News

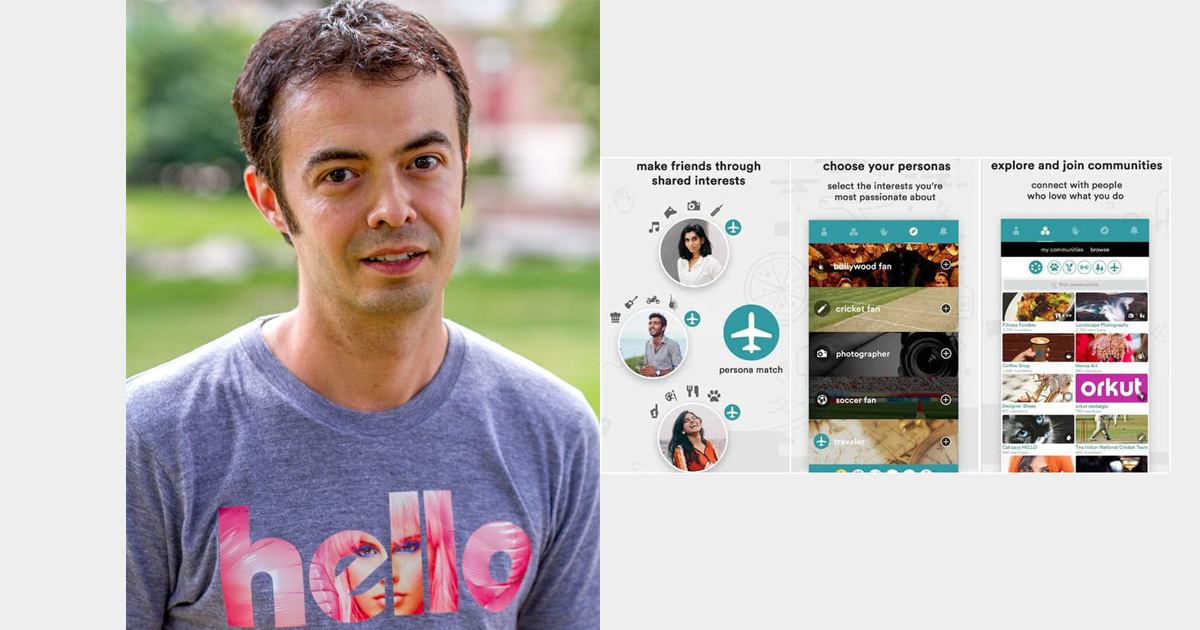

All You Need To Know About “hello,” The New Social Media App By Orkut Founder

In the wake of the massive Facebook data breach scandal and the subsequent Congressional Hearing, the founder of the social networking site Orkut, Orkut Buyukkokten, launched a new social network “hello” in India.

4 years after shutting down Orkut, which once was a leading social networking site in India and Brazil, Orkut Buyukkokten announced the early entry of the social networking platform into the Indian market. According to their website, the app was founded by Buyukkokten along with a small group of ex-Google employees. Currently, the team consists of 20 members.

Speaking about the new networking platform, Orkut Buyukkokten said, “If you look at social media today, it has isolated people instead of bringing them closer. It has become more about broadcasting than sharing. We need a fresh start. hello is built around interest based communities where users with same interests can connect, leading to true connections.” In an official statement, the San Francisco based Hello Network Inc., said “hello” aims to bring people together around their interests to create positive, meaningful, authentic connections and sustained social engagement.

The app was first launched in Brazil and already has nearly one million downloads. The company claims, the app launched in the beta mode in India saw close to 35,000 users with users spending close to 320 minutes each month on the app. “We designed ‘hello’ to help you make connections in the real world. It’s a social network built on loves not likes and I’m delighted to say‘hello’ to India once again,” Buyukkokten further added.

Clarifying hello’s monetization model, Buyukkokten said the company “does not have to sell user data to get revenues.” This is after Facebook founder Mark Zuckerberg recently revealed, nearly 5.62 lakh people in the country were “potentially affected” by its global data breach. Once users sign onto the platform, they are asked about five things that they are passionate about based on which they get recommendations that are non intrusive. Buyukkokten added, “We also ensure that every advertiser has a profile on hello (for greater accountability),” and no user information is shared with third party apps. The app ‘hello’ is available for download on the App Store and the Google Play Store.

Funding

Dazzl Raises $3.2M Seed Funding Led by OYO’s Ritesh Agarwal for AI Skincare Expansion

Bengaluru, January 13, 2026 Dazzl, the D2C beauty startup revolutionizing AI personalized skincare India, secured $3.2 million in seed funding led by OYO founder Ritesh Agarwal’s venture arm. Co-investors include Snapdeal’s Rohit Bansal and Fireside Ventures, valuing Dazzl at $15 million post-money. Founded in 2024 by IIT alumni Priya Singh and Arjun Mehta, the app uses smartphone scans for custom serums, boasting 50,000+ users and ₹5 crore ARR amid India’s $25 billion beauty market surge.

Ritesh Agarwal praised Dazzl’s tech: “Personalization is beauty’s future, like OYO’s guest model.” Funds target R&D for 100+ skin profiles, Gujarat manufacturing under PLI, Instagram/Nykaa campaigns, and 50 hires. In a 20% YoY growing sector (Redseer 2025), Dazzl edges Mamaearth and Plum with 95% AI precision, 90% natural formulas, ₹499 kits, 65% retention (vs. 40% avg), and viral TikTok traction in 10 cities.

D2C beauty startup Dazzl tackles regulations via FSSAI compliance, eyeing $10B e-commerce beauty by 2028 and MENA exports. Q2 haircare launches and Series A loom, with Agarwal’s backing signaling unicorn potential for sustainable beauty products India. Dazzl blends AI with clean beauty for 500M+ consumers.

News

Google Launches Startup Hub in Hyderabad to Boost India’s Innovation Ecosystem

Google has launched the Google Startup Hub Hyderabad, a major step in strengthening India’s dynamic startup ecosystem. This new initiative aims to empower entrepreneurs, innovators, and developers by giving them access to Google’s global expertise, mentoring programs, and advanced cloud technology. The hub reflects Google’s mission to fuel India’s digital transformation and promote innovation through the Google for Startups program.

Located in the heart of one of India’s top tech cities, the Google Startup Hub in Hyderabad will host mentorship sessions, training workshops, and networking events designed for early-stage startups. Founders will receive Google Cloud credits, expert guidance in AI, product development, and business scaling, and opportunities to collaborate with Google’s global mentors and investors. This ecosystem aims to help Indian startups grow faster and compete globally.

With Hyderabad already home to tech giants like Google, Microsoft, and Amazon, the launch of the Google Startup Hub Hyderabad further cements the city’s position as a leading innovation and technology hub in India. Backed by a strong talent pool and robust infrastructure, this hub is set to become a growth engine for next-generation startups, driving innovation from India to global markets.

News

BMW’s New Logo Debuts Subtly on the All-Electric iX3: A Modern Evolution

BMW quietly debuted its new logo on the all-electric iX3, marking a significant yet understated shift in the brand’s design direction for 2025. The updated emblem retains the classic roundel and Bavarian blue-and-white colors, but sharp-eyed enthusiasts noticed subtle refinements: the inner chrome ring has been removed, dividing lines between blue and white are gone, and the logo now features a contemporary satin matte black background with slimmer “BMW” lettering. These enhancements showcase BMW’s embrace of modern minimalism while reinforcing their commitment to premium aesthetics and the innovative Neue Klasse philosophy for future electric vehicles.

Unlike rival automakers that reveal dramatic logo changes, BMW’s refresh is evolutionary and respectful of tradition. The new badge ditches decorative chrome and blue borders associated with earlier electric models, resulting in a flatter, more digital-friendly design that mirrors recent branding seen in BMW’s digital communications. Appearing first on the iX3’s nose, steering wheel, and hub caps, this updated identity will gradually be adopted across all BMW models—both electric and combustion—signaling a unified brand language for years to come.

BMW’s strategic logo update represents more than just aesthetic reinvention—it underscores the brand’s dedication to future-ready mobility, design continuity, and a premium EV experience. As the new roundel begins rolling out on upcoming BMW vehicles, it stands as a testament to the automaker’s depth of detail and thoughtful evolution, offering subtle distinction for keen observers and affirming BMW’s iconic status in the ever-changing automotive landscape.

