Entrepreneur Stories

Raymond Kroc And The McDonald’s Journey

Red tiles, neon lights and yellow sign boards. Big juicy burgers and sweet milkshakes. An ice cream cone oozing deliciousness and sprinkled with a flavour like never before. A bad work day instantly made better with a Big Happy Meal or a craving satiated with a Maharaja Mac on a broke wallet. Today, all these things are widely synonymous with McDonald’s as a brand and while the food chain may have had a rocky start, it has an inspiring journey.

The beginning of McDonald’s

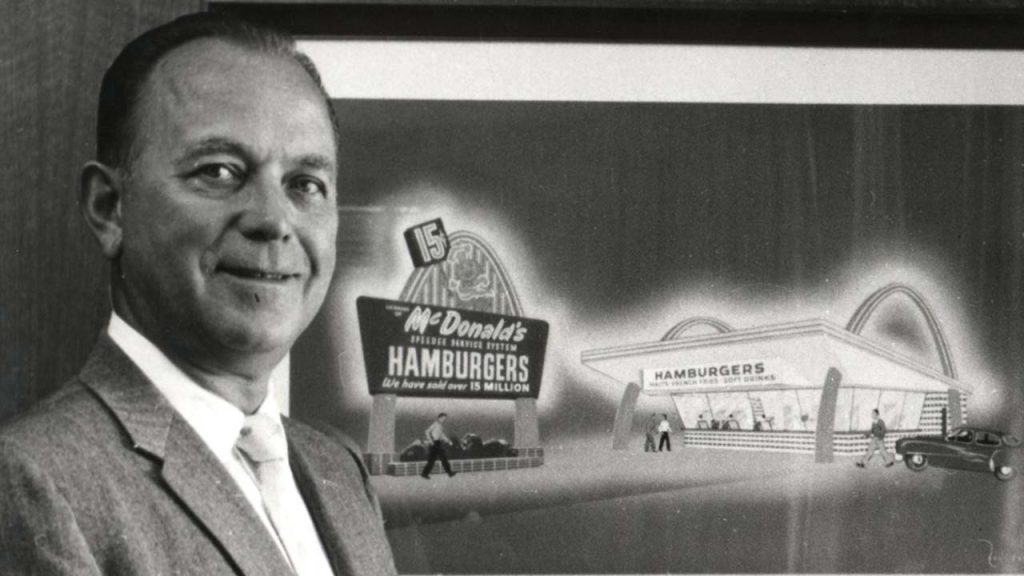

Raymond Kroc, a salesman with 34 years of experience to his name, saw how the McDonald brothers were changing the burger game one milkshake at a time. As a milkshake salesman, one of Ray’s routine involved visiting the people to whom he sold Multi Mixers. When he met two of his biggest clients, Richard and Maurice McDonald, life as he knew it was never the same. Realising he had the opportunity of turning something as homely and delicious as a hamburger into a phenomenon, Ray knew he had to capitalize on the idea.

While most of Ray’s regular customers bought only one or two Multi Mixers at a time, the McDonald brothers bought 8! Why? To make 40 milkshakes at a time so they could give their customers a regular supply of milkshakes and burgers. Looking at people lining up in queues outside the golden arches way into the dusky evenings, Ray realised the McDonald brothers had a booming business on their hands. Watching the many workers in crisp white hats and ironed uniforms scurrying around and serving burgers and fries with perfect precision, Kroc instantly saw why McDonald’s as a franchise was an idea into which he just had to tap.

By 1954, a 52 year old Ray Kroc and the McDonald brothers embarked on the journey of shaping and revolutionizing the way the fast food industry in itself worked. Using consistency and discipline as the key ingredients, Ray created a recipe for success, the likes of which we haven’t seen replicated. The first McDonald’s restaurant Ray saw was like a perfectly tuned factory, with all the workers and chefs humming around in sync.

By investing all his savings and more money than he could put into the business, Kroc joined hands with the McDonald brothers and set about creating history. Despite the resistance he received from the brothers as well as the rest of his friends and family, Kroc started working at putting his sales experience to good use! The brothers finally agreed to Ray’s deal. The brothers sold Ray the franchises for the low price of $ 950. In exchange, he would keep 1.4 % of all sales and give 0.5 % back to the brothers. With the existing franchisees only giving such a meager percentage of total sales, the corporate parent made very little money.

