because as a company they take in inputs from their consumers and adapt them to their products. Pei seems to be using the same strategy with Nothing, as he invited retail investors to invest in his new startup. Normally a startup raises Series A funding to begin product development and then goes on to Series B and so on. For a normal retail investor to invest in a stock, they could only do it at the time of an Initial Public Offering (IPO) at the time of which the company would be valued highly. However, Carl Pei is letting in investors from the beginning.

Usually the community has to wait for an IPO to invest, but by that time, the valuation is already high. We are inviting you to own Nothing from the very beginning, at the same price as our Series A, and be on board for the entire ride.🚀 https://t.co/mnQtoiJwOV

— Carl Pei (@getpeid) February 16, 2021

ALSO READ: Alphabet Invests In Carl Pei’s Startup Nothing

This lets the investors be a part of the product development process and makes Nothing more personalised. Moreover the investors would also act as promoters for the products. Currently, there are $ 1.5 million worth of shares available. Users can invest a minimum of € 50 and a maximum of € 20,000. However, the demand to invest is off the charts and was unexpected as Carl Pei confirmed there was an interest worth of $ 10 million from 8,700 users.

WOW we have just reached $10m USD of registered interest in just 7 hours from over 8,700 people! So grateful for the amazing community behind @nothing ! 🥰🥰

— Carl Pei (@getpeid) February 16, 2021

Nothing’s first wireless earphones will be unveiled in the summer of 2021. Nothing aims to build an ecosystem of listening devices which talk to each other. Initial investors of Nothing include the likes of Tony Fadell (Principal at Future Shape and the Inventor of the iPod,) Casey Neistat (YouTuber,) Kevin Lin (Co founder of Twitch,) Steve Huffman (CEO of Reddit,) Liam Casey (Founder and CEO, PCH,) Paddy Cosgrave (Founder of Web Summit,) Kunal Shah (CEO of CRED) and Josh Buckley (CEO of Product Hunt.) Alphabet’s investment arm Google Ventures was the latest investor in Nothing as they invested $ 15 million.

Funding

Dazzl Raises $3.2M Seed Funding Led by OYO’s Ritesh Agarwal for AI Skincare Expansion

Bengaluru, January 13, 2026 Dazzl, the D2C beauty startup revolutionizing AI personalized skincare India, secured $3.2 million in seed funding led by OYO founder Ritesh Agarwal’s venture arm. Co-investors include Snapdeal’s Rohit Bansal and Fireside Ventures, valuing Dazzl at $15 million post-money. Founded in 2024 by IIT alumni Priya Singh and Arjun Mehta, the app uses smartphone scans for custom serums, boasting 50,000+ users and ₹5 crore ARR amid India’s $25 billion beauty market surge.

Ritesh Agarwal praised Dazzl’s tech: “Personalization is beauty’s future, like OYO’s guest model.” Funds target R&D for 100+ skin profiles, Gujarat manufacturing under PLI, Instagram/Nykaa campaigns, and 50 hires. In a 20% YoY growing sector (Redseer 2025), Dazzl edges Mamaearth and Plum with 95% AI precision, 90% natural formulas, ₹499 kits, 65% retention (vs. 40% avg), and viral TikTok traction in 10 cities.

D2C beauty startup Dazzl tackles regulations via FSSAI compliance, eyeing $10B e-commerce beauty by 2028 and MENA exports. Q2 haircare launches and Series A loom, with Agarwal’s backing signaling unicorn potential for sustainable beauty products India. Dazzl blends AI with clean beauty for 500M+ consumers.

Funding

Yali Capital Makes History with ₹893 Crore Deeptech Fund to Power Indian Innovation

Bangalore’s Yali Capital has closed its first deeptech-focused fund, raising a substantial ₹893 crore (about $104 million) and surpassing its initial ₹500 crore target. This major fundraising milestone highlights the growing appeal and investor confidence in India’s deeptech landscape, fueling innovation in pivotal sectors like semiconductors, artificial intelligence, robotics, aerospace, genomics, and smart manufacturing. The fund cements Yali Capital’s position as a key player driving progress in India’s burgeoning tech ecosystem.

Strategically, Yali Capital’s fund targets both early-stage (Seed, Series A) and later-stage (Series D and beyond) startups. Its diverse roster of Limited Partners (LPs) includes prominent corporations such as Infosys, Qualcomm Ventures, and Tata AIG, alongside government-backed organizations like the DPIIT Fund of Funds for Startups and the Self-Reliant India Fund. With heavyweight backers like Kris Gopalakrishnan (Infosys co-founder), Gopal Srinivasan (TVS Capital), and Utpal Sheth (RARE Enterprises), Yali Capital ensures robust strategic support. The firm’s dual structure—a SEBI-registered Alternative Investment Fund (AIF) and a GIFT City-based feeder vehicle—enables global investor participation, guided by tech luminary Lip-Bu Tan and managing partner Ganapathy Subramaniam.

Already, Yali Capital has invested in five breakthrough startups, including C2I Semiconductor, 4baseCare, and Perceptyne, focusing on chip design and AI. By devoting two-thirds of its fund to early-stage companies, Yali Capital underscores its commitment to nurturing next-generation Indian deeptech founders. This fundraising success aligns with a nationwide trend of surging investments in advanced technology and positions Yali Capital at the forefront of India’s drive toward self-reliance and global tech leadership.

Funding

Agritech Startup Gramik Raises INR 17 Crore to Expand Rural Commerce in India

- Gramik, a Lucknow-based agritech startup, has secured INR 17 crore in a bridge funding round ahead of its upcoming INR 56 crore Series A raise.

- The funding round included investments via Optionally Convertible Debentures (OCDs) and Compulsorily Convertible Debentures (CCDs).