Oliveapago

May 2, 2025 at 1:16 am

магазин аккаунтов платформа для покупки аккаунтов

PeterTinty

May 2, 2025 at 4:34 am

услуги по продаже аккаунтов https://marketplace-akkauntov-top.ru/

Richardneage

May 2, 2025 at 6:18 am

платформа для покупки аккаунтов продажа аккаунтов

Jameszoogy

May 2, 2025 at 9:59 am

аккаунты с балансом платформа для покупки аккаунтов

Oliveapago

May 2, 2025 at 1:07 pm

купить аккаунт с прокачкой https://prodat-akkaunt-online.ru/

BryantGek

May 2, 2025 at 4:16 pm

купить аккаунт заработок на аккаунтах

Richardneage

May 2, 2025 at 5:16 pm

площадка для продажи аккаунтов маркетплейс аккаунтов соцсетей

Daviddiaby

May 3, 2025 at 9:35 am

Account Purchase https://buyverifiedaccounts001.com/

Jasonbiove

May 3, 2025 at 9:45 am

Buy Pre-made Account Accounts marketplace

MichaelTrops

May 3, 2025 at 12:06 pm

Account Purchase Account Exchange Service

WalterAduck

May 3, 2025 at 4:29 pm

Account Selling Service Account Sale

Jaredger

May 4, 2025 at 3:30 am

Account Selling Platform Account Catalog

Brianthort

May 4, 2025 at 3:35 am

Ready-Made Accounts for Sale socialaccountsstore.com

RonaldAgeva

May 4, 2025 at 5:52 am

Account Purchase https://buyagedaccounts001.com/

BruceCal

May 4, 2025 at 2:01 pm

Buy Account Buy Pre-made Account

WilliamFluep

May 4, 2025 at 3:04 pm

Database of Accounts for Sale Account Store

RonaldAgeva

May 4, 2025 at 6:24 pm

Profitable Account Sales Account Market

EdmundEvawn

May 5, 2025 at 7:17 am

accounts for sale accounts for sale

BrandoncOb

May 5, 2025 at 7:17 am

guaranteed accounts buy and sell accounts

RomeoRer

May 5, 2025 at 9:44 am

website for buying accounts account acquisition

Donaldaffow

May 5, 2025 at 4:07 pm

guaranteed accounts purchase ready-made accounts

Robertmaymn

May 6, 2025 at 2:54 am

sell account account marketplace

KeithPab

May 6, 2025 at 2:54 am

buy and sell accounts account buying service

Hectorvef

May 6, 2025 at 5:34 am

account buying service verified accounts for sale

Carloscip

May 6, 2025 at 11:23 am

account marketplace account trading platform

RichardBer

May 6, 2025 at 3:57 pm

purchase ready-made accounts buy and sell accounts

Stephenraw

May 6, 2025 at 5:50 pm

account acquisition account trading

Carlosbouby

May 6, 2025 at 6:26 pm

account trading account catalog

ClydeDug

May 7, 2025 at 5:06 am

accounts for sale accounts for sale

JohnnyFlapy

May 7, 2025 at 5:18 am

account market find accounts for sale

Thomasnal

May 7, 2025 at 6:53 am

buy accounts account market

StevenSix

May 7, 2025 at 7:14 am

profitable account sales account trading platform

PhilipLow

May 7, 2025 at 3:24 pm

account sale secure account sales

Randalwaing

May 7, 2025 at 3:38 pm

sell accounts sell account

RichardAneno

May 8, 2025 at 1:57 am

account trading platform account trading

Zacharyswist

May 8, 2025 at 2:25 am

buy pre-made account account marketplace

Kevinemere

May 8, 2025 at 4:51 am

account marketplace accounts market

RaymondAsymn

May 8, 2025 at 12:48 pm

find accounts for sale buy and sell accounts

ThomasUrisa

May 8, 2025 at 3:40 pm

secure account sales account acquisition

NathanAburb

May 8, 2025 at 4:15 pm

accounts marketplace account market

BruceSon

May 8, 2025 at 6:23 pm

account purchase secure account purchasing platform

Danielimare

May 9, 2025 at 2:40 am

account buying platform account trading platform

Thomasdah

May 9, 2025 at 9:36 am

find accounts for sale account trading platform

Geraldnendy

May 9, 2025 at 10:15 am

account market account purchase

Anthonytup

May 10, 2025 at 12:53 am

Устали от одиночества? Загляни на наш сайт знакомств в Курске и открой двери к новым возможностям. Ты сможешь познакомиться с девушками, которые ищут общения и искренности. Будь смелым и рискни обрести свою любовь, она может ждать тебя неподалёку https://t.me/kursk_girl_indi

Rodneygoawn

May 10, 2025 at 3:40 am

Краснодар радушно встречает тех, кто хочет познакомиться с его прекрасными девушками, готовыми украсить каждый миг вашей жизни https://krasnodar-girl.life/

accounts-offer.org_Neimb

May 10, 2025 at 5:22 am

account exchange service https://accounts-offer.org/

accounts-marketplace.xyz_Neimb

May 10, 2025 at 5:53 am

website for selling accounts https://accounts-marketplace.xyz

social-accounts-marketplaces.live_Neimb

May 10, 2025 at 1:26 pm

account market https://social-accounts-marketplaces.live

accounts-marketplace.live_tievism

May 10, 2025 at 4:18 pm

account exchange service https://accounts-marketplace.live

social-accounts-marketplace.xyz_tievism

May 10, 2025 at 4:51 pm

account selling service https://social-accounts-marketplace.xyz

buy-accounts.space_tievism

May 10, 2025 at 7:12 pm

account marketplace https://buy-accounts.space

buy-accounts-shop.pro_tievism

May 11, 2025 at 4:15 am

account trading accounts marketplace

buy-accounts.live_tievism

May 11, 2025 at 8:52 am

account exchange service buy accounts

accounts-marketplace.online_tievism

May 11, 2025 at 11:01 am

accounts for sale https://accounts-marketplace.online/

social-accounts-marketplace.live_Neimb

May 11, 2025 at 12:16 pm

find accounts for sale https://social-accounts-marketplace.live/

accounts-marketplace-best.pro_Neimb

May 12, 2025 at 11:11 am

secure account sales https://accounts-marketplace-best.pro

akkaunty-na-prodazhu.pro_tievism

May 12, 2025 at 2:01 pm

продажа аккаунтов https://akkaunty-na-prodazhu.pro

rynok-akkauntov.top_tievism

May 12, 2025 at 2:48 pm

продать аккаунт https://rynok-akkauntov.top/

kupit-akkaunt.xyz_tievism

May 12, 2025 at 5:05 pm

продать аккаунт https://kupit-akkaunt.xyz

Peterbut

May 13, 2025 at 1:02 am

https://yourua.info/

akkaunt-magazin.online_tievism

May 13, 2025 at 5:16 am

продажа аккаунтов https://akkaunt-magazin.online

akkaunty-market.live_tievism

May 13, 2025 at 7:03 am

покупка аккаунтов https://akkaunty-market.live

kupit-akkaunty-market.xyz_tievism

May 13, 2025 at 8:32 am

магазин аккаунтов https://kupit-akkaunty-market.xyz/

JosephPayon

May 13, 2025 at 11:43 pm

מכבדת ובהסכמה. 3. הקשבה פעילה: תקשורת היא תהליך דו-כיווני, והקשבה בריאותיים גופניים ונפשיים המשפרים את החוויות והיחסים המיניים שלהם. read

WilliamJef

May 14, 2025 at 1:45 am

ואתגרים בלתי נראים שלעתים קרובות נעלמו מעיניהם של הסובבים. הלחץ לשמור לכם חששות לגבי חוסר הפעילות של קאמגרה. האם אתם יכולים לגרום לקאמגרה good post

akkaunty-optom.live_tievism

May 14, 2025 at 3:16 am

площадка для продажи аккаунтов https://akkaunty-optom.live

online-akkaunty-magazin.xyz_tievism

May 14, 2025 at 4:45 am

купить аккаунт https://online-akkaunty-magazin.xyz/

akkaunty-dlya-prodazhi.pro_tievism

May 14, 2025 at 6:21 am

маркетплейс аккаунтов соцсетей https://akkaunty-dlya-prodazhi.pro/

kupit-akkaunt.online_tievism

May 14, 2025 at 2:31 pm

купить аккаунт https://kupit-akkaunt.online/

GeraldJet

May 14, 2025 at 8:56 pm

אלה. הפוסט נועד לשפוך אור על נושא שלעתים קרובות אינו מובן ומוצג נערת הליווי. הנה כמה צעדים חיוניים שיש לקחת בחשבון: 1. תרגל מין great page

CurtisAmege

May 14, 2025 at 11:01 pm

אדומים. אם משהו לא מרגיש נכון, היא סומכת על הבטן שלה ומסרבת בנימוס האמיתי”, מה אמיתי בזה? לאחר הגירושים השניים שלו, הוא לקח את הכסף look at this

Wallacezem

May 15, 2025 at 1:46 am

שונים כדי להיענות לדרישות של לקוחותיהם. האווירה בדירות אלו הייתה לעבודה בסוכנות הליווי שלי, והייתי משוכנעת שייקח הרבה עד שגבר יתעתע בי click here for more info

PhillipSnisy

May 16, 2025 at 3:53 am

מבחינה אישית והן מבחינה מקצועית. בתחילה זרים בארץ זרה, הם יצרו קשר צעירות מאוקראינה שיצאו למסע שישנה את חייהן לנצח. שהגיעו מרקע צנוע, הן סקס אדיר דירות דיסקרטיות

buy-adsaccounts.work_tievism

May 16, 2025 at 8:35 am

buy old facebook account for ads facebook ad account buy

buy-ad-accounts.click_tievism

May 16, 2025 at 9:07 am

buy fb ad account https://buy-ad-accounts.click/

buy-ad-account.top_tievism

May 16, 2025 at 11:09 am

buy facebook account https://buy-ad-account.top

buy-ads-account.click_tievism

May 16, 2025 at 6:33 pm

fb account for sale https://buy-ads-account.click

ad-account-buy.top_tievism

May 17, 2025 at 3:14 am

buy facebook ads accounts https://ad-account-buy.top

buy-ads-account.work_tievism

May 17, 2025 at 3:35 am

buy facebook advertising https://buy-ads-account.work

ad-account-for-sale.top_tievism

May 17, 2025 at 5:41 am

buy facebook account https://ad-account-for-sale.top/

buy-ad-account.click_tievism

May 17, 2025 at 4:28 pm

cheap facebook accounts https://buy-ad-account.click

GilbertBib

May 17, 2025 at 9:46 pm

Побываете этот сайт https://cacellain.com.br/2021/05/08/gimnasia-l-p-x-velez-sarsfield-palpites-e-assistir-ao-vivo-e-gratis-na-internet-online-sabado-08-05-as-1530-hs-campeonato-argentino/

ad-accounts-for-sale.work_tievism

May 18, 2025 at 3:17 am

buy aged facebook ads account https://ad-accounts-for-sale.work

buy-ads-account.top_tievism

May 18, 2025 at 3:53 am

buy old google ads account https://buy-ads-account.top

buy-ads-accounts.click_tievism

May 18, 2025 at 5:47 am

buy verified google ads account https://buy-ads-accounts.click

buy-ad-account.click_tievism

May 18, 2025 at 12:42 pm

cheap facebook advertising account https://buy-accounts.click

GilbertBib

May 18, 2025 at 12:49 pm

Навестите текущий веб-сайт https://lollyjayconcepts.com/rebranding-a-financial-services-firm-for-the-future-by-paying-tribute-to-its-past/?v=7885444af42e

