Latest News

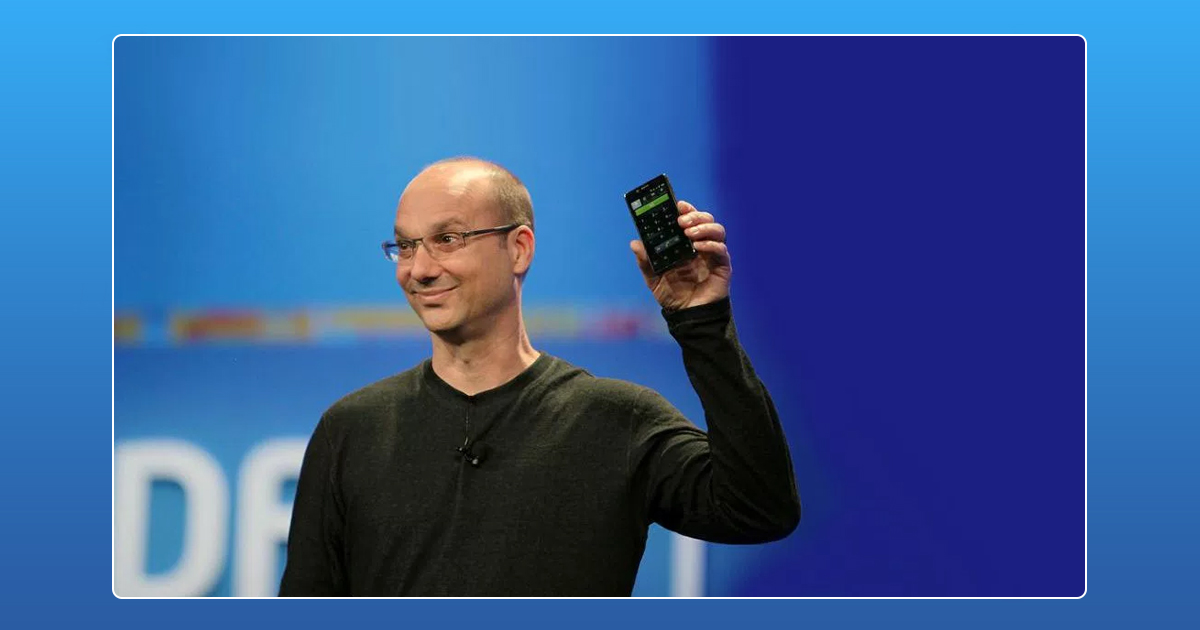

Father Of Latest Android Phone, Essential Has Already Raised $300 Million.

The creator of one of the leading operating systems in the smartphone market, Andy Rubin has reportedly raised $300 million for his latest venture the Essential Phone. Launched only on 30th May this year, this Series B financing round valued the phone maker at $900 million to $1 billion according to Equidate, a firm that offers up valuations of private startups.

Also Read: FATHER OF ANDROID ANDY RUBIN SET TO RELEASE ESSENTIAL SMARTPHONE

Reportedly, Andy Rubin is looking to use this financing to break further into the consumer electronics segment. While the paperwork on the investment was filed late last month regarding the new investments, Bloomberg reported that the financial backers were not disclosed. Japan-based SoftBank initially had plans to invest $100 million in Essential but later decided to walk away because of its existing relationship with Apple.

This was the second major funding round for Essential Phone, the first being a $30 million raise last year by Redpoint Ventures and Andy Rubin’s own firm Playground Global. The first round also saw participation from Altimeter Capital, China-based Tencent Holdings, and Foxconn Technology group.

Rubin has also unveiled plans for two future products a high-end smartphone and a home speaker. The smartphone and speaker are likely to compete against Amazon’s Echo, Google Home and the newly revealed HomePod by Apple.

Essential PH-1 smartphone will cost $ 749 with the 360-degree camera, 128 GB of internal storage, 4 GB RAM and a Qualcomm Snapdragon 835 processor packed in a hefty 5.7-inch screen.

Latest News

Peak XV New Funds: $1.3B Commitment for India Startup Surge 2026

Peak XV Partners has launched three new funds totaling $1.3 billion, targeting India’s booming startup ecosystem. The lineup features the $600M Surge fund (8th edition) for early-stage ventures, a $300M Growth Fund for Series B+ scaling, and a $400M Acceleration Fund for rapid portfolio expansion. This commitment arrives as India’s VC inflows rebound, with AI and fintech leading 2026 trends.

