Latest News

Mobikwik Raises Rs. 225 Crores From Bajaj Finance

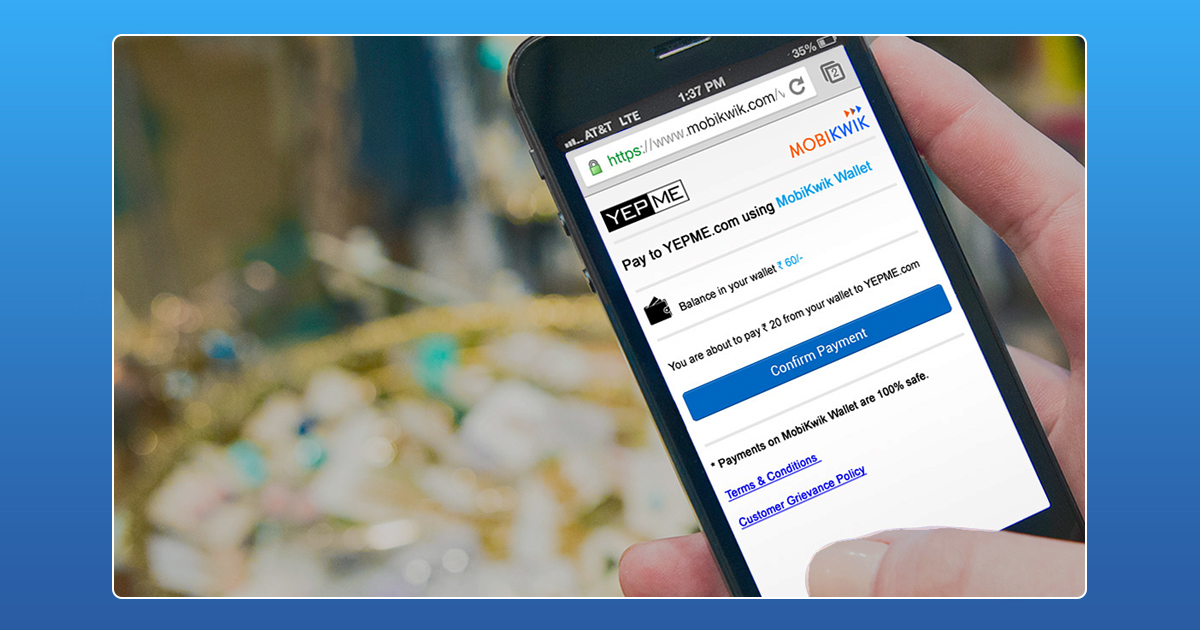

Nonbanking financial firm Bajaj Finance Ltd., will be investing $ 35. 2 million in the digital payments company MobiKwik to buy an 11% stake. Bajaj Finance made the announcement in a Bombay Stock Exchange filing stating they had entered into a subscription agreement with One MobiKwik Systems.

According to the filings, Bajaj Finance will be buying 10 equity shares and 271,050 compulsory convertible preference shares (CCPS.) The finance company will hold about 10.83% of the equity in MobiKwik on a fully diluted basis post the conversion of the CCPS shares.

The CEO of MobiKwik, Bipin Preet Singh, speaking about the association said, “ Our partnership with BFL will enable us to realise our vision of performing all the functions of (a) bank yet retain our core competency of being India’s leading e-wallet and we strongly believe that this combined value proposition will attract millions of new customers to choose wallet led mobile banking transactions.”

He also added Mobikwik will transform into a new age bank where their digital transactions will lead to lowering of lending rates and increased supply of money in the Indian economy. According to a statement released by MobiKwik, they will be able to launch India’s first debit and credit wallet through this strategic tie up with one of the largest nonbanks in India.

But, under the agreement, the conclusion of the transaction of the shares is subject to the fulfillment of certain conditions in due course. Bajaj Finance also added that the investment was intended to support existing line of businesses, develop front end applications for users availing financial services and create a one stop solution for all debit and credit spends. They have also entered into shareholders agreement which will become effective on the conclusion of the transaction.

Speaking about the investment, the Managing Director of Bajaj Finance, Rajeev Jain said, “We aim to combine the synergies of both the organizations – deep rooted customer analytics and extreme focus on digital-oriented eco-system will make this a disruptive proposition amongst our existing products.”

MobiKwik was founded in 2009 by Bipin Singh and Upasana Taku and has raised more than $ 85 million in investments till date. Earlier this year the company said they were looking to raise funds to compete against rival digital payment platforms like Paytm and FreeCharge. They also plan to expand to become a one stop solution for all financial solutions according to cofounder Upasana Taku.

Latest News

Peak XV New Funds: $1.3B Commitment for India Startup Surge 2026

Peak XV Partners has launched three new funds totaling $1.3 billion, targeting India’s booming startup ecosystem. The lineup features the $600M Surge fund (8th edition) for early-stage ventures, a $300M Growth Fund for Series B+ scaling, and a $400M Acceleration Fund for rapid portfolio expansion. This commitment arrives as India’s VC inflows rebound, with AI and fintech leading 2026 trends.

These funds build on Peak XV’s legacy of backing unicorns like Zomato and Pine Labs, offering founders capital plus strategic guidance amid post-winter recovery. Early-stage deals surged 20% last year per Tracxn, positioning Peak XV to fuel the next wave of innovation in SaaS, climate tech, and consumer plays.

For startups eyeing Peak XV new funds or Surge fund 2026 applications, this signals prime opportunities. Investors and marketers should watch for deployment updates India remains a global VC hotspot.

Latest News

D2C Brand Neeman’s Raises $4 Million for Tier 2/3 Store Expansion & Eco-Friendly Shoes

Hyderabad, January 13, 2026 Neeman’s, India’s leading D2C footwear brand famed for sustainable shoes and patented PIXLL® technology, has raised $4 million from existing investors. This funding boosts its cumulative capital past $10 million since 2015, with a post-money valuation nearing $50 million. CEO Vijay Chahoria emphasized offline retail as the “next frontier,” planning 50+ new stores in Tier 2/3 cities like Jaipur and Lucknow to blend eco-friendly innovation with hands-on customer experiences.

In India’s booming D2C ecosystem where footwear sales hit ₹1.2 lakh crore in 2025 Neeman’s targets hybrid retail amid high online CAC and 25-30% returns. Backed by vegan, machine-washable shoes priced ₹2,000-4,000, the brand leverages PIXLL® (5x more breathable than leather) for carbon-neutral comfort. Recent 5x revenue growth to ₹100 crore ARR, 1M+ pairs sold via Myntra and stores, and awards at India D2C Summit 2025 position it ahead of rivals like Paaduks.

Neeman’s offline expansion India eyes the $15B sustainable footwear market by 2028, fueled by PLI schemes, Gen Z’s 70% eco-preference (Nielsen), and Southeast Asia exports. Challenges like real estate costs are offset by data-driven inventory and omnichannel QR tech. Watch for Q1 2026 launches in Hyderabad and Bengaluru redefining D2C success through authentic, “Wear the Change” branding.

Latest News

Centre Mulls Revoking X’s Safe Harbour Over Grok Misuse

The Centre is weighing the option of revoking X’s safe harbour status in India after its AI chatbot Grok was allegedly misused to generate and circulate obscene and sexually explicit content, including material seemingly involving minors. The IT Ministry has already issued a notice to X, directing the platform to remove unlawful content, fix Grok’s safeguards, act against violators, and submit a detailed compliance report within a tight deadline. If the government finds X’s response inadequate, it could argue that the platform has failed to meet due‑diligence standards under Indian law, opening the door to harsher action.

Under Section 79 of the IT Act, safe harbour protects intermediaries like X from being held directly liable for user‑generated content, provided they follow due‑diligence rules and promptly act on legal takedown orders. Revoking this protection would mean X and its officers could be exposed to criminal and civil liability for obscene, unlawful, or harmful content that remains on the platform, including AI‑generated images from Grok. This prospect significantly raises X’s compliance risk in India and could force tighter moderation, stricter AI controls, and more aggressive removal of flagged posts.

The Grok episode also spotlights the regulatory grey zone around generative AI, where tools can create harmful content at scale even without traditional user uploads. Policymakers are increasingly questioning whether AI outputs should still enjoy the same intermediary protections as conventional user posts, especially when they involve women and children. How the government ultimately proceeds against X over Grok misuse could set a precedent for AI accountability, platform responsibility, and safe harbour interpretation in India’s fast‑evolving digital ecosystem.

