Funding

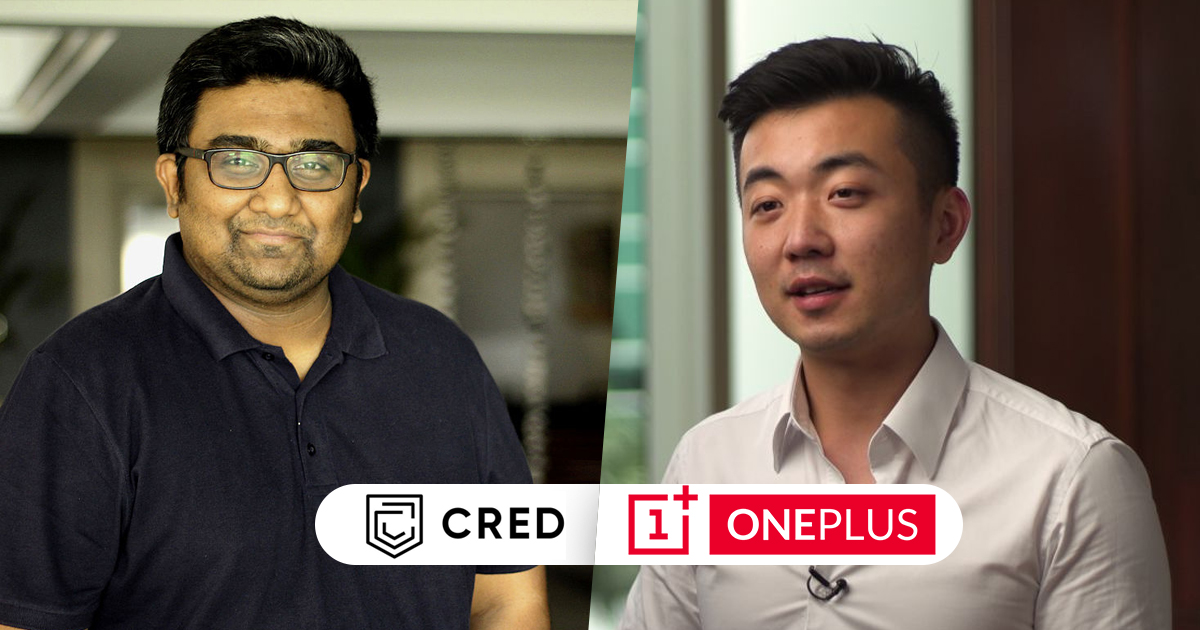

CRED’s Kunal Shah Invests In One Plus Founder Carl Pei’s Startup

Carl Pei is one of the most well known names in the startup circles considering he gave the world one its best smartphone brands OnePlus. Since the debut of OnePlus One. The smartphone maker earned the moniker ‘flagship killer’ and has grown in leaps and bounds. Today OnePlus boasts on an impressive product line up apart from its smartphones and is one of the leading electronic brands in the world. In October 2020, Carl Pei said the time came for him to leave OnePlus and focus on other interests. Since then, Pei had been working on his new startup in the audio hardware sector.

Thank you. @PeteLau @oneplus https://t.co/2RD9AdyWhO

— Carl Pei (@getpeid) October 16, 2020

The name of Carl Pei’s new startup will be unveiled on January 27th, 2021 but in the past three months the unnamed startup received almost $ 7 million in seed funding. The investors include Tony Fadell (Principal at Future Shape & Inventor of the iPod,) Casey Neistat (YouTuber,) Kevin Lin (Co-founder of Twitch,) Steve Huffman (CEO of Reddit,) Liam Casey (Founder and CEO, PCH,) Paddy Cosgrave (Founder of Web Summit) and Josh Buckley (CEO of Product Hunt.)

The latest to invest in Carl Pei’s startup is Indian based CRED founder Kunal Shah who invested an undisclosed amount. Shah is not new to being an angel investor as he already has a portfolio of investing in almost 80 startups. “Carl is working on a new consumer electronics company that I am sure will be a disruptor in the tech industry. I am excited to be part of this journey (sic,)” the CRED founder said in a statement.

While Pei’s startup is headquartered in London, more details will be known on January 27th, 2021.