These funds build on Peak XV’s legacy of backing unicorns like Zomato and Pine Labs, offering founders capital plus strategic guidance amid post-winter recovery. Early-stage deals surged 20% last year per Tracxn, positioning Peak XV to fuel the next wave of innovation in SaaS, climate tech, and consumer plays.

For startups eyeing Peak XV new funds or Surge fund 2026 applications, this signals prime opportunities. Investors and marketers should watch for deployment updates India remains a global VC hotspot.

Latest News

D2C Brand Neeman’s Raises $4 Million for Tier 2/3 Store Expansion & Eco-Friendly Shoes

Hyderabad, January 13, 2026 Neeman’s, India’s leading D2C footwear brand famed for sustainable shoes and patented PIXLL® technology, has raised $4 million from existing investors. This funding boosts its cumulative capital past $10 million since 2015, with a post-money valuation nearing $50 million. CEO Vijay Chahoria emphasized offline retail as the “next frontier,” planning 50+ new stores in Tier 2/3 cities like Jaipur and Lucknow to blend eco-friendly innovation with hands-on customer experiences.

In India’s booming D2C ecosystem where footwear sales hit ₹1.2 lakh crore in 2025 Neeman’s targets hybrid retail amid high online CAC and 25-30% returns. Backed by vegan, machine-washable shoes priced ₹2,000-4,000, the brand leverages PIXLL® (5x more breathable than leather) for carbon-neutral comfort. Recent 5x revenue growth to ₹100 crore ARR, 1M+ pairs sold via Myntra and stores, and awards at India D2C Summit 2025 position it ahead of rivals like Paaduks.

Neeman’s offline expansion India eyes the $15B sustainable footwear market by 2028, fueled by PLI schemes, Gen Z’s 70% eco-preference (Nielsen), and Southeast Asia exports. Challenges like real estate costs are offset by data-driven inventory and omnichannel QR tech. Watch for Q1 2026 launches in Hyderabad and Bengaluru redefining D2C success through authentic, “Wear the Change” branding.

Latest News

Centre Mulls Revoking X’s Safe Harbour Over Grok Misuse

The Centre is weighing the option of revoking X’s safe harbour status in India after its AI chatbot Grok was allegedly misused to generate and circulate obscene and sexually explicit content, including material seemingly involving minors. The IT Ministry has already issued a notice to X, directing the platform to remove unlawful content, fix Grok’s safeguards, act against violators, and submit a detailed compliance report within a tight deadline. If the government finds X’s response inadequate, it could argue that the platform has failed to meet due‑diligence standards under Indian law, opening the door to harsher action.

Under Section 79 of the IT Act, safe harbour protects intermediaries like X from being held directly liable for user‑generated content, provided they follow due‑diligence rules and promptly act on legal takedown orders. Revoking this protection would mean X and its officers could be exposed to criminal and civil liability for obscene, unlawful, or harmful content that remains on the platform, including AI‑generated images from Grok. This prospect significantly raises X’s compliance risk in India and could force tighter moderation, stricter AI controls, and more aggressive removal of flagged posts.

The Grok episode also spotlights the regulatory grey zone around generative AI, where tools can create harmful content at scale even without traditional user uploads. Policymakers are increasingly questioning whether AI outputs should still enjoy the same intermediary protections as conventional user posts, especially when they involve women and children. How the government ultimately proceeds against X over Grok misuse could set a precedent for AI accountability, platform responsibility, and safe harbour interpretation in India’s fast‑evolving digital ecosystem.

谷歌蜘蛛池

November 7, 2025 at 2:56 pm

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

Kuwin

November 8, 2025 at 3:59 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

MM88

November 13, 2025 at 8:10 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

J88

November 14, 2025 at 9:31 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Casino App unterwegs

December 20, 2025 at 10:09 pm

Dafür müssen Sie aber auf keine Casinospiele verzichten,

weil es nicht nur virtuelle Automatenspiele, sondern auch alle anderen Glücksspiele gibt.

Diese sind natürlich auch als Live Casino Spiele verfügbar,

wo noch die beliebten Spielshows im Verde Casino online dazukommen. Dazu gehören die Brettspiele, die wir eher als Tischspiele bezeichnen würden, wie

Poker, Roulette, Blackjack, Baccarat oder

Craps. Dennoch gibt es neben den Verde Casino Spielautomaten auch jede Menge andere Casinospiele im Spielangebot.