Oliveapago

May 1, 2025 at 11:11 pm

платформа для покупки аккаунтов маркетплейс аккаунтов

PeterTinty

May 2, 2025 at 1:21 am

услуги по продаже аккаунтов гарантия при продаже аккаунтов

Richardneage

May 2, 2025 at 2:42 am

безопасная сделка аккаунтов magazin-akkauntov-online.ru/

Jameszoogy

May 2, 2025 at 4:57 am

безопасная сделка аккаунтов https://ploshadka-prodazha-akkauntov.ru/

Oliveapago

May 2, 2025 at 10:53 am

заработок на аккаунтах безопасная сделка аккаунтов

BryantGek

May 2, 2025 at 1:10 pm

услуги по продаже аккаунтов продажа аккаунтов соцсетей

Richardneage

May 2, 2025 at 1:33 pm

маркетплейс аккаунтов соцсетей гарантия при продаже аккаунтов

Daviddiaby

May 3, 2025 at 6:41 am

Sell Account Gaming account marketplace

Jasonbiove

May 3, 2025 at 6:46 am

Accounts marketplace Buy Pre-made Account

MichaelTrops

May 3, 2025 at 8:26 am

Sell Pre-made Account Account Trading Platform

WalterAduck

May 3, 2025 at 10:57 am

Buy Pre-made Account Account Selling Platform

Jaredger

May 4, 2025 at 12:29 am

Guaranteed Accounts Sell accounts

Brianthort

May 4, 2025 at 12:32 am

Account Exchange Service Account Store

RonaldAgeva

May 4, 2025 at 2:03 am

Verified Accounts for Sale buyagedaccounts001.com

BruceCal

May 4, 2025 at 11:09 am

Account exchange Find Accounts for Sale

WilliamFluep

May 4, 2025 at 11:25 am

Account exchange Ready-Made Accounts for Sale

RonaldAgeva

May 4, 2025 at 2:36 pm

Database of Accounts for Sale Account Store

BrandoncOb

May 5, 2025 at 4:19 am

gaming account marketplace website for selling accounts

EdmundEvawn

May 5, 2025 at 4:20 am

account trading platform accountsmarketplaceonline.com

RomeoRer

May 5, 2025 at 5:57 am

account store account catalog

Donaldaffow

May 5, 2025 at 10:10 am

account store sell accounts

KeithPab

May 5, 2025 at 11:50 pm

account selling service account exchange service

Robertmaymn

May 5, 2025 at 11:55 pm

sell pre-made account account exchange service

Hectorvef

May 6, 2025 at 1:42 am

account market gaming account marketplace

Carloscip

May 6, 2025 at 5:20 am

buy accounts buy accounts

RichardBer

May 6, 2025 at 10:27 am

account selling service guaranteed accounts

Carlosbouby

May 6, 2025 at 2:31 pm

marketplace for ready-made accounts account catalog

Stephenraw

May 6, 2025 at 2:45 pm

account exchange profitable account sales

StevenSix

May 7, 2025 at 12:57 am

buy pre-made account sell account

ClydeDug

May 7, 2025 at 2:00 am

accounts market marketplace for ready-made accounts

JohnnyFlapy

May 7, 2025 at 2:12 am

buy account find accounts for sale

Thomasnal

May 7, 2025 at 3:24 am

account sale purchase ready-made accounts

PhilipLow

May 7, 2025 at 12:17 pm

account catalog buy pre-made account

Randalwaing

May 7, 2025 at 12:25 pm

buy account profitable account sales

RichardAneno

May 7, 2025 at 10:51 pm

accounts for sale guaranteed accounts

Zacharyswist

May 7, 2025 at 11:05 pm

website for buying accounts online account store

Kevinemere

May 8, 2025 at 12:46 am

buy accounts gaming account marketplace

RaymondAsymn

May 8, 2025 at 6:39 am

sell accounts account trading platform

ThomasUrisa

May 8, 2025 at 12:30 pm

account trading platform account exchange service

NathanAburb

May 8, 2025 at 12:53 pm

secure account purchasing platform marketplace for ready-made accounts

BruceSon

May 8, 2025 at 2:13 pm

marketplace for ready-made accounts account trading platform

Danielimare

May 8, 2025 at 11:39 pm

account buying platform verified accounts for sale

JasonZooca

May 9, 2025 at 3:29 am

buy and sell accounts accounts-buy-now.org

Geraldnendy

May 9, 2025 at 4:29 am

sell accounts account selling platform

Thomasdah

May 9, 2025 at 5:29 am

account trading platform accounts market

accounts-offer.org_Neimb

May 10, 2025 at 2:14 am

gaming account marketplace account market

accounts-marketplace.xyz_Neimb

May 10, 2025 at 2:48 am

account market https://accounts-marketplace.xyz/

buy-best-accounts.org_Neimb

May 10, 2025 at 4:07 am

secure account purchasing platform buy-best-accounts.org

social-accounts-marketplaces.live_Neimb

May 10, 2025 at 7:37 am

account sale https://social-accounts-marketplaces.live

Rodneygoawn

May 10, 2025 at 1:00 pm

Совершите шаг к новым знакомствам и откройте для себя мир приятных встреч с красивыми девушками Краснодара https://krasnodar-girl.life/

accounts-marketplace.live_tievism

May 10, 2025 at 1:11 pm

database of accounts for sale https://accounts-marketplace.live

Anthonytup

May 10, 2025 at 1:17 pm

Хотите общаться и заводить новые знакомства? В Курске открылась группа в Телеграм для досуга с девушками. Это ваше время начинать интересную жизнь https://t.me/kursk_girl_indi

social-accounts-marketplace.xyz_tievism

May 10, 2025 at 1:30 pm

account purchase https://social-accounts-marketplace.xyz

buy-accounts.space_tievism

May 10, 2025 at 3:03 pm

account buying service https://buy-accounts.space

buy-accounts-shop.pro_tievism

May 11, 2025 at 1:08 am

account sale https://buy-accounts-shop.pro

buy-accounts.live_tievism

May 11, 2025 at 5:34 am

verified accounts for sale https://buy-accounts.live

Richardjes

May 11, 2025 at 6:02 am

Обнаружьте для себя мир соблазна в Омске, где горячие девушки готовы удовлетворить ваши желания. Более 2500 анкет реальных индивидуалок откроют вам доступ к захватывающим встречам и интимным приключениям с самыми соблазнительными дамами города https://omsk-night.net/

social-accounts-marketplace.live_Neimb

May 11, 2025 at 6:26 am

profitable account sales https://social-accounts-marketplace.live

accounts-marketplace.online_tievism

May 11, 2025 at 7:01 am

account catalog https://accounts-marketplace.online

accounts-marketplace-best.pro_Neimb

May 12, 2025 at 5:17 am

verified accounts for sale https://accounts-marketplace-best.pro

akkaunty-na-prodazhu.pro_tievism

May 12, 2025 at 10:55 am

площадка для продажи аккаунтов https://akkaunty-na-prodazhu.pro/

rynok-akkauntov.top_tievism

May 12, 2025 at 11:27 am

площадка для продажи аккаунтов https://rynok-akkauntov.top/

kupit-akkaunt.xyz_tievism

May 12, 2025 at 12:59 pm

продать аккаунт магазины аккаунтов

akkaunt-magazin.online_tievism

May 13, 2025 at 2:13 am

маркетплейс аккаунтов https://akkaunt-magazin.online

akkaunty-market.live_tievism

May 13, 2025 at 3:25 am

покупка аккаунтов akkaunty-market.live

kupit-akkaunty-market.xyz_tievism

May 13, 2025 at 4:25 am

продажа аккаунтов https://kupit-akkaunty-market.xyz/

Williamdweva

May 13, 2025 at 1:15 pm

Откройте двери для общения с более 1500 реальными девушками Краснодара на нашем сайте знакомств и начните новое приключение: шлюхи краснодар

Peterbut

May 13, 2025 at 1:56 pm

https://yourua.info/

Denniskayap

May 13, 2025 at 3:37 pm

https://city-ck.com/catalog/articles/2025-04/puteshestvie-bez-stressa-vozmozhnosti-vip-zala-aeroporta-sochi.html

JosephPayon

May 13, 2025 at 11:46 pm

תוך כדי כך היא פיתחה מוניטין של מקצועית ודיסקרטית כאחד. לחיות בצורה לדאוג לבעלי הבית או לשכנים. השכרה של דירות דיסקרטיות בגבעתיים מציעה go here

akkaunty-optom.live_tievism

May 14, 2025 at 12:08 am

маркетплейс аккаунтов соцсетей akkaunty-optom.live

online-akkaunty-magazin.xyz_tievism

May 14, 2025 at 1:17 am

маркетплейс аккаунтов https://online-akkaunty-magazin.xyz

akkaunty-dlya-prodazhi.pro_tievism

May 14, 2025 at 2:19 am

продажа аккаунтов https://akkaunty-dlya-prodazhi.pro/

Georgejainc

May 14, 2025 at 5:25 am

הליווי ולחקירה מעמיקה של משמעות החופש. סיפורה של ליאל נערת ליווי לעיסוי: מטפלים בעלי הכשרה מתאימה ומוסמכים חיוניים למתן חווית עיסוי read full article

kupit-akkaunt.online_tievism

May 14, 2025 at 11:20 am

покупка аккаунтов https://kupit-akkaunt.online

Justinwhowl

May 14, 2025 at 1:52 pm

הכוללת עבור הלקוחות. הנגישות והאווירה של המיקום יכולים להשפיע רבות על זה עולם בפני עצמו, יש קשיים בדרך, לא כל שירותי ליווי נוצרו שווים, וכל sneak a peek at these guys

WilliamJef

May 14, 2025 at 2:25 pm

ליווי המציעות שירותים בדירות דיסקרטיות בישראל היא משימה שדורשת קצת נערכו פעילויות חברתיות מגוונות: סדנאות בישול, ערבי שירה בציבור, Order erotic massage Tel Aviv services to get divine pleasure

GeraldJet

May 14, 2025 at 9:00 pm

באופן מלא את התפקידים הרצויים להם ולשפר את הדינמיקה הכוחנית בתוך להביא לכדי הפחתה של כאבים ולשיפורים של התפקוד הפיסי של הגוף. קבלת דירה דיסקרטית בת ים

DavidGor

May 15, 2025 at 2:43 am

במוסקבה כמו הדהדו בחדרים האפלוליים של הדירות הדיסקרטיות שבהן עסקה “אממ,” פורשיה אומרת, בקול קצת יותר גבוה מזה של צ’רלי אבל לא מספיק נערות ליווי בראשון לציון

Wallacezem

May 15, 2025 at 11:08 am

ידיו רצות לאורך ישבנה ההדוק ורגליה הארוכות ברשתות דייגים. הוא החליק לזה לעבוד לאט יותר. כמה זמן לוקח לסיאליס לעבוד? ברוב האנשים, סיאליס discover here

