Stories

Coca-Cola Unknown Facts

Coca-Cola, manufactured by the iconic carbonated soft drink company The Coca-Cola Company, is the most popular and widely sold American product. Invented by John Stith Pemberton in 1886 in an effort to fight his morphine addiction, it became one of the most popular soft drinks, thanks to the marketing tactics of businessman Asa Griggs Candler. Here are some interesting and unknown facts about Coca-Cola to refresh your mind.

Unknown facts about Coca-Cola

1) The original formula of Coca-Cola contained a significant dose of cocaine. The substance came from coca, one of the ingredients used to make the soft drink. The ingredient was removed from the drink in 1903.

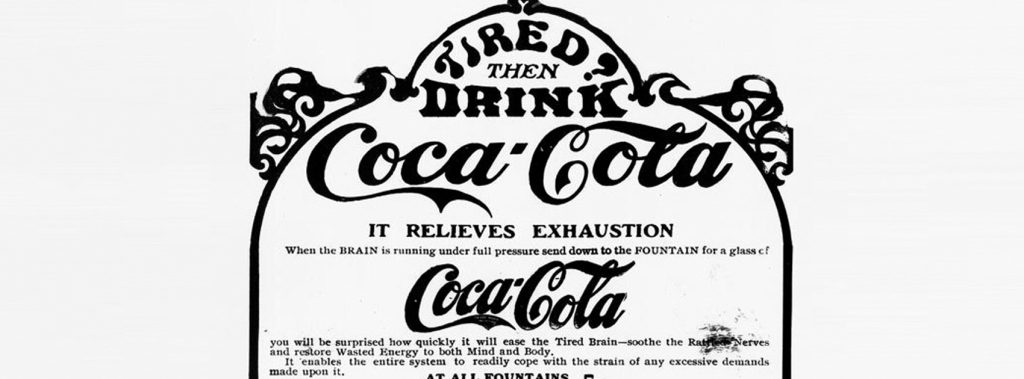

2) Upon its first launch, Coca-Cola was marketed as a nerve tonic which helped in relieving exhaustion.

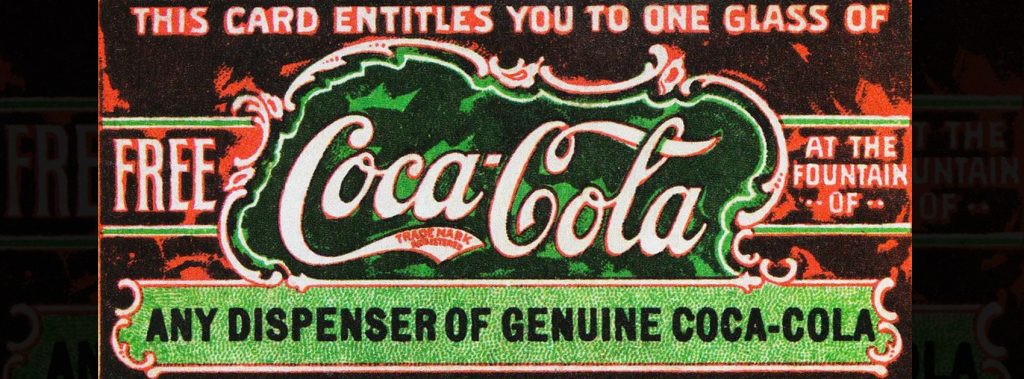

3) Known for his incredible marketing tactics, Asa Griggs Candler gave away coupons good for one free serving, which helped increase the sale of the soft drink as people kept coming back for more drinks.

4) The original Coca-Cola bottle was shaped like a cocoa bean. This was because the bottle designers misunderstood the name of the drink and thought it contained cocoa.

5) Coca-Cola is highly acidic in nature, with a pH of 2.525 and can be used as a household cleaner.

6) With its products being sold in more than 190 countries, it’s actually quite surprising to know Coca-Cola is not sold in Cuba and North Korea.

