Articles

Fun Facts About Netflix

Gone are those days when you would have to spend your pocket money on buying DVDs to watch your favourite films. This is the 21st century and in this age of technology, whether it is for watching a popular film or your favourite web shows, you know where to reach—Netflix, of course! With new films, documentaries and shows being added on a daily basis, Netflix is the most popular streaming platform in the world. Today, we bring you some interesting facts about Netflix which may surprise you.

Fun facts about Netflix

1) Though Netflix started renting out DVDs only from 1998, it was founded in 1997 by Reed Hastings and Marc Randolph. This makes Netflix a year older than Google.

2) Netflix was originally called Kibble. Kibble was the name of Netflix’s co founder Marc Randolph’s dog. This name was to remind everyone, “No matter how good the advertising, it’s not a success if the dogs don’t eat the dog food.”

3) House of Cards was not the first original content produced by Netflix. Netflix made a test video called Example Show in 2010. In this 11 minute long test video, you can find pretty inane content like an actor moonwalking with a laptop and reciting a monologue from Julius Caesar. You can still watch it on Netflix.

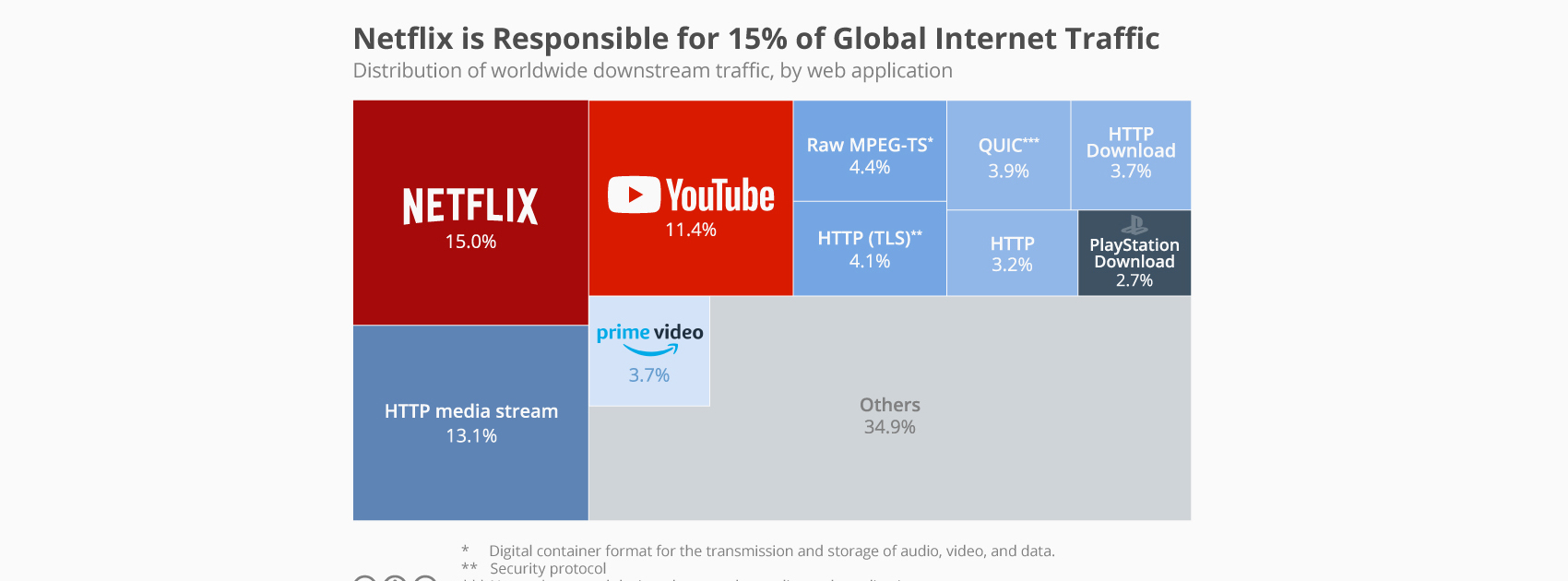

4) As of October 2018, Netflix accounts for 15 % of the world’s web traffic and approximately 36.5 % of North America’s web traffic. If Netflix did not compress its videos, this number would have been three times higher. YouTube, which is also a streaming platform, accounts for 11.4 % percent of the web traffic.

5) In 2013, Netflix hosted an award show of its own and aptly titled it “The Flixies.” It allowed users to vote for their favourite films and shows under various categories.

6) Orange Is The New Black, 13 Reasons Why, The Crown, House Of Cards and Stranger Things are some of the most watched Netflix original series.