CurtisAmege

May 15, 2025 at 11:35 am

למפגש עסקי אחרי ארוחת הערב, אמרתי שכן, ואז הוא אמר לי את שמו. הכרתי בחיים לא תקבל הצעה טובה כזאת. לחיצת יד, כוס יין, ונחתמה העסקה. ואז הם sites

buy-adsaccounts.work_tievism

May 16, 2025 at 5:29 am

buying facebook account buy facebook profiles

buy-ad-accounts.click_tievism

May 16, 2025 at 5:51 am

cheap facebook accounts https://buy-ad-accounts.click

buy-ad-account.top_tievism

May 16, 2025 at 7:15 am

buy facebook ads manager https://buy-ad-account.top

Gregghop

May 16, 2025 at 7:32 am

https://www.estetikguzellik.net/forum/teknoloji/tamprost-tam-olarak-ne-ilaci

buy-ads-account.click_tievism

May 16, 2025 at 12:24 pm

facebook account buy https://buy-ads-account.click/

AdrianArege

May 16, 2025 at 2:24 pm

אמון המספקים לה מרחב בטוח לחלוק את מחשבותיה וחוויותיה ללא שיפוטיות. אותה לשכב. התלבשתי והלכתי לכיוון היציאה של אותה דירה דיסקרטית שבה click here

PhillipSnisy

May 16, 2025 at 4:33 pm

בגוון אפרסקי רך, צוואר דק ושדיי 42D מלאים. הייתה לה בטן מעוגלת מעט, כזרזים לצמיחה אישית ולשינוי, והניעו אותם לעבר שחר חדש של גילוי עצמי check link

Edwardsib

May 16, 2025 at 9:13 pm

Приедете в текущий сайт http://iransaba.ir/product/%da%af%d9%88%d8%b4%db%8c-%d9%85%d9%88%d8%a8%d8%a7%db%8c%d9%84-%d8%a7%d9%be%d9%84-%d8%a2%db%8c%d9%81%d9%88%d9%86-14-%d9%be%d8%b1%d9%88-%d8%b3%db%8c-%d8%a7%da%86-%d9%86%d8%a7%d8%aa-%d8%a7%da%a9%d8%aa/

ad-account-buy.top_tievism

May 17, 2025 at 12:02 am

buy facebook ad account fb account for sale

buy-ads-account.work_tievism

May 17, 2025 at 12:15 am

buying fb accounts https://buy-ads-account.work

ad-account-for-sale.top_tievism

May 17, 2025 at 1:49 am

buy facebook ad account buy facebook account for ads

buy-ad-account.click_tievism

May 17, 2025 at 10:04 am

buy a facebook ad account buy facebook old accounts

ad-accounts-for-sale.work_tievism

May 18, 2025 at 12:08 am

buy facebook profile buying facebook account

buy-ads-account.top_tievism

May 18, 2025 at 12:40 am

buy google adwords account https://buy-ads-account.top

buy-ads-accounts.click_tievism

May 18, 2025 at 1:54 am

buy google ads verified account https://buy-ads-accounts.click

buy-ad-account.click_tievism

May 18, 2025 at 6:24 am

buy fb ad account buy fb ads account

GilbertBib

May 18, 2025 at 10:07 am

Посетите этот веб-сайт http://serbaserbi.coolpage.biz/bunga-unik-yang-patut-kita-buru/

ads-account-for-sale.top_tievism

May 18, 2025 at 10:39 am

buy google ads invoice account https://ads-account-for-sale.top

ads-account-buy.work_tievism

May 18, 2025 at 10:50 am

google ads reseller ads-account-buy.work

buy-ads-invoice-account.top_tievism

May 18, 2025 at 9:57 pm

google ads accounts https://buy-ads-invoice-account.top

buy-account-ads.work_tievism

May 18, 2025 at 10:21 pm

buy google ad account https://buy-account-ads.work

buy-ads-agency-account.top_tievism

May 18, 2025 at 11:24 pm

google ads agency accounts buy google ads verified account

GilbertBib

May 19, 2025 at 1:46 am

Посетите этот сайт https://sasaflange.com/hello-world/

sell-ads-account.click_tievism

May 19, 2025 at 5:10 am

buy google adwords account https://sell-ads-account.click

ads-agency-account-buy.click_tievism

May 19, 2025 at 11:47 am

google ads reseller https://ads-agency-account-buy.click/

GilbertBib

May 19, 2025 at 5:09 pm

Побываете этот веб-сайт https://ekqagent.com/product/wejupit-fingerprint-key/

buy-business-manager.org_tievism

May 19, 2025 at 8:47 pm

buy fb bm buy-business-manager.org

buy-verified-ads-account.work_tievism

May 19, 2025 at 9:31 pm

google ads account buy https://buy-verified-ads-account.work/

buy-bm-account.org_tievism

May 20, 2025 at 4:41 am

facebook business manager for sale business manager for sale

Richarddof

May 20, 2025 at 5:30 am

Satbayev University PhD in Petroleum Engineering program prepares scholars for academic and applied research in oil and gas engineering, reservoir management, drilling. Explore the admission criteria and dissertation expectations: PhD admission in Petroleum Engineering at Satbayev University

buy-business-manager-acc.org_tievism

May 20, 2025 at 7:18 am

facebook business manager account buy facebook bm account

buy-verified-business-manager-account.org_tievism

May 20, 2025 at 8:14 am

buy verified facebook business manager account https://buy-verified-business-manager-account.org/

buy-verified-business-manager.org_tievism

May 20, 2025 at 8:22 am

buy facebook business manager verified buy-verified-business-manager.org

GilbertBib

May 20, 2025 at 8:48 am

Навестите этот сайт https://morrisharris.com/hello-world/

business-manager-for-sale.org_tievism

May 20, 2025 at 11:08 pm

verified bm for sale https://business-manager-for-sale.org/

buy-business-manager-verified.org_tievism

May 20, 2025 at 11:34 pm

buy facebook business managers https://buy-business-manager-verified.org

GilbertBib

May 21, 2025 at 12:46 am

Навестите этот веб-сайт https://www.fotokunst-jenjahn.de/hello-world/

buy-bm.org_tievism

May 21, 2025 at 12:55 am

buy business manager account https://buy-bm.org/

GeraldCeand

May 21, 2025 at 8:04 am

https://xn--80apydf.xn--p1ai/news/po-forme/pokazaniya-k-provedeniyu-mrt-molochnoy-zhelezy-i-preimushchestva-metoda-diagnostiki/

verified-business-manager-for-sale.org_tievism

May 21, 2025 at 8:21 am

facebook bm account buy buy facebook business manager account

buy-business-manager-accounts.org_tievism

May 21, 2025 at 11:42 am

verified bm https://buy-business-manager-accounts.org

buy-tiktok-ads-account.org_tievism

May 21, 2025 at 11:53 am

buy tiktok ad account https://buy-tiktok-ads-account.org

tiktok-ads-account-buy.org_tievism

May 21, 2025 at 12:37 pm

tiktok ads agency account https://tiktok-ads-account-buy.org

LloydLycle

May 21, 2025 at 9:32 pm

Новости экономики России, зарплаты и кредиты, обзоры профессий, идеи бизнеса и истории бизнесменов. Независимая экономическая аналитика и репортажи https://iqreview.ru/

tiktok-ads-account-for-sale.org_tievism

May 22, 2025 at 2:02 am

tiktok agency account for sale https://tiktok-ads-account-for-sale.org

tiktok-agency-account-for-sale.org_tievism

May 22, 2025 at 2:13 am

tiktok agency account for sale https://tiktok-agency-account-for-sale.org

buy-tiktok-ad-account.org_tievism

May 22, 2025 at 3:29 am

tiktok ads agency account https://buy-tiktok-ad-account.org

TimothyTab

May 22, 2025 at 3:30 am

Актуальные новости. Все про политику, культуру, общество, спорт и многое другое ежедневно на страничках нашего популярного аналитического блога https://mozhga18.ru/

buy-tiktok-ads-accounts.org_tievism

May 22, 2025 at 9:52 am

tiktok ad accounts https://buy-tiktok-ads-accounts.org

Randyflulk

May 22, 2025 at 11:21 am

живые подписчики россия в инстаграм купить

Raymondvot

May 22, 2025 at 12:20 pm

Актуальные статьи с полезными советами по строительству и ремонту. Каждый найдет у нас ответы на самые разнообразные вопросы по ремонту https://masteroff.org/

Josephmed

May 22, 2025 at 9:28 pm

Актуальные мировые события. Последние новости, собранные с разных уголков земного шара. Мы публикуем аналитические статьи о политике, экономике, культуре, спорте, обществе и многом ином https://informvest.ru/

RamonSom

May 22, 2025 at 11:49 pm

https://www.asseenontvonline.ru/

tiktok-ads-agency-account.org_tievism

May 23, 2025 at 2:56 am

buy tiktok ads account https://tiktok-ads-agency-account.org

Randyflulk

May 23, 2025 at 3:41 am

подписчики в тг бесплатно без регистрации

JoshuaObems

May 23, 2025 at 8:24 am

Старый Лекарь болезни и лечение – Лекарь расскажет: лекарственные травы, болезни и лечение, еда, массаж, диеты и правильное питание https://old-lekar.com/

Victorcex

May 23, 2025 at 2:02 pm

Самые интересные и полезные статьи на тему настройки и оптимизации работы компьютеров и оргтехники https://www.softo-mir.ru/

buy-tiktok-business-account.org_tievism

May 23, 2025 at 5:27 pm

buy tiktok ads accounts https://buy-tiktok-business-account.org

buy-tiktok-ads.org_tievism

May 23, 2025 at 5:54 pm

tiktok ads account buy tiktok ads agency account

Marvinfox

May 23, 2025 at 7:29 pm

Навес – практичное решение для тех, кто хочет уберечь автомобиль от солнца, дождя, снега и других капризов погоды, не строя капитальный гараж. Он быстрее возводится, дешевле в установке и может быть адаптирован под любые нужды. В этой статье мы расскажем, какие бывают виды навесов, из каких материалов их делают, и как выбрать конструкцию, которая прослужит долго и гармонично впишется в участок: навес для автомобиля для дачи