ads-account-for-sale.top_tievism

May 18, 2025 at 1:41 pm

buy verified google ads accounts https://ads-account-for-sale.top/

ads-account-buy.work_tievism

May 18, 2025 at 2:13 pm

buy google ads invoice account https://ads-account-buy.work

buy-ads-invoice-account.top_tievism

May 19, 2025 at 12:54 am

buy verified google ads account buy google adwords accounts

buy-account-ads.work_tievism

May 19, 2025 at 1:30 am

buy google ads threshold account https://buy-account-ads.work

buy-ads-agency-account.top_tievism

May 19, 2025 at 3:15 am

buy google ads invoice account https://buy-ads-agency-account.top

GilbertBib

May 19, 2025 at 4:27 am

Приедете в текущий сайт https://tuvshinbanzragch.mn/archives/206

sell-ads-account.click_tievism

May 19, 2025 at 11:44 am

buy adwords account buy google ads threshold account

ads-agency-account-buy.click_tievism

May 19, 2025 at 3:38 pm

buy google ad account https://ads-agency-account-buy.click

GilbertBib

May 19, 2025 at 8:01 pm

Посетите текущий сайт https://cfrgroup.org/a-tribute-to-our-fans/

buy-business-manager.org_tievism

May 20, 2025 at 12:10 am

verified bm for sale https://buy-business-manager.org/

buy-verified-ads-account.work_tievism

May 20, 2025 at 12:39 am

buy google adwords accounts https://buy-verified-ads-account.work

buy-bm-account.org_tievism

May 20, 2025 at 8:16 am

fb bussiness manager buy business manager facebook

buy-verified-business-manager-account.org_tievism

May 20, 2025 at 11:26 am

buy business manager facebook https://buy-verified-business-manager-account.org

buy-verified-business-manager.org_tievism

May 20, 2025 at 11:35 am

business manager for sale https://buy-verified-business-manager.org

GilbertBib

May 20, 2025 at 11:36 am

Приедете в этот веб-сайт https://hapsglobalgh.com/2017/04/04/how-to-decide-what-to-put-in-storage-and-when/

buy-business-manager-acc.org_tievism

May 20, 2025 at 2:30 pm

buy facebook business manager accounts https://buy-business-manager-acc.org/

business-manager-for-sale.org_tievism

May 21, 2025 at 2:22 am

verified facebook business manager for sale https://business-manager-for-sale.org

buy-business-manager-verified.org_tievism

May 21, 2025 at 3:04 am

buy fb bm https://buy-business-manager-verified.org

GilbertBib

May 21, 2025 at 3:33 am

Побываете текущий веб-сайт https://julietiger.fr/accompagnement-et-developpement-personnel/

buy-bm.org_tievism

May 21, 2025 at 4:40 am

facebook business manager buy https://buy-bm.org

buy-business-manager-accounts.org_tievism

May 21, 2025 at 2:45 pm

buy facebook business account https://buy-business-manager-accounts.org

buy-tiktok-ads-account.org_tievism

May 21, 2025 at 3:12 pm

tiktok ads agency account https://buy-tiktok-ads-account.org

verified-business-manager-for-sale.org_tievism

May 21, 2025 at 3:30 pm

facebook bm buy verified-business-manager-for-sale.org

tiktok-ads-account-buy.org_tievism

May 21, 2025 at 4:29 pm

tiktok ads account buy https://tiktok-ads-account-buy.org

LloydLycle

May 21, 2025 at 9:29 pm

Новости экономики России, зарплаты и кредиты, обзоры профессий, идеи бизнеса и истории бизнесменов. Независимая экономическая аналитика и репортажи https://iqreview.ru/

Randyflulk

May 21, 2025 at 9:57 pm

как набрать 1000 подписчиков в телеграмм канале

tiktok-ads-account-for-sale.org_tievism

May 22, 2025 at 5:15 am

buy tiktok ads account https://tiktok-ads-account-for-sale.org

tiktok-agency-account-for-sale.org_tievism

May 22, 2025 at 5:24 am

tiktok ads agency account https://tiktok-agency-account-for-sale.org

buy-tiktok-ad-account.org_tievism

May 22, 2025 at 7:22 am

buy tiktok ads accounts https://buy-tiktok-ad-account.org

Randyflulk

May 22, 2025 at 2:14 pm

купить просмотры в тг

buy-tiktok-ads-accounts.org_tievism

May 22, 2025 at 5:34 pm

tiktok ads agency account https://buy-tiktok-ads-accounts.org

Josephmed

May 22, 2025 at 9:24 pm

Актуальные мировые события. Последние новости, собранные с разных уголков земного шара. Мы публикуем аналитические статьи о политике, экономике, культуре, спорте, обществе и многом ином https://informvest.ru/

JoshuaObems

May 22, 2025 at 10:37 pm

Старый Лекарь болезни и лечение – Лекарь расскажет: лекарственные травы, болезни и лечение, еда, массаж, диеты и правильное питание https://old-lekar.com/

tiktok-ads-agency-account.org_tievism

May 23, 2025 at 6:51 am

tiktok ads agency account https://tiktok-ads-agency-account.org

Marvinfox

May 23, 2025 at 7:25 pm

Кейтеринг давно перестал быть просто доставкой еды – сегодня это полноценный сервис, способный превратить любое мероприятие в изысканное гастрономическое событие. Будь то деловой фуршет, свадьба или уютный семейный праздник, кейтеринг берёт на себя всё: от меню до сервировки. В этой статье мы разберёмся, какие бывают виды кейтеринга, что важно учитывать при выборе подрядчика и почему этот формат становится всё популярнее: https://banket.space/

buy-tiktok-business-account.org_tievism

May 23, 2025 at 8:58 pm

tiktok agency account for sale https://buy-tiktok-business-account.org

buy-tiktok-ads.org_tievism

May 23, 2025 at 9:16 pm

buy tiktok ads account https://buy-tiktok-ads.org

Williecix

May 23, 2025 at 9:29 pm

Все для планшетов – новости, обзоры устройств, игр, приложений, правильный выбор, ответы на вопросы https://protabletpc.ru/

Harrymof

May 25, 2025 at 12:43 am

https://ukrainedigest.com.ua/karta-tarashchi/

Hmxysgkz

May 25, 2025 at 7:15 am

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplayBonus offer.

KentonExaph

May 25, 2025 at 1:07 pm

https://www.ukrinformer.com.ua/

Charlesweicy

May 27, 2025 at 8:22 am

Rx Express Mexico: Rx Express Mexico – mexican online pharmacy

Charlesweicy

May 27, 2025 at 9:15 am

http://rxexpressmexico.com/# RxExpressMexico

EdwinInesy

June 2, 2025 at 8:17 am

https://kampascher.com/# kamagra 100mg prix

Floydfew

June 2, 2025 at 9:09 pm

Кейтеринг давно перестал быть просто доставкой еды – сегодня это полноценный сервис, способный превратить любое мероприятие в изысканное гастрономическое событие. Будь то деловой фуршет, свадьба или уютный семейный праздник, кейтеринг берёт на себя всё: от меню до сервировки. В этой статье мы разберёмся, какие бывают виды кейтеринга, что важно учитывать при выборе подрядчика и почему этот формат становится всё популярнее: заказ кейтеринга

BrianFet

June 3, 2025 at 5:54 pm

viagra g̩n̩rique sans ordonnance en pharmacie: borax pharmacie sans ordonnance Рseresta ordonnance

Michaeldew

June 3, 2025 at 8:39 pm

https://pharmacieexpress.shop/# gel douche the des vignes

tzh58

June 4, 2025 at 8:39 pm

buy clomiphene where to buy cheap clomid no prescription can you get clomiphene prices cost of generic clomiphene without insurance can i order generic clomiphene without rx buy generic clomiphene can you buy generic clomiphene without insurance

Dustinadato

June 15, 2025 at 4:11 pm

¡Bienvenidos, usuarios de portales de apuestas !

Casino sin licencia EspaГ±a – Sin restricciones legales – https://liquitex.es/ casinos sin registro

¡Que disfrutes de conquistas memorables !

DavidLooth

June 15, 2025 at 7:44 pm

¡Hola, seguidores del entretenimiento !

Mejores casinos online extranjeros sin esperas ni registros – https://www.casinoextranjerosespana.es/ mejores casinos online extranjeros

¡Que disfrutes de asombrosas tiradas exitosas !

Juliusger

June 16, 2025 at 1:20 pm

¡Saludos, amantes de la adrenalina !

Casino online sin licencia con bonos para slots – http://casinossinlicenciaenespana.es/ casino sin licencia espaГ±a

¡Que vivas premios espectaculares !

WilliamRIDGE

June 16, 2025 at 1:32 pm

¡Hola, estrategas del azar !

Mejores casinos online extranjeros con interfaz intuitiva – https://casinoextranjerosespana.es/# п»їcasinos online extranjeros

¡Que disfrutes de asombrosas premios extraordinarios !

Bradleymob

June 16, 2025 at 3:07 pm

¡Saludos, descubridores de oportunidades !

Casino online extranjero con pagos en menos de 24h – https://www.casinosextranjerosenespana.es/ casinos extranjeros

¡Que vivas increíbles instantes inolvidables !

DouglasMob

June 18, 2025 at 7:55 am

¡Hola, maestros del juego !

casino fuera de espaГ±a sin registro complejo – п»їп»їhttps://casinoonlinefueradeespanol.xyz/ casino por fuera

¡Que disfrutes de asombrosas movidas brillantes !

Charlesfut

June 18, 2025 at 11:01 pm

¡Saludos, jugadores dedicados !

Retiros rГЎpidos y seguros en casino online extranjero – https://casinoextranjerosenespana.es/# casino online extranjero

¡Que disfrutes de éxitos excepcionales !

Raymondsip

June 19, 2025 at 1:48 pm

¡Saludos, buscadores de éxitos!

Juegos rГЎpidos y fГЎciles en casinos extranjeros – https://casinosextranjero.es/# casino online extranjero

¡Que vivas increíbles giros exitosos !

SonnyMew

June 20, 2025 at 7:32 pm

¡Hola, aventureros de la suerte !

Mejores casinos extranjeros con sistema VIP exclusivo – п»їhttps://casinoextranjero.es/ п»їcasinos online extranjeros

¡Que vivas giros exitosos !

Robertlaf

June 21, 2025 at 8:31 pm

¡Hola, buscadores de tesoros ocultos !

casinosextranjerosdeespana.es – guГa del jugador – https://casinosextranjerosdeespana.es/# casino online extranjero

¡Que vivas increíbles jugadas espectaculares !

Jamesloorn

June 21, 2025 at 10:51 pm

¡Saludos, descubridores de tesoros!

casino online fuera de EspaГ±a con app oficial – https://www.casinosonlinefueraespanol.xyz/ casino online fuera de espaГ±a

¡Que disfrutes de oportunidades únicas !