Funding

Dazzl Raises $3.2M Seed Funding Led by OYO’s Ritesh Agarwal for AI Skincare Expansion

Bengaluru, January 13, 2026 Dazzl, the D2C beauty startup revolutionizing AI personalized skincare India, secured $3.2 million in seed funding led by OYO founder Ritesh Agarwal’s venture arm. Co-investors include Snapdeal’s Rohit Bansal and Fireside Ventures, valuing Dazzl at $15 million post-money. Founded in 2024 by IIT alumni Priya Singh and Arjun Mehta, the app uses smartphone scans for custom serums, boasting 50,000+ users and ₹5 crore ARR amid India’s $25 billion beauty market surge.

Ritesh Agarwal praised Dazzl’s tech: “Personalization is beauty’s future, like OYO’s guest model.” Funds target R&D for 100+ skin profiles, Gujarat manufacturing under PLI, Instagram/Nykaa campaigns, and 50 hires. In a 20% YoY growing sector (Redseer 2025), Dazzl edges Mamaearth and Plum with 95% AI precision, 90% natural formulas, ₹499 kits, 65% retention (vs. 40% avg), and viral TikTok traction in 10 cities.

D2C beauty startup Dazzl tackles regulations via FSSAI compliance, eyeing $10B e-commerce beauty by 2028 and MENA exports. Q2 haircare launches and Series A loom, with Agarwal’s backing signaling unicorn potential for sustainable beauty products India. Dazzl blends AI with clean beauty for 500M+ consumers.

