Stories

Hermès – Strategy Insights Of Luxury Brand

Hermès, a French fashion luxury goods manufacturer, has been ranked consistently as world’s most valuable luxury brand and one of the best global brands. Hermès, which is also known as Hermès International or Hermès Paris, has maintained an iconic status in the luxury market with products ranging from leather goods, perfume and lifestyle accessories to watches.

In 2018, the Company’s net profit rose to 1.41 billion euros, a 16 % increase from 1.22 billion euros in 2017. Fifty percent of the Company’s profits came from the brand’s leather goods and saddlery products. With competitors like LVMH and Richemont in the luxury business, Hermès still enjoys the top position in the market because of its exquisite craftsmanship and eye for detail through the entire manufacturing process.

History

Founded in the year 1837 by Thierry Hermès, the Company’s initial purpose was to build saddles, bridles and other leather riding gear for European nobility. After taking over the Company from his father, Charles-Émile moved the Company to 24 Rue Du Faubourg Saint-Honore in Paris in the 20th century. This remains the global headquarters of Hermès till date.

Through the generations, the Company slowly expanded from selling leather saddles to other products. The Company started selling “Haut à Courroies” bags in 1900, which were used by riders to carry saddles in it. The Company introduced its first leather handbag in 1922, a product which has played a significant role in increasing the popularity of Hermès in the global market.

Strategy

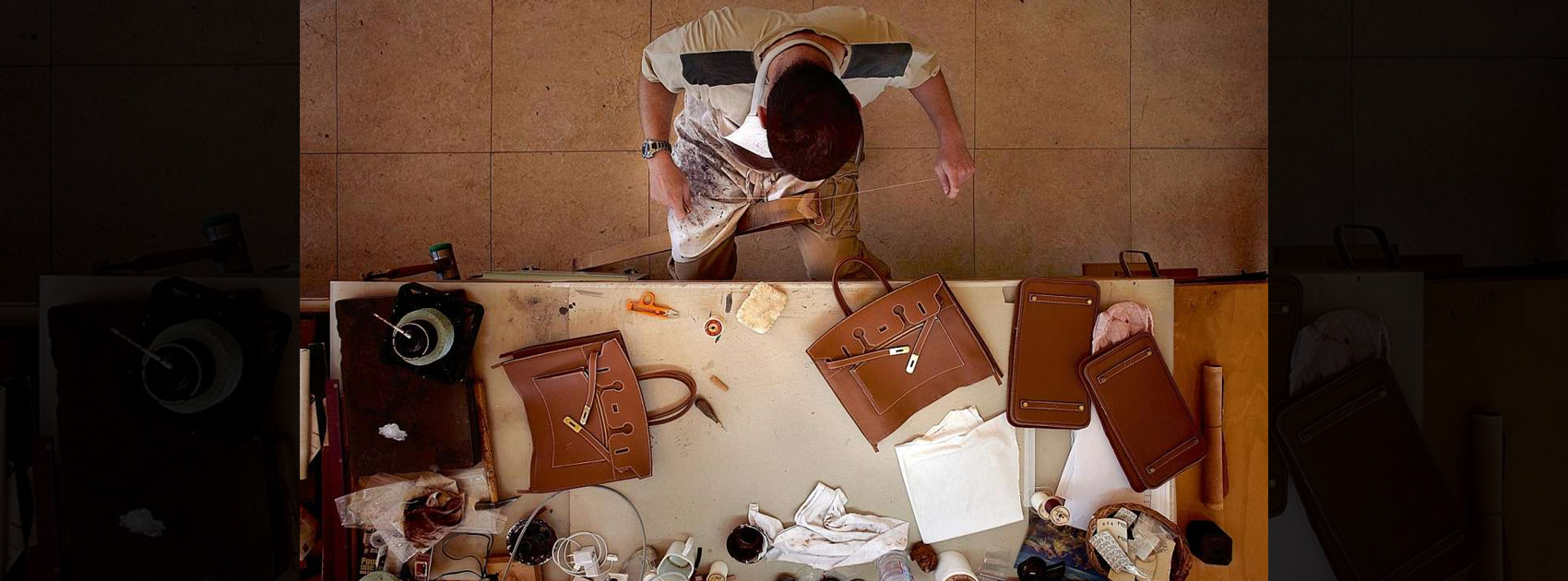

Hermès has a unique strategy in place to ensure it retains its position on top in the market. Hermès is very strict about the traditional way of manufacturing and rejects any form of mass production. Every product produced by the Company is handmade by craftsmen who are trained for a period of two to three years. According to the Company, every product is made from beginning to end by a single person to preserve the product quality and uniqueness.

Jean Louis Dumas, the chairman of Hermès from 1978 to 2006, told Vanity Fair, “We don’t have a policy of image; we have a policy of product.” Hermès has always claimed, it values creativity more than anything and to this day, maintains a deep connection to its French identity. Most of Hermès’ products are manufactured in France and 60 % of the Company’s workshops are located in different parts of the Country.

Another strategy the Company uses is giving a sense of exclusivity. In order to do so, Hermès uses the “Limited Edition” strategy and releases only a handful of products at a time. The Birkin bag, created by Hermès for Jane Birkin in 1982, remains the most popular product by the Company. One of the reasons behind this is the brand’s strategy to make the customer wait for a few months or a year after making an order. The cost of each Birkin bag ranges from 7,000 USD to 300,000 USD. Every Birkin bag is made of crocodile skin and has exquisite handiwork by a single craftsman.

The brand continuously collaborates with other ultra luxury brands to maintain its reputation in the market. Hermès has collaborated with luxury designers like John Lobb, Saint Louis as well as tech mogul Apple. Each collaboration brought the Company media attention and skyrocketed its brand value and sales.