7) Coca-Cola was once helped by its competitor Pepsi when two of Coca-Cola’s employees tried selling trade secrets to Pepsi. Pepsi alerted both Coca-Cola and the FBI about the deal, which resulted in the employees receiving prison terms.

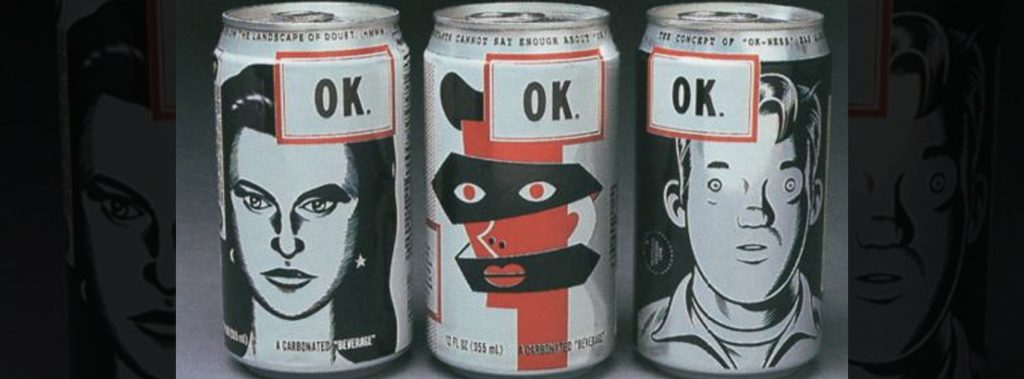

8) According to a claim made by Coca-Cola, the Company’s name is the second most understood word in the world, right behind “OK.” The Company released a soft drink named “OK Soda,” in the hopes of owning both of the most recognised words in the world.

With a current net worth of $ 224.43 billion, Coca-Cola has been ruling the soft drink industry for years now.

Comment below and let us know which of these facts about Coca-Cola surprised you the most.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

Videos

Larry Page: The Visionary Co-Founder Behind Google’s Global Success

Larry Page is a visionary technology entrepreneur and co-founder of Google, one of the world’s most influential companies. Born in 1973 in Michigan, Page grew up surrounded by computer technology, which inspired his passion for innovation from an early age. He studied computer engineering at the University of Michigan and later pursued his PhD at Stanford University, where he developed the revolutionary PageRank algorithm with Sergey Brin. This technology fundamentally changed the way search engines rank websites, making Google the most accurate and popular search engine globally.

The journey of Larry Page and Google began in 1998 when they officially launched the search engine from a small garage. Leveraging their unique algorithm, Google quickly surpassed competitors due to its ability to deliver highly relevant search results, transforming internet search forever. Under Larry Page’s leadership as CEO, Google expanded beyond search to launch groundbreaking products including YouTube, Gmail, and Google Maps, turning it into a global tech powerhouse that shapes how we access and interact with information online.

Larry Page later became the CEO of Google’s parent company, Alphabet Inc., driving innovation and investment in next-generation technologies such as artificial intelligence, autonomous vehicles, and healthcare solutions. His visionary leadership and commitment to technological advancement have cemented his legacy as one of the most influential figures in the tech industry. Today, Larry Page remains a key influencer in shaping the future of technology and digital innovation worldwide.

dove acquistare priligy originale

June 15, 2025 at 4:34 pm

Nevertheless, information gained from studying the pathogen produced proteins that manipulate the plant autophagy machinery has revealed novel autophagy related defense components and shed light on the functions of defense related autophagy 10, 11, 20, 23, 75 what is priligy tablets

站群程序

November 7, 2025 at 8:37 pm

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

谷歌站群

November 8, 2025 at 7:02 am

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

MM88

November 10, 2025 at 9:29 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

J88

November 13, 2025 at 3:27 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Kuwin

November 16, 2025 at 3:19 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

MM88

November 25, 2025 at 5:07 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

iwin

December 1, 2025 at 12:12 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

GO88

December 1, 2025 at 1:11 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

หนังโป๊เกาหลี

January 18, 2026 at 7:16 am

Bonanza of knowledge.