Funding

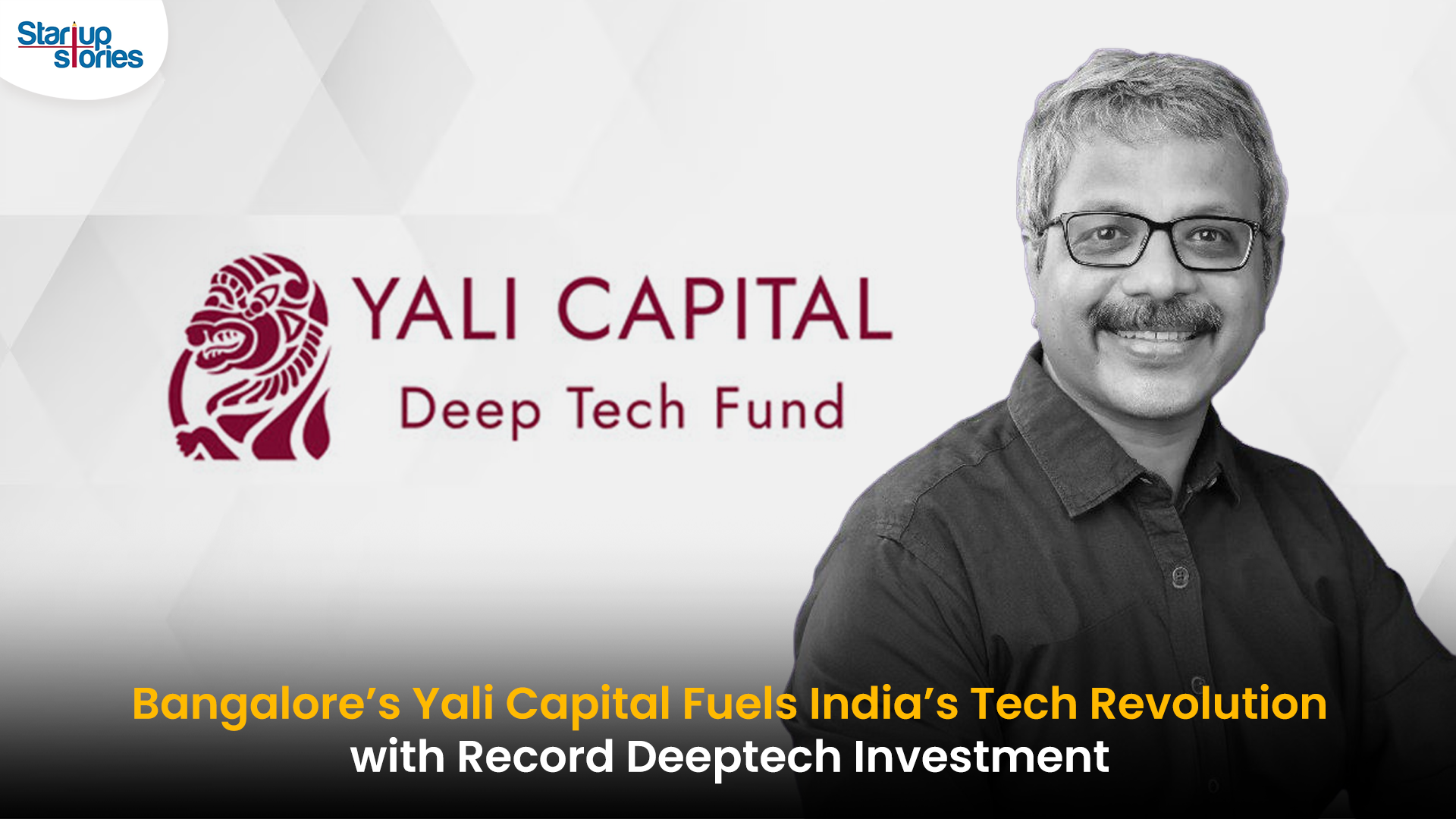

Yali Capital Makes History with ₹893 Crore Deeptech Fund to Power Indian Innovation

Bangalore’s Yali Capital has closed its first deeptech-focused fund, raising a substantial ₹893 crore (about $104 million) and surpassing its initial ₹500 crore target. This major fundraising milestone highlights the growing appeal and investor confidence in India’s deeptech landscape, fueling innovation in pivotal sectors like semiconductors, artificial intelligence, robotics, aerospace, genomics, and smart manufacturing. The fund cements Yali Capital’s position as a key player driving progress in India’s burgeoning tech ecosystem.

Strategically, Yali Capital’s fund targets both early-stage (Seed, Series A) and later-stage (Series D and beyond) startups. Its diverse roster of Limited Partners (LPs) includes prominent corporations such as Infosys, Qualcomm Ventures, and Tata AIG, alongside government-backed organizations like the DPIIT Fund of Funds for Startups and the Self-Reliant India Fund. With heavyweight backers like Kris Gopalakrishnan (Infosys co-founder), Gopal Srinivasan (TVS Capital), and Utpal Sheth (RARE Enterprises), Yali Capital ensures robust strategic support. The firm’s dual structure—a SEBI-registered Alternative Investment Fund (AIF) and a GIFT City-based feeder vehicle—enables global investor participation, guided by tech luminary Lip-Bu Tan and managing partner Ganapathy Subramaniam.

Already, Yali Capital has invested in five breakthrough startups, including C2I Semiconductor, 4baseCare, and Perceptyne, focusing on chip design and AI. By devoting two-thirds of its fund to early-stage companies, Yali Capital underscores its commitment to nurturing next-generation Indian deeptech founders. This fundraising success aligns with a nationwide trend of surging investments in advanced technology and positions Yali Capital at the forefront of India’s drive toward self-reliance and global tech leadership.

Funding

Agritech Startup Gramik Raises INR 17 Crore to Expand Rural Commerce in India

- Gramik, a Lucknow-based agritech startup, has secured INR 17 crore in a bridge funding round ahead of its upcoming INR 56 crore Series A raise.

- The funding round included investments via Optionally Convertible Debentures (OCDs) and Compulsorily Convertible Debentures (CCDs).

- Key investors include Sammaan Global Ventures, Money Creeper Investment, and prominent angels such as Balram Yadav (MD & CEO, Godrej Agrovet), Gev Aryaton, Irfan Alam, Nikhil Bhagat, and Salvia Siddiqui.

Gramik’s Unique Peer Commerce Model

- Founded in 2021 by Raj Yadav, Gramik empowers over 120 million small and marginal farmers in India through a technology-driven rural commerce platform.

- The startup operates a dual-channel distribution network using Village-Level Entrepreneurs (VLEs) and rural retailers to deliver high-quality agri-inputs to remote areas.

- Gramik’s full-stack platform offers demand aggregation, logistics, embedded credit, and agronomy services, ensuring last-mile delivery and support for farmers.

Expansion Plans and Future Growth

- Gramik currently operates in 12 districts, with 1,200+ active VLEs and 250+ rural retail partners, and plans to expand to 3,000 VLEs and reach 1 million+ farmers across Uttar Pradesh, Maharashtra, and Jammu.