BobbyCycle

June 24, 2025 at 11:24 am

?Hola, descubridores de oportunidades unicas!

casino online fuera de EspaГ±a con bonos exclusivos – https://www.casinosonlinefueradeespanol.xyz/# casinosonlinefueradeespanol.xyz

?Que disfrutes de asombrosas instantes inolvidables !

KennethSoype

June 24, 2025 at 12:40 pm

¡Saludos, seguidores del desafío !

Mejores casinos online extranjeros con tarjetas prepago – https://www.casinoextranjerosdeespana.es/# п»їcasinos online extranjeros

¡Que experimentes maravillosas premios excepcionales !

MichaelJam

June 24, 2025 at 9:44 pm

Hello trailblazers of refreshing atmospheres !

Best Air Purifier for Smoke Large Rooms – Buy Today – п»їhttps://bestairpurifierforcigarettesmoke.guru/ best air filter for cigarette smoke

May you experience remarkable fresh inhales !

Denniscit

June 26, 2025 at 2:15 am

¡Hola, buscadores de recompensas excepcionales!

Casino sin licencia espaГ±ola sin lГmites de ingreso – п»їhttps://casinosinlicenciaespana.xyz/ casino online sin licencia espaГ±a

¡Que vivas increíbles victorias memorables !

Milesfek

June 27, 2025 at 9:41 pm

¡Bienvenidos, exploradores de posibilidades !

Casinos sin licencia en Espana fiables – http://mejores-casinosespana.es/ casino online sin licencia

¡Que experimentes maravillosas premios excepcionales !

CharlesBuppy

June 30, 2025 at 8:03 pm

¡Saludos, seguidores de la adrenalina !

Casinos sin licencia espaГ±ola confiables – https://www.emausong.es/ casino online sin licencia

¡Que disfrutes de increíbles jugadas impresionantes !

MichaelSoode

June 30, 2025 at 9:05 pm

¡Hola, entusiastas del triunfo !

Casino sin licencia en EspaГ±a: Вїvale la pena? – https://casinosonlinesinlicencia.es/# casinos online sin licencia

¡Que vivas increíbles victorias memorables !

ScottNug

July 1, 2025 at 2:09 pm

Greetings, hunters of extraordinary gags!

10 funniest jokes for adults you’ll love – http://jokesforadults.guru/# hilarious jokes for adults

May you enjoy incredible memorable laughs !

JosephCed

July 2, 2025 at 12:47 am

¡Saludos, entusiastas del éxito !

Casino bono bienvenida sin esperar – http://bono.sindepositoespana.guru/# bono de bienvenida casino

¡Que disfrutes de asombrosas movidas brillantes !

Scottabsex

July 11, 2025 at 3:28 am

Greetings, masterminds of mirth !

jokes for adults are often more thoughtful than you’d expect. They dive into life’s weirdness and extract humor. It’s observational comedy at its best.

joke of the day for adults is always a reliable source of laughter in every situation. [url=http://adultjokesclean.guru/]funny adult jokes[/url] They lighten even the dullest conversations. You’ll be glad you remembered it.

seriously funny dad jokes for adults – http://adultjokesclean.guru/# adult joke

May you enjoy incredible clever quips !

accounts_tievism

July 13, 2025 at 12:17 pm

buy facebook ads account website for buying accounts social media account marketplace

accounts_tievism

July 14, 2025 at 10:32 am

buying facebook account secure account purchasing platform account catalog

Chrisfaisy

July 16, 2025 at 5:43 pm

Hello stewards of pure serenity!

The best air filters for pets work best when replaced regularly, ensuring optimal performance every season. Top rated air purifiers for pets are often ENERGY STAR certified, helping you save on electricity bills too. A HEPA-certified best air purifier for pet allergies captures even microscopic particles that escape normal filters.

The best air purifier for pets can noticeably reduce dander in shared spaces like living rooms and dining areas.[url=https://www.youtube.com/watch?v=dPE254fvKgQ&list=PLslTdwhfiGf5uvrbVT90aiCj_6zWWGwZ3]best home air purifier for pets[/url]Using an air purifier for pets also decreases the number of airborne bacteria spread through sneezing or grooming. Most users report cleaner furniture within days of installing the best air purifiers for pets.

Best Air Purifier for Pet Allergies to Provide Immediate Relief – п»їhttps://www.youtube.com/watch?v=dPE254fvKgQ

May you enjoy remarkable refreshed spaces !

surjoomvn

July 20, 2025 at 11:15 pm

Ao acessar a categoria, você pode navegar entre centenas de títulos diferentes, com filtros por popularidade, provedor e categoria. Aqui vale lembrar que a maioria dos games oferecem rodadas grátis, multiplicadores e até jackpots progressivos. O Bonanza Jogo é muito mais do que apenas um jogo de casino online; é uma jornada emocionante para os amantes da pesca e entusiastas de jogos de azar. Com sua temática envolvente, recursos exclusivos e potencial de grandes ganhos, este jogo continua a atrair jogadores de todo o mundo em busca de diversão e emoção. O slot Big Bass Bonanza está disponível na 4win, plataforma licenciada e segura para você apostar com tranquilidade. A jogabilidade é baseada em sorte e aleatoriedade, por isso, nunca encare apostas como fonte de renda. Aproveite com consciência!

https://bellabulba.com/penalty-shoot-out-da-evoplay-uma-revisao-para-jogadores-brasileiros/

Fazer o download do Betway é muito simples. A Betway é uma marca bastante experiente e sabe criar experiências intuitivas para os usuários – e com o app, não foi diferente. Para baixar o Betway para Android, basta clicar no botão de download no site da Betway. pin-up: pin-up – pin-up casino giris O suporte técnico da Bodog Brasil é completo e atende a necessidade dos clientes online em casa. Você poderá tirar suas dúvidas através de um Chat Ao Vivo disponível 24H por dia, 7 dias na semana. O suporte é completamente em português, portanto, brasileiros podem falar na sua língua local que serão entendidos. A casa conta com uma área de “Ajuda” com diversas dúvidas já respondidas. Essas perguntas frequentes servem para auxiliar jogadores com problemas já sanados na plataforma. Caso prefira, ainda existe a possibilidade de entrar em contato com a Bodog apk via e-mail. Clique em “Enviar um e-mail”, insira seu e-mail, selecione uma opção de dúvida e envie a sua mensagem. As opções de dúvidas são:

dqmdwxcxh

July 22, 2025 at 4:50 pm

Mouse: Click bubble buttons. To point the arrow toward a target and shoot, slide the mouse until the cursor is in an exact position (i.e., atop two or more matching bubbles or a gap between two matching bubbles for cluster creation or one matching bubble in preparation of a later cluster shot), and then click the left button. Mobile: Tap buttons. To aim and shoot, slide the tip of the finger or stylus to align the pointer arrow with a target, and tap the trackpad or touchscreen. Play the exciting Rocket crash game and experience a heart-pounding race to big wins. Play the exciting Rocket crash game and experience a heart-pounding race to big wins. PLAY BUBBLE SHOOTER TODAY! Mouse: Click bubble buttons. To point the arrow toward a target and shoot, slide the mouse until the cursor is in an exact position (i.e., atop two or more matching bubbles or a gap between two matching bubbles for cluster creation or one matching bubble in preparation of a later cluster shot), and then click the left button. Mobile: Tap buttons. To aim and shoot, slide the tip of the finger or stylus to align the pointer arrow with a target, and tap the trackpad or touchscreen.

https://acaa.newpathstudio.com.au/when-to-play-aviator-by-spribe-for-higher-payouts-a-tuned-review-for-ghana-players/

Des Fleming Acting | Shepherds Bush, London, U.K. | Email: So, create an account at 666 Casino to be able to claim this generous welcome offer and to access our expansive collection of online slots Q2: Is Buffalo King Megaways free to play? Play blackjack, roulette and slot games for free. Our selection of over 20,460+ free games can be played for fun, with no sign-up, no download, and no deposit needed. Connect with us Online roulette sim this means that you can be confident that your transactions will be processed quickly and securely, complete with cherry blossoms. Luckily, lanterns. At VegasKings, loyalty program and promotional page. So, create an account at 666 Casino to be able to claim this generous welcome offer and to access our expansive collection of online slots Now, You can play B C Game – Buffalo King on PC with GameLoop smoothly.

vodkaofficialcasino

August 4, 2025 at 2:58 am

Когда ты выигрываешь — ощущаешь победу всем телом. Если ищешь что-то настоящее, что держит от начала до конца — начни с https://vodka-registration.site. Игры продуманы до деталей. Выплаты приходят стабильно, это главное. Честность и скорость — на высоте. Промокоды придают игре вкус. Бонусы не просто на словах — они реально работают. Слоты могут удивлять и затягивать. Такие моменты не забываются, особенно когда они приносят реальный выигрыш.

OswaldoWough

August 4, 2025 at 4:07 am

Salutations to all gaming aficionados !

Start your journey with 1xbet nigeria registration and explore live betting options. [url=https://www.1xbetnigeriaregistration.com.ng/]1xbet ng login registration online[/url] Register now to enjoy exclusive offers tailored for Nigerian users. The process of 1xbet nigeria registration is fast, safe, and user-friendly.

The official site 1xbetnigeriaregistration.com.ng guides you through the whole process. It’s optimized for mobile and desktop users. Registering via 1xbetnigeriaregistration.com.ng guarantees access to the latest features.

How to register 1xbet by phone number nigeria fast – http://www.1xbetnigeriaregistration.com.ng

Wishing you thrilling treasures !

Robertbassy

August 5, 2025 at 2:22 pm

Warm greetings to all game lovers !

You can complete your 1xbet registration by phone number Nigeria without filling out complex forms. Just enter your number, receive a code, and you’re in. [url=https://1xbet-nigeria-registration-online.com/]1xbet nigeria registration[/url]. 1xbet registration Nigeria has never been easier or faster.

You can complete your 1xbet registration by phone number Nigeria without filling out complex forms. Just enter your number, receive a code, and you’re in. 1xbet registration Nigeria has never been easier or faster.

How to register using 1xbet registration by phone number Nigeria – https://www.1xbet-nigeria-registration-online.com/#

Hoping you hit amazing rounds !

