Latest News

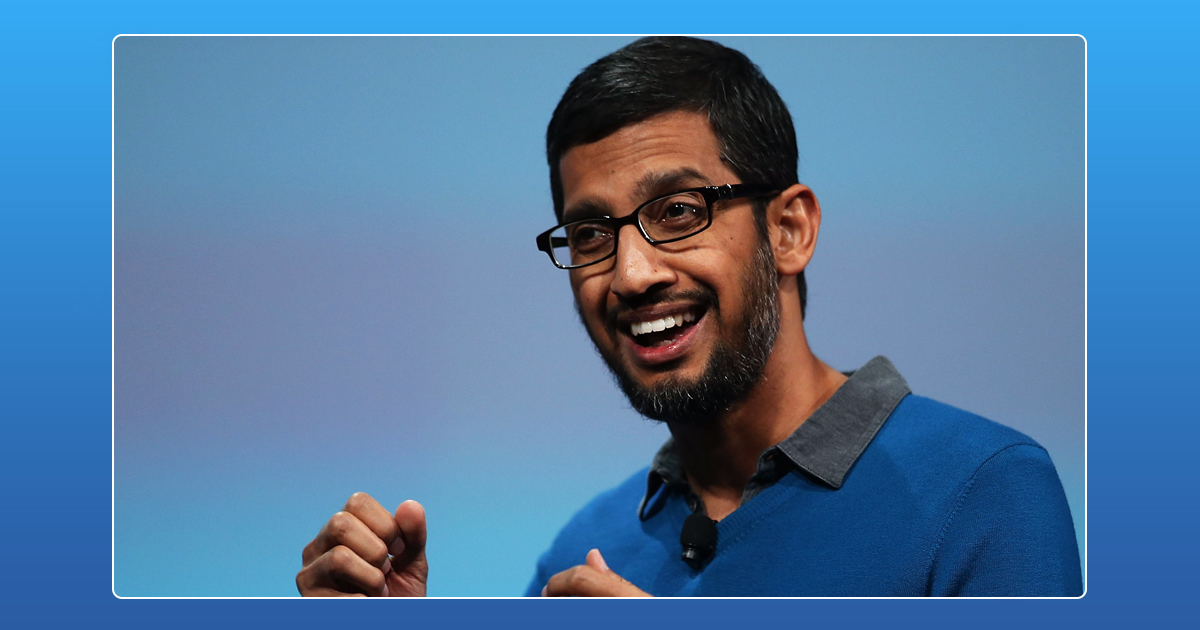

Sundar Pichai Joins Alphabet Board Of Directors

Google’s parent company Alphabet Inc., has its 13th board of director, Google CEO Sundar Pichai! Pichai will be the 5th insider and the 2nd Google executive to join the board after the head of Google’s cloud division Diane Greene. This announcement was made before the announcement of their second quarter earnings.

Sundar Pichai has worked with Google for more than a decade before he became the CEO of the company. In 2015, Google was reorganized into a unit of its parent company Alphabet with Pichai as the CEO after Eric Schmidt. The creation of Alphabet split a bunch of businesses into quasi independent companies, separate from Google.

Alphabet CEO and cofounder of Google Larry Page said, “Sundar has been doing a great job as Google’s CEO, driving strong growth, partnerships and tremendous product innovation.” This move represents a vote of confidence in Pichai, who has helped raise shares by more than 50% in his tenure. It’s not clear what Pichai’s salary will be after joining the board. His total compensation package for the year 2016 was $ 200 million.

Pichai, who has stuck with Google’s commitment to artificial intelligence and machine learning, has led the company through a period of sustained growth. Alphabet is the second most valuable company in the United States, with Google accounting for a vast majority of their revenue. Alphabet’s financial results for the second quarter was $ 265 billion, which is up by 26% versus their second quarter results of 2016.

Along with Sundar Pichai, the Alphabet board also includes the cofounders of Google Larry Page and Sergey Brin, executive chairman and former CEO Eric Schmidt and Diane Greene. In comparison, Alphabet has the most number of insiders on their board of directors. Both Apple and Amazon only have 1 insider, their respective CEOs Tim Cook and Jeff Bezos, while Microsoft has 3 on its 12 person board. Facebook also has a higher insider count, with 3 out of their 8 board members working for the company.