7) Netflix is available in more than 190 countries, from Australia and Europe to most parts of Asia. However, it is most popular in the U.S.

8) As of January 2019, Netflix has around 139 million paying subscribers. More than 58 millions of these subscribers are U.S. based.

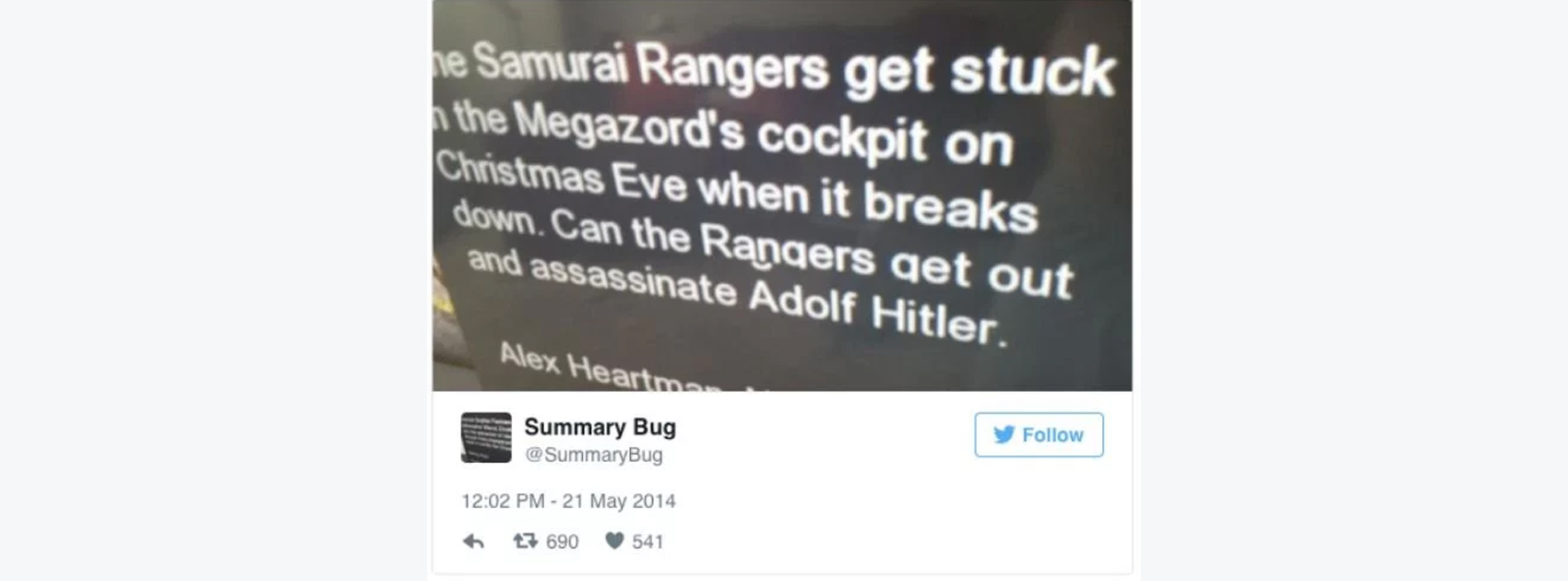

9) In 2014, a glitch caused the summaries of various titles to merge, creating completely hilarious and ridiculous summaries. One summary which appeared to combine the Power Rangers installments with Inglourious Basterds read, “The Samurai Rangers get stuck in the Megazord’s cockpit on Christmas Even when it breaks down. Can the Rangers get out and assassinate Adolf Hitler?”

10) Netflix was instrumental in coining the word “binge watch,” when it started to release its series’ episodes all at once.

Which of these facts about Netflix surprised you the most? Comment and let us know.

Articles

5 Successful Indian Startups Founded By Women

The workplace has undergone massive changes in the last century. At the turn of the Industrial Revolution, any workplace was dominated by men while the women were delegated to run the homes. However, with the advent of the internet and new and exciting technologies, workplaces have undergone a tectonic shift. Women are no longer comfortable staying at home and are instead opting to lead teams and organisations. As every year passes, we get closer to true gender equality, women have proven time and again that they are equally capable to get the job done if not better in some instances. Names like Wolfe Herd (Bumble founder,) Kylie Jenner (Kylie Cosmetics founder,) Masaba Gupta (Masaba clothing label founder) are just some of the names who are known for leading world famous brands with their unique style of leadership.

As the world celebrates International Women’s Day, we bring to you five women founders who run world famous and successful startups.