- The new funds will be used to expand Gramik’s private-label products, enhance agronomy-led farmer engagement, and scale operations in key states.

- With a strong focus on supply chain efficiency, technology, and farmer advisory services, Gramik aims to become a leader in India’s $50 billion agri-input and rural commerce market.

- Backed by previous seed funding of over INR 25 crore, Gramik is set to drive innovation and inclusive growth for rural communities.

Bryant Norrix

April 14, 2025 at 3:17 pm

Thankyou for this grand post, I am glad I discovered this web site on yahoo.

Virgil Dolph

May 3, 2025 at 12:18 am

I’ve been exploring for a bit for any high quality articles or blog posts on this kind of area . Exploring in Yahoo I at last stumbled upon this website. Reading this information So i’m happy to convey that I’ve an incredibly good uncanny feeling I discovered just what I needed. I most certainly will make sure to don’t forget this site and give it a look regularly.

bitcoin mining

May 10, 2025 at 9:45 am

I am really impressed together with your writing abilities and also with the format for your weblog. Is that this a paid subject or did you modify it your self? Anyway keep up the excellent high quality writing, it’s rare to see a nice weblog like this one today..

best cloud mining

May 13, 2025 at 9:14 pm

We are a group of volunteers and starting a new scheme in our community. Your web site offered us with valuable info to work on. You’ve done an impressive job and our entire community will be grateful to you.

binance create account

May 15, 2025 at 10:42 am

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

morocco private tours

May 24, 2025 at 9:40 am

I will right away grasp your rss feed as I can’t in finding your email subscription link or newsletter service. Do you’ve any? Please allow me recognise in order that I could subscribe. Thanks.

Quincy Avinger

June 2, 2025 at 12:01 am

I believe this site holds some very great information for everyone : D.

vtc cdg

June 6, 2025 at 6:47 am

Way cool, some valid points! I appreciate you making this article available, the rest of the site is also high quality. Have a fun.

7exzi

June 6, 2025 at 12:54 pm

how can i get clomiphene pill get generic clomid for sale where can i buy clomiphene tablets can i order generic clomid prices buy cheap clomiphene no prescription buy cheap clomid tablets can you buy generic clomiphene without insurance

atomic wallet

June 16, 2025 at 5:23 pm

I conceive this website has some rattling good information for everyone. “The foundation of every state is the education of its youth.” by Diogenes.

Sandy Niro

July 2, 2025 at 4:58 pm

I believe this website has some rattling fantastic info for everyone. “He is able who thinks he is able.” by Buddha.

investing in defi

July 23, 2025 at 11:15 pm

I will right away take hold of your rss feed as I can’t in finding your e-mail subscription link or newsletter service. Do you have any? Kindly let me realize so that I may subscribe. Thanks.

commercial microbial remediation

July 31, 2025 at 3:01 am

Howdy! I know this is somewhat off topic but I was wondering which blog platform are you using for this site? I’m getting sick and tired of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be great if you could point me in the direction of a good platform.

Grand Prairie ac repair

August 6, 2025 at 4:01 pm

Deference to author, some good information .

registro en Binance

August 10, 2025 at 8:20 am

Your article helped me a lot, is there any more related content? Thanks!

patmypets

August 13, 2025 at 2:22 pm

I’ve been absent for a while, but now I remember why I used to love this site. Thanks , I will try and check back more often. How frequently you update your website?

olxtoto

August 18, 2025 at 1:34 pm

Hi, Neat post. There’s a problem with your web site in internet explorer, would check this… IE still is the market leader and a good portion of people will miss your magnificent writing because of this problem.

basket168

August 22, 2025 at 3:24 am

I view something truly special in this website .

diamond painting

August 26, 2025 at 2:31 am

Would love to always get updated outstanding website! .

Taneka Elion

September 22, 2025 at 12:12 am

I enjoy your piece of work, thankyou for all the interesting content.

https://crypto-city.pro/

September 25, 2025 at 7:53 pm

Greetings! This is my first visit to your blog! We are a group of volunteers and starting a new initiative in a community in the same niche. Your blog provided us beneficial information to work on. You have done a wonderful job!

https://dorado.tech/

September 26, 2025 at 2:32 am

wonderful post.Ne’er knew this, thankyou for letting me know.

