Entrepreneur Stories

Louis Vuitton Unknown Facts

Founded in 1854, the French fashion powerhouse Louis Vuitton rose to become the world’s most valuable luxury brand. Known for never having any of its product on sale, it is one of the most counterfeited brands in the world.

With its CEO Bernard Arnauld being declared world’s second richest man with a net worth of $ 108 billion, let’s look at some unknown facts about Louis Vuitton.

Unknown facts about Louis Vuitton

1) The founder of the luxury brand, Louis Vuitton, was the personal box maker and packer of Napoleon Bonaparte’s wife Empress Eugénie de Montijo.

2) The famous monogram of Louis Vuitton was created to fight counterfeit ones and served as inspiration for surreal artist Salvador Dali’s La Toile Daligram.

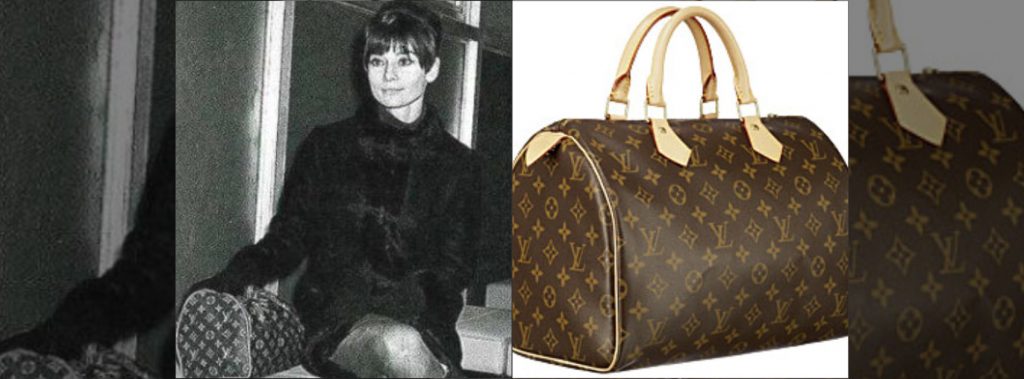

3) The most famous creation by the brand, Speedy, was originally launched as a travel case. It got its popularity after American icon Audrey Hepburn requested Vuitton to make a custom mini Speedy for her.

4) Mikhail Gorbachev, the last president of the U.S.S.R., once posed for a Louis Vuitton ad campaign.

5) American rapper Kanye West has mentioned Louis Vuitton more than 19 times in his songs.

6) Known for creating luxury bags and accessories, Louis Vuitton once created a collection of luxury pens. It also sells scrapbooks for people with extravagant taste.

7) The bags and jewellery of Louis Vuitton go through an intense durability test before being released to the public. Louis Vuitton bags are subjected to UV rays in an effort to increase the bags’ resistance to fading.

8) After every season, the unsold Louis Vuitton products are sent back to its factory in France and are shredded or burnt, in order to maintain the item’s value.

Considered one of the top luxury brands in the world, Louis Vuitton currently has a brand value of $ 47.2 billion.

Comment and let us know which of these facts impressed you the most.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

MM88

November 5, 2025 at 7:58 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

J88

November 7, 2025 at 12:01 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

站群程序

November 8, 2025 at 12:48 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

谷歌站群

November 10, 2025 at 8:37 pm

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

MM88

November 13, 2025 at 3:26 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

GO88

November 13, 2025 at 11:03 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

站群程序

November 14, 2025 at 12:42 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

iwin

November 22, 2025 at 8:27 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Casino Promo Code einlösen

December 20, 2025 at 5:32 am

King’s bietet auch Karten- und Würfelspiele wie Blackjack, Craps oder Roulette an.

Die Heimat der WSOP Europe bietet auch Karten- und Würfelspiele wie

Blackjack, Craps oder Roulette. Fordere deinen Platz ein und spiele im größten Pokerraum

Europas.

Die zentrale Position des Casinos ermöglicht es den Besuchern, ihre Glücksspielerfahrung

mit anderen Attraktionen in der lebendigen Stadt Frankfurt zu kombinieren. Spielhalle Spielolino Casino MörlenbachSchulstraße 2, Mörlenbach SpielhalleBahnhofstraße,

Butzbach SpielhalleFabrikstraße, Bensheim Twin casino demo

Reel ’em in Die Reel ’em in Freispielrunde dreht sich um spezielle Fischsymbole

auf den Walzen 1 bis 4 und den Angler auf der fünften Walze.

Casino Las VegasGerberstraße 5, Breisach am Rhein Extra-Spiel SpielhalleBahnhofstraße 3, BirkenfeldSchließt um 2.00 Uhr BS-AUTOMATEN, AutomatenaufstellerRollinstraße 62,

Biberach an der Riß

References:

https://online-spielhallen.de/starda-casino-bonus-code-ihr-weg-zu-noch-mehr-spielspas/

Casino magic game

December 27, 2025 at 8:27 pm

The northern reef is accessible by boat or seaplane from Cairns, making it the perfect place to get away from

the crowds and explore this natural wonder.

The reef is quite big, and while the reef close to Cairns is

very popular with tourists, the northern section of the Great Barrier Reef is quite isolated.

Stingers are typically found in tropical waters from around November to May.

Giant fig trees, primeval palms, delicate orchids and curious creatures such as tree-kangaroos make the Daintree an unforgettable place.

Membership in Club Privé, which offers premium rewards, is complimentary.

Observe free-roaming rainforest wallabies and see bettongs, curlews, kookaburras,

turtles, pythons, crocodiles, and lizards. At the Velvet Underground, you’ll discover two

floors featuring live entertainment and drinks.

References:

https://blackcoin.co/understanding-the-login-process-in-online-gambling/

http://shop.ororo.co.kr

December 29, 2025 at 9:41 am

online casino usa paypal

References:

http://shop.ororo.co.kr

https://www.lms.pidernegi.org/employer/paypal-casinos-2025-best-paypal-slot-sites-in-the-uk/

December 29, 2025 at 10:54 am

online casino that accepts paypal

References:

https://www.lms.pidernegi.org/employer/paypal-casinos-2025-best-paypal-slot-sites-in-the-uk/

ww.enhasusg.co.kr

December 30, 2025 at 2:28 pm

paypal neteller

References:

http://ww.enhasusg.co.kr/bbs/board.php?bo_table=free&wr_id=3028356

b2xbet

January 31, 2026 at 12:55 am

Hey I know this is off topic but I was wondering if you knew of any widgets I could add

to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this.

Please let me know if you run into anything. I truly enjoy reading your blog and I look

forward to your new updates.

國產 av

February 1, 2026 at 9:42 pm

Howdy! Do you use Twitter? I’d like to follow you if that would be ok. I’m absolutely enjoying your blog and look forward to new updates.

onlinecasino

February 5, 2026 at 1:46 am

ifuntv海外华人首选,采用机器学习个性化推荐,提供最新华语剧集、美剧、日剧等高清在线观看。

australianonlinecasino

February 19, 2026 at 8:18 am

超人和露易斯第一季高清完整版运用AI智能推荐算法,海外华人可免费观看最新热播剧集。