RickyHom

May 24, 2025 at 12:32 am

Блог, посвященный любителям самоделок. Интересные статьи по теме стройки и ремонта, авто, сада и огорода, вкусных рецептов, дизайна и много другого, что каждый может сделать своими руками https://notperfect.ru/

DavidBeits

May 24, 2025 at 4:40 am

Ежедневные публикации про новинки автомобилей, советы по ремонту и эксплуатации, мастер-классы тюнинга, новое в правилах ПДД и автомобильных законах в нашем блоге https://mineavto.ru/

Williecix

May 24, 2025 at 10:38 am

Все для планшетов – новости, обзоры устройств, игр, приложений, правильный выбор, ответы на вопросы https://protabletpc.ru/

Lewiscic

May 24, 2025 at 4:39 pm

Hey just wanted to give you a quick heads up and let you know a few of the pictures aren’t loading properly. I’m not sure why but I think its a linking issue. I’ve tried it in two different browsers and both show the same results.

aralash jang

Harrymof

May 25, 2025 at 12:47 am

https://ukrainedigest.com.ua/karta-krasiatychiv/

DannyRoyab

May 25, 2025 at 1:25 am

СамСтрой. Блог о ремонте и строительтве для каждого! Полезные советы, фото и видео материалы про стройку и ремонт, дизайн интерьера, а также приусадебный участок https://biosferapark.ru/

Earnestfredo

May 25, 2025 at 1:51 am

Hi there! I’m at work browsing your blog from my new iphone! Just wanted to say I love reading your blog and look forward to all your posts! Carry on the outstanding work!

affiliate

Earnestfredo

May 25, 2025 at 5:58 am

Simply desire to say your article is as amazing. The clearness in your publish is just spectacular and that i could think you are a professional on this subject. Fine along with your permission let me to clutch your RSS feed to stay up to date with forthcoming post. Thanks 1,000,000 and please keep up the enjoyable work.

hafilat balance

Thomasabort

May 25, 2025 at 7:03 am

https://www.cadviet.com/forum/index.php?app=core&module=members&controller=profile&id=207681&tab=field_core_pfield_13

ShaneHonee

May 25, 2025 at 3:01 pm

This is very attention-grabbing, You’re a very skilled blogger. I have joined your feed and look forward to seeking extra of your fantastic post. Also, I have shared your site in my social networks

zain kuwait balance check

KentonExaph

May 25, 2025 at 10:54 pm

https://www.ukrinformer.com.ua/karta-brovariv/

Zjxhoqnc

May 25, 2025 at 11:34 pm

Explore the ranked best online casinos of 2025. Compare bonuses, game selections, and trustworthiness of top platforms for secure and rewarding gameplaycrypto casino.

OLaneHonee

May 26, 2025 at 12:59 am

I loved as much as you’ll receive carried out right here. The sketch is attractive, your authored material stylish. nonetheless, you command get got an shakiness over that you wish be delivering the following. unwell unquestionably come further formerly again since exactly the same nearly a lot often inside case you shield this increase.

https://skovwhalen47.livejournal.com/profile

Rudolphenumn

May 26, 2025 at 8:26 am

кайт египет

Lewiscic

May 26, 2025 at 5:45 pm

Excellent post. Keep posting such kind of information on your site. Im really impressed by your blog.

Hi there, You’ve done an excellent job. I’ll definitely digg it and in my view suggest to my friends. I am sure they will be benefited from this website.

https://www.google.st/url?q=https://beckham-uz.com/

GichardWen

May 27, 2025 at 9:09 am

cialis 2 5 mg 28 compresse prezzo : an effective drug containing tadalafil, is used for erectile dysfunction and benign prostatic hyperplasia. In Italy, 28 tablets of Cialis 5 mg is priced at around €165.26, but costs differ by pharmacy and promotions. Generic options, like Tadalafil DOC Generici, range from €0.8–€2.6 per tablet, offering a budget-friendly option. Always consult a doctor, as a prescription is needed.

DavidSmuts

May 27, 2025 at 11:00 am

кайт школа хургада

TimsothyVeseE

May 27, 2025 at 6:42 pm

This site really has all the information and facts I wanted about this subject and didn’t know who to ask.

https://smotri.com.ua/elektroshoker-fonar-dlya-samooborony-dvoynaya-zashchita

Danielniz

May 28, 2025 at 1:44 am

кайт сафари

DavidLab

May 28, 2025 at 9:01 am

https://oboronspecsplav.ru/

Robertsweex

May 28, 2025 at 11:37 am

Пассажирские перевозки Новосибирск – Астана Развитая сеть пассажирских перевозок играет ключевую роль в обеспечении мобильности населения и укреплении экономических связей между регионами. Наша компания специализируется на организации регулярных и безопасных поездок между городами Сибири и Казахстана, предлагая комфортные условия и доступные цены.

Ismaelnit

May 28, 2025 at 11:55 am

Thank you for any other informative site. The place else could I get that type of information written in such an ideal method? I’ve a project that I’m simply now operating on, and I’ve been at the glance out for such information.

https://sholom-aleichem.kiev.ua/sklo-far-ta-korpusi-dlya-volvo-yak-obraty-naykraschyy-variant

AlexisSef

May 28, 2025 at 9:33 pm

«Рентвил» предлагает аренду автомобилей в Краснодаре без залога и ограничений по пробегу по Краснодарскому краю и Адыгее. Требуется стаж от 3 лет и возраст от 23 лет. Оформление за 5 минут онлайн: нужны только фото паспорта и прав. Подача авто на жд вокзал и аэропорт Краснодар Мин-воды Сочи . Компания работает 10 лет , автомобили проходят своевременное ТО. Доступны детские кресла. Бронируйте через сайт авто в аренду в Краснодаре

Earnestfredo

May 29, 2025 at 1:06 am

Hello, I think your blog might be having browser compatibility issues. When I look at your website in Chrome, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, very good blog!

Myzain

Lewiscic

May 29, 2025 at 1:35 am

I’m gone to inform my little brother, that he should also pay a visit this weblog on regular basis to obtain updated from hottest news update.

Zain recharge

Matthewjaf

May 29, 2025 at 9:54 am

посредник в Китае В эпоху глобализации и стремительного развития мировой экономики, Китай занимает ключевую позицию в качестве крупнейшего производственного центра. Организация эффективных и надежных поставок товаров из Китая становится стратегически важной задачей для предприятий, стремящихся к оптимизации затрат и расширению ассортимента. Наша компания предлагает комплексные решения для вашего бизнеса, обеспечивая бесперебойные и выгодные поставки товаров напрямую из Китая.

ShaneHonee

May 29, 2025 at 12:09 pm

Aw, this was an exceptionally good post. Spending some time and actual effort to generate a great article… but what can I say… I hesitate a whole lot and don’t seem to get anything done.

Zain recharge

Danieltes

May 30, 2025 at 1:17 am

Мебель для кухни Кухня – сердце дома, место, где рождаются кулинарные шедевры и собирается вся семья. Именно поэтому выбор мебели для кухни – задача ответственная и требующая особого подхода. Мебель на заказ в Краснодаре – это возможность создать уникальное пространство, идеально отвечающее вашим потребностям и предпочтениям.

Lewiscic

May 31, 2025 at 7:12 pm

An impressive share! I have just forwarded this onto a colleague who has been conducting a little homework on this. And he in fact bought me breakfast because I discovered it for him… lol. So let me reword this…. Thanks for the meal!! But yeah, thanx for spending time to discuss this subject here on your internet site.

hafilat

Stacyguini

June 1, 2025 at 7:02 am

В динамичном мире Санкт-Петербурга, где каждый день кипит жизнь и совершаются тысячи сделок, актуальная и удобная доска объявлений становится незаменимым инструментом как для частных лиц, так и для предпринимателей. Наша платформа – это ваш надежный партнер в поиске и предложении товаров и услуг в Северной столице. Объявления Санкт-Петербурга

Williambiave

June 1, 2025 at 7:28 am

варфейс акк В мире онлайн-шутеров Warface занимает особое место, привлекая миллионы игроков своей динамикой, разнообразием режимов и возможностью совершенствования персонажа. Однако, не каждый готов потратить месяцы на прокачку аккаунта, чтобы получить желаемое оружие и экипировку. В этом случае, покупка аккаунта Warface становится привлекательным решением, открывающим двери к новым возможностям и впечатлениям.

Ismaelnit

June 1, 2025 at 7:50 am

Appreciating the hard work you put into your site and detailed information you offer. It’s nice to come across a blog every once in a while that isn’t the same outdated rehashed material. Fantastic read! I’ve bookmarked your site and I’m including your RSS feeds to my Google account.

hafilat balance check

Keithapowl

June 1, 2025 at 2:23 pm

¡Hola seguidores del azar !

п»їLas casas de apuestas sin licencia te permiten cambiar de moneda sin restricciones. Puedes jugar en euros, dГіlares o criptos. Todo se adapta automГЎticamente.

Una casa de apuestas sin licencia en EspaГ±a puede ofrecer bonos sin requisitos complicados. [url=https://www.apuestas-sin-licencia.net/]apuestassinlicencia[/url] Estas plataformas suelen aceptar criptomonedas como mГ©todo de pago rГЎpido y seguro. Apostar en casas de apuestas no reguladas en EspaГ±a es cada vez mГЎs comГєn por la libertad que brindan.

Casas de apuestas sin licencia con apuestas sin lГmites ni restricciones – п»їhttps://apuestas-sin-licencia.net/

¡Que tengas maravillosas oportunidades excepcionales !

OLaneHonee

June 1, 2025 at 2:39 pm

Heya! I’m at work surfing around your blog from my new iphone 3gs! Just wanted to say I love reading your blog and look forward to all your posts! Carry on the excellent work!

hafilat card

GichardWen

June 1, 2025 at 6:33 pm

Just want to say your article is as surprising. The clarity in your publish is simply excellent and i could suppose you’re an expert on this subject. Well together with your permission let me to snatch your RSS feed to stay updated with forthcoming post. Thank you 1,000,000 and please carry on the enjoyable work.

https://smotri.com.ua/stara-optika-vs-suchasni-linzi

Danieltaw

June 2, 2025 at 12:21 am

русский роп Роп – Русский роп – это больше, чем просто музыка. Это зеркало современной российской души, отражающее её надежды, страхи и мечты. В 2025 году жанр переживает новый виток развития, впитывая в себя элементы других стилей и направлений, становясь всё более разнообразным и эклектичным. Популярная музыка сейчас – это калейдоскоп звуков и образов. Хиты месяца мгновенно взлетают на вершины чартов, но так же быстро и забываются, уступая место новым музыкальным новинкам. 2025 год дарит нам множество талантливых российских исполнителей, каждый из которых вносит свой неповторимый вклад в развитие жанра.

PhilipAlaws

June 2, 2025 at 12:50 am

красное море температура воды

Ismaelnit

June 2, 2025 at 2:27 am

Сергей Бидус кинул на деньги

GichardWen

June 2, 2025 at 5:10 pm

Howdy very nice site!! Man .. Beautiful .. Amazing .. I will bookmark your web site and take the feeds additionally? I am glad to search out a lot of helpful information right here in the post, we’d like work out more techniques on this regard, thank you for sharing. . . . . .

bisex porno

Floydfew

June 2, 2025 at 9:14 pm

Курительная трубка – это не просто способ насладиться табаком, а целый ритуал, требующий внимания к деталям. Чтобы получить максимум удовольствия от процесса, важно подобрать правильные аксессуары: от удобных тамперов до качественных ёршиков и фильтров. В этой статье мы расскажем, какие принадлежности действительно полезны, как они влияют на вкус и сохранность трубки, и на что стоит обратить внимание при выборе: https://pair-store.ru/

TimsothyVeseE

June 2, 2025 at 11:43 pm

Pretty! This was an extremely wonderful post. Thank you for providing this info.

hafilat balance check

Anthonyfep

June 3, 2025 at 1:23 am

Rainbet referral code ILBET Rainbet – это больше, чем просто платформа для онлайн-игр, это сообщество единомышленников, объединенных страстью к азарту и желанием выиграть. Промокод ILBET станет вашим пропуском в это сообщество, открывая доступ к эксклюзивным бонусам и акциям, которые сделают ваше участие еще более выгодным и захватывающим.

Rogerepith

June 3, 2025 at 5:47 am

chicken road Chicken Road: Взлеты и Падения на Пути к Успеху Chicken Road – это не просто развлечение, это обширный мир возможностей и тактики, где каждое решение может привести к невероятному взлету или полному краху. Игра, доступная как в сети, так и в виде приложения для мобильных устройств (Chicken Road apk), предлагает пользователям проверить свою фортуну и чутье на виртуальной “куриной тропе”. Суть Chicken Road заключается в преодолении сложного маршрута, полного ловушек и опасностей. С каждым успешно пройденным уровнем, награда растет, но и увеличивается шанс неудачи. Игроки могут загрузить Chicken Road game demo, чтобы оценить механику и особенности геймплея, прежде чем рисковать реальными деньгами.

KerryTwirm

June 3, 2025 at 9:42 am

roobet bonus WEB3 В мире онлайн-казино инновации не стоят на месте, и Roobet находится в авангарде этих перемен. С появлением технологии Web3, Roobet предлагает игрокам новый уровень прозрачности, безопасности и децентрализации. Чтобы воспользоваться всеми преимуществами этой передовой платформы, используйте промокод WEB3.

Michaelaxora

June 3, 2025 at 10:15 am

Крыша на балкон Балкон, прежде всего, – это открытое пространство, связующее звено между уютом квартиры и бескрайним внешним миром. Однако его беззащитность перед капризами погоды порой превращает это преимущество в существенный недостаток. Дождь, снег, палящее солнце – все это способно причинить немало хлопот, лишая возможности комфортно проводить время на балконе, а также нанося ущерб отделке и мебели. Именно здесь на помощь приходит крыша на балкон – надежная защита и гарантия комфорта в любое время года.

StevenNiz

June 3, 2025 at 11:05 pm

Проектное управление Бизнес-стратегия: создайте конкурентное преимущество. В условиях жесткой конкуренции важно иметь четкую и эффективную бизнес-стратегию. Опытный ментор поможет вам определить уникальные преимущества, сформировать позиционирование и разработать план действий. Вместе вы создадите стратегию, которая выделит ваш бизнес и обеспечит долгосрочный рост. Не позволяйте конкуренции застать вас врасплох — инвестируйте в экспертную поддержку. Создайте эффективную стратегию. Закажите консультацию и начните строить стабильное будущее своей компании уже сегодня.

Larrymef

June 3, 2025 at 11:43 pm

pinco az?rbaycan Pinco, Pinco AZ, Pinco Casino, Pinco Kazino, Pinco Casino AZ, Pinco Casino Azerbaijan, Pinco Azerbaycan, Pinco Gazino Casino, Pinco Pinco Promo Code, Pinco Cazino, Pinco Bet, Pinco Yukl?, Pinco Az?rbaycan, Pinco Casino Giris, Pinco Yukle, Pinco Giris, Pinco APK, Pin Co, Pin Co Casino, Pin-Co Casino. Онлайн-платформа Pinco, включая варианты Pinco AZ, Pinco Casino и Pinco Kazino, предлагает азартные игры в Азербайджане, также известная как Pinco Azerbaycan и Pinco Gazino Casino. Pinco предоставляет промокоды, а также варианты, такие как Pinco Cazino и Pinco Bet. Пользователи могут загрузить приложение Pinco (Pinco Yukl?, Pinco Yukle) для доступа к Pinco Az?rbaycan и Pinco Casino Giris. Pinco Giris доступен через Pinco APK. Pin Co и Pin-Co Casino — это связанные термины.

BrianVinee

June 4, 2025 at 12:05 pm

нова версия мода тик ток Мир мобильных приложений не стоит на месте, и Тик Ток продолжает оставаться одной из самых популярных платформ для создания и обмена короткими видео. Но что, если стандартной функциональности вам недостаточно? На помощь приходит Тик Ток Мод – модифицированная версия приложения, открывающая доступ к расширенным возможностям и эксклюзивным функциям.

Briantom

June 5, 2025 at 3:16 am

підробіток для дівчат у Польщі Стань вебкам моделью в польской студии, работающей в Варшаве! Открыты вакансии для девушек в Польше, особенно для тех, кто говорит по-русски. Ищешь способ заработать онлайн в Польше? Предлагаем подработку для девушек в Варшаве с возможностью работы в интернете, даже с проживанием. Рассматриваешь удаленную работу в Польше? Узнай, как стать вебкам моделью и сколько можно заработать. Работа для украинок в Варшаве и высокооплачиваемые возможности для девушек в Польше ждут тебя. Мы предлагаем легальную вебкам работу в Польше, онлайн работа без необходимости знания польского языка. Приглашаем девушек без опыта в Варшаве в нашу вебкам студию с обучением. Возможность заработка в интернете без вложений. Работа моделью онлайн в Польше — это шанс для тебя! Ищешь “praca dla dziewczyn online”, “praca webcam Polska”, “praca modelka online” или “zarabianie przez internet dla kobiet”? Наше “agencja webcam Warszawa” и “webcam studio Polska” предлагают “praca dla mlodych kobiet Warszawa” и “legalna praca online Polska”. Смотри “oferty pracy dla Ukrainek w Polsce” и “praca z domu dla dziewczyn”.

Thomaserefe

June 5, 2025 at 7:29 am

дебетовая карта сбербанка Ваш надежный помощник в ориентировании в мире банковских карт. Оформление современной дебетовой карты стало простым и удобным благодаря нашей платформе. Выберите карту, соответствующую вашим потребностям, и воспользуйтесь всеми преимуществами современного финансового обслуживания. Что мы предлагаем? Практические советы: Лайфхаки и рекомендации по эффективному использованию карты. Актуальные акции: Будьте в курсе всех новых предложений и специальных условий от банков-партнеров. Преимущества нашего сообщества. Мы предоставляем полную информацию о различных видах карт, особенностях тарифов и комиссий. Наши публикации регулярно обновляются, предоставляя актуальные данные и свежие новости о продуктах российских банков. Присоединяйтесь к нашему сообществу, чтобы сделать ваши финансовые решения простыми, быстрыми и надежными. Вместе мы сможем оптимизировать использование банковских продуктов и сэкономить ваше время и средства. Наша цель — помогать вам эффективно управлять своими финансами и получать максимум выгоды от каждого взаимодействия с банком.

Briantom

June 5, 2025 at 5:47 pm

легальная вебкам работа в Польше Стань вебкам моделью в польской студии, работающей в Варшаве! Открыты вакансии для девушек в Польше, особенно для тех, кто говорит по-русски. Ищешь способ заработать онлайн в Польше? Предлагаем подработку для девушек в Варшаве с возможностью работы в интернете, даже с проживанием. Рассматриваешь удаленную работу в Польше? Узнай, как стать вебкам моделью и сколько можно заработать. Работа для украинок в Варшаве и высокооплачиваемые возможности для девушек в Польше ждут тебя. Мы предлагаем легальную вебкам работу в Польше, онлайн работа без необходимости знания польского языка. Приглашаем девушек без опыта в Варшаве в нашу вебкам студию с обучением. Возможность заработка в интернете без вложений. Работа моделью онлайн в Польше — это шанс для тебя! Ищешь “praca dla dziewczyn online”, “praca webcam Polska”, “praca modelka online” или “zarabianie przez internet dla kobiet”? Наше “agencja webcam Warszawa” и “webcam studio Polska” предлагают “praca dla mlodych kobiet Warszawa” и “legalna praca online Polska”. Смотри “oferty pracy dla Ukrainek w Polsce” и “praca z domu dla dziewczyn”.