注册获取100 USDT

September 29, 2025 at 3:08 pm

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Lurline Zubia

November 3, 2025 at 1:34 am

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

站群程序

November 6, 2025 at 7:21 pm

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

MM88

November 7, 2025 at 6:09 am

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

Kuwin

November 8, 2025 at 8:03 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

Prostadine Review

November 10, 2025 at 6:38 pm

Hello There. I found your blog using msn. This is a very well written article. I’ll make sure to bookmark it and return to read more of your useful information. Thanks for the post. I’ll certainly return.

Kerassentials

November 10, 2025 at 7:58 pm

Yay google is my queen helped me to find this outstanding internet site! .

谷歌外推

November 11, 2025 at 3:25 am

采用高效谷歌外推策略,快速提升网站在搜索引擎中的可见性与权重。谷歌外推

nextogel

November 12, 2025 at 9:05 pm

Thanks for another magnificent post. The place else may just anybody get that kind of information in such a perfect means of writing? I have a presentation subsequent week, and I’m on the look for such information.

MM88

November 17, 2025 at 10:57 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

48v dc light bulb

November 19, 2025 at 6:02 am

I appreciate, result in I found exactly what I used to be looking for. You’ve ended my 4 day long hunt! God Bless you man. Have a great day. Bye

J88

November 23, 2025 at 5:14 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

binance kod

November 27, 2025 at 7:14 pm

Your point of view caught my eye and was very interesting. Thanks. I have a question for you. https://accounts.binance.com/lv/register?ref=SMUBFN5I

mpo500

November 28, 2025 at 12:23 pm

Pretty section of content. I just stumbled upon your web site and in accession capital to assert that I acquire in fact enjoyed account your blog posts. Anyway I’ll be subscribing to your feeds and even I achievement you access consistently quickly.

honey trick

November 28, 2025 at 1:44 pm

Good info. Lucky me I reach on your website by accident, I bookmarked it.

iwin

November 29, 2025 at 11:07 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

pink salt trick for weight loss

December 2, 2025 at 5:20 am

fantastic post, very informative. I wonder why the other experts of this sector do not notice this. You should continue your writing. I’m confident, you have a great readers’ base already!

Nervital

December 7, 2025 at 8:53 am

I would like to thank you for the efforts you’ve put in writing this web site. I’m hoping the same high-grade web site post from you in the upcoming as well. In fact your creative writing skills has inspired me to get my own website now. Really the blogging is spreading its wings rapidly. Your write up is a great example of it.

situs toto togel

December 7, 2025 at 3:57 pm

Hey just wanted to give you a brief heads up and let you know a few of the images aren’t loading correctly. I’m not sure why but I think its a linking issue. I’ve tried it in two different internet browsers and both show the same results.

Odkryj

December 9, 2025 at 4:12 am

Clear explanation

nagad88 casino live

December 11, 2025 at 7:56 pm

Thanks for sharing excellent informations. Your site is so cool. I am impressed by the details that you have on this blog. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for more articles. You, my pal, ROCK! I found simply the information I already searched everywhere and just could not come across. What a great website.

AtomCasino

December 13, 2025 at 6:31 pm

https://t.me/s/atom_official_casino

top 10 ragnarok private server 2026

December 13, 2025 at 7:00 pm

I believe that avoiding prepared foods would be the first step to be able to lose weight. They may taste fine, but ready-made foods currently have very little vitamins and minerals, making you feed on more just to have enough electricity to get with the day. If you are constantly feeding on these foods, transferring to cereals and other complex carbohydrates will let you have more power while consuming less. Interesting blog post.

