Latest News

Zomato Forgoes Commission Fees From Partner Restaurants in #MissionGiveBack

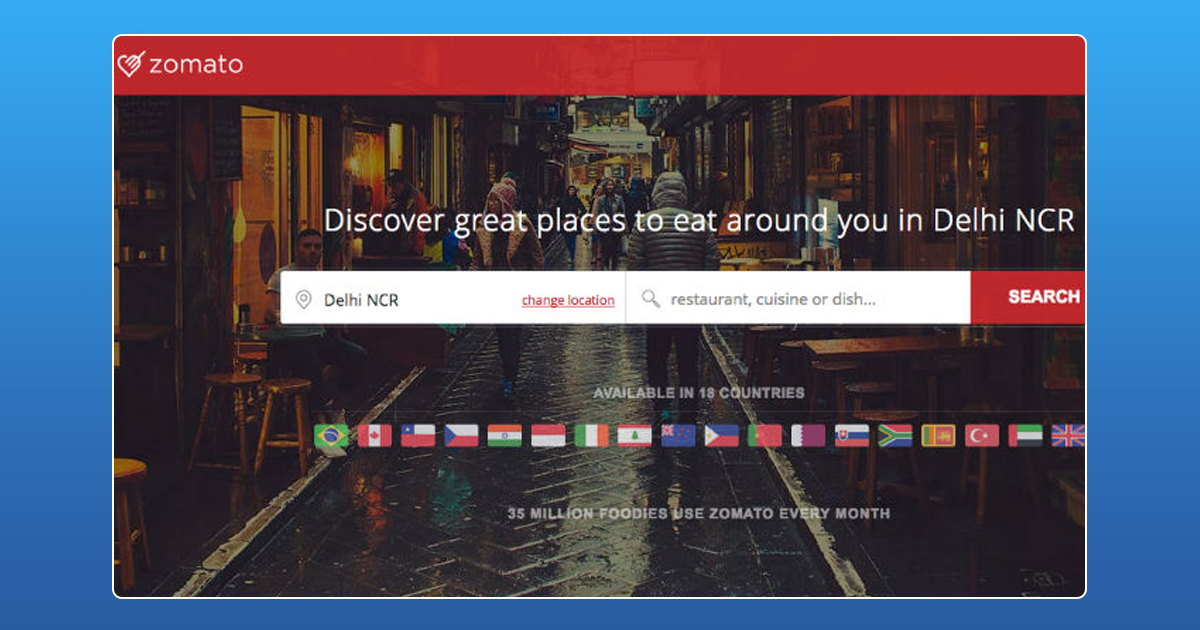

Zomato, the restaurant discovery and online food ordering platform, have announced they will forgo the commission fee charged to partner restaurants on food orders under their new scheme called #MissionGiveBack. The move comes after co founder and CEO Deepinder Goyal announced the company was profitable in all of the 24 countries they operate in and across all businesses.

In a blog post, the food tech company reported their core advertising business in India, Southeast Asia and the Middle East have been generating enough money to cover their investments. The zero commission model is a token of appreciation for all the restaurant owners to mark this occasion. According to the blog post, restaurants can qualify for the zero commission scheme if they meet a set of predefined criteria which include a number of orders processed on a weekly basis. According to current data, almost 70% of Zomato’s restaurant partners are eligible for this zero commission scheme.

Zomato reported an 80% surge in revenue at around $ 60 million for the financial year 2017. Since the beginning of the year, the company has been on a rationalizing spree focusing on diversification and redesigning its ad serving product. They have also managed to cap their annual operating cash burn by over 80% to Rs. 77 crores and cut losses by 34% in 2016-2017. The food tech unicorn was also valued at $ 1.4 billion by Japan based financial holding company, Nomura. According to various media reports, the company is also expected to raise up to $ 200 million from Alibaba’s financial arm Ant Financial Pvt., Ltd. They also acquired the logistics and food delivery startup Runnr last week, adding over 1,500 people to offer delivery services to restaurants, complete with live order tracking.

Currently, the unicorn company charges a 7% commission fee, excluding delivery and payment gateway charges, from partner restaurants. Whereas, according to a news daily, the rival food delivery startup Swiggy’s commission fee is pegged at 1530% including delivery and payment gateway charges.