Picture credit: succeedfeed.com

The growth of McDonald’s as a business

Once the deal was struck and written in stone, Kroc set about working on how to turn this food chain into a brand. The first McDonald’s franchise opened in 1955 as an experimental model, just outside Chicago in Des Plaines, Illinois. Although this first store started churning out more than enough profit in the beginning, Ray knew that in order to start making an impact, he had to enforce more order than there already was. Everything in making and delivering burgers had a certain sense of science to it and using this formula, Kroc grew McDonald’s to greater heights. However, the speed with which Kroc was growing was quite different from what the partners had agreed to when they signed the deal. Realising Kroc was changing the way the business was running, the McDonald brothers had no choice but to bow out and leave Ray alone.

Although the move came as a disruptive thought process for Kroc, the end goal was always in sight. With dedication and an eye on perfection, Kroc built his business up so much that by 1960, there were more than 200 stores across the Midwest, the central parts of the United States. Squashing all his customers one delicious burger and tempting meal at a time, Kroc quite literally perfected the way the fast food industry worked not just in the United States, but all over the world as well!

Picture credit: newsweek.com

The largest food chain in the world

With all the different advertising and marketing tactics McDonald’s used, the brand started growing to phenomenal heights. By the year 1970, it was the single largest food chain in all of the United States. Picking up speed not just in the United States, McDonald’s as a brand first started spreading to Europe and then to other parts of the world.

While the taste of the food is the same in all the branches, the menu has been tweaked to suit the tastes of the people in places outside the United States. For example, in India, the menu reflects dishes which have been curated for the Indian palate and in Germany, McDonald’s started serving beer in the 1970s!

Picture credits: gonebrakscity.com

Today, with over 36,000 restaurants, McDonald’s serves 69 billion orders on a regular basis. Easily one of the most popular food chains the world over, there is no meal that is a Happier Meal happier meal than a McDonald’s one!

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Videos

Larry Page: The Visionary Co-Founder Behind Google’s Global Success

Larry Page is a visionary technology entrepreneur and co-founder of Google, one of the world’s most influential companies. Born in 1973 in Michigan, Page grew up surrounded by computer technology, which inspired his passion for innovation from an early age. He studied computer engineering at the University of Michigan and later pursued his PhD at Stanford University, where he developed the revolutionary PageRank algorithm with Sergey Brin. This technology fundamentally changed the way search engines rank websites, making Google the most accurate and popular search engine globally.

The journey of Larry Page and Google began in 1998 when they officially launched the search engine from a small garage. Leveraging their unique algorithm, Google quickly surpassed competitors due to its ability to deliver highly relevant search results, transforming internet search forever. Under Larry Page’s leadership as CEO, Google expanded beyond search to launch groundbreaking products including YouTube, Gmail, and Google Maps, turning it into a global tech powerhouse that shapes how we access and interact with information online.

Larry Page later became the CEO of Google’s parent company, Alphabet Inc., driving innovation and investment in next-generation technologies such as artificial intelligence, autonomous vehicles, and healthcare solutions. His visionary leadership and commitment to technological advancement have cemented his legacy as one of the most influential figures in the tech industry. Today, Larry Page remains a key influencer in shaping the future of technology and digital innovation worldwide.

Kuwin

November 6, 2025 at 6:04 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

GO88

November 7, 2025 at 8:36 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

谷歌蜘蛛池

November 7, 2025 at 6:48 pm

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

J88

November 8, 2025 at 10:15 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

站群程序

November 9, 2025 at 8:54 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

站群程序

November 12, 2025 at 3:29 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

iwin

November 19, 2025 at 6:06 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

MM88

November 21, 2025 at 12:31 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

fresh casino auszahlungsmethoden

December 21, 2025 at 5:57 am

Exklusiv für GOLD und PLATINUM Members! Mit dem New Year

Mystery Pot und attraktiven Gewinnchancen ins neue Jahr! Im November 1987 begann ein Neubau des Casinos, welches

am 26. Es ist eine von zwölf Spielbanken der österreichischen Casinos Austria AG.

Das Casino Velden ist das einzige Casino am Wörthersee in Kärnten.

Die Kombination aus Lage am See, saisonalem Programm und klassischen Tischen macht den Ort attraktiv, ohne Garantien zu

implizieren. Besucherinnen und Besucher sollten vorab reflektieren, welche Form des Spiels – Gelegenheitsspiel, Pokerturnier, Roulette-Abend – zur eigenen Risikobereitschaft passt und welche zeitlichen/finanziellen Grenzen sinnvoll sind.

Das betrifft Glücksspiel Velden ebenso wie andere Häuser im Bundesgebiet.