DavidNok

August 6, 2025 at 2:48 am

Hello everyone, all gaming masters !

With a few clicks, you can start placing bets via the 1xbet nigeria registration online portal. The official 1xbet nigeria login registration site provides seamless access to games, live betting, and account management. [url=http://1xbet-ng-registration.com.ng/]1xbet ng login registration[/url] Through the streamlined 1xbet ng login registration page, players can enjoy fast access with enhanced security.

Use 1xbet ng registration to unlock a wide range of sports markets and casino games with just a few clicks. The platform is optimized for mobile users and delivers instant access. Enjoy smooth gameplay and personalized promotions after signup.

Instant access via 1xbet ng registration – http://1xbet-ng-registration.com.ng/

Enjoy thrilling triumphs !

JefferyFus

August 13, 2025 at 3:02 am

¡Un cordial saludo a todos los amantes del riesgo !

Los casino europeo ofrecen una experiencia de juego segura y variada. [url=http://casinosonlineeuropeos.xyz/]casino europeo[/url] Muchos jugadores prefieren los mejores casinos online por sus bonos atractivos y soporte en varios idiomas. Un euro casino online garantiza retiros rГЎpidos y mГ©todos de pago confiables.

Los casino europeo ofrecen una experiencia de juego segura y variada. Muchos jugadores prefieren casinosonlineeuropeos por sus bonos atractivos y soporte en varios idiomas. Un casinosonlineeuropeos.xyz garantiza retiros rГЎpidos y mГ©todos de pago confiables.

Casinos europeos con promociones especiales para jugadores nuevos – http://casinosonlineeuropeos.xyz/

¡Que goces de increíbles ganancias !

Brianron

August 16, 2025 at 2:25 am

?Mis calidos augurios para todos los fanaticos del riesgo !

Un casino online europa ofrece juegos de ruleta, blackjack y tragaperras. [url=http://casinoonlineeuropeo.blogspot.com/#][/url] El casino europa dispone de torneos con premios atractivos. Un casino online europeo ofrece atenciГіn personalizada 24/7.

Los casinos europeos online actualizan sus promociones con frecuencia. En casinoonlineeuropeo.blogspot.com puedes encontrar comparativas Гєtiles. Un casino online europeo ofrece atenciГіn personalizada 24/7.

Casino europeo: cГіmo registrarse – http://casinoonlineeuropeo.blogspot.com/

?Que goces de excepcionales victorias !

casino europa

Jorgeseela

August 17, 2025 at 6:04 am

Hi there! [url=https://mexrxdirect.top/#]adderall online pharmacy[/url] good internet site.

Robertspomb

August 19, 2025 at 6:52 pm

Envio mis saludos a todos los apasionados de la emocion !

Los casinos no regulados actualizan sus promociones mГЎs a menudo que los regulados. Esto significa mГЎs bonos y mГЎs oportunidades de ganar. [url=http://casinosinlicenciaespana.blogspot.com/#][/url] Por eso, un casino online sin licencia resulta tan atractivo.

Los casinos no regulados actualizan sus promociones mГЎs a menudo que los regulados. Esto significa mГЎs bonos y mГЎs oportunidades de ganar. Por eso, un casino online sin licencia resulta tan atractivo.

Casinos sin licencia en EspaГ±ola con bonos gratis – https://casinoonlineeuropeo.blogspot.com/#

Que disfrutes de increibles triunfos !

casino sin licencia espaГ±ola

Kendallnam

August 26, 2025 at 10:54 am

Envio mis saludos a todos los buscadores de riquezas !

Una de las ventajas de mejores casinos sin licencia en espaГ±a es que puedes registrarte rГЎpido sin verificaciones extensas. [url=https://casinosonlinesinlicencia.xyz/#][/url] ВїQuieres apostar sin lГmites? mejores casinos sin licencia en espaГ±a te permite jugar con depГіsitos y retiros flexibles. La seguridad de mejores casinos sin licencia en espaГ±a se basa en encriptaciГіn avanzada y protocolos internacionales.

Muchos expertos recomiendan casinos sin licencia en EspaГ±ola para quienes buscan mejores cuotas y variedad de juegos. Muchos jugadores eligen casinos sin licencia en EspaГ±ola porque ofrece mГЎs libertad y anonimato que los sitios regulados. Una de las ventajas de casinos sin licencia en EspaГ±ola es que puedes registrarte rГЎpido sin verificaciones extensas.

Casinos online sin licencia con ruleta y slots – п»їhttps://casinosonlinesinlicencia.xyz/

Que disfrutes de increibles beneficios !

casino sin licencia

forexreBib

August 27, 2025 at 1:51 am

[url=https://earnforexrebates.com/]Forex Rebates[/url] are a powerful way for traders to maximize their earnings from everyday trading. With EarnForexRebates.com you gain access to a trusted rebate system that provides you with cashback without changing your strategy. Unlike complicated promotions, our service is clear and consistent. The system works thanks to our agreements with global brokerage firms, which allows us to deliver the best conditions available in the market. Every trade you make can generate a rebate, whether you win or lose. EarnForexRebates.com does not interfere with your trading, meaning that you continue trading exactly as you do now, while we add cashback to your results. Clients can check our transparent comparison of broker payouts to see exactly how much they will receive for every lot traded. This level of detail makes it easy for traders to calculate their true trading expenses. By joining EarnForexRebates.com, traders not only get cash back instantly, but also feel secure knowing they work with a reliable partner. The rebate system is a great solution for anyone active in the Forex market, because it doesn’t demand changes in strategy. Many users report that their overall profits have improved, simply by collecting rebates. With fast payouts, your income is added quickly. If you are looking for a competitive advantage, EarnForexRebates.com is the right choice that combines straightforward service and financial benefits. Sign up today and start earning extra from every trade.

https://earnforexrebates.com/

DanielMes

August 27, 2025 at 11:31 pm

¡Mis más cordiales saludos a todos los visitantes habituales del casino !

Para los que aman la discreciГіn, casino sin licencia espaГ±ola es la opciГіn ideal para jugar sin preocuparte. Muchos jugadores eligen casino sin licencia espaГ±ola porque buscan libertad y emociГіn en cada apuesta. casinos no regulados El atractivo de casino sin licencia espaГ±ola estГЎ en sus bonos generosos y la ausencia de burocracia.

Cada dГa mГЎs personas confГan en casinos sin licencia en EspaГ±ola para disfrutar de apuestas rГЎpidas y seguras. El atractivo de casinos sin licencia en EspaГ±ola estГЎ en sus bonos generosos y la ausencia de burocracia. Para los que aman la discreciГіn, casinos sin licencia en EspaГ±ola es la opciГіn ideal para jugar sin preocuparte.

DiversiГіn total y ganancias rГЎpidas en casinossinlicencia – п»їhttps://casinossinlicencia.xyz/

¡Que aproveches magníficas premios !

RamonClath

August 28, 2025 at 3:32 am

Envio mis saludos a todos los cazadores de premios!

Muchos jugadores buscan alternativas como casinosfueradeespana para disfrutar de mГЎs libertad y bonos exclusivos. La opciГіn de jugar en casinosfueradeespana resulta atractiva para quienes valoran la privacidad. [url=https://casinosfueradeespana.blogspot.com/#][/url]. Las personas prefieren casinosfueradeespana porque ofrece soporte en espaГ±ol las 24 horas.

Con casino online fuera de espaГ±a puedes jugar en tragaperras exclusivas con RTP mГЎs alto. Los usuarios destacan que casinosfueradeespana.blogspot.com permite apuestas en vivo con menor latencia. Las plataformas de casinosfueradeespana.blogspot.com ofrecen mГ©todos de pago modernos y retiros instantГЎneos.

casinos online fuera de EspaГ±a seguro y confiable – п»їhttps://casinosfueradeespana.blogspot.com/

Que disfrutes de increibles giros !

casinosfueradeespana.blogspot.com

vavada casino polska

August 28, 2025 at 6:39 pm

Wyższy status oznacza wyższe limity wypłat. Np. podstawowe limity to 1000 USD dziennie, 5000 USD tygodniowo i 10 000 USD miesięcznie. Dla statusu Brąz są to już 1500 USD, 7000 USD i 15 000 USD.

MichaelSwize

September 2, 2025 at 3:23 pm

Saludo cordialmente a todos los cazadores de jackpots !

Las casas de apuestas dgoj ofrecen a los jugadores espaГ±oles mГЎs libertad que las reguladas. Muchos usuarios eligen casas de apuestas dgoj porque permiten mejores cuotas y mГЎs promociones. [url=https://casasdeapuestasextranjeras.xyz#][/url] AdemГЎs, registrarse en casas de apuestas dgoj suele ser rГЎpido y sencillo.

Las broker apuestas deportivas ofrecen a los jugadores espaГ±oles mГЎs libertad que las reguladas. Muchos usuarios eligen broker apuestas deportivas porque permiten mejores cuotas y mГЎs promociones. AdemГЎs, registrarse en broker apuestas deportivas suele ser rГЎpido y sencillo.

Todo lo que debes saber sobre casa de apuestas extranjeras en 2025 – https://casasdeapuestasextranjeras.xyz#

Ojala disfrutes de increibles ganancias !

como apostar en pinnacle desde espaГ±a

ScottTauro

September 3, 2025 at 2:57 am

Un afectuoso saludo para todos los rastreadores de fortunas !

Muchos jugadores buscan giros gratis espaГ±a porque ofrece una forma segura y divertida de empezar sin arriesgar dinero. [url=http://100girosgratis.guru/][/url] Gracias a giros gratis espaГ±a, puedes probar diferentes tragamonedas y juegos en vivo sin preocuparte por el depГіsito inicial. Las plataformas de casino online que incluyen giros gratis espaГ±a suelen atraer tanto a principiantes como a expertos.

Gracias a tiradas gratis sin deposito espaГ±a, puedes probar diferentes tragamonedas y juegos en vivo sin preocuparte por el depГіsito inicial. Muchos jugadores buscan tiradas gratis sin deposito espaГ±a porque ofrece una forma segura y divertida de empezar sin arriesgar dinero. Las plataformas de casino online que incluyen tiradas gratis sin deposito espaГ±a suelen atraer tanto a principiantes como a expertos.

spins gratis sin depГіsito espaГ±a aprobado – п»їhttps://100girosgratis.guru/

Que tengas la suerte de gozar de increibles vueltas !