Der Willkommensbonus folgt den möglichen Freispielen ohne Einzahlung beziehungsweise nachdem Sie vom

Verde Casino 25 Euro Startguthaben erhalten haben. Sie starten zum Beispiel mit einem No Deposit Bonus und erhalten danach den Willkommensbonus von bis zu 1.200 Euro

mit 220 Freispielen. Sie erhalten den Bonus ohne Einzahlung gutgeschrieben, müssen aber eine Mindesteinzahlung von 10€ tätigen, um mit dem

Freispielen des Bonus beginnen zu können. Das Willkommensbonuspaket setzt sich aus Bonus und Freispielen zusammen. Unter anderem

gibt es einen hohen Willkommensbonus mit Bonusgeld und

Freispielen.

References:

https://online-spielhallen.de/avantgarde-casino-freispiele-ihr-weg-zu-kostenlosem-spielspas/

bitcoin gambling

December 26, 2025 at 9:35 pm

Please note that tables of 12 or more are required to dine

from the Master Smoker’s Platter menu. We have homemade rubs and a curated range of sauces to complement every

dish. Our team live to grill and smoke Tasmania’s best meats

to perfection.

The gaming floor includes everything from blackjack and roulette,

through to electronic gaming machines, sports betting,

TASkeno and a whole lot more. Wrest Point’s location, stunning views and spaces that include foyers,

restaurants, bars, and large and small private rooms ensure every occasion will impress.

Our rooms range from compact workspaces right

through to large seating areas. Wrest Point’s large range of spaces mean we can equip any

session you have in mind for attendees perfectly.

It’s the closest thing to being in the casino without leaving home.

These machines provide fast-paced, automated action with flexible betting options and minimal wait times.

Wrest Point is home to some of Tasmania’s most competitive

live poker events. Whether you’re a weekend visitor or a daily online player, Wrest Point tailors its rewards to suit your

style.

References:

https://blackcoin.co/1_the-ultimate-guide-to-high-roller-games-top-games-to-play_rewrite_1/

paypal casino sites

December 27, 2025 at 3:06 am

You can use our expert tips to find the best casino, such

as exploring the game lobby, checking the software providers, reading the bonus terms, and talking to customer support.

Its tropical setting adds a unique vibe while you explore over

500 gaming machines and a variety of table games.

With two casino floors packed with over 1,500 gaming machines and tables, there’s always something happening.

Check our responsible gambling page for more information about how to

manage your bankroll and make sure you stay in control when playing.

When you’re gambling online, an unstable connection is

problematic, so I suggest upgrading your plan or switching providers if your internet isn’t stable.

No round-trip to casinos, no dressing up, and you don’t

even need to be on a PC.

The legal landscape of online gambling in Australia is complex, with regulations at both state and federal

levels. Cryptocurrency casinos are becoming popular in Australia due to their fast transactions and

privacy features. These promotions provide a great chance to try different games and experience the casino environment without financial risk.

ThunderPick Casino provides 100 free spins upon the first

deposit, making it a competitive offer. DundeeSlots offers a

welcome bonus of up to AU$8,000 plus 180

free spins, and 1Red Casino provides up to AU$15,450 with free spins.

Skilled players know that strategy significantly boosts their chances of winning at

blackjack.

Study the games before playing. These are a great option if you’re looking for high RTP games

(some are over 99%), but they do require knowledge and skill

to play. This means the games are randomised, and you’re playing against a computer.

The choice of game providers is also relevant, as some, like BGaming, are

known for high RTP slots, while others, like Pragmatic Play, focus

on bonus games and high volatility. This means you can’t

withdraw unless you clear the bonus of any wagering requirements,

which is why it’s usually a smart way to skip the bonus if

the WRs are over 40x.

References:

https://blackcoin.co/casino-gambling-the-kinds-of-casino-bonuses/

365.expresso.blog

December 29, 2025 at 9:28 am

online poker real money paypal

References:

365.expresso.blog

https://www.revedesign.co.kr/bbs/board.php?bo_table=free&wr_id=319334

December 29, 2025 at 9:46 am

online american casinos that accept paypal

References:

https://www.revedesign.co.kr/bbs/board.php?bo_table=free&wr_id=319334

divyangrojgar.com

December 30, 2025 at 2:26 pm

casino sites that accept paypal

References:

https://divyangrojgar.com/employer/40-best-australian-online-casinos-for-real-money-in-december-2025/