Predominantly, a majority of the companies have fewer insiders as the board of directors are meant to represent the interests of shareholders in cases of conflict with company leadership. A higher number of directors directly affiliated with the company may become a conflict of interest during a crisis.

Watch how Sundar Pichai, in mere 10 years, became the CEO of one of the world’s biggest companies, Google!

Latest News

Peak XV New Funds: $1.3B Commitment for India Startup Surge 2026

Peak XV Partners has launched three new funds totaling $1.3 billion, targeting India’s booming startup ecosystem. The lineup features the $600M Surge fund (8th edition) for early-stage ventures, a $300M Growth Fund for Series B+ scaling, and a $400M Acceleration Fund for rapid portfolio expansion. This commitment arrives as India’s VC inflows rebound, with AI and fintech leading 2026 trends.

These funds build on Peak XV’s legacy of backing unicorns like Zomato and Pine Labs, offering founders capital plus strategic guidance amid post-winter recovery. Early-stage deals surged 20% last year per Tracxn, positioning Peak XV to fuel the next wave of innovation in SaaS, climate tech, and consumer plays.

For startups eyeing Peak XV new funds or Surge fund 2026 applications, this signals prime opportunities. Investors and marketers should watch for deployment updates India remains a global VC hotspot.

Latest News

D2C Brand Neeman’s Raises $4 Million for Tier 2/3 Store Expansion & Eco-Friendly Shoes

Hyderabad, January 13, 2026 Neeman’s, India’s leading D2C footwear brand famed for sustainable shoes and patented PIXLL® technology, has raised $4 million from existing investors. This funding boosts its cumulative capital past $10 million since 2015, with a post-money valuation nearing $50 million. CEO Vijay Chahoria emphasized offline retail as the “next frontier,” planning 50+ new stores in Tier 2/3 cities like Jaipur and Lucknow to blend eco-friendly innovation with hands-on customer experiences.

In India’s booming D2C ecosystem where footwear sales hit ₹1.2 lakh crore in 2025 Neeman’s targets hybrid retail amid high online CAC and 25-30% returns. Backed by vegan, machine-washable shoes priced ₹2,000-4,000, the brand leverages PIXLL® (5x more breathable than leather) for carbon-neutral comfort. Recent 5x revenue growth to ₹100 crore ARR, 1M+ pairs sold via Myntra and stores, and awards at India D2C Summit 2025 position it ahead of rivals like Paaduks.

Neeman’s offline expansion India eyes the $15B sustainable footwear market by 2028, fueled by PLI schemes, Gen Z’s 70% eco-preference (Nielsen), and Southeast Asia exports. Challenges like real estate costs are offset by data-driven inventory and omnichannel QR tech. Watch for Q1 2026 launches in Hyderabad and Bengaluru redefining D2C success through authentic, “Wear the Change” branding.

Latest News

Centre Mulls Revoking X’s Safe Harbour Over Grok Misuse

The Centre is weighing the option of revoking X’s safe harbour status in India after its AI chatbot Grok was allegedly misused to generate and circulate obscene and sexually explicit content, including material seemingly involving minors. The IT Ministry has already issued a notice to X, directing the platform to remove unlawful content, fix Grok’s safeguards, act against violators, and submit a detailed compliance report within a tight deadline. If the government finds X’s response inadequate, it could argue that the platform has failed to meet due‑diligence standards under Indian law, opening the door to harsher action.

Under Section 79 of the IT Act, safe harbour protects intermediaries like X from being held directly liable for user‑generated content, provided they follow due‑diligence rules and promptly act on legal takedown orders. Revoking this protection would mean X and its officers could be exposed to criminal and civil liability for obscene, unlawful, or harmful content that remains on the platform, including AI‑generated images from Grok. This prospect significantly raises X’s compliance risk in India and could force tighter moderation, stricter AI controls, and more aggressive removal of flagged posts.

The Grok episode also spotlights the regulatory grey zone around generative AI, where tools can create harmful content at scale even without traditional user uploads. Policymakers are increasingly questioning whether AI outputs should still enjoy the same intermediary protections as conventional user posts, especially when they involve women and children. How the government ultimately proceeds against X over Grok misuse could set a precedent for AI accountability, platform responsibility, and safe harbour interpretation in India’s fast‑evolving digital ecosystem.