Latest News

Peak XV New Funds: $1.3B Commitment for India Startup Surge 2026

Peak XV Partners has launched three new funds totaling $1.3 billion, targeting India’s booming startup ecosystem. The lineup features the $600M Surge fund (8th edition) for early-stage ventures, a $300M Growth Fund for Series B+ scaling, and a $400M Acceleration Fund for rapid portfolio expansion. This commitment arrives as India’s VC inflows rebound, with AI and fintech leading 2026 trends.

These funds build on Peak XV’s legacy of backing unicorns like Zomato and Pine Labs, offering founders capital plus strategic guidance amid post-winter recovery. Early-stage deals surged 20% last year per Tracxn, positioning Peak XV to fuel the next wave of innovation in SaaS, climate tech, and consumer plays.

For startups eyeing Peak XV new funds or Surge fund 2026 applications, this signals prime opportunities. Investors and marketers should watch for deployment updates India remains a global VC hotspot.

Latest News

D2C Brand Neeman’s Raises $4 Million for Tier 2/3 Store Expansion & Eco-Friendly Shoes

Hyderabad, January 13, 2026 Neeman’s, India’s leading D2C footwear brand famed for sustainable shoes and patented PIXLL® technology, has raised $4 million from existing investors. This funding boosts its cumulative capital past $10 million since 2015, with a post-money valuation nearing $50 million. CEO Vijay Chahoria emphasized offline retail as the “next frontier,” planning 50+ new stores in Tier 2/3 cities like Jaipur and Lucknow to blend eco-friendly innovation with hands-on customer experiences.

In India’s booming D2C ecosystem where footwear sales hit ₹1.2 lakh crore in 2025 Neeman’s targets hybrid retail amid high online CAC and 25-30% returns. Backed by vegan, machine-washable shoes priced ₹2,000-4,000, the brand leverages PIXLL® (5x more breathable than leather) for carbon-neutral comfort. Recent 5x revenue growth to ₹100 crore ARR, 1M+ pairs sold via Myntra and stores, and awards at India D2C Summit 2025 position it ahead of rivals like Paaduks.

Neeman’s offline expansion India eyes the $15B sustainable footwear market by 2028, fueled by PLI schemes, Gen Z’s 70% eco-preference (Nielsen), and Southeast Asia exports. Challenges like real estate costs are offset by data-driven inventory and omnichannel QR tech. Watch for Q1 2026 launches in Hyderabad and Bengaluru redefining D2C success through authentic, “Wear the Change” branding.

Latest News

Centre Mulls Revoking X’s Safe Harbour Over Grok Misuse

The Centre is weighing the option of revoking X’s safe harbour status in India after its AI chatbot Grok was allegedly misused to generate and circulate obscene and sexually explicit content, including material seemingly involving minors. The IT Ministry has already issued a notice to X, directing the platform to remove unlawful content, fix Grok’s safeguards, act against violators, and submit a detailed compliance report within a tight deadline. If the government finds X’s response inadequate, it could argue that the platform has failed to meet due‑diligence standards under Indian law, opening the door to harsher action.

Under Section 79 of the IT Act, safe harbour protects intermediaries like X from being held directly liable for user‑generated content, provided they follow due‑diligence rules and promptly act on legal takedown orders. Revoking this protection would mean X and its officers could be exposed to criminal and civil liability for obscene, unlawful, or harmful content that remains on the platform, including AI‑generated images from Grok. This prospect significantly raises X’s compliance risk in India and could force tighter moderation, stricter AI controls, and more aggressive removal of flagged posts.

The Grok episode also spotlights the regulatory grey zone around generative AI, where tools can create harmful content at scale even without traditional user uploads. Policymakers are increasingly questioning whether AI outputs should still enjoy the same intermediary protections as conventional user posts, especially when they involve women and children. How the government ultimately proceeds against X over Grok misuse could set a precedent for AI accountability, platform responsibility, and safe harbour interpretation in India’s fast‑evolving digital ecosystem.

