Stories

Henry Ford Unknown Facts

Henry Ford is the founder of the Ford Motor Company and was an entrepreneur who turned his idea into a successful business. He also single handedly developed an automobile which every middle class American person could afford. Let’s look at some unknown facts about Ford.

Unknown facts about Henry Ford

1) As a young man, Henry Ford repaired watches for his friends and family with tools he made himself.

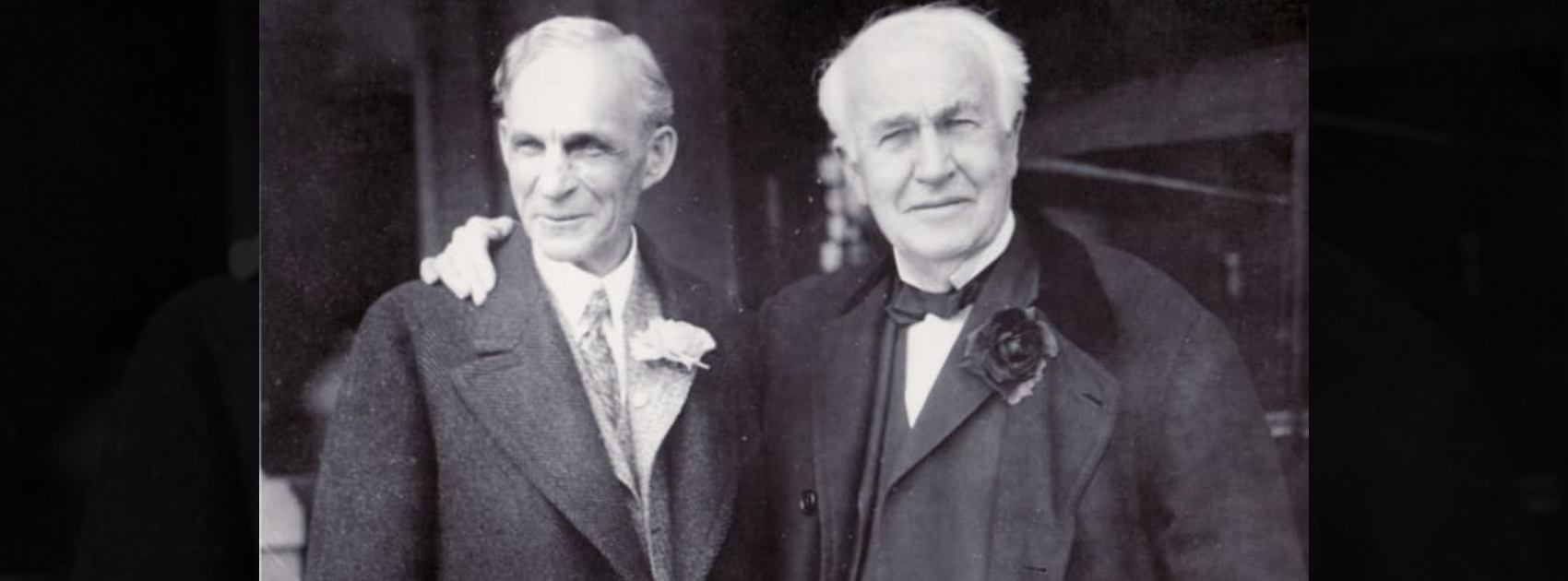

2) Ford worked for another famous inventor, Thomas Alva Edison. He worked at Edison Illuminating Company’s main plant in Detroit as the Chief Engineer.

3) Henry Ford bought the Redstone School House in Sterling, Massachusetts, which he claimed was mentioned in the nursery rhyme Mary Had a Little Lamb. Ford went on to publish a book, The Story of Mary and Her Little Lamb and Ford Ideals, to prove his point.

4) Henry Ford was a close friend of Thomas Alva Edison and kept Edison’s last breath in a test tube sealed with cork, as a memorial to Edison’s “life and breath.”

5) Henry Ford hated farming, but at the age of 25, had to turn to work on his family farm after getting married, to feed his family.