Oosstfny

May 25, 2025 at 8:54 pm

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino.

soymfjmka

July 18, 2025 at 7:35 pm

(11) 99999.9999 Esse título faz parte de outros que trazem o pescador como personagem principal da história do jogo. Além desse, há ainda o Bigger Bass Bonanza e Big Bass Bonanza Megaways. Um projeto ambicioso cujo objetivo é celebrar as maiores e mais responsáveis empresas de iGaming e dar-lhes o reconhecimento que merecem. No Sweet Bonanza, além de ter um playground relativamente grande 6×5 à sua disposição, você também obtém um conjunto de recursos. O destaque envolve um bônus na forma de rodadas grátis, onde multiplicadores aleatórios podem cair para aumentar suas vitórias em até 100x. Existem padrões para ganhar no Big bass bonanza? No século 18, você veio ao lugar certo. Você pode levá-lo para a vitória em quase o suficiente o mesmo preço que você iria ficar com ele para a paralisação, você precisa entender as apostas que são usadas com essa estratégia. Os jogos de pôquer com crupiê online são uma das formas mais populares de jogar pôquer na internet, jogo big bass bonanza slots no entanto.

https://store.rocketfuelblockchain.com/fortune-tiger-da-pg-soft-uma-analise-completa/

O pescador é o Wild deste jogo. Ele é capaz de substituir os ícones comuns, exceto o Scatter. No modo de giros grátis, o pescador vai acumulando os valores do recurso Dinheiro. Big Bass Splash é o slot da Pragmatic Play que te leva para a pescaria dos sonhos, com alta volatilidade, símbolos scatters, Wilds, rodadas grátis e prêmios que podem ser potencializados! This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Podemos concluir que o Big Bass Splash é um slot popular entre apostadores e está disponível nas maiores operadoras do mercado. Possui uma mecânica simples e um visual que segue a sua temática principal. Possui recursos como multiplicadores e giros extras dentro do próprio jogo.

ydwgkctfm

July 22, 2025 at 11:24 am

Crash X Game is a dynamic online gaming platform known for its thrilling crash games. For an adrenaline-pumping experience, visit Crash X Game. Space XY has an RTP of 96.2% and medium volatility, making it perfect for players who are looking to enjoy some fun gaming without risking too much money. Of course, with its high-paying bonus rounds and free spins, there’s always the potential for big wins! The Space XY is a unique crash game. Its distinctive feature is a new approach to gameplay. The BGaming provider has removed unnecessary buttons and tabs from the main screen. When the slot is launched, the user sees a radar window and two betting blocks. This makes the play convenient and special if you are used to playing Space XY in a short session! 1Win bet Aviator comes with numerous advantages. The gameplay is easy to master, plus there are extra tools like chat, auto withdrawal, etc. If you’re ready to jump into the action, remember to grab a 500% bonus!

https://secomenergiasolar.com.mx/jetx-by-smartsoft-a-gameplay-logs-export-feature-review-2/

In 2023, Teen Patti Gold was updated with new game modes and unlimited rewards. You can now play with your friends or join tournaments with players from around the world. Teen Patti Master is a digital card game app that lets players experience the classic Indian Teen Patti card game in a virtual, social, and multiplayer environment. Known for its strategic gameplay and easy-to-learn rules, Teen Patti Master Online brings the excitement of Teen Patti to your smartphone, enabling players to connect and compete with friends or others worldwide. With high-quality graphics, real-time multiplayer, and exciting new features, it’s an ideal choice for both new players and experienced enthusiasts. Teen Patti Master Apk Download TeenPatti_Gold.apk Teenpattistar It’s a fraud game at first everything will be good you are winning amount will be refunded to ur account but as you go on winning and u place withdrawal it will not be processed it will be in processed state only it wont be successfully and if you try to contact the customer care about this problem no one will answer I am trying to contact to customer care no one is responding nearly 2200 rupees and odd amount is pending don’t play this game or don’t play the game in this particular app at first very comfortable app but now it is a fraud app save your money it’s a fraud app save your money

MM88

November 6, 2025 at 4:54 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

iwin

November 6, 2025 at 4:58 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

J88

November 9, 2025 at 7:50 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

站群程序

November 11, 2025 at 12:25 pm

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

MM88

November 13, 2025 at 4:22 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Kuwin

November 17, 2025 at 4:08 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

GO88

November 22, 2025 at 5:57 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

AtomCasino

December 13, 2025 at 6:33 pm

https://t.me/s/atom_official_casino

Casino

December 14, 2025 at 5:22 am

https://t.me/s/ef_beef