Xoilac

December 16, 2025 at 3:27 am

Great blog here! Also your website so much up very fast! What web host are you using? Can I am getting your affiliate link in your host? I wish my web site loaded up as fast as yours lol

random trc20 address

December 18, 2025 at 1:29 pm

Hi there, I discovered your blog via Google while searching for a related topic, your web site came up, it appears to be like good. I have bookmarked it in my google bookmarks.

humanizer for ChatGPT

December 18, 2025 at 8:23 pm

Hey, I think your website might be having browser compatibility issues. When I look at your blog in Chrome, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, excellent blog!

headquarterscomplaints

December 18, 2025 at 10:42 pm

One thing I’d really like to say is always that before getting more pc memory, have a look at the machine directly into which it could be installed. Should the machine is usually running Windows XP, for instance, the actual memory ceiling is 3.25GB. Installing a lot more than this would just constitute a new waste. Make sure one’s motherboard can handle an upgrade volume, as well. Thanks for your blog post.

kazino_s_minimalnym_depozitom

December 19, 2025 at 2:21 pm

https://t.me/s/Kazino_s_minimalnym_depozitom

custom tron vanity address

December 20, 2025 at 4:42 am

Hey! Do you know if they make any plugins to assist with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good results. If you know of any please share. Cheers!

fdertolmrtokev

December 20, 2025 at 10:31 am

Hello, I think your website might be having browser compatibility issues. When I look at your website in Safari, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, awesome blog!

Kings Casino App

December 21, 2025 at 5:15 pm

Diese Tische sind kleiner, da die Spieler am Tisch stehen und ihre Chips

oder Jetons selbst platzieren. Auf über 1.000 Quadratmetern finden Sie hier ein außergewöhnlich Eventlocation, die man auch über einen eigenen Eingang erreichen kann.

Die Slot Machines finden Sie direkt im Erdgeschoss und den beiden Untergeschossen.

Wenn Sie in die obere dritte Ebene gehen, werden Sie die Tischspiele entdecken.

Das Casino verfügt über 8 Amerikanisches Roulette, 2

Ultimate Texas Hold’em, 12 Pokerspiele und 500

Automaten. Hier befinden sich über 100 unterhaltsame Spielautomaten mit

einem Mindesteinsatz von 0,01 €. Des Weiteren bietet dieses Casino

seinen Gästen verschiedene Pakete zur Auswahl an. In diesem aufregenden Casino können Sie Spiele wie Blackjack, Europäisches Roulette und hochauflösende Spielautomaten finden. Zusätzlich finden Sie in diesem

Casino jede Menge kostenloser Parkplätze, was in einer Großstadt immer von Vorteil ist.

Hier sind die meisten der großen deutschen Spielhallen-Ketten vertreten und

Sie können in vielen Automatencasinos von Merkur Spielothek,

Löwen Play, Joker, Vulkan Stern oder Casino

Royal zocken. Wer Spaß am Glücksspiel hat und sich an keine

Öffnungszeiten halten will, ist bei den Testsiegern der Online Casinos in Berlin bestens aufgehoben.

Dann gibt es noch das Live Casino, in dem

man in Echtzeit und HD-Qualität den Spielverlauf verfolgen kann, der von echten Croupiers geleitet wird

und eine besondere Casino Atmosphäre bietet.

Hauptgrund, sich für ein Online Casino zu entscheiden, sind

mit Sicherheit die Bonus Angebote, eine riesige

Spielauswahl sowie Freispiele und eine große Anzahl sicherer Zahlungsanbieter.

Ein Top Casino Bonus Angebot besteht dabei meistens aus Bonus Geld und

im besten Fall bekommt man noch Freispiele zusätzlich.

References:

https://online-spielhallen.de/nomini-casino-aktionscode-dein-schlussel-zu-besseren-pramien/

trx address

December 23, 2025 at 12:43 am

Pretty nice post. I just stumbled upon your weblog and wanted to say that I have really enjoyed surfing around your blog posts. After all I will be subscribing to your feed and I hope you write again soon!

pmu pigment

December 23, 2025 at 12:36 pm

One thing I’d like to say is car insurance cancelling is a dreadful experience and if you are doing the suitable things as being a driver you simply won’t get one. A lot of people do are sent the notice that they have been officially dumped by their own insurance company and many have to struggle to get added insurance after the cancellation. Inexpensive auto insurance rates are often hard to get from cancellation. Knowing the main reasons pertaining to auto insurance cancelling can help people prevent completely losing in one of the most important privileges offered. Thanks for the concepts shared by means of your blog.

cribs

December 23, 2025 at 9:20 pm

Another thing I’ve really noticed is the fact that for many people, bad credit is the reaction of circumstances over and above their control. As an example they may be actually saddled with an illness and because of this they have large bills going to collections. Maybe it’s due to a job loss or perhaps the inability to work. Sometimes divorce or separation can send the money in the undesired direction. Thanks for sharing your thinking on this web site.

best newborn stroller

December 24, 2025 at 9:19 am

Thanks for sharing your ideas on this blog. Likewise, a fantasy regarding the banking companies intentions when talking about foreclosure is that the bank will not take my repayments. There is a specific amount of time in which the bank will require payments from time to time. If you are far too deep in the hole, they may commonly demand that you pay the payment in full. However, i am not saying that they will have any sort of payments at all. When you and the lender can be capable to work some thing out, this foreclosure process may cease. However, in the event you continue to miss out on payments within the new program, the foreclosure process can pick up from where it left off.

baby travel system

December 24, 2025 at 11:44 am

It?s hard to find knowledgeable individuals on this matter, however you sound like you realize what you?re speaking about! Thanks

best hair transplant turkey

December 26, 2025 at 3:48 pm

Please let me know if you’re looking for a writer for your weblog. You have some really great articles and I think I would be a good asset. If you ever want to take some of the load off, I’d really like to write some content for your blog in exchange for a link back to mine. Please send me an email if interested. Kudos!

NetBet Casino bonus

December 27, 2025 at 2:42 am

Tether gives players stable-value bets without having to worry about market swings, and most casinos support both ERC-20 and TRC-20 networks.

Many blockchain casinos, such as BetPanda,

also develop their own in-house Provably Fair games, generally

listed under “Originals.” Games like Aviator, Spaceman, and Space XY are usually available at any crypto casino.

Yes, many Bitcoin casinos in Australia accept other cryptocurrencies

such as Ethereum, Litecoin, and Bitcoin Cash.

Yes, it’s safe to play at licensed Bitcoin casinos in Australia.

Then, go to the casino’s deposit page, select the cryptocurrency you

want to use, and follow the instructions to transfer the funds from your

wallet to the casino’s address. To make a deposit at a Bitcoin casino in Australia, you’ll need to have a digital wallet with Bitcoin or another cryptocurrency.

With an ever-growing catalog spanning over 5,500 diverse games from

revered studios, everyone finds endless entertainment backed by the site’s strong responsible

gaming initiatives. With so many strengths powering this nascent yet wildly popular platform, crypto

gambling fans would be remiss not to give BC.Game a spin. In an increasingly crowded online gambling landscape, KatsuBet has

carved out a distinctive niche since its 2020 founding by merging vibrant Japanese visuals with varied gaming.

Steering operations, the site offers an abundant game selection numbering over 5,

000 titles. Coins.Game is a new online gambling site making waves in the crypto space since its launch in 2022.

References:

https://blackcoin.co/understanding-online-gambling-platforms/

sol casino

December 27, 2025 at 8:40 pm

A grand slam experience 🎾 With close proximity to federal buildings and international

establishments, you’ll enjoy seamless access to the city’s top

destinations. Our accommodation partners provide

comfort, convenience, and style, all just a short distance from the casino.

Natural and aqua hues compose a modern residential

décor with generous spaces, luxury touches, intuitive technology

and breathtaking views. Designed by award-winning British architecture

firm, Wilkinson Eyre, the sculptural form of the

building in Barangaroo is reminiscent of three petals twisting together towards the sky.

Not every variant will get all of the above, so check out our spec-by-spec

guide below, based on officially available details. Looking to

sell your car? Like the Alza, it’s DNGA-based and comes out

of the Perodua Manufacturing Sdn Bhd (PMSB) plant in Sungai Choh.

References:

https://blackcoin.co/ufo9-casino-your-place-to-play-your-way/

7kCasino

December 29, 2025 at 8:14 am

https://t.me/s/officials_7k_casino

https://udyogseba.com

December 29, 2025 at 11:58 am

online casino mit paypal einzahlung

References:

https://udyogseba.com

https://optimaplacement.com/

December 29, 2025 at 12:14 pm

paypal casinos

References:

https://optimaplacement.com/

soga para saltar

December 30, 2025 at 9:30 am

Some really great info , Glad I observed this.