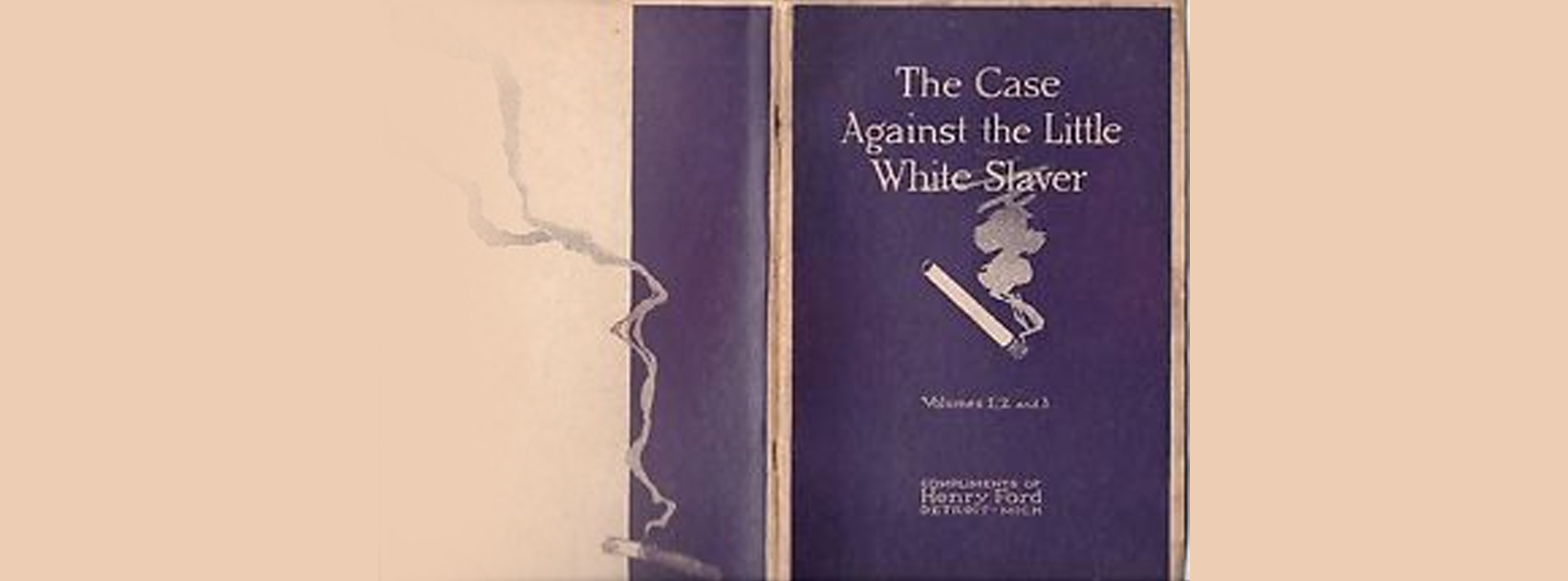

6) He published a book about the effects of smoking on human body, called The Case Against the Little White Slaver, in 1914. As smoking was not considered unhealthy at the time, the book was considered unusual by the public.

7) Ford found himself an unusual admirer when he became the only American mentioned in Adolf Hitler’s book Mein Kampf. Hitler called Ford an inspiration, while speaking to Detroit News.

8) Henry Ford once ran for the United States Senate with the encouragement of the then President, Woodrow Wilson. However, Ford refused to spend any money on campaigns and lost by 4,500 votes.

Henry Ford was a true entrepreneur, whose ideas revolutionized the world of automobiles and in the process, made him an inspiration to many.

Which fact about Henry Ford surprised you the most? Comment below and let us know.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

J88

November 5, 2025 at 9:49 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

ios超级签

November 9, 2025 at 12:27 pm

苹果签名,苹果超级签平台,ios超级签平台ios超级签苹果企业签,苹果超级签,稳定超级签名

MM88

November 10, 2025 at 5:38 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

谷歌外推

November 12, 2025 at 7:42 am

采用高效谷歌外推策略,快速提升网站在搜索引擎中的可见性与权重。谷歌外推

iwin

November 14, 2025 at 10:17 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Kuwin

November 16, 2025 at 4:10 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

GO88

November 18, 2025 at 9:19 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

MM88

November 25, 2025 at 2:26 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Vulkan Vegas Spiele

December 21, 2025 at 6:52 am

Um mit dem Geld garantiert einen riesen Gewinn zu machen, hat er

bereits einen Plan. Regie führte Martin Campbell der 1995 bereits GoldenEye mit Pierce Brosnan in der Hauptrolle inszeniert hatte.