Keeping it in the family

For the last 180 years, since the founding of Hermès, it has been run exclusively by the Hermès family. Currently, the brand is managed by Axel Dumas (6th generation,) who is the sole manager of the Company. The Company maintains its independence and uniqueness by keeping the control within the family.

Even though Hermès is 180 years old, it still maintains an ultra luxury status because of its ability to evolve by maintaining a perfect balance between tradition and modernity. With its clever strategy of exclusivity, controlled marketing and limited edition, Hermès is able to engage potential and wealthy clients, which ensures continuous profits and growth of the Company.

Entrepreneur Stories

Zupee Bolsters Short-Video Play with Vertical TV Acquisition Under INR 40 Cr

Delhi NCR-based gaming startup Zupee has acquired Mumbai-based microdrama platform Vertical TV in a deal valued under INR 40 Cr. This move strengthens Zupee Studio, its short-video arm launched in September 2025, by integrating Vertical TV’s expertise in bite-sized dramas like romance and thrillers.

Facing challenges from India’s 2025 real-money gaming ban, Zupee valued at $1 Bn after raising $120 Mn has pivoted to non-gaming content, including recent layoffs of 40% of its workforce. The acquisition builds on its November 2025 purchase of Australian AI firm Nucanon for interactive storytelling, targeting its 200 Mn+ users with engaging, mobile-first formats.

This deal underscores the rising microdrama trend in India, helping Zupee diversify amid regulatory pressures and compete in the short-video space dominated by quick, shareable content for on-the-go audiences.

Videos

T.N. Seshan: The Fearless Reformer Who Redefined Indian Democracy

T.N. Seshan’s name stands tall in India’s history as the man who transformed the nation’s electoral system with extraordinary courage and integrity. Born in 1932 in Kerala, Seshan grew up with values of discipline, education, and service to the nation — virtues that shaped his illustrious journey. From his early brilliance at Madras Christian College to his advanced studies in public administration at Harvard University, Seshan’s path reflected rare determination and intellect. Joining the Indian Administrative Service in 1955, he built a reputation as a no‑nonsense officer committed to efficiency and honesty, serving in key roles such as Secretary of Defense and overseeing vital national programs.

As the Chief Election Commissioner of India in 1990, T.N. Seshan sparked a new era of electoral integrity. In a system once marred by corruption, violence, and malpractice, Seshan brought order, fear, and respect through his groundbreaking reforms. He introduced voter ID cards, imposed strict spending limits on campaigns, and insisted on transparency at every level of the election process. Despite criticism from political circles that labeled him dictatorial, his relentless pursuit of fairness empowered every citizen to vote fearlessly. Under his leadership, the Election Commission became a symbol of strength and integrity in Indian democracy.

Seshan’s passing in November 2019 marked the end of an era, but his message continues to resonate across generations. Leaders from every corner of the country mourned the loss of the man who restored faith in free and fair elections. His enduring legacy reminds us that true leadership lies not in wielding power, but in serving people with honesty, courage, and conviction. T.N. Seshan’s life remains a timeless inspiration a reminder that democracy thrives only when its citizens are vigilant, responsible, and fearless.

Entrepreneur Stories

Indian Man Quits JPMorgan, Takes 70% Pay Cut to Launch $6 Million Startup

Leaving behind a high-paying job at JPMorgan, an Indian entrepreneur embraced a 70% salary cut to pursue true purpose and passion in the startup world. Disenchanted with what he described as a “robotic” corporate routine, he sought meaningful work that made a real impact. This pivotal decision marked the beginning of his new journey, one focused on value creation rather than titles and corporate perks.

Powered by resilience and fresh perspective, the entrepreneur launched his own startup, prioritizing innovation and hands-on solutions. The road was challenging, but his vision resonated with the market: the startup quickly gained traction and raised $6 million—an impressive acknowledgement of its potential in a competitive landscape. Every hard lesson from early setbacks and bootstrapping paid off in real customer growth and investor confidence.

Today, his journey stands as an inspiring example for professionals seeking authentic success outside the corporate grind. By trading comfort for creative freedom, he grew a venture that solves important problems, generates jobs, and builds wealth beyond just salary. For ambitious founders, his story highlights the power of risk-taking, adaptability, and relentless focus on impact in India’s thriving startup ecosystem.

v1z6t

June 6, 2025 at 9:46 am

buying generic clomid no prescription cost of clomiphene for men can i purchase generic clomid without a prescription cost of clomiphene without prescription where buy generic clomid no prescription buying clomid without dr prescription clomiphene for sale in usa

DanielCot

September 7, 2025 at 5:24 pm

Launch into the breathtaking realm of EVE Online. Find your fleet today. Fight alongside thousands of pilots worldwide. [url=https://www.eveonline.com/signup?invc=46758c20-63e3-4816-aa0e-f91cff26ade4]Start playing for free[/url]

MM88

November 6, 2025 at 7:43 pm

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

站群程序

November 8, 2025 at 10:00 am

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

iwin

November 10, 2025 at 4:08 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

J88

November 20, 2025 at 3:36 am

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

Kuwin

November 29, 2025 at 3:35 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

GO88

November 30, 2025 at 4:26 am

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

AtomCasino

December 13, 2025 at 12:51 am

https://t.me/s/atom_official_casino

Casino

December 14, 2025 at 2:26 pm

https://t.me/s/Martin_officials

kazino_s_minimalnym_depozitom

December 19, 2025 at 5:14 am

https://t.me/s/kazino_s_minimalnym_depozitom

Ezcash_Officials

December 20, 2025 at 8:37 pm

https://t.me/s/Ezcash_Officials

7kCasino

December 29, 2025 at 6:04 am

https://t.me/s/officials_7K_casino