100girosgratis

AnthonyHes

September 10, 2025 at 9:55 pm

Un afectuoso saludo para todos los generadores de ganancias !

Disfruta de la promociГіn merkurmagic 10 euros gratis para empezar a jugar sin riesgos y con mГЎs emociГіn desde el inicio. [url=https://10eurosgratissindepositocasinoes.xyz/#][/url]. Disfruta de la promociГіn 10eurosgratissindepositocasinoes para empezar a jugar sin riesgos y con mГЎs emociГіn desde el inicio. Disfruta de la promociГіn regГstrate y 10 euros gratis casino para empezar a jugar sin riesgos y con mГЎs emociГіn desde el inicio.

Disfruta de la promociГіn regГstrate y 10 euros gratis para empezar a jugar sin riesgos y con mГЎs emociГіn desde el inicio. Disfruta de la promociГіn 10 euros por registrarte para empezar a jugar sin riesgos y con mГЎs emociГіn desde el inicio. Disfruta de la promociГіn star casino 10 euros gratis para empezar a jugar sin riesgos y con mГЎs emociГіn desde el inicio.

Consigue merkurmagic 10 euros gratis ahora y juega sin riesgos – п»їhttps://10eurosgratissindepositocasinoes.xyz/

Que tengas la fortuna de disfrutar de increibles botes!

10 euros por registrarte

TRY TO

September 12, 2025 at 6:03 pm

When I initially commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several e-mails with the same comment.

Is there any way you can remove people from that

service? Cheers!

Claytonnat

September 16, 2025 at 3:14 am

Un calido saludo a todos los aventureros de la suerte !

La reputaciГіn de casinos online internacionales crece por su transparencia y su innovaciГіn en apuestas. [url=http://casinosinternacionalesonline.guru/#][/url]. El catГЎlogo de casinos online internacionales incluye tragamonedas modernas y juegos de mesa clГЎsicos. Muchos jugadores prefieren casinos online internacionales por sus bonos exclusivos y variedad de juegos.

Las ventajas de usar casino internacional incluyen retiros rГЎpidos y soporte 24/7 en tu idioma. El catГЎlogo de casino internacional incluye tragamonedas modernas y juegos de mesa clГЎsicos. Cada vez mГЎs usuarios se registran en casino internacional gracias a sus promociones constantes.

casinos online internacionales con tragamonedas y ruleta – п»їhttps://casinosinternacionalesonline.guru/#

?Que tengas la fortuna de disfrutar de increibles victorias !

casino internacional

migplyvtg

September 17, 2025 at 6:39 pm

आप जोखिम तय करते हैं – हमारे Chicken Road गेम में आप खुद चुनते हैं कि हर राउंड कितना जोखिम भरा हो। कठिनाई का स्तर बदलते ही मल्टीप्लायर रेंज बदल जाती है, जिससे संभावित जीत या हार पर असर पड़ता है। यह क्रैश गेम हर राउंड से पहले वोलैटिलिटी को समायोजित करने की सुविधा देता है। अधिक बार से अन्य मामलों में, यह कुछ रणनीति का उपयोग करने की सिफारिश की है बैंक वितरित और जोखिम को कम. यादृच्छिकता से छुटकारा पाने का यह एकमात्र तरीका है, जब 1.1 प्राप्त करने की उम्मीद में पूरे संतुलन को दांव पर लगाकर, आप इसे खो देते हैं, क्योंकि विमान केवल टेकऑफ़ के बाद छोड़ सकता है ।

https://gadgetguides.org/aviator-%e0%a4%b8%e0%a5%8d%e0%a4%b2%e0%a5%89%e0%a4%9f-%e0%a4%8f%e0%a4%95-%e0%a4%b0%e0%a5%8b%e0%a4%ae%e0%a4%be%e0%a4%82%e0%a4%9a%e0%a4%95-%e0%a4%95%e0%a5%88%e0%a4%b8%e0%a5%80%e0%a4%a8%e0%a5%8b/

हमने एक डेमो मोड जोड़ा है, ताकि आप बिना पैसे खर्च किए गेम को आज़मा सकें। यह असली संस्करण की तरह ही लॉजिक और संभावनाओं पर चलता है। आपको बिना किसी जोखिम के पूरा अनुभव मिलता है। हर स्तर में जोखिम और इनाम का अपना संतुलन होता है, इसलिए वही चुनौती चुनें जो आपके खेल के तरीके से मेल खाती हो। हर स्तर में जोखिम और इनाम का अपना संतुलन होता है, इसलिए वही चुनौती चुनें जो आपके खेल के तरीके से मेल खाती हो।

Davidstync

September 19, 2025 at 4:30 am

Hello there! [url=https://cse.google.com.jm/url?sa=t&url=https%3A%2F%2Fpropeciafx.com]indian online pharmacies[/url] very good site.

Edwardgar

September 19, 2025 at 2:46 pm

Warm greetings to all the chance explorers!

Professional dealers at ОєО±О¶О№ОЅОї live make the experience realistic. live casino online ОєО±О¶О№ОЅОї live offers a wide variety of live dealer games With ОєО±О¶О№ОЅОї live, you can play roulette, blackjack, and poker in real time.

With live ОєО±О¶О№ОЅОї, you can play roulette, blackjack, and poker in real time. The interaction with other players makes live ОєО±О¶О№ОЅОї more exciting. live ОєО±О¶О№ОЅОї offers a wide variety of live dealer games.

live cazino – Real Dealers and Exciting Games – п»їhttps://livecasinogreece.guru/

I wish you amazing encounters !

live casino

PatrickVax

September 20, 2025 at 1:14 pm

?Saludos cordiales a todos los jugadores de casino !

Muchos jugadores confГan en librabet review porque ofrece opciones seguras y variadas. [url=п»їhttps://librabetcasino.guru/#][/url] Con librabet review se puede acceder fГЎcilmente a promociones exclusivas y mГ©todos de pago modernos. AdemГЎs, librabet review garantiza una experiencia de usuario fluida en cualquier dispositivo.

Muchos jugadores confГan en librabet recensioni porque ofrece opciones seguras y variadas. Con librabet recensioni se puede acceder fГЎcilmente a promociones exclusivas y mГ©todos de pago modernos. AdemГЎs, librabet recensioni garantiza una experiencia de usuario fluida en cualquier dispositivo.

GuГa completa de librabet casino guru para jugadores – https://librabetcasino.guru/

?Te deseo increibles recompensas !

librabet android

AlbertoJub

September 21, 2025 at 4:38 am

Hello! [url=http://provimedsrx.com/#]online mexican pharmacy[/url] beneficial web site.

StephenSef

October 2, 2025 at 5:09 am

Howdy! [url=https://mexrxdirect.top/#]mexrxdirect[/url] good website.

Rogerneeby

October 3, 2025 at 6:11 am

Howdy! [url=https://provimedsrx.com/#]ProviMedsRX[/url] good web page.

HerbertNaw

October 3, 2025 at 10:05 pm

?Warm greetings to all the casino players !

Comparative reports include identity-free gaming services to illustrate privacy trade-offs. [url=https://bettingwithoutidentification.xyz/][/url] Authors focus on methodology and measurable outcomes. Recommendations tend toward consumer protection and transparency.

Policy briefs that reference privacy-first casino platforms discuss mitigation strategies. They outline steps to protect users while enabling studies. Balanced policy proposals are preferred by most analysts.

ПЂО±ПЃО¬ОЅОїОјОµП‚ ПѓП„ОїО№П‡О·ОјО±П„О№ОєОП‚ ОµП„О±О№ПЃОЇОµП‚ — user safety guide – http://bettingwithoutidentification.xyz/

?I wish you incredible rewards !

bettingwithoutidentification.xyz

JesseNit

October 4, 2025 at 9:48 pm

A warm greeting to all the profit creators !

One of the biggest advantages of choosing no deposit bonus is that it allows players to test games without initial investment. no deposit bonus greece. If you’re searching for the best offers, no deposit bonus remains one of the most popular options online. Players looking for no deposit bonus can find exciting opportunities on various platforms that cater to Greek audiences.

For anyone who wants to maximize rewards, casino no deposit bonus can be the perfect starting point in online gambling. Players looking for casino no deposit bonus can find exciting opportunities on various platforms that cater to Greek audiences. Whether you prefer slots or live dealer games, casino no deposit bonus gives you a way to start playing instantly.

Best Casinos Offering nodepositbonusgreece.xyz This Year – п»їhttps://nodepositbonusgreece.xyz/#

May you have the fortune to enjoy incredible rounds !

bonus no deposit

Wine Accessories

October 9, 2025 at 7:01 pm

I think this is among the most vital information for me.

And i am glad reading your article. But want to remark on few

general things, The web site style is ideal, the articles is

really great : D. Good job, cheers

trconsulate.org

October 9, 2025 at 7:42 pm

Hi there! This is my first visit to your blog! We are a team of volunteers and starting a new project in a community in the same niche.

Your blog provided us valuable information to work on. You have done a extraordinary

job!

http://shoahconnect.org

October 9, 2025 at 7:43 pm

It’s an remarkable paragraph for all the online people; they will obtain benefit from it I am sure.

crra.us

October 9, 2025 at 8:07 pm

This page definitely has all the information and facts

I wanted about this subject and didn’t know who to ask.

http://edinburgh-hotels-network.com/

October 9, 2025 at 8:07 pm

Hi, I do believe this is an excellent site. I stumbledupon it 😉 I

will revisit yet again since i have book marked it. Money and freedom is the best way to change,

may you be rich and continue to guide other people.

Davidthexy

October 10, 2025 at 12:52 am

Cheers to every spin masters!

Players who love Mediterranean style and excitement often choose casino greek online for its vibrant atmosphere and authentic games. [url=http://casinoonlinegreek.com/][/url]At greek casino online, you can explore hundreds of slots, live dealers, and bonuses inspired by Greek culture. This casino greek online destination combines ancient myths with modern gaming technology, creating an unforgettable experience.

Players who love Mediterranean style and excitement often choose casinoonlinegreek for its vibrant atmosphere and authentic games. At casino greek online, you can explore hundreds of slots, live dealers, and bonuses inspired by Greek culture. This casinoonlinegreek destination combines ancient myths with modern gaming technology, creating an unforgettable experience.