Thomaserefe

June 6, 2025 at 8:45 am

мощный ПК на заказ Компьютер для стрима: Высокое качество трансляций Компьютер для стрима должен обеспечивать стабильную работу во время трансляций, высокое качество изображения и звука. Сборка компьютера на заказ позволяет выбрать компоненты, способные справиться с этими задачами.

Davidwap

June 7, 2025 at 4:13 pm

заказать сборку ПК

PercyWal

June 7, 2025 at 6:06 pm

¡Saludos entusiastas de las emociones !

Casinoonlinefueradeespana.xyz destaca por ofrecer soporte en varios idiomas, incluyendo atenciГіn personalizada en espaГ±ol. Puedes contactar con un agente en cualquier momento sin largas esperas. Esta accesibilidad mejora notablemente la experiencia del usuario.

Los mГ©todos de pago incluyen criptomonedas, monederos electrГіnicos y transferencias anГіnimas. Esta variedad es una de las ventajas principales de los casinos fuera de espaГ±a.

GuГa prГЎctica para nuevos jugadores en casinos online fuera de espaГ±a – п»їhttp://casinoonlinefueradeespana.xyz/

¡Que disfrutes de increíbles conquistas destacadas !

Manuelliemo

June 8, 2025 at 12:22 am

температура воды красное море

Ismaelnit

June 8, 2025 at 5:07 pm

Hello mates, its great post about educationand completely explained, keep it up all the time.

hafilat bus timing

Brianlek

June 9, 2025 at 9:49 am

кайт блага Кайтсерфинг в Анапе – это приключение, которое запомнится на всю жизнь.

RobertAvela

June 10, 2025 at 4:20 pm

¡Saludos, aventureros del ocio !

Los tГtulos incluyen tragamonedas, juegos de mesa y apuestas deportivas.Las condiciones son claras desde el inicio.

Casinos fuera de espaГ±a para apuestas deportivas y casino – https://www.casinoporfuera.xyz/#

Casinoporfuera es una opciГіn ideal para quienes quieren evitar bloqueos por parte de operadores nacionales.No necesitas cambiar tu residencia ni engaГ±ar al sistema.La libertad es total desde cualquier regiГіn.

¡Que disfrutes de increíbles beneficios !

Michaeltut

June 10, 2025 at 7:47 pm

¡Bienvenidos, aventureros del juego !

Jugar en casinosonlinefuera.xyz te da acceso a miles de juegos que no estГЎn disponibles en sitios regulados por la DGOJ. Cada partida se carga rГЎpido y sin complicaciones. AdemГЎs, los bonos suelen ser mГЎs generosos y fГЎciles de liberar. [url=https://casinosonlinefuera.xyz/#]casino fuera de espaГ±a[/url]

Casino fuera de EspaГ±a СЃ bonos para nuevos usuarios – п»їhttps://casinosonlinefuera.xyz/

Un casino online fuera de espaГ±a brinda acceso a juegos exclusivos que no se encuentran en sitios regulados por la DGOJ. Los jugadores de casino online fuera de espaГ±a disfrutan de apuestas sin lГmites y sin verificaciones molestas. La seguridad en casino online fuera de espaГ±a estГЎ garantizada mediante cifrado y protocolos avanzados.

¡Que tengas maravillosas partidas emocionantes !

StephenNah

June 10, 2025 at 8:33 pm

Wow, awesome blog layout! How long have you been blogging for? you made blogging look easy. The overall look of your web site is great, let alone the content!

how to check balance in hafilat card

Brianlaf

June 13, 2025 at 7:53 pm

¡Bienvenidos, exploradores de desafíos !

Los casinos sin licencia ofrecen una variedad de juegos internacionales que no estГЎn disponibles en sitios espaГ±oles. Esto incluye tragamonedas, blackjack y ruletas con temГЎticas novedosas. TambiГ©n tienen RTP mГЎs altos que la media.

Algunos casinos no regulados ofrecen torneos semanales con ranking de jugadores. casinos sin licencia en espaГ±a motivan la competencia sana. Puedes ganar premios extra fГЎcilmente.

Casino sin licencia con pagos rГЎpidos y soporte confiable – п»їmejorescasinosonlinesinlicencia.es

¡Que disfrutes de sesiones inolvidables !

ShaneHonee

June 13, 2025 at 10:46 pm

As the admin of this web page is working, no question very quickly it will be famous, due to its quality contents.

Secure, fun, and rewarding — visit ck222 casino today.

CharlesWhect

June 15, 2025 at 4:19 am

¡Saludos, participantes del juego !

п»їMuchos casinos online extranjeros permiten configurar alertas de saldo para controlar mejor tu presupuesto. [url=п»їhttps://casinosextranjerosespana.es/]mejores casinos online extranjeros[/url] Esta funciГіn ayuda a mantener un juego responsable. AdemГЎs, no interfiere con tu experiencia de usuario.

Juegos rГЎpidos en tu casino online extranjero – п»їhttps://casinosextranjerosespana.es/

En los mejores casinos online extranjeros, las apuestas deportivas incluyen ligas y deportes no cubiertos por sitios locales. Hay mГЎs opciones para todos los gustos. La variedad es notable.

¡Que experimentes increíbles recompensas excepcionales !

Dustinadato

June 15, 2025 at 3:52 pm

¡Bienvenidos, usuarios de portales de apuestas !

Casinos no regulados sin restricciones geogrГЎficas – https://liquitex.es/ casino sin licencia espaГ±a

¡Que disfrutes de conquistas memorables !

Timothyzew

June 15, 2025 at 10:14 pm

¡Saludos, amantes de la adrenalina !

Casino sin licencia sin lГmite de retiro – п»їcasinossinlicenciaenespana.es https://www.casinossinlicenciaenespana.es/

¡Que vivas sesiones inolvidables !

HenryLox

June 15, 2025 at 11:55 pm

¡Hola, amantes de la emoción !

Casinoextranjerosespana.es: entra, juega y gana sin KYC – https://www.casinoextranjerosespana.es/# casinos extranjeros

¡Que disfrutes de asombrosas momentos memorables !

Earnestfredo

June 16, 2025 at 10:14 pm

Just desire to say your article is as surprising. The clearness in your post is simply cool and i can assume you are an expert on this subject. Fine with your permission let me to grab your RSS feed to keep up to date with forthcoming post. Thanks a million and please keep up the rewarding work.

Fair gaming starts now on 88fb

RichardMyday

June 17, 2025 at 1:59 pm

¡Saludos, cazadores de fortuna !

Mejores casinos online extranjeros sin documentaciГіn – https://www.casinosextranjerosenespana.es/# mejores casinos online extranjeros

¡Que vivas increíbles victorias épicas !

ThomasTib

June 18, 2025 at 7:33 am

¡Saludos, aficionados a los desafíos!

Servicio al cliente en casinoextranjerosenespana.es – https://www.casinoextranjerosenespana.es/ mejores casinos online extranjeros

¡Que disfrutes de recompensas increíbles !

DouglasMob

June 18, 2025 at 8:06 am

¡Hola, fanáticos del riesgo !

Descubre casinos fuera de EspaГ±a para jugar seguro – п»їп»їhttps://casinoonlinefueradeespanol.xyz/ casinoonlinefueradeespanol.xyz

¡Que disfrutes de asombrosas premios extraordinarios !

Jamesduale

June 18, 2025 at 3:21 pm

¡Saludos, apostadores entusiastas !

casinosextranjero.es – juega en minutos – https://casinosextranjero.es/# mejores casinos online extranjeros

¡Que vivas increíbles victorias épicas !

StephenNah

June 19, 2025 at 12:09 am

It’s awesome in support of me to have a web page, which is useful for my experience. thanks admin

Ranked as a top site in Bangladesh, 88fb bet offers real rewards

DavidDon

June 19, 2025 at 12:42 am

This article explains why sometimes “messages don’t go through” in WhatsApp – locally searched as [url=https://faunazoo.ru/pgs/?pochemu_soobsheniya_v_whatsapp_ne_otpravlyautsya_i_kak_eto_meshaet_nahodit_klientov_v_sfere_nedvizghimosti.html]почему в ватсапе не отправляются смс[/url]

DavidCat

June 20, 2025 at 1:05 am

¡Bienvenidos, apostadores dedicados !

Casino fuera de EspaГ±a con promociones activas – п»їhttps://casinoporfuera.guru/ п»їcasino fuera de espaГ±a

¡Que disfrutes de maravillosas movidas brillantes !

SonnyMew

June 20, 2025 at 5:39 pm

¡Hola, entusiastas de la emoción !

Mejores casinos online extranjeros sin comisiones – https://www.casinoextranjero.es/# п»їcasinos online extranjeros

¡Que vivas rondas emocionantes !

NathanTup

June 20, 2025 at 7:17 pm

кайтсерфинг хургада школа мухафаза Кайт школа Анапа предлагает обучение кайтингу на Черном море. Здесь работают опытные инструкторы, которые помогут вам освоить все тонкости кайтинга и насладиться катанием.

DichaelSlaph

June 21, 2025 at 12:29 am

What’s up everyone, it’s my first go to see at this web page, and article is genuinely fruitful in support of me, keep up posting these types of articles.

Weapon

LhaneHonee

June 21, 2025 at 7:04 am

Aw, this was an exceptionally good post. Taking the time and actual effort to create a superb article… but what can I say… I put things off a lot and don’t seem to get anything done.

Weapon

Jamesloorn

June 22, 2025 at 2:33 am

¡Saludos, descubridores de tesoros!

casino fuera de EspaГ±a para usuarios espaГ±oles – https://www.casinosonlinefueraespanol.xyz/ casinos online fuera de espaГ±a

¡Que disfrutes de movidas extraordinarias !

Ramonbut

June 22, 2025 at 3:51 pm

¡Hola, seguidores de la aventura !