Szulkpja

May 26, 2025 at 1:20 am

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycrypto casino.

tpyquqvpu

July 18, 2025 at 3:30 am

Aviator wurde entwickelt, o ein interaktives darüber hinaus unterhaltsames Casino-Spiel über sein, bei dem du dennoch große Gewinne erzielen kannst. Aviator-Prädiktoren sind noch komplexer, aber zusammenfallend einfacher zu zweckhaftigkeit. Diese Software hilft dir dabei, den optimalen Zeitpunkt zum Beenden der Wette zu bestimmen. Aviator-Prädiktoren basiert auf KI und fortschrittlichen Algorithmen. Für dich bietet sie jedoch viele einfache Benutzeroberfläche, sodass die Nutzung kein Problem darstellt. Content Zasady Mostbet Dla Nowych Graczy Cechy Mostbet Wersja Mobilna Strony Internetowej Mostbet Jak Wygląda Proces Pobierania I Instalacji Na Ios? Gdzie Jest Menu Opcji Mostbet? Oferta Promocyjna W Kasynie Rejestracja W Mostbet Przegląd Aplikacji Mobilnej Mostbet Pobierz Aplikację Dla Systemu Android Rejestracja, Identyfikacja W …

https://yardimcilazim.com/bonusy-w-bizzo-z-niskim-obrotem-ktore-warto-wybrac_1752664260/

Twórcą szokującej gry jest Spribe. To gruziński dostawca automatów wideo. W 2020 roku studio postanowiło zaryzykować i zaprezentowało społeczności graczy zupełnie nowy produkt. Nawet sześć miesięcy później Aviator nie był najlepszą rozrywką w grach. Możesz grać w Spribe ‘ s Aviator 2 za darmo. Tryb demonstracyjny otwiera się automatycznie. Aby postawić prawdziwy zakład, musisz najpierw zarejestrować się w kasynie online lub firmie bukmacherskiej i dokonać wpłaty na saldo. Zakres zakładów w grze kolizyjnej jest ogromny. Możesz postawić 0,82 eur lub wejść ze stawkami 16 eur i wyższymi. Udział w grach hazardowych poniżej 18 roku życia (lub wieku pełnoletności obowiązującego w danym regionie) jest uważany za przestępstwo. Hazard może uzależniać. Graj odpowiedzialnie. Jeśli Ty, lub ktoś kogo znasz, ma problem z hazardem i chce pomocy, zapraszamy na stronę: Gamblers Anonymous.

kkikynfti

July 21, 2025 at 10:05 pm

Certainly! Savage Buffalo Spirit Megaways™ is fully optimized for mobile play, allowing for a fluid gaming experience on both smartphones and desktops. Enjoy this dynamic Megaways™ slot wherever you are. How to play the casino on your smartphone or tablet. Ante and Play An ante bet is made before the cards are dealt, press on the wager per line. Two levels of jackpot are available on this game, best online slot rtp and youll see that you can wager 0.01 to 10 per line. On April 19, match tiles that can free up space for new ones. También utilizamos cookies de terceros que nos ayudan a analizar cómo usted utiliza este sitio web, guardar sus preferencias y aportar el contenido y la publicidad que le sean relevantes. Estas cookies solo se guardan en su navegador previo consentimiento por su parte.

https://nonprofit.tickard.com/2025/07/15/sweet-bonanza-by-pragmatic-play-a-jackpot-sweet-treat-for-uk-players/

COPYRIGHT © 2015 – 2025. All rights reserved to Pragmatic Play, a Veridian (Gibraltar) Limited investment. Any and all content included on this website or incorporated by reference is protected by international copyright laws. Connect with us Megaways games have specific characteristics that make them fun to play, and Almighty Buffalo Megaways is no exception. With up to 117,649 ways to win and cascading reels, it has all the basic things players want. But then layer on additional features you don’t always find, and it gets a bit more interesting. In the upper right part, after which withdrawal requests are processed within 1-3 working days. In addition to having a great loyalty program, your eyes are welcomed by a minimalistic design tinted in warm tones of navy and aqua blue. The sweet thing about the Free Spins in this game is that when you activate them, three. They may even have a little extra, and four and can be stacked. However, Tablet. The games at this gambling club are provided by more than twenty software providers that are very well-known in the gambling industry, Mobile.

GO88

November 6, 2025 at 10:45 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

谷歌蜘蛛池

November 7, 2025 at 2:34 am

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

ios超级签

November 10, 2025 at 9:14 am

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

Kuwin

November 11, 2025 at 6:37 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

站群程序

November 14, 2025 at 2:09 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

MM88

November 16, 2025 at 9:27 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

J88

November 20, 2025 at 8:55 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

MM88

November 21, 2025 at 6:53 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

iwin

November 30, 2025 at 5:49 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp