News

Epic Games Locks Horns With Google And Apple In A Lawsuit Over Fortnite

Google and Apple combined are responsible for providing a platform for downloading applications and are also the market leaders for app stores. Almost every developer launches their app either on the Google Play Store and/or the Apple App Store, so that consumers and customers can see their products or services. There are 2.8 million android applications available on the Google Play Store while the Apple App Store has close to 1.3 million apps available for its users in early 2020.

A popular game, Fortnite was removed from both Apple and Google platforms over ambiguity in the way Fortnite developer Epic Games conducted payments inside the gaming app. This led to Epic Games filing lawsuits against both Apple and Google for banning Fortnite from their platforms. Fortnite is one of the biggest battle royale games in the world right now and there are over 250 million Fortnite players in the world.

Unfolding of the ban:

Fortnite’s latest game update offered all players a 20% discount on its in-game currency V-bucks, but only if they paid Epic Games directly rather than using Apple or Google’s payment systems. This did not sit well with Google and Apple as both platforms take a standard 30% of purchases on their app stores. It also meant Epic Games broke the rules applying to both the stores.

Apple proceeded to remove Epic Games from their platform leaving ios users with no way to install the game. Epic games released a video mocking Apple with a television themes advert similar to the one Apple used in their 1984 Super Bowl commercial.

Epic Games has defied the App Store Monopoly. In retaliation, Apple is blocking Fortnite from a billion devices.

Visit https://t.co/K3S07w5uEk and join the fight to stop 2020 from becoming "1984" https://t.co/tpsiCW4gqK

— Fortnite (@FortniteGame) August 13, 2020

A few hours later after the Apple ban, Fortnite vanished from the Google Play Store, as well.

Fortnite is currently unavailable on Google Play. More information will be forthcoming soon.

— Fortnite (@FortniteGame) August 14, 2020

What is the lawsuit

Documents available in the public domain through the United States court records system show Epic Games filed a complaint against Google in a California court, just as it did against Apple. The lawsuit highlights Google’s motto which was once “Don’t be evil.” Epic Games said “Google has relegated its motto to nearly an afterthought, and is using its size to do evil upon competitors, innovators, customers, and users in a slew of markets it has grown to monopolise (sic.)”

The lawsuit further goes on to describe a deal that Epic Games had reached with phone maker OnePlus to make its games available ‘seamlessly’ on their devices. Epic Games said “But Google forced OnePlus to renege on the deal, citing Google’s ‘particular concern’ about Epic having the ability to install and update mobile games while ‘bypassing the Google Play Store (sic.)”

What is Epic Games looking for?

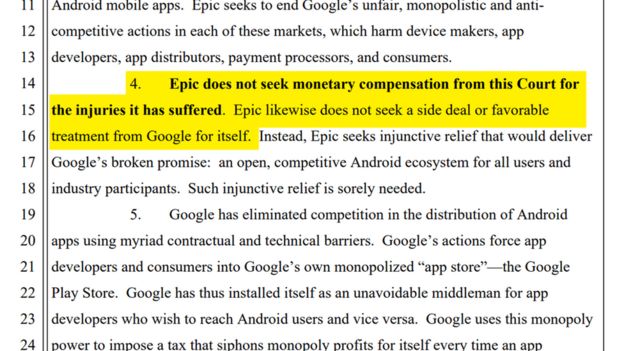

Epic Games says it wants the mobile app stores to be fairer for all developers. Epic Games also highlights that it is not seeking a compensation payout or more favourable deal for itself. However, they state any reduction in the 30% cut charged by both Apple and Google will help Epic Games favourably.

Google said “The open Android ecosystem lets developers distribute apps through multiple app stores. For game developers who choose to use the Play Store, we have consistent policies that are fair to developers and keep the store safe for users. While Fortnite remains available on Android, we can no longer make it available on Play because it violates our policies (sic.)”

Apple said in a statement “Epic has had apps on the App Store for a decade, and have benefited from the App Store ecosystem – including its tools, testing, and distribution that Apple provides to all developers. Epic agreed to the App Store terms and guidelines freely and we’re glad they’ve built such a successful business on the App Store. The fact that their business interests now lead them to push for a special arrangement does not change the fact that these guidelines create a level playing field for all developers and make the store safe for all users (sic.)” It also said “We will make every effort to work with Epic to resolve these violations so they can return Fortnite to the App Store (sic.)”

It will be interesting to watch the outcome of the lawsuit filed by Epic Games and if the courts will rule in the favour of a fairer market or in the favour of existing market rules.

News

Google Launches Startup Hub in Hyderabad to Boost India’s Innovation Ecosystem

Google has launched the Google Startup Hub Hyderabad, a major step in strengthening India’s dynamic startup ecosystem. This new initiative aims to empower entrepreneurs, innovators, and developers by giving them access to Google’s global expertise, mentoring programs, and advanced cloud technology. The hub reflects Google’s mission to fuel India’s digital transformation and promote innovation through the Google for Startups program.