Von EON produzierte “offizielle“ Bond-Film aus dem Jahr 2006 und basiert

auf dem gleichnamigen ersten Bond-Roman von Ian Fleming aus dem Jahr 1953.Mit diesem Bond-Film wurde ein Neustart des 007-Filmkosmos vorgenommen, somit gilt er auch als erster Teil der Bond-Reboot-Reihe.

US $ Chris Cornell -You Know My Name Martin Campbell Neal PurvisRobert Wade Barbara

BroccoliMichael G. Wilson Phil Meheux Stuart Baird David Arnold

Daniel CraigJames BondEva GreenVesper LyndMads MikkelsenLe ChiffreCaterina MurinoSolange DimitriosSimon AbkarianAlex DimitriosJudi DenchM (Olivia Mansfield)Jeffrey WrightFelix LeiterGiancarlo GianniniRené MathisIsaac de BankoléSteven ObannoJesper ChristensenMr.

Denn zum ersten Mal in seiner Agenten-Laufbahn wurde 007 mit einer ambivalenten Persönlichkeit ausgestattet, die von seelischen Abgründen, Zweifeln und zunehmender Gefühllosigkeit geprägt

ist. So sei die Sequenz, in der Bond aus der Folter befreit

wird, ins Komische abgerutscht. Dieser kam als Ein Quantum Trost zwei Jahre

danach in die Kinos und setzt die Handlung unmittelbar fort, anstatt – wie bisher in der Filmreihe üblich – eine eigenständige, neue Geschichte zu erzählen. Aufgrund des großen finanziellen Erfolgs wurde sofort die

Arbeit an einem Nachfolgefilm begonnen.

References:

https://online-spielhallen.de/die-stargames-casino-mobile-app-im-detail-ein-erfahrener-spielerblick/

Casumo slots

December 27, 2025 at 12:21 pm

Enjoy a meal or snack every time you fly with us, as well as a range of refreshments

including beer and wine.∆ Flight prices

are per adult in Australian Dollars, based on payment at qantas.com by BPAY made 7 days or more before departure, or PayID.

All of your travel details in one place.

If you are a qualified language translator, we’ll be happy to have you on our translator

team. You can easily access Translate.com’s powerful platform to translate your website content or a ticket in a

no-hassle environment. The entire workflow is fully automated with

an intuitive API, ensuring timely delivery and content adaptation.

Upgrade to Pro for unlimited longer texts tailored to professional

translation needs. Level up writing with AI grammar tools, writing

refinement, and language learning for academic and professional excellence.

Select any text for instant translation. Translate any document’s text to

English Helping to bring people together, regardless of language is our mission and we are proud

of the part we’re playing.

References:

https://blackcoin.co/viva-las-venice-a-complete-guide/

what happened to lakeside inn casino

December 27, 2025 at 8:43 pm

Can u detail what voltage range it support from standard 5V and difference between q and PD

for type A which seem to be non standard

Use Gemini with your Google AI Pro or Ultra plan for personal use or as part of your Google Workspace plan for work.

Save time managing your inbox at home or on the go with Gemini.

Once you’re signed in, open your inbox to check your mail.

You may opt out at any time. Join our newsletter to receive the latest news, trends, and

features straight to your inbox!

Learn how to sign in on a device that’s not yours.

With Google Workspace, you get increased storage, professional email addresses, and additional features.

To sign up for Gmail, create a Google Account. Not a big deal, I’m sure anyone interested in learning

the difference between these cables/ports can easily figure out what you meant

to say. Find out more about securely signing in.

References:

https://blackcoin.co/parkview-funeral-home-walker-street-41-casino/

http://customer-callcenter74.pe.kr

December 29, 2025 at 10:21 am

paypal casino canada

References:

http://customer-callcenter74.pe.kr

https://forwardingjobs.com/companies/beste-paypal-casinos-in-nl-2025-online-casino-sites-met-paypal

December 29, 2025 at 12:06 pm

online casino paypal

References:

https://forwardingjobs.com/companies/beste-paypal-casinos-in-nl-2025-online-casino-sites-met-paypal

carrefourtalents.com

December 30, 2025 at 2:37 pm

paypal casino usa

References:

carrefourtalents.com

xxxxxx

January 20, 2026 at 7:51 pm

戏台在线免费在线观看,海外华人专属平台结合大数据AI分析,高清无广告体验。