Für die Rückreise empfiehlt es sich, Fahrpläne öffentlicher

Verkehrsmittel vorauszuplanen – speziell bei späteren Spielzeiten. Ein klarer

zeitlicher Rahmen und ein Budgetlimit unterstützen die Eigenkontrolle und tragen zu

einem entspannten Erlebnis bei. Für spezifische Interessen – etwa

Poker-Eventserien, Galaabende oder saisonale Specials – empfiehlt sich eine frühzeitige Terminabfrage.

References:

https://online-spielhallen.de/rizk-casino-mobile-app-dein-spielvergnugen-fur-unterwegs/

top slot games Australia

December 27, 2025 at 12:16 am

“Alpha and Omega” (the last letter of the Greek alphabet) means from beginning to the end.

A is the first letter of the English alphabet.

The Latin letters ⟨A⟩ and ⟨a⟩ have Unicode encodings

U+0041 A LATIN CAPITAL LETTER A and U+0061 a

LATIN SMALL LETTER A. These are the same code

points as those used in ASCII and ISO 8859. ⟨a⟩ represents approximately 8.2% of letters as used in English texts; the figure is around 7.6% in French 11.5% in Spanish,

and 14.6% in Portuguese.

⟨a⟩ is the third-most-commonly used letter in English after ⟨e⟩ and ⟨t⟩, as well

as in French; it is the second most common in Spanish, and the most common in Portuguese.

However, ⟨a⟩ occurs in many common digraphs, all with their own sound or sounds,

particularly ⟨ai⟩, ⟨au⟩, ⟨aw⟩, ⟨ay⟩, ⟨ea⟩ and ⟨oa⟩.

There are some other cases aside from italic type where script a ⟨ɑ⟩, also called Latin alpha, is used in contrast with Latin ⟨a⟩, such as in the International

Phonetic Alphabet. The Roman form ⟨a⟩ is found in most printed

material, and consists of a small loop with an arc over it.

In the hands of medieval Irish and English writers, this

form gradually developed from a 5th-century form resembling the Greek letter tau ⟨τ⟩.

The names of the vowel letter u and the semivowel letters w and y are pronounced with a beginning

consonant sound. The names of the consonant letters f, h, l,

m, n, r, s, and x are pronounced with a beginning vowel sound.

Problems arise occasionally when the following word begins with a vowel letter but

actually starts with a consonant sound, or vice versa.

In algebra, the letter “A” along with other letters at the beginning of the alphabet is used to represent known quantities.

In most languages that use the Latin alphabet, ⟨a⟩ denotes an open unrounded vowel, such as /a/, /ä/, or /ɑ/.

References:

https://blackcoin.co/vip-casinos-in-canada-2022/

winning slots strategies

December 27, 2025 at 6:33 am

On 1 February 2021, Bergin reported the findings of the inquiry to

ILGA, including findings that Crown was unsuitable to hold a licence to operate the Crown Sydney Casino.

Despite the inability of the casino to open, other operations within the Crown Sydney building were unaffected.

Despite the development’s approval, the Millers Point Fund

lodged legal action against the project in early

August 2016 challenging the validity of the casino and aiming to have construction on the project

halted. An observation deck on the 66th floor from a height of 250

metres (820 feet) above ground, as well as public access

to the upper floors, was also proposed.

They have suggested that students, new immigrants and working class individuals are typically and more likely found to be losing large amounts of money

at Casino style table and electronic games. Crown Resort’s six

star hotel makes up the lower levels of the tower from levels 6 to 32, including the protruding lower

south east wing of the building. The casino floor along with bars, restaurants and other hospitality venues occupy the podium of the tower.

In June 2016, the casino received final approval from the Planning

Assessment Commission on condition that the casino met needs proposed

by the commission, including adequate public spaces

and access.

Amid spectacular views of Australia’s iconic harbour, taste some of the best

dishes from internationally acclaimed chefs.

With perfectly framed views of Sydney’s skyline, each room heralds sophisticated, modern decor capturing

the essence of the gorgeous and unique harbourside setting.

Rising majestically above the bustling Barangaroo precinct, Crown Towers offers unparalleled luxury stays in Sydney.

Just a 1-minute walk from the Queen Victoria Building (QVB), Megaboom City Hotel is located in the heart of

Sydney CBD. Located in the heart of Sydney CBD (Central Business

District), Castlereagh Boutique Hotel, an Ascend Collection Hotel offers

a restored, heritage-listed property near Sydney’s most cherished…

Ideally situated in the heart of North Sydney, a

short train journey from Sydney’s city centre.

References:

https://blackcoin.co/slotimo-casino/