Located in the heart of one of India’s top tech cities, the Google Startup Hub in Hyderabad will host mentorship sessions, training workshops, and networking events designed for early-stage startups. Founders will receive Google Cloud credits, expert guidance in AI, product development, and business scaling, and opportunities to collaborate with Google’s global mentors and investors. This ecosystem aims to help Indian startups grow faster and compete globally.

With Hyderabad already home to tech giants like Google, Microsoft, and Amazon, the launch of the Google Startup Hub Hyderabad further cements the city’s position as a leading innovation and technology hub in India. Backed by a strong talent pool and robust infrastructure, this hub is set to become a growth engine for next-generation startups, driving innovation from India to global markets.

News

BMW’s New Logo Debuts Subtly on the All-Electric iX3: A Modern Evolution

BMW quietly debuted its new logo on the all-electric iX3, marking a significant yet understated shift in the brand’s design direction for 2025. The updated emblem retains the classic roundel and Bavarian blue-and-white colors, but sharp-eyed enthusiasts noticed subtle refinements: the inner chrome ring has been removed, dividing lines between blue and white are gone, and the logo now features a contemporary satin matte black background with slimmer “BMW” lettering. These enhancements showcase BMW’s embrace of modern minimalism while reinforcing their commitment to premium aesthetics and the innovative Neue Klasse philosophy for future electric vehicles.

Unlike rival automakers that reveal dramatic logo changes, BMW’s refresh is evolutionary and respectful of tradition. The new badge ditches decorative chrome and blue borders associated with earlier electric models, resulting in a flatter, more digital-friendly design that mirrors recent branding seen in BMW’s digital communications. Appearing first on the iX3’s nose, steering wheel, and hub caps, this updated identity will gradually be adopted across all BMW models—both electric and combustion—signaling a unified brand language for years to come.

BMW’s strategic logo update represents more than just aesthetic reinvention—it underscores the brand’s dedication to future-ready mobility, design continuity, and a premium EV experience. As the new roundel begins rolling out on upcoming BMW vehicles, it stands as a testament to the automaker’s depth of detail and thoughtful evolution, offering subtle distinction for keen observers and affirming BMW’s iconic status in the ever-changing automotive landscape.

News

iPhone 17 India Price, Features & Availability: All You Need to Know

Apple has officially launched the highly anticipated iPhone 17 series in India, with prices starting at INR 82,900 for the base 256GB model. The new lineup includes the iPhone 17, iPhone 17 Pro, iPhone 17 Pro Max, and the newly introduced ultra-slim iPhone Air. Apple has removed the 128GB storage variant, making 256GB the minimum for all models. The standard iPhone 17 features a vibrant 6.3-inch ProMotion OLED display with a 120Hz refresh rate and an upgraded Ceramic Shield 2 for improved durability. It comes in fresh color options like lavender, mist blue, sage, white, and black.

The iPhone 17 Pro and Pro Max models are powered by Apple’s latest A19 Pro chip and start at INR 1,34,900 and INR 1,49,900, respectively. These Pro models feature sleek titanium frames, significant camera upgrades including 8K video recording, and up to 6x optical zoom in the Pro Max. Meanwhile, the iPhone Air, priced from INR 1,19,900, is the slimmest and lightest iPhone ever, boasting a 6.7-inch Super Retina XDR display with ProMotion technology and a triple-camera setup, positioning itself between the standard and Pro models.

Pre-orders for the iPhone 17 series commence on September 12, with sales beginning on September 19, 2025. Alongside the launch, Apple has reduced prices for the previous iPhone 16 models while discontinuing the iPhone 16 Pro and Pro Max variants. The iPhone 17 series exemplifies Apple’s ongoing commitment to enhancing display technology, camera capabilities, and overall performance, setting a new benchmark for premium smartphones in the Indian market.

binance

February 26, 2025 at 6:57 pm

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

create a binance account

March 15, 2025 at 3:17 pm

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

binance

March 27, 2025 at 11:26 pm

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.com/da-DK/register?ref=V2H9AFPY

open binance account

May 19, 2025 at 7:19 pm

Your article helped me a lot, is there any more related content? Thanks!

Rsbolaky

May 26, 2025 at 9:11 pm

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycrypto casino.

Kuwin

November 6, 2025 at 12:25 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

MM88

November 7, 2025 at 2:59 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

站群程序

November 7, 2025 at 9:54 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

GO88

November 10, 2025 at 9:12 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

站群程序

November 12, 2025 at 5:00 am

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

J88

November 14, 2025 at 8:04 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

iwin

November 14, 2025 at 3:29 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp