News

Fake Amazon App Takes A Dig At Toxic Dating Culture

Dating took to the digital platform, where people could just log on to an app and look at people nearby, displayed as per the user’s preferences. The dating culture took a turn for the worse with people becoming increasingly vain and letting it affect them to the extent of them having mental breakdowns.

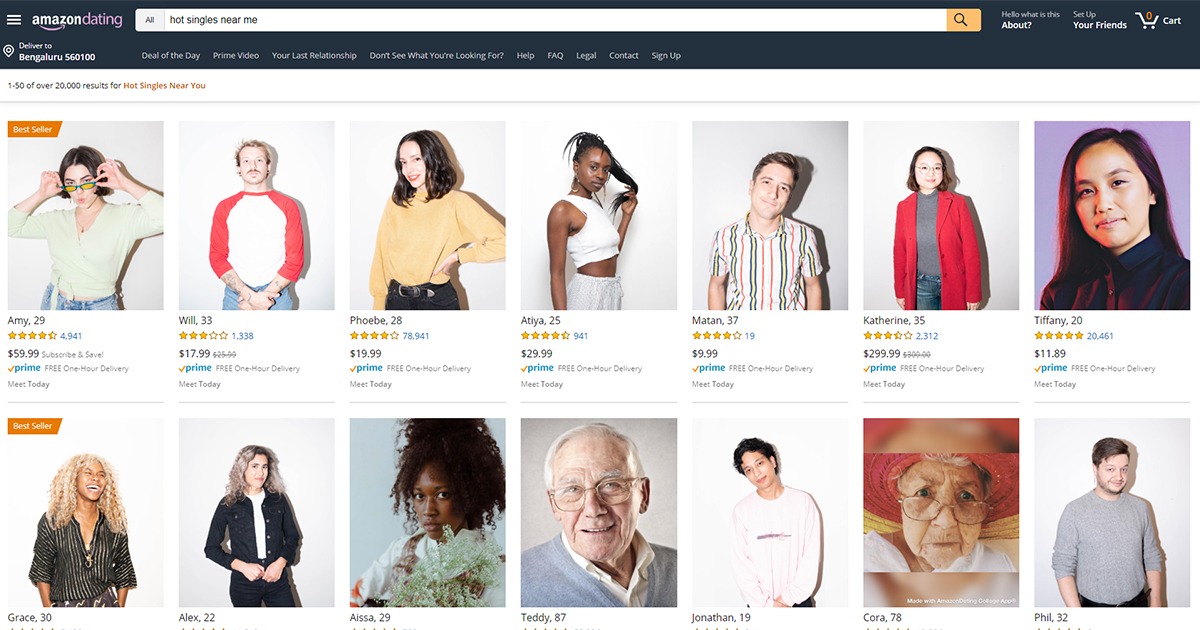

Content creators Suzy Shinn, Ani Acopian and Morgan Gruer came up with an idea to collaborate with an animation company, Thinko, to create a dating site which looks strangely similar to the Amazon e commerce platform.

The work is meant to be a satirical take on the increasingly toxic dating culture prevalent in society today. The site ‘sells,’ or rather auctions off people with a price tag. The people are priced differently and have love languages added into the descriptions so people can choose or buy a digital date according to their preference.

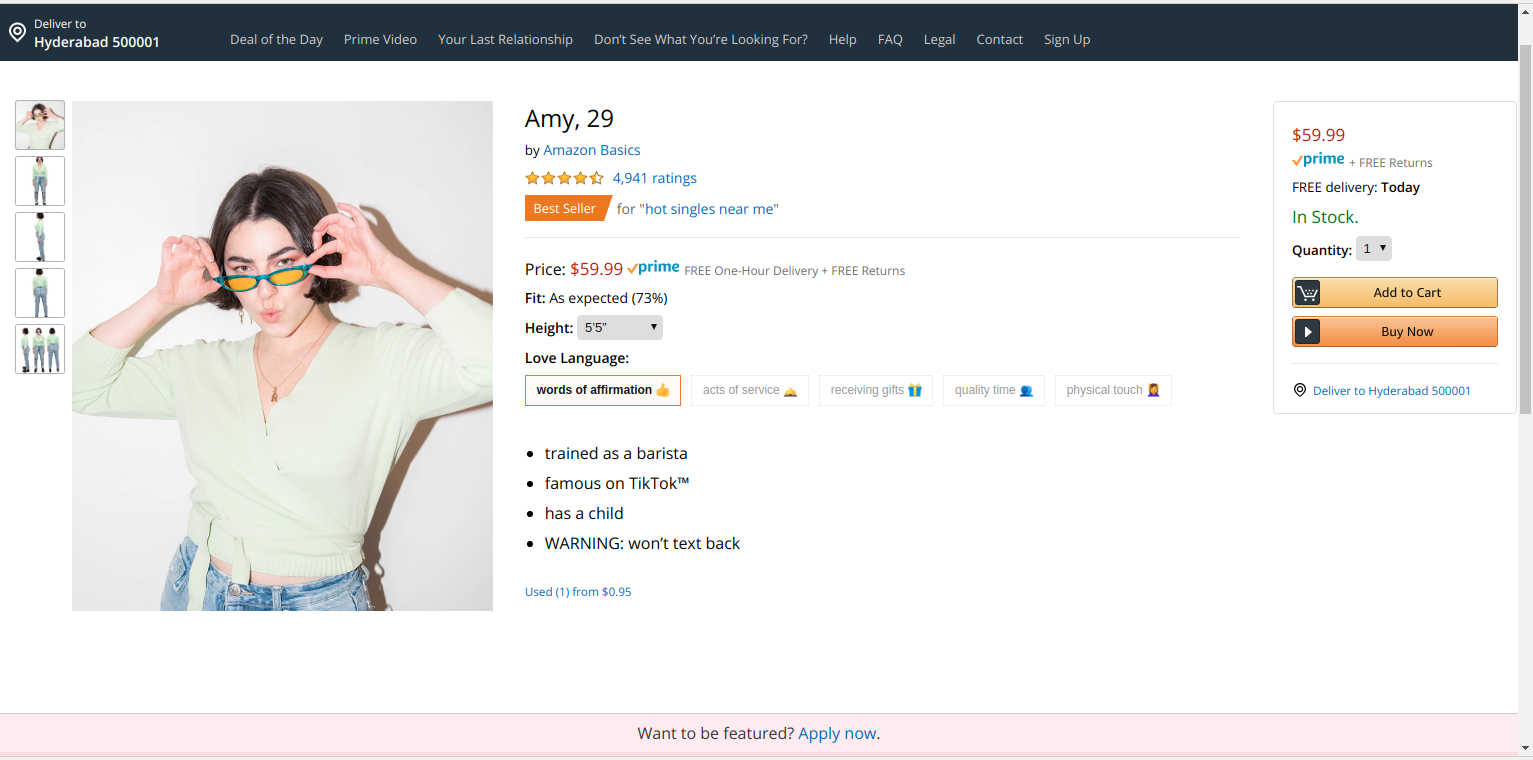

For example, a woman named Amy, aged 29, has a description which says she is “trained as barista,” “famous on TikTok,” “has a child” and “WARNING: won’t text back.”

The entire web page looks like a carbon copy of Amazon, including the checkout process and the buying options.

Clickbait ads which say “Find singles near you” are a testament to how easy it is to influence people under the guise of a date. Therefore, it came as no surprise once the site went online that it attracted criticism, horror and ridicule. Social media had multiple reactions, with people saying black people are priced less than white people in view of the Black History Month. Others took it with a pinch of salt and saw the humor behind the satire.

Regardless of the reactions it attracted, the creators managed to achieve their goal, which was to open the eyes of people to the toxic culture of online dating. Amazon Dating also makes for an interesting case study about the power of what good digital marketing can do.

Funding

Dazzl Raises $3.2M Seed Funding Led by OYO’s Ritesh Agarwal for AI Skincare Expansion

Bengaluru, January 13, 2026 Dazzl, the D2C beauty startup revolutionizing AI personalized skincare India, secured $3.2 million in seed funding led by OYO founder Ritesh Agarwal’s venture arm. Co-investors include Snapdeal’s Rohit Bansal and Fireside Ventures, valuing Dazzl at $15 million post-money. Founded in 2024 by IIT alumni Priya Singh and Arjun Mehta, the app uses smartphone scans for custom serums, boasting 50,000+ users and ₹5 crore ARR amid India’s $25 billion beauty market surge.

Ritesh Agarwal praised Dazzl’s tech: “Personalization is beauty’s future, like OYO’s guest model.” Funds target R&D for 100+ skin profiles, Gujarat manufacturing under PLI, Instagram/Nykaa campaigns, and 50 hires. In a 20% YoY growing sector (Redseer 2025), Dazzl edges Mamaearth and Plum with 95% AI precision, 90% natural formulas, ₹499 kits, 65% retention (vs. 40% avg), and viral TikTok traction in 10 cities.

D2C beauty startup Dazzl tackles regulations via FSSAI compliance, eyeing $10B e-commerce beauty by 2028 and MENA exports. Q2 haircare launches and Series A loom, with Agarwal’s backing signaling unicorn potential for sustainable beauty products India. Dazzl blends AI with clean beauty for 500M+ consumers.

News

Google Launches Startup Hub in Hyderabad to Boost India’s Innovation Ecosystem

Google has launched the Google Startup Hub Hyderabad, a major step in strengthening India’s dynamic startup ecosystem. This new initiative aims to empower entrepreneurs, innovators, and developers by giving them access to Google’s global expertise, mentoring programs, and advanced cloud technology. The hub reflects Google’s mission to fuel India’s digital transformation and promote innovation through the Google for Startups program.

Located in the heart of one of India’s top tech cities, the Google Startup Hub in Hyderabad will host mentorship sessions, training workshops, and networking events designed for early-stage startups. Founders will receive Google Cloud credits, expert guidance in AI, product development, and business scaling, and opportunities to collaborate with Google’s global mentors and investors. This ecosystem aims to help Indian startups grow faster and compete globally.

With Hyderabad already home to tech giants like Google, Microsoft, and Amazon, the launch of the Google Startup Hub Hyderabad further cements the city’s position as a leading innovation and technology hub in India. Backed by a strong talent pool and robust infrastructure, this hub is set to become a growth engine for next-generation startups, driving innovation from India to global markets.

News

BMW’s New Logo Debuts Subtly on the All-Electric iX3: A Modern Evolution

BMW quietly debuted its new logo on the all-electric iX3, marking a significant yet understated shift in the brand’s design direction for 2025. The updated emblem retains the classic roundel and Bavarian blue-and-white colors, but sharp-eyed enthusiasts noticed subtle refinements: the inner chrome ring has been removed, dividing lines between blue and white are gone, and the logo now features a contemporary satin matte black background with slimmer “BMW” lettering. These enhancements showcase BMW’s embrace of modern minimalism while reinforcing their commitment to premium aesthetics and the innovative Neue Klasse philosophy for future electric vehicles.

Unlike rival automakers that reveal dramatic logo changes, BMW’s refresh is evolutionary and respectful of tradition. The new badge ditches decorative chrome and blue borders associated with earlier electric models, resulting in a flatter, more digital-friendly design that mirrors recent branding seen in BMW’s digital communications. Appearing first on the iX3’s nose, steering wheel, and hub caps, this updated identity will gradually be adopted across all BMW models—both electric and combustion—signaling a unified brand language for years to come.

BMW’s strategic logo update represents more than just aesthetic reinvention—it underscores the brand’s dedication to future-ready mobility, design continuity, and a premium EV experience. As the new roundel begins rolling out on upcoming BMW vehicles, it stands as a testament to the automaker’s depth of detail and thoughtful evolution, offering subtle distinction for keen observers and affirming BMW’s iconic status in the ever-changing automotive landscape.

Ueeqbthp

May 25, 2025 at 11:25 pm

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycasino bonus.

MM88

November 5, 2025 at 1:46 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

iwin

November 6, 2025 at 10:37 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

J88

November 7, 2025 at 9:01 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

谷歌站群

November 7, 2025 at 5:42 pm

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

站群程序

November 11, 2025 at 3:02 am

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

站群程序

November 14, 2025 at 3:49 am

搭载智能站群程序,自动化搭建与管理,为SEO项目提供核心驱动力。站群程序

Kuwin

November 15, 2025 at 9:17 pm

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

MM88

November 30, 2025 at 7:27 pm

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

Robocat Auszahlung Wartezeit

December 21, 2025 at 8:49 pm

Zusammen sorgen diese Anbieter dafür, dass unsere Bibliothek über 9.000 Spiele umfasst, darunter Spielautomaten, Tischspiele,