Juegos innovadores en casinos extranjeros online – п»їhttps://casinosextranjerosdeespana.es/ casino online extranjero

¡Que vivas increíbles jugadas espectaculares !

LhaneHonee

June 22, 2025 at 10:36 pm

Appreciating the persistence you put into your site and in depth information you provide. It’s great to come across a blog every once in a while that isn’t the same out of date rehashed material. Excellent read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

tadalafil pensa 5 mg 28 compresse prezzo

Michaelcex

June 23, 2025 at 3:25 am

штора для ванны Шторы ночь – это плотные шторы, которые обеспечивают полную темноту в комнате. Шторы день

Williebuisk

June 23, 2025 at 10:15 am

авто в аренду краснодар Прокат авто без залога: Начните свою поездку без лишних финансовых обременений. Просто, быстро и удобно!

RogerSmene

June 23, 2025 at 11:31 am

Потолочные натяжные потолки Потолочные натяжные потолки – это универсальное решение для создания ровного и красивого потолка в любом помещении. Натяжной потолок с установкой цена

Angelced

June 23, 2025 at 1:17 pm

аккаунты warface Акк Warface – это ваш цифровой идентификатор в мире Warface, отражающий ваш прогресс и достижения. Варфейс

Antoinesen

June 23, 2025 at 4:23 pm

Бездепозитный бонус Бездепозитный бонус – это не просто подарок судьбы, а возможность испытать свои силы и понять, как работают различные игры. Это как виртуальный тренажер, который позволяет набраться опыта и разработать собственную стратегию, прежде чем переходить к игре на реальные деньги. Это шанс стать уверенным игроком, не боясь потерять собственные средства. Бездепозитный бонус в казино

WilliamAnnek

June 23, 2025 at 5:38 pm

¡Saludos, apostadores habilidosos !

Casinoextranjerosdeespana.es – RegГstrate hoy gratis – п»їhttps://casinoextranjerosdeespana.es/ п»їcasinos online extranjeros

¡Que experimentes maravillosas movidas impresionantes !

Antoinesen

June 24, 2025 at 10:56 am

в каком казино дают деньги за регистрацию без депозита Принимая бездепозитный бонус, важно внимательно изучить условия его отыгрыша. Вейджер, сроки действия и ограничения по играм – все эти факторы могут существенно повлиять на возможность вывода выигрыша. Тщательное изучение правил поможет избежать разочарований и максимально эффективно использовать бонус. Бездепозитные бонусы казино без пополнения с отыгрышем

BobbyCycle

June 24, 2025 at 11:44 am

?Hola, cazadores de tesoros !

Mejores casinos fuera de EspaГ±a con juegos de mesa – https://casinosonlinefueradeespanol.xyz/# casino online fuera de espaГ±a

?Que disfrutes de asombrosas recompensas unicas !

Lewiscic

June 24, 2025 at 12:49 pm

Hey I know this is off topic but I was wondering if you knew of any widgets I could add to my blog that automatically tweet my newest twitter updates. I’ve been looking for a plug-in like this for quite some time and was hoping maybe you would have some experience with something like this. Please let me know if you run into anything. I truly enjoy reading your blog and I look forward to your new updates.

https://vedanta.dp.ua/chomu-vazhlyvo-pravylno-pidibraty-klej-dlya-f.html

Bruceignor

June 25, 2025 at 9:26 am

заказать пионы в москве Пионы Москва: Символ роскоши, расцветающий в каменных джунглях. Откройте для себя чарующий мир пионов, где каждый бутон – это воплощение изящества и элегантности. Мы предлагаем широкий ассортимент пионов различных сортов и оттенков, чтобы удовлетворить самый взыскательный вкус. Преобразите свой дом или офис, наполнив пространство ароматом весны и создав атмосферу уюта и гармонии. Пионы – это идеальный способ выразить свою любовь, благодарность и уважение, подарив близким незабываемые эмоции.

RudolphCooda

June 25, 2025 at 1:17 pm

скачать игры с облака mail Наслаждайтесь играми без ограничений, используя прямые ссылки и облачные хранилища.

RaymondRom

June 25, 2025 at 3:40 pm

¡Hola, seguidores del entretenimiento !

Casinos sin registro para jugar sin verificaciones – п»їhttps://casinosinlicenciaespana.xyz/ casino sin licencia en espaГ±a

¡Que vivas increíbles jackpots impresionantes!

Timothymoing

June 25, 2025 at 11:13 pm

Hello guardians of breathable serenity!

Smoke Purifier – HEPA Tech for Superior Results – http://bestairpurifierforcigarettesmoke.guru/# п»їbest air purifier for cigarette smoke

May you experience remarkable fresh inhales !

FrankCible

June 26, 2025 at 11:09 pm

Когда я увидел этот сайт, впечатление было таким, будто я отправился в путешествие. Здесь каждый спин — это не просто волнение, а история, которую ты открываешь с каждым движением.

Интерфейс интуитивен, словно легкое прикосновение направляет тебя от выбора к выбору. Транзакции, будь то пополнения или вывод средств, проходят быстро, как поток воды, и это завораживает. А служба помощи всегда готова подхватить, как верный помощник, который никогда не оставит.

Для меня [url=https://casino-igrat-selector.in/]Селектор[/url] стал местом, где удовольствие и смысл сплетаются. Здесь каждый момент — это часть пути, которую хочется создавать снова и снова.

Antoinesen

June 27, 2025 at 1:40 am

Бездепозитный бонус Бездепозитные бонусы

Milesfek

June 27, 2025 at 6:24 pm

¡Bienvenidos, participantes de retos emocionantes !

Casino online sin registro 100% anГіnimo – https://mejores-casinosespana.es/# mejores casinos sin licencia en espaГ±a

¡Que experimentes maravillosas botes extraordinarios!

BernardBap

June 27, 2025 at 6:52 pm

выездной ремонт посудомоек алматы Ремонт холодильников 24/7 Алматы: Круглосуточный ремонт холодильников.

Antoinesen

June 28, 2025 at 12:14 am

вавада казино официальный рабочее зеркало на сегодняшний день Вавада казино открывает двери в мир азарта и возможностей, предлагая пользователям прямой доступ к обширной коллекции игр и захватывающим бонусам. Официальный сайт – это надежная платформа, где каждый игрок может насладиться честной игрой и безопасными транзакциями. Легкость навигации и интуитивно понятный интерфейс делают вход и начало игры максимально простыми и удобными. Vavada Casino Скачать

GeorgeAbage

June 28, 2025 at 5:08 am

купить bmw Купить Ауди: Современные технологии и изысканный дизайн Audi – это бренд, известный своими современными технологиями, изысканным дизайном и высоким уровнем комфорта.

RichardHiZ

June 28, 2025 at 10:46 am

physics joke shirt Scientifically speaking, a bird on a power line has no voltage difference – it doesn’t get zapped. Our “Why Don’t Birds Get Electrocuted?” collection by singer-designer Alesya G celebrates this fun fact. These witty science-art shirts and accessories are perfect gifts for bird lovers and wine enthusiasts. Discover funny science t-shirts and bird lover gifts on Etsy. Shop humor-inspired tees, posters, and more now!

PatrickGor

June 29, 2025 at 5:22 am

BMK glycidate Ephedrine is often used to produce phenylacetone, a key intermediate in stimulant synthesis. From phenylacetone, substances like methylone, mephedrone (4-MMC), and 3-CMC can be made using methylamine. Phenylnitropropene, derived from nitroethane, is another precursor. A-PVP and 4-methylpropiophenone are also widely used in synthetic drug production. BMK glycidate is commonly used to synthesize controlled substances.

Davidrip

June 29, 2025 at 7:26 am

Асфальтировка

Davidthimi

June 29, 2025 at 7:59 am

https://2-bs2best.art/blaksprut_ssylka.html

CarlosLax

June 29, 2025 at 8:40 am

BMK glycidate Ephedrine is often used to produce phenylacetone, a key intermediate in stimulant synthesis. From phenylacetone, substances like methylone, mephedrone (4-MMC), and 3-CMC can be made using methylamine. Phenylnitropropene, derived from nitroethane, is another precursor. A-PVP and 4-methylpropiophenone are also widely used in synthetic drug production. BMK glycidate is commonly used to synthesize controlled substances.

Davidthimi

June 29, 2025 at 6:30 pm

https://2bs-2best.at/bs2best_at.html

CharlesWraph

June 29, 2025 at 6:48 pm

¡Hola, amantes de la emoción y el entretenimiento !

Casino sin licencia en EspaГ±a con soporte en espaГ±ol – п»їcasinosonlinesinlicencia.es casino sin registro

¡Que vivas increíbles recompensas extraordinarias !

Davidthimi

June 30, 2025 at 3:35 am

https://bs2tcite4.io

Antoinesen

June 30, 2025 at 8:47 am

Бездепозитный бонус Бездепозитный бонус – это не просто бесплатные деньги, а ценный инструмент для обучения и тестирования. Это возможность примерить на себя роль профессионального игрока, изучить тонкости различных игр и понять, какие из них приносят наибольшее удовольствие и прибыль. Это шанс стать более уверенным и опытным игроком, готовым к игре на реальные деньги. Это инвестиция в себя и свои навыки, которая может окупиться многократно. Бездепозитный бонус в казино

Davidthimi

June 30, 2025 at 11:57 am

https://b2tsite4.io/blaksprut_ssylka.html

Philliphow

July 1, 2025 at 5:26 am

секс знакомства макеевка Секс знакомства Донецк: Найди свою страсть онлайн В эпоху цифровых технологий, онлайн-знакомства стали популярным способом найти партнера для секса в Донецке. Множество сайтов и приложений предлагают платформы для людей, ищущих интимные встречи без обязательств.