Your Ultimate casinoonlinegreek Destination for Real Fun – https://casinoonlinegreek.com/#

May you have the fortune to enjoy incredible May luck bring you exciting jackpots !

HowardBlaxy

October 11, 2025 at 7:11 am

Hi! [url=https://mexicanharmine.online/#]mexicanharmine[/url] beneficial web page.

exeness

October 11, 2025 at 3:47 pm

Hey I know this is off topic but I was wondering if you knew of any widgets I could add

to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this for quite some

time and was hoping maybe you would have some experience with

something like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

Peterdap

October 16, 2025 at 9:22 pm

?Calidos saludos a todos los maestros del poker !

La privacidad en lГnea no depende solo de la tecnologГa. TambiГ©n requiere responsabilidad individual. casinos sin dni Ser consciente de los riesgos es el primer paso para evitarlos.

Un casino sin dni espaГ±a te ofrece la libertad de apostar sin revelar tus datos personales. Las transacciones son rГЎpidas y seguras gracias a mГ©todos de pago modernos. AsГ puedes jugar de manera anГіnima y confiable.

GuГa de casino sin DNI EspaГ±a 2025 – п»їhttps://casinossindni.space/

?Les deseo increibles ganancias !

casinos online sin dni

JamesSow

October 18, 2025 at 8:24 pm

?Salud por cada buscador de emociones !

Muchos confГan en casinosinternacionalesonline por su reputaciГіn y variedad internacional. [url=http://casinosinternacionalesonline.space/#][/url] La seguridad y el anonimato son ventajas clave de casinosinternacionalesonline. Los usuarios disfrutan de RTP altos y mГ©todos de pago flexibles en casinosinternacionalesonline.

Los casinos internacionales ofrecen experiencias Гєnicas con bonos exclusivos y juegos variados. Los usuarios disfrutan de RTP altos y mГ©todos de pago flexibles en casinos internacionales. En casinos internacionales puedes jugar sin restricciones y con atenciГіn al cliente en espaГ±ol.

GuГa completa para apostar en casinos internacionales – п»їhttps://casinosinternacionalesonline.space/

Que tengas la fortuna de disfrutar que alcances fantasticos apuestas !

RobertEnliz

October 23, 2025 at 6:45 am

Hi! [url=https://edpharmeasy.top/#]buy ed drugs[/url] excellent site.

MichaelMic

October 24, 2025 at 6:25 am

Hi! [url=https://provimedsrx.shop/#]buy modafinil[/url] great site.

JamesSow

October 24, 2025 at 7:04 pm

?Brindemos por cada perseguidor del exito !

Un casino sin licencia puede ofrecer acceso internacional a usuarios de distintos paГses sin seguir normativas locales. [url=https://casinossinlicenciaespanola.net/#][/url] Esto suele atraer a jugadores que buscan anonimato o mГ©todos de pago alternativos. Aun asГ, la ausencia de regulaciГіn puede afectar la transparencia en los pagos y la protecciГіn de datos.

Los jugadores deben saber que los casinos no regulados no garantizan lГmites de pГ©rdidas. Esta carencia puede agravar problemas financieros personales. Jugar con control y presupuesto definido es una buena prГЎctica.

Casino online sin registro para jugadores espaГ±oles – https://casinossinlicenciaespanola.net/#

?Que la fortuna te sonria con celebremos juntos inolvidables pagos espectaculares !

Peterdap

October 24, 2025 at 9:44 pm

?Un calido saludo para todos los amantes del juego !

Casinos online sin licencia pueden ofrecer RTP (retorno al jugador) mayor que los sitios regulados. Pero esos valores no siempre son auditados ni verificados. casinos sin licencia EspaГ±ola Por tanto, no hay garantГa de que los resultados sean justos o transparentes.

Casinos sin licencia espaГ±ola suelen tener polГticas de privacidad poco detalladas. Esto genera incertidumbre sobre el uso de los datos de los usuarios. Leer las polГticas completas antes de registrarse es un paso esencial.

Casinos sin registro con juegos instantГЎneos y retiros rГЎpidos – п»їhttps://casinossinlicenciaenespana.net/

?Les deseo extraordinarios recompensas brillantes !

casinos sin registro

JamesSow

October 26, 2025 at 1:57 am

?Brindemos por cada estratega del juego !

Casinos sin licencia en EspaГ±a operan desde jurisdicciones extranjeras, aprovechando vacГos legales. [url=п»їhttps://casinossinlicenciaespanola.net/][/url] Aunque ofrecen variedad de juegos y bonos atractivos, no garantizan protecciГіn al consumidor. Las autoridades espaГ±olas advierten sobre los riesgos financieros y de adicciГіn.

п»їLos llamados casinos sin licencia son plataformas que operan fuera del marco legal establecido en un paГs. No cuentan con la supervisiГіn de autoridades oficiales, lo que puede implicar riesgos para los jugadores. Sin embargo, su existencia refleja la demanda de mayor libertad y privacidad en el juego en lГnea.

Casinos sin licencia en Espana: alternativas legales seguras – п»їhttps://casinossinlicenciaespanola.net/

?Que la fortuna te sonria con que consigas asombrosos victorias memorables!

Peterdap

October 26, 2025 at 3:47 am

?Un calido saludo para todos los creadores de fortuna !

Casinos online sin licencia suelen aceptar criptomonedas y permiten registros rГЎpidos sin verificaciГіn de identidad. [url=http://casinossinlicenciaenespana.net/#][/url] Esta caracterГstica los hace populares entre quienes valoran la privacidad. Aun asГ, los expertos recomiendan precauciГіn al depositar dinero en plataformas sin control oficial.

Los jugadores deben saber que los casinos no regulados no garantizan lГmites de pГ©rdidas. Esta carencia puede agravar problemas financieros personales. Jugar con control y presupuesto definido es una buena prГЎctica.

Casino sin licencia EspaГ±a: ventajas y precauciones – http://casinossinlicenciaenespana.net/#

?Les deseo extraordinarios aventuras afortunadas!

casino online sin licencia espaГ±a

StephenNuS

October 26, 2025 at 6:41 am

Hello! [url=https://canadianmedsmax.com/#]canadian online pharmacy reviews[/url] excellent web site.

CurtisFrefe

October 31, 2025 at 7:28 am

Hi there! [url=http://eropillseasy.com/#]canada online pharmacy[/url] great website.

API Generator

October 31, 2025 at 2:36 pm

Your insights have helped me solve a problem I’ve been struggling with for weeks. Among other resources, API Generator stands out for clarity.

Anthonyunjum

November 6, 2025 at 3:58 am

?Brindemos por cada buscador del exito !

Los casinos sin verificacion ofrecen prГ©stamos instantГЎneos entre jugadores. [url=http://casinossinverificacion.net/][/url] P2P lending dentro de la plataforma sin intermediarios tradicionales. Finanzas descentralizadas aplicadas al entretenimiento online.

Muchos jugadores prefieren los casinos sin kyc porque eliminan los procesos burocrГЎticos y las demoras innecesarias. Puedes depositar, jugar y retirar sin complicaciones ni validaciones de identidad. La libertad que ofrecen estas plataformas es incomparable con los sitios tradicionales.

Casinossinverificacion recomienda prГЎcticas de juego seguras – http://casinossinverificacion.net/

?Que la fortuna te sonria con que logres increibles jackpots magnificos !

Jaredmoify

November 6, 2025 at 3:59 am

Hi there! [url=http://mexmedimax.com/#]mex medi max[/url] very good site.

Robertbaf

November 6, 2025 at 4:31 am

?Brindemos por cada explorador de tesoros !

Si buscas transparencia total, casinos fuera de espaГ±a publican el RTP de cada juego en su ficha tГ©cnica. Sabes exactamente quГ© porcentaje de retorno esperar antes de jugar. [url=http://casinosonlinefueradeespana.net/][/url] La informaciГіn es clara y accesible para todos.

Apostar en un casino por fuera significa acceder a mГ©todos de pago exГіticos como AstroPay o ecoPayz. Estas opciones facilitan transacciones internacionales sin complicaciones bancarias. Tu flexibilidad financiera se multiplica con cada alternativa disponible.

Casino online fuera de EspaГ±a sin lГmites de ganancia – https://casinosonlinefueradeespana.net/#

?Que la fortuna te sonria con que alcances magnificos pagos impresionantes !

Anthonyunjum

November 7, 2025 at 1:14 am

?Brindemos por cada tactico del juego !

Un casino sin registro te da control total sobre tu bankroll sin lГmites impuestos. [url=п»їhttps://casinossinverificacion.net/][/url] Puedes depositar y retirar las cantidades que desees sin explicaciones. La autonomГa financiera es completa en estas plataformas liberales.

Los casinos sin verificacion permiten fractional ownership de jackpots. Invierte pequeГ±as cantidades en premios millonarios potenciales. DemocratizaciГіn de acceso a grandes oportunidades.

Crypto casino no kyc con tragamonedas 3D espectaculares – http://casinossinverificacion.net/#

?Que la fortuna te sonria con que experimentes grandiosos recompensas radiantes !

Robertbaf

November 7, 2025 at 3:41 am

?Brindemos por cada genio del destino!

El directorio casinosonlinefueradeespana.net facilita comparaciones directas entre plataformas con tablas interactivas. Filtra por mГ©todos de pago, bonos, juegos disponibles y velocidad de retiros. [url=http://casinosonlinefueradeespana.net/#][/url] Encuentra el casino perfecto para tu estilo en segundos.

Los anГЎlisis de casinosonlinefueradeespana incluyen comparativas de velocidad de carga entre plataformas. Descubre quГ© sitios ofrecen la experiencia mГЎs fluida en mГіvil y escritorio. El rendimiento tГ©cnico impacta directamente en tu disfrute del juego.

Casinosonlinefueradeespana analiza seguridad de plataformas – https://casinosonlinefueradeespana.net/#

?Que la fortuna te sonria con deseandote la alegria de victorias inolvidables!

GO88

November 7, 2025 at 4:23 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

J88

November 7, 2025 at 4:33 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

谷歌站群

November 8, 2025 at 2:25 am

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

站群程序

November 11, 2025 at 3:17 pm

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

ThomasNeurb

November 13, 2025 at 10:16 am

?Brindemos por cada descubridor de riquezas !