1) Upasana Taku-MobiKwik

If you are an Indian and are used to doing online shopping, more often than not at the time of payment, you would be directed to a payment gateway. One of these gateways would normally be MobiKwik. The startup is a well known name in the digital payments and digital wallet space. MobiKwik was founded by Upasana Taku in 2009, who prior to founding MobiKwik used to work with PayPal. Today Upasana Taku is also in charge of bank partnerships, business operations, and talent acquisition at MobiKwik.

2) Richa Kar-Zivame

An enthusiastic MBA student, Richa Kar, developed an online lingerie shopping platform in the year 2011. Currently, Zivame is India’s leading online lingerie store with a valuation of more than $ 100 million. The brilliant idea for her own lingerie business came to light when Richa tracked Victoria’s Secret’s sales, who was one of her clients when she was working at SAP. She observed the lingerie sales figures reached peaks overseas but, Indian women were not provided with the similar innerwear. While Richa was studying the Indian lingerie market, she realized the social embarrassment in India surrounding lingerie shopping. Today Richa Kar could be credited with destigmatising the uneasiness surrounding lingerie shopping in India.

3) Falguna Nayar-Nykaa

After a long stint as an investment banker, Falguni Nayar founded Nykaa.com in the year 2013. An online one stop shop for beauty products from Indian and international brands, Nykaa changed the world of online shopping. Who would have ever thought buying makeup online would be so easy? Falguni Nayar proved many critics wrong and created a brand new place for people who love experimenting with styles, designs and colors.

ALSO READ: Zivame: Founding Story

4) Sabina Chopra-Yatra.com

Yatra.com is a popular Indian website for making flight and hotel bookings. Sabina Chopra was instrumental in identifying the potential for travel commerce in India and people moving towards cheaper or easier travel. By the time, people started looking to make bookings, Sabina made sure Yatra.com was already in place. Sabina was the former Head of India Operations of eBookers, which is also an online travel company based in Europe. Along with this, she was also working with Japan Airlines which further adds to her experience in the travel industry.

5) Rashmi Sinha-SlideShare

SlideShare allows people to upload and access their presentations online. While this feature is presently available everywhere, SlideShare was one of the first players in making this happen. Rashmi Sinha was one of the founders of the presentation sharing platform SlideShare. The company became so successful that in 2012, LinkedIn acquired the company for an amount of $100 million.

Let us know in the comments if you know any other wonderful women who have become leaders of their right or have started up and are doing extraordinary things. We at Startup Stories wish a wonderful Women’s Day to all the women in the world who are changemakers.

Articles

Why Are Ads On Digital Media Failing To Reach The Right Audience?

If you are a regular user of social media platforms and also a fan of consuming content on the digital medium, then there is a very high likelihood that you have seen ads on pages you are reading or watching something. There would be times when you have been targeted by an ad which feels like it was wrongly targeted at you. Imagine if you are a vegetarian by choice and while browsing online, if you are targeted by a food delivery app which shows ads about chicken dishes. The ad would only serve to spoil the mood of the online user instead of serving its actual purpose which is to push the user to buy a chicken dish.

These wrongly targeted ads might be the side effects of performance marketing or a weak brand marketing. Performance marketing means advertising programs where advertisers pay only when a specific action occurs. These actions can include a generated lead, a sale, a click, and more. Inshort, performance marketing is used to create highly targeted ads for a very specific target audience at a low cost. Performance marketing usually means high volume for a very specific cost.

Brand marketers on the other hand believe in narrowly defining target audiences but end up spending a lot of money on ad placements. Gautam Mehra, CEO, Dentsu Programmatic India & CDO, Dentsu International Asia Pacific said, “You’ve defined a persona, you know the emotions you want to elicit, but then you buy a YouTube masthead and CricInfo sponsorships because IPL is up. If brand advertisers look at audience-based buys more deeply than just placements, you will see more relevant ads (sic.)”

ALSO READ: How Digital Marketing Is Impacted Due To The COVID-19 Pandemic

Performance marketing is more of a sales function rather than a marketing function and is about meeting the cost of acquisition. This is a reason why budgets are usually high for performance marketing. Mehra goes on to add, “the fact is that an engineer can out-beat FMCGs on performance marketing. Advertisers who have cracked this are spending 10x and are on an ‘always on’ mode (unlike time-bound brand campaigns.)”

There is always the case of supply and demand, with the supply usually exceeding the demand on digital platforms. Ultimately, it boils down to the choice between no ad versus low relevance ad and it is quite easy to guess that having a low relevance ad is better.