Live-Casino-Optionen und vieles mehr. Weitere renommierte Anbieter

wie Red Tiger, Big Time Gaming, Betsoft und Elk Studios tragen zu unserem vielfältigen Portfolio bei

und bieten Spielern eine Vielzahl von Genres,

Themen und Funktionen. Im Bass Bet Casino arbeiten wir mit den besten Spieleanbietern der Branche zusammen, um unseren Spielern ein unvergleichliches

Spielerlebnis zu bieten. Ganz gleich, ob Sie auf größere Gewinne aus sind oder einfach

nur eine hochwertigere Spielumgebung suchen, unser VIP-Programm ist

dazu da, Ihre Casino-Reise zu neuen Höhen zu führen. Wenn

Sie die höchsten Stufen unseres VIP-Programms

erreichen, erhalten Sie einzigartige Privilegien, darunter Vor-Ort-Aktionen und maßgeschneiderte Angebote.

Als VIP kommen Sie in den Genuss von Vorteilen wie einem eigenen VIP-Manager, höheren Auszahlungslimits, Cashback-Angeboten und

einzigartigen Werbeaktionen.

Die Bedienung ist einfach, perfekt für alle Spieler. Dazu gehören Slots

und Tischspiele, alles von Top-Softwareanbietern. Wir bieten Spannung, Sicherheit und

sind kundenfreundlich. Es ist ein Casino, das sicher seinen Platz unter Ihren Lieblings-Casinos

finden wird. Was Einzahlungen und Auszahlungen betrifft, funktioniert

alles schnell und reibungslos. Und wenn Sie es lieben, auf Sportergebnisse zu wetten, werden Sie

sicherlich die reiche Auswahl an Ereignissen und attraktiven Boni schätzen.

Alle Transaktionen erfolgen verschlüsselt über moderne Sicherheitsprotokolle, sodass die Daten der Spieler jederzeit geschützt sind.

Dieses mobile Angebot sorgt dafür, dass BassBet-Spieler

auch unterwegs eine hochwertige, sichere und komfortable Spielerfahrung genießen können. Die Bedienoberfläche wurde

speziell für kleine Bildschirme optimiert und sorgt für eine intuitive Navigation,

schnelle Ladezeiten und ein flüssiges Spielerlebnis ohne Unterbrechungen. Die mobile Version erlaubt es Spielern, jederzeit und überall

auf Slots, Tischspiele, Live-Dealer und Sportwetten zuzugreifen. BassBet

bietet dafür eine voll optimierte mobile Plattform sowie eine benutzerfreundliche App, die auf allen gängigen Geräten reibungslos funktioniert.

References:

https://online-spielhallen.de/bizzo-casino-deutschland-test-boni-erfahrungen/

VIP casino experience

December 26, 2025 at 10:09 pm

Lucky Ones players can indulge in a range of exclusive games and a

personalised gaming experience like no other. These aren’t just games – they’re front-row seats to the most

sophisticated live VIP casino experience available online.

It doesn’t matter if you’re seeking a casual game or a high-roller

experience, our live dealer games provide an exclusive setting where sophistication meets excitement.

Our live dealer games bring the sophistication and energy of a world-class casino directly

to you, blending modern convenience with timeless luxury. These games are designed to suit both beginners and seasoned players, with adjustable betting limits and customisation options.

For poker enthusiasts, the dedicated poker room

proudly boasts two standalone poker tables, where amateurs and pros alike

can test their skills and apply their strategy amongst like-minded individuals.

The atmosphere, gaming options, and hospitality will leave lasting impressions.

If you’re planning a trip to Chile, be sure to include this casino on your must-visit list.

Social gaming platform slots

December 27, 2025 at 2:18 pm

QuillBot’s AI Chat now supports voice input!

Get information immediately, without having to shift through piles of data.

QuillBot’s free AI Chat is powered by advanced large language models.

© All content is property of Webtickets Instantly translate text between over

20 languages with high accuracy. Save time and learn faster

with AI-powered summaries. The “Search” button gives the AI access to

the internet to answer your questions.

References:

https://blackcoin.co/crownplay-casino-majestic-gambling-for-australia/

https://empleoo.net

December 29, 2025 at 1:30 pm

casino avec paypal

References:

https://empleoo.net

http://play123.co.kr/bbs/board.php?bo_table=online&wr_id=275910

December 29, 2025 at 2:08 pm

casino with paypal

References:

http://play123.co.kr/bbs/board.php?bo_table=online&wr_id=275910