- Key investors include Sammaan Global Ventures, Money Creeper Investment, and prominent angels such as Balram Yadav (MD & CEO, Godrej Agrovet), Gev Aryaton, Irfan Alam, Nikhil Bhagat, and Salvia Siddiqui.

Gramik’s Unique Peer Commerce Model

- Founded in 2021 by Raj Yadav, Gramik empowers over 120 million small and marginal farmers in India through a technology-driven rural commerce platform.

- The startup operates a dual-channel distribution network using Village-Level Entrepreneurs (VLEs) and rural retailers to deliver high-quality agri-inputs to remote areas.

- Gramik’s full-stack platform offers demand aggregation, logistics, embedded credit, and agronomy services, ensuring last-mile delivery and support for farmers.

Expansion Plans and Future Growth

- Gramik currently operates in 12 districts, with 1,200+ active VLEs and 250+ rural retail partners, and plans to expand to 3,000 VLEs and reach 1 million+ farmers across Uttar Pradesh, Maharashtra, and Jammu.

- The new funds will be used to expand Gramik’s private-label products, enhance agronomy-led farmer engagement, and scale operations in key states.

- With a strong focus on supply chain efficiency, technology, and farmer advisory services, Gramik aims to become a leader in India’s $50 billion agri-input and rural commerce market.

- Backed by previous seed funding of over INR 25 crore, Gramik is set to drive innovation and inclusive growth for rural communities.

f5vqj

June 4, 2025 at 7:57 pm

get generic clomiphene pills where can i get cheap clomid pill cost clomid prices buy cheap clomiphene tablets cost generic clomid online clomid generic buying clomid no prescription

binance Register

June 11, 2025 at 1:27 pm

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Create a free account

July 30, 2025 at 10:41 am

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

binance anm"alningsbonus

August 11, 2025 at 11:22 pm

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

MM88

November 6, 2025 at 1:58 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

站群程序

November 7, 2025 at 2:01 pm

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

谷歌蜘蛛池

November 11, 2025 at 7:39 am

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

ios超级签

November 12, 2025 at 8:19 pm

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

iwin

November 17, 2025 at 4:05 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Kuwin

November 17, 2025 at 11:41 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

MM88

November 23, 2025 at 9:19 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

labākais binance norādījuma kods

December 2, 2025 at 7:21 pm

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Nomini Casino Erfahrungen

December 20, 2025 at 12:22 pm

In der nachfolgenden Tabelle finden Sie eine Übersicht der aktuellen Top-Anbieter, die neben attraktiven Boni

auch eine breite Auswahl an Spielen bieten. Wir testen regelmäßig neue Casinos

und überprüfen bereits getestete Anbieter monatlich,

um Ihnen stets die aktuellsten und verlässlichen Informationen bieten zu können. Casinacho bietet

eine perfekte Kombination aus hohem Bonuswert und einem umfangreichen Freispielpaket.

Ja, so gut wie jedes neue Casino bietet einen Bonus für neue Kunden an.

Außerdem bietet nahezu jedes neue Online Casino einen kostenfreien Demomodus.

In unserer Bestenliste der neuen Online Casinos 2023 findest du auch Freispiele ohne Einzahlung.

Neue Online Casinos bieten eine Vielzahl unterschiedlicher Bonusangebote.

Eine lizenzierte Casino Seite erkennst du am schnellsten anhand ihres Hinweises auf die Zulassungs- bzw.

Neue Casinos sind sicher und vertrauenswürdig, wenn es sich um in Deutschland lizenzierte Anbieter

handelt. Du solltest dich immer über die Lizenz informieren, mit

der das Casino seine Spiele anbietet.

Abräumen kannst du durch die Jagd sowohl Bonusguthaben als auch Freispiele und Echtgeld.

Du kannst auf Freispiele und Bonusguthaben hoffen, in einigen Shops aber auch Cash-Guthaben aktivieren. Mit dem Bonus Shop bieten dir neue Casinos die Möglichkeit, zusätzliche

Boni freizuschalten. Einsetzen kannst du die Freispiele nicht im

gesamten Spielangebot, sondern den dafür vorgesehenen Titeln.

References:

https://online-spielhallen.de/locowin-casino-auszahlung-ein-umfassender-leitfaden-fur-spieler-in-deutschland/

Crown Casino Melbourne entertainment

December 27, 2025 at 4:18 pm

That’s the simple true following a postseason-less campaign.

Is the Lions’ championship window as open as it was entering this season or last season? The Lions’ main needs

this offseason figure to be … Branch’s late-season Achilles tear may mean he’s not ready for the start of 2026.

What’s working — and what isn’t working — along the offensive line?

By adding native and adaptive vegetation, using rainwater capture for toilet flushing,

and installing efficient fixtures and irrigation, the campus is

projected to save more than 20 million gallons of water each year.

The all-electric buildings are completely fossil-fuel free,

drawing renewable energy from off-site sources and the campus’s Thermal

Energy Center, which houses a geothermal system that provides heating and

cooling for 18 buildings. Since Microsoft established its headquarters in Redmond,

Washington, in 1986, the company’s campus has grown from four buildings to more than 100.

The Pedestrian Bridge connects Microsoft’s East and West Campus, creating a

direct connection between the distinct areas of campus while also eliminating the need for cars to traverse campus.

References:

https://blackcoin.co/basic-draw-poker-rule/

ninecasino

January 12, 2026 at 12:07 am

Greate article. Keep posting such kind of info on your blog. Im really impressed by your blog.

av 在线

January 28, 2026 at 1:24 am

I know this if off topic but I’m looking into starting

my own weblog and was wondering what all is required to get set up?

I’m assuming having a blog like yours would cost a pretty penny?

I’m not very web smart so I’m not 100% positive. Any suggestions or advice would be greatly appreciated.

Appreciate it