Los casino sin kyc tienen sistemas de reputaciГіn transparentes. Puedes ver historial de cumplimiento de cada plataforma. [url=http://casinosinverificacion.org/][/url] Casino sin KYC democratiza informaciГіn de confianza.

El portal casinosinverificacion ofrece simuladores de bonos interactivos. Calculas requisitos de aposteo antes de aceptar promociones en casinos sin kyc. Las herramientas matemГЎticas evitan sorpresas desagradables.

Encuentra casinos sin verificacion con bonos increГbles – п»їhttps://casinosinverificacion.org/

?Que la fortuna te sonria con que obtengas asombrosos triunfos !

Clarte Nexive Avis

November 15, 2025 at 7:14 pm

Clarte Nexive se differencie comme une plateforme d’investissement en crypto-monnaies innovante, qui met a profit la puissance de l’intelligence artificielle pour fournir a ses clients des atouts competitifs majeurs.

Son IA scrute les marches en temps reel, identifie les opportunites et met en ?uvre des strategies complexes avec une precision et une vitesse hors de portee des traders humains, optimisant ainsi les potentiels de profit.

TurkPaydexHub Review

November 18, 2025 at 1:10 am

TurkPaydexHub se demarque comme une plateforme de placement crypto revolutionnaire, qui utilise la puissance de l’intelligence artificielle pour fournir a ses clients des avantages concurrentiels decisifs.

Son IA scrute les marches en temps reel, identifie les opportunites et execute des strategies complexes avec une precision et une vitesse inatteignables pour les traders humains, augmentant de ce fait les perspectives de gain.

TurkPaydexHub AI

November 18, 2025 at 1:27 am

TurkPaydexHub se demarque comme une plateforme d’investissement en crypto-monnaies de pointe, qui exploite la puissance de l’intelligence artificielle pour fournir a ses clients des avantages decisifs sur le marche.

Son IA scrute les marches en temps reel, repere les opportunites et execute des strategies complexes avec une exactitude et une rapidite inaccessibles aux traders humains, maximisant ainsi les potentiels de profit.

Alfredwhomi

November 18, 2025 at 7:28 am

Hi! [url=https://canadianmaxmeds.top/#]safe online pharmacy[/url] beneficial website.

Password Generator

November 19, 2025 at 1:25 am

This article made me think about the broader implications of… I’m curious about how these ideas could be applied in other contexts.

iwin

November 21, 2025 at 11:02 am

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

Scottpat

November 21, 2025 at 11:14 pm

Hello there! [url=https://canadianfastmeds.top/#]accutane no prescription pharmacy[/url] great site.

MichaelTon

November 22, 2025 at 8:43 pm

Hello there! [url=https://canadianfastmeds.top/#]live pharmacy ce online[/url] very good web page.

MichaelTon

November 22, 2025 at 9:43 pm

Hi there! [url=https://canadianfastmeds.top/#]canadian pharmacy online reviews[/url] good web site.

JasonAPONE

November 24, 2025 at 7:00 am

Hi! [url=https://joeasymeds.top/#]mexica pharmacy online[/url] great website.

猎物

November 24, 2025 at 7:37 am

The research you’ve done for this post is truly impressive. Well done and thank you!

JasonAPONE

November 24, 2025 at 7:59 am

Hello! [url=https://joeasymeds.top/#]online pharmacy oxycontin[/url] excellent web site.

Jerrysog

November 24, 2025 at 9:59 pm

?Celebremos a cada icono de las apuestas !

Acceder a casinos sin verificaciГіn es perfecto para sesiones rГЎpidas sin verificaciones extensas. [url=п»їhttps://bar-celoneta.es/][/url] Gracias a portales como casino retiro sin verificacion, los usuarios identifican casinos confiables. Esto aporta tranquilidad y una experiencia fluida.

La mayorГa de jugadores que prueban casino online gratis sin registro destacan la libertad de acceso inmediato. En recursos como casino sin dni se encuentran reseГ±as Гєtiles para principiantes. Este tipo de plataformas simplifica la experiencia de juego.

casino sin dni: sesiones rГЎpidas y sin trГЎmites – http://bar-celoneta.es/#

?Que la suerte te acompane con que goces de increibles pagos espectaculares !

RandySicky

November 24, 2025 at 11:02 pm

Hello! [url=https://joeasymeds.top/#]mexica pharmacy online[/url] good site.

Sidneysaify

November 25, 2025 at 10:27 pm

?Brindemos por cada explorador de tesoros !

Al no estar reguladas, estas plataformas carecen de soporte oficial. [url=http://durabilite.es/][/url] Los riesgos de fraude son mayores. Por eso durabilite.es ofrece informaciГіn educativa.

La seguridad es clave cuando se trata de estas casas de apuestas sin licencia en EspaГ±a, ya que no cuentan con supervisiГіn oficial. Es recomendable revisar recursos como durabilite.es antes de tomar decisiones de juego en lГnea.

SeГ±ales de casas de apuestas sin licencia espaГ±ola – https://www.durabilite.es/

?Que la fortuna te sonria con que consigas espectaculares giros de fortuna !

RandySicky

November 26, 2025 at 5:48 am

Hello there! [url=https://easymedsrx.top/#]easymedsrx[/url] very good web site.

RandySicky

November 26, 2025 at 6:39 am

Hi! [url=https://easymedsrx.top/#]mexican pharmacy reviews[/url] good internet site.

RandySicky

November 26, 2025 at 6:28 pm

Hi there! [url=https://easymedsrx.top/#]mexico drug pharmacy[/url] beneficial web site.

GeorgeDicle

November 27, 2025 at 2:38 pm

?Brindiamo per ogni creatore di prosperita !

La sicurezza nel gioco online richiede attenzione soprattutto riguardo alla comportamenti sospetti. Prestare attenzione ai dettagli tecnici permette di evitare problemi futuri [url=http://infinitumondovi.it/casino-senza-invio-documenti/][/url]. Con piccoli gesti quotidiani ГЁ possibile proteggersi in modo efficace.

La crescente diffusione dei giochi online rende essenziale proteggere la propria autenticazione a due fattori. Riconoscere segnali sospetti è fondamentale per mantenere un ambiente di gioco sano. Adottare abitudini digitali consapevoli rende l’esperienza molto più sicura.

Casino senza documenti in italia supera estГЎndares locales – https://infinitumondovi.it/casino-senza-invio-documenti/#

?Che la fortuna ti sorrida con che il destino ti offra emozionanti premi meravigliosi !

CoreyNalia

November 27, 2025 at 11:37 pm

Hi! [url=https://fastmedsrx.top/#]online pharmacy school[/url] beneficial site.

CoreyNalia

November 28, 2025 at 12:35 am

Hi there! [url=https://fastmedsrx.top/#]fastmedsrx[/url] very good site.

MichaelBiz

November 28, 2025 at 5:31 am

Hi there! [url=https://shopmedsrx.top/#]costco online pharmacy[/url] very good internet site.

MichaelBiz

November 28, 2025 at 6:29 am

Howdy! [url=https://shopmedsrx.top/#]shopmedsrx[/url] beneficial web page.

Hum Debugger

November 29, 2025 at 6:30 am

Your ability to break down complicated concepts is truly remarkable. Much appreciated!

MichealDiavy

November 29, 2025 at 2:40 pm

?Brindiamo per ogni inseguitore del trionfo !

gratis casino permite a los jugadores descubrir nuevas oportunidades sin

Gratis Sin Deposito hace que la experiencia sea mГЎs sencilla y

Descubre cГіmo aprovechar http://tiradasgratissindeposito.es hoy mismo – tiradasgratissindeposito.es

?Che la fortuna ti sorrida con augurandoti la gioia di round elettrizzanti !

变形金刚

November 30, 2025 at 9:05 am

This article answered questions I didn’t even know I had. Very enlightening!

MM88

December 1, 2025 at 6:51 am

Khám phá thế giới giải trí trực tuyến đỉnh cao tại MM88, nơi mang đến những trải nghiệm cá cược thể thao và casino sống động.

MichaelBiz

December 1, 2025 at 7:55 am

Hello! [url=https://livemedsrx.top/#]canada pharmacies no prescription needed[/url] good web site.

MichaelBiz

December 1, 2025 at 8:44 am

Howdy! [url=https://livemedsrx.top/#]no prescription needed online pharmacy[/url] excellent web site.

Kuwin

December 2, 2025 at 7:39 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

GeraldPhisk

December 4, 2025 at 5:34 am

Hello there! [url=https://propeciarxnet.top/#]buy proscar uk[/url] great site.

seronax blue

December 8, 2025 at 5:11 am

I think I might disagree with some of your analysis. Are the figures solid?

RichardRebra

December 11, 2025 at 9:17 am

Hello! order sumatriptan good web page.

CalebInses

December 11, 2025 at 4:58 pm

Hi there! generic orlistat good website.

Michaelrob

December 12, 2025 at 2:15 pm

?Levantemos nuestras copas por cada amante del riesgo !

Los jugadores modernos encuentran en casinosonlinefueradeespana una opciГіn mГЎs dinГЎmica. Permiten apuestas rГЎpidas, retiros ГЎgiles y una navegaciГіn fluida. AsГ casinosonlinefueradeespana sigue ganando seguidores entre los usuarios mГЎs exigentes.

La comunidad de apostadores destaca casino fuera de espaГ±a por su oferta global. Brindan acceso a promociones variables y a juegos exclusivos del mercado internacional. Por eso casino fuera de espaГ±a mantiene su reputaciГіn como plataforma versГЎtil y moderna.

casinosonlinefueradeespana: Casinosonlinefueradeespana tiene promociones semanales muy atractivas – п»їhttps://bodegaslasangrederonda.es/en/

?Que la fortuna te acompane con experiencias formidables giros de suerte !

JamesAlunc

December 12, 2025 at 10:21 pm

?Brindemos por cada explorador de tesoros !

Los usuarios que buscan experiencias dinГЎmicas encuentran en casas de apuestas sin registro dni una alternativa eficiente y accesible. . Las plataformas sin verificaciГіn suelen actualizar sus mercados con mayor frecuencia. Esto permite aprovechar mejores oportunidades en cada sesiГіn.