7kCasino

December 30, 2025 at 10:42 pm

http://www.google.by/url?q=https://t.me/officials_7k/199

Ideal homes Portugal resales

January 2, 2026 at 12:38 am

Thanks for your write-up. I would love to opinion that the first thing you will need to carry out is find out if you really need credit repair. To do that you simply must get your hands on a copy of your credit report. That should never be difficult, because government necessitates that you are allowed to get one free copy of your actual credit report each year. You just have to request that from the right folks. You can either look into the website for the Federal Trade Commission as well as contact one of the leading credit agencies directly.

cbd oil side effects

January 9, 2026 at 6:20 pm

Thanks for your strategies. One thing I’ve noticed is the fact that banks along with financial institutions are aware of the spending patterns of consumers and as well understand that a lot of people max out their own credit cards around the trips. They smartly take advantage of this real fact and then start flooding ones inbox as well as snail-mail box together with hundreds of Zero APR credit cards offers right after the holiday season closes. Knowing that if you are like 98 of American general public, you’ll jump at the opportunity to consolidate financial debt and transfer balances to 0 interest rate credit cards.

bokep indo colmek

January 10, 2026 at 1:35 am

Excellent site. Lots of useful info here. I?m sending it to several friends ans also sharing in delicious. And of course, thanks for your sweat!

IDE/UID

January 20, 2026 at 7:27 am

Just about all of the things you claim happens to be supprisingly appropriate and it makes me ponder why I had not looked at this with this light before. Your article truly did switch the light on for me as far as this particular subject matter goes. Nevertheless there is actually one particular factor I am not really too comfy with so while I make an effort to reconcile that with the main idea of the position, let me observe exactly what the rest of the visitors have to say.Well done.

bokep indo colmek

January 21, 2026 at 1:38 am

I have noticed that over the course of making a relationship with real estate entrepreneurs, you’ll be able to come to understand that, in every single real estate exchange, a commission is paid. Eventually, FSBO sellers really don’t “save” the commission rate. Rather, they struggle to win the commission by doing a good agent’s job. In completing this task, they commit their money and also time to complete, as best they can, the assignments of an representative. Those assignments include uncovering the home by means of marketing, introducing the home to buyers, making a sense of buyer urgency in order to make prompt an offer, organizing home inspections, dealing with qualification check ups with the lender, supervising repairs, and assisting the closing of the deal.

zaborna torilon

January 21, 2026 at 9:31 am

whoah this blog is wonderful i like studying your posts. Keep up the good work! You already know, a lot of individuals are hunting round for this info, you could aid them greatly.

Where to buy Cocaine online

January 22, 2026 at 2:04 am

I have learned some new things by your weblog. One other thing I’d like to say is always that newer laptop or computer os’s often allow extra memory to get used, but they additionally demand more memory space simply to run. If someone’s computer cannot handle extra memory along with the newest software package requires that memory increase, it may be the time to shop for a new Computer system. Thanks

Buy Cocaine online

January 22, 2026 at 8:23 am

I’m in awe of the author’s capability to make complicated concepts understandable to readers of all backgrounds. This article is a testament to his expertise and dedication to providing useful insights. Thank you, author, for creating such an engaging and insightful piece. It has been an absolute pleasure to read!

Buy Cocaine online

January 22, 2026 at 9:27 pm

Thanks for the write-up. I have usually observed that a lot of people are needing to lose weight since they wish to look slim plus attractive. Even so, they do not continually realize that there are many benefits just for losing weight also. Doctors insist that overweight people come across a variety of conditions that can be directly attributed to their excess weight. Fortunately that people who definitely are overweight and suffering from different diseases can reduce the severity of their illnesses by simply losing weight. It is possible to see a constant but notable improvement with health as soon as even a negligible amount of weight-loss is reached.

बॉन्डेज मॉडल

January 28, 2026 at 1:50 pm

Hi, i think that i saw you visited my blog thus i came to “return the favor”.I am trying to find things to improve my site!I suppose its ok to use a few of your ideas!!

whatisthe1realmoneyonlinecasino

February 4, 2026 at 5:28 pm

Season reviews, comprehensive summaries of completed campaigns

EnriqueKix

February 6, 2026 at 6:14 pm

tilecleaners https://otvetnow.ru create email marketing templates

hqivvsqq

February 8, 2026 at 3:48 am

https://askoff.ru

Binance账户

February 18, 2026 at 5:19 am

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me. https://accounts.binance.info/da-DK/register?ref=V3MG69RO