Arvind R. P., Director – Marketing and Communications at McDonald’s India (West and South,) said “McDonalds’ for instance, has seen its share of spends on digital grow from 20% levels a couple of years back to over 40% at present. Outcomes of this journey have been encouraging, proven by our media-mix-modelling and other key metrics. We have seen best results from an optimal mix of Television plus digital (sic.)” Moreover, Arvind also believes performance marketing only approach could turn out to be more suited to short term, versus a more consistent full funnel effort. The latter ensures adequate emphasis on building consideration, as well as growing transactions. Arvind feels digital is a complex medium which needs investment in the right talent who could use the right tools. Brands which underestimate the need for the investment are often disappointed from the return on investment from the digital medium.

With the constantly changing consumer dynamics marketers are now shifting to unscripted marketing which frankly needs more insights into the consumer mindset. The lack of marketers to do the proper research is why digital medium is plagued with irrelevant ads.

Articles

From Unicorn To Bankruptcy; Knotel Bears The Brunt Of COVID-19 Pandemic

It is no secret that in the fast paced world of startups, fortunes can change at the snap of fingers. Sometimes startups tend to scale so quickly that they become unicorns and sometimes the fortunes reverse so quickly that a startup can immediately go bankrupt from being a unicorn. The latter was the case for an American property technology startup Knotel, who are now bankrupt due to the disruptions by the COVID-19 pandemic.

Knotel is a property technology company quite similar to WeWork. Knotel designed, built and ran custom headquarters for companies which It manages the spaces with ‘flexible’ terms. Knotel does a mix of direct leases and revenue sharing deals. Knotel marketed its offering as ‘headquarters as a service’ or a flexible office space which could be customized for each tenant while also growing or shrinking as needed. For the revenue-share agreements, Knotel solicits clients, builds out offices, and manages properties, and shares the rent paid to it by the client with the landlord. This model is the majority revenue generator for Knotel.

In March 2020, just before the COVID-19 pandemic unleashed its economic destruction on the world, Knotel was valued at $ 1.6 billion. What is even more interesting is Knotel raised $ 400 million in Series C funding in August 2019 which led to its unicorn status. However, with the COVId-19 pandemic and its consequent lockdowns and curfews by various governments across the world, startups and businesses shifted to a remote working model. This in turn led to startups pulling out of Knotel properties to cut down on working costs.

ALSO READ: Quibi : Startup With A Billion Dollar Launch To Shutting Down All In Six Months

In late March 2020, according to Forbes, Knotel laid off 30% of its workforce and furloughed another 20%, due to the impact of the coronavirus. It was at this point that Knotel was valued at $ 1.6 billion. The company had started the year with about 500 employees. By the third week of March,Knotel had a headcount of 400. With the cuts, about 200 employees remained with the other 200 having either lost their jobs or on unpaid leave, according to Forbes.

In 2021, Knotel filed for bankruptcy and agreed to sell its assets to Newmark, one of their investors for a total of $ 70 million dollars. As work culture is still undergoing changes as a consequence of the COVID-19 pandemic and with many companies realising that remote work model saves costs and improves work efficiency, the flexible workspace sector would continue to face challenges. Knotel is just the tip of the iceberg and is a warning call for the flexible working spaces industry.

Danielemode

May 28, 2025 at 3:13 pm

https://biotpharm.com/# get antibiotics without seeing a doctor

JamesUsath

May 31, 2025 at 6:37 pm

achat kamagra: Kamagra oral jelly pas cher – kamagra oral jelly

8gswh

June 7, 2025 at 12:33 pm

order generic clomid online where can i get clomid how to buy cheap clomiphene withou clomid without insurance how to get cheap clomid without prescription can i purchase cheap clomid without insurance how can i get generic clomid tablets

MM88

November 5, 2025 at 11:14 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

站群程序

November 7, 2025 at 5:00 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

Kuwin

November 7, 2025 at 11:23 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

站群程序

November 8, 2025 at 12:49 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

谷歌站群

November 11, 2025 at 7:47 pm

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

iwin

November 13, 2025 at 5:08 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

J88

November 16, 2025 at 12:42 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

GO88

November 29, 2025 at 7:16 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

AtomCasino

December 13, 2025 at 6:35 pm

https://t.me/s/atom_official_casino

kazino_s_minimalnym_depozitom

December 19, 2025 at 12:36 am

https://t.me/s/kazino_s_minimalnym_depozitom/10

kazino_s_minimalnym_depozitom

December 20, 2025 at 5:20 am

https://t.me/s/Kazino_s_minimalnym_depozitom