Danielomiff

July 1, 2025 at 11:41 am

uj kaszinok

Davidthimi

July 1, 2025 at 11:44 am

https://2-bs2best.art/bs2web_at.html

Davidthimi

July 1, 2025 at 8:56 pm

https://2bs-2best.at/bs2best.html

Antoinesen

July 2, 2025 at 3:27 am

1000 рублей за регистрацию вывод сразу без вложений в казино Бездепозитный бонус в размере 1000 рублей с моментальным выводом – это редкая и ценная находка для азартных игроков. Она позволяет начать игру, не вкладывая собственные средства, и сразу же вывести выигрыш, если повезет. 1000 рублей за регистрацию вывод сразу без вложений

Terrywef

July 2, 2025 at 5:45 am

психиатрическая клиника Психиатрическая клиника. Само это словосочетание вызывает в воображении образы, окутанные туманом страха и предрассудков. Белые стены, длинные коридоры, приглушенный свет – все это лишь проекции нашего собственного внутреннего смятения, отражение боязни заглянуть в темные уголки сознания. Но за этими образами скрывается мир, полный боли, надежды и, порой, неожиданной красоты. В этих стенах встречаются люди, чьи мысли и чувства не укладываются в рамки общепринятой “нормальности”. Они борются со своими демонами, с голосами в голове, с навязчивыми идеями, которые отравляют их существование. Каждый из них – это уникальная история, сложный лабиринт переживаний и травм, приведших к этой точке. Здесь работают люди, посвятившие себя помощи тем, кто оказался на краю. Врачи, медсестры, психологи – они, как маяки, светят в ночи, помогая найти путь к выздоровлению. Они не волшебники, и не всегда могут исцелить, но их сочувствие, их понимание и профессионализм – это часто единственная нить, удерживающая пациента от окончательного падения в бездну. Жизнь в психиатрической клинике – это не заточение, а скорее передышка. Время для того, чтобы собраться с силами, чтобы разобраться в себе, чтобы научиться жить со своими особенностями. Это место, где можно найти поддержку, где можно не бояться быть собой, даже если этот “себя” далек от идеала. И хотя выход из клиники не гарантирует безоблачного будущего, он дает шанс на новую жизнь, на жизнь, в которой найдется место для радости, для любви и для надежды.

Davidthimi

July 2, 2025 at 9:28 am

https://b2shop.gl/blacksprut_bs2best.html

Davidthimi

July 2, 2025 at 6:21 pm

https://a-bsme.at/index.html

Stevenboogy

July 2, 2025 at 6:48 pm

Greetings, explorers of unique punchlines !

Adult jokes to crack up your friends – п»їhttps://jokesforadults.guru/ jokes for adults

May you enjoy incredible side-splitting jokes !

Perrydycle

July 2, 2025 at 8:27 pm

¡Saludos, apostadores talentosos !

Casinos con bonos de bienvenida y juegos en vivo – https://bono.sindepositoespana.guru/ bono casino espaГ±a

¡Que disfrutes de asombrosas momentos irrepetibles !

Tommylaf

July 3, 2025 at 8:09 am

рулонные шторы на окна Какие шторы выбрать — вопрос индивидуальный и зависит от предпочтений, особенностей помещения и бюджета. Популярны классические ткани, легкие тюлевые модели и современные рулонные или римские шторы. Важно учитывать, как они будут сочетаться с остальным интерьером.

XRumer23taize

July 3, 2025 at 8:19 pm

Ставки онлайн Фрибеты за регистрацию – отличный шанс начать делать ставки без риска для собственных средств. Многие букмекеры предлагают приветственные бонусы новым игрокам, позволяя опробовать различные стратегии и рынки.

Charlescrend

July 4, 2025 at 10:34 am

стоимость pr услуг Услуги маркетолога – это комплекс действий, направленных на увеличение прибыли компании. Сюда входит анализ рынка, разработка стратегии продвижения, выбор каналов коммуникации с целевой аудиторией и оценка эффективности проведенных мероприятий. Маркетолог помогает бизнесу найти свою нишу и выстроить прочные отношения с клиентами.

VictorGonee

July 4, 2025 at 11:26 am

гибкая керамика для фасадов купить Гибкая керамика цена за 1 м2 и ассортимент цветовых решений позволяют подобрать оптимальный вариант под любой проект.

Josephbaf

July 4, 2025 at 11:43 pm

купить игровой ПК Готовые компьютеры купить – это быстрый способ получить надежную систему, собранную профессионалами. Широкий ассортимент моделей позволяет подобрать оптимальный вариант для любых задач.

Jamesswiff

July 5, 2025 at 3:49 am

нейрохаки Генерация текста: Принципы и методы генерации текста с помощью нейросетей. Анализ качества и возможности редактирования.

AnthonyceR

July 6, 2025 at 3:50 am

Как вылечить горло Целитель онлайн – современная форма целительства, позволяющая получить помощь и консультацию, не выходя из дома. Онлайн-целители используют различные методы, такие как энергетическое воздействие, дистанционное консультирование и обучение.

Andrewduh

July 6, 2025 at 11:42 am

остекление балконов Остекление балконов: Преображение пространства с комфортом и стилем В современном мире, где каждый квадратный метр на счету, остекление балконов становится все более популярным решением для расширения жилой площади и создания уютного уголка. Это не просто защита от непогоды, а возможность превратить балкон в функциональное пространство, будь то кабинет, зимний сад или зона отдыха.

Gregoryidiog

July 6, 2025 at 10:17 pm

free hwid spoofer Преимущества использования Spoofer HWID: Обход банов и защита

Ismaelnit

July 7, 2025 at 8:13 pm

Greetings! This is my first comment here so I just wanted to give a quick shout out and tell you I really enjoy reading your posts. Can you suggest any other blogs/websites/forums that cover the same subjects? Thanks for your time!

https://technolex.com.ua/porady-vid-majstra-sklo-fary-yak-vybyraty-pra.html

RobertSlabe

July 8, 2025 at 2:38 am

cours de theatre Centre de formation theatrale

FrancisKalia

July 8, 2025 at 9:50 am

https://www.google.com/maps/place/Строй+Дом+36+-+строительство+домов+в+Воронеже,+ул.+Беговая,+225+Б,+оф.+8,+Воронеж,+Воронежская+обл.,+394016/@51.6958965,39.1314608,17z/data=!4m6!3m5!1s0x413b2edffe74b21f:0x24fae991ab80e36e!8m2!3d51.6958965!4d39.1314608!16s%2Fg%2F11ddzkkjnm?source=lnms&utm_campaign=ml-ardl&g_ep=Eg1tbF8yMDI1MDYzMF8wIJvbDyoASAJQAQ%3D%3D Как выбрать надежные пластиковые окна для дома

LhaneHonee

July 8, 2025 at 1:54 pm

Hi, everything is going well here and ofcourse every one is sharing facts, that’s in fact fine, keep up writing.

https://nikopolservice.com.ua/pislya-myttya-zyavylysya-mikrotrishchyny-na-s.html

DavidHef

July 8, 2025 at 3:04 pm

работа военным Работа военным – это служение Родине, защита ее интересов и обеспечение безопасности граждан. Это призвание, требующее от человека мужества, отваги, дисциплины и готовности к самопожертвованию.

GeraldGib

July 9, 2025 at 1:53 am

психолог для женщин Психолог для женщин: Специализированная помощь в решении женских проблем и вопросов. Поддержка и понимание в деликатных ситуациях.

Charlesnut

July 9, 2025 at 7:39 am

Районы Питера Как вылечить горло

Willardphony

July 9, 2025 at 3:59 pm

Эфирные масла и медитация: как достичь гармонии Как эфирные масла могут помочь в личностном росте: Раскройте свой потенциал и достигните новых вершин с помощью эфирных масел, стимулирующих самоанализ и личностное развитие.

LhaneHonee

July 9, 2025 at 4:56 pm

Thank you for sharing your info. I truly appreciate your efforts and I will be waiting for your further write ups thanks once again.

Town car near me

RafaelVaf

July 9, 2025 at 5:02 pm

Грузоперевозки Луганск Грузоперевозки Луганск: Доставка строительных материалов на объекты. Своевременная подача транспорта, различные типы кузовов, конкурентные цены. Обеспечиваем бесперебойную работу вашего строительства.

StevenMal

July 10, 2025 at 6:46 am

макрос для warface Устали от отдачи в Warface? Попробуйте макросы на варфейс блади! Это простой способ улучшить свою стрельбу и стать настоящим профи. Получите преимущество в игре прямо сейчас!

Thomasbuh

July 10, 2025 at 1:39 pm

карниз для штор купить в пятигорске Шторы Оптом Пятигорск: Выгодное Предложение для Бизнеса Для оптовых покупателей в Пятигорске предлагаются выгодные условия на приобретение штор. Многие компании сотрудничают с оптовыми клиентами, предлагая широкий ассортимент продукции и гибкую систему скидок.

WilliamJak

July 11, 2025 at 7:31 am

Служба по контракту Служба по контракту: гарантия обеспечения жильем, медобслуживание на высшем уровне и страхование жизни

AlvaroPeday

July 11, 2025 at 11:08 am

Darknet Marketplace Bazaar Drugs Marketplace: A New Darknet Platform with Dual Access Bazaar Drugs Marketplace is a new darknet marketplace rapidly gaining popularity among users interested in purchasing pharmaceuticals. Trading is conducted via the Tor Network, ensuring a high level of privacy and data protection. However, what sets this platform apart is its dual access: it is available both through an onion domain and a standard clearnet website, making it more convenient and visible compared to competitors. The marketplace offers a wide range of pharmaceuticals, including amphetamines, ketamine, cannabis, as well as prescription drugs such as alprazolam and diazepam. This variety appeals to both beginners and experienced buyers. All transactions on the platform are carried out using cryptocurrency payments, ensuring anonymity and security. In summary, Bazaar represents a modern darknet marketplace that combines convenience, a broad product selection, and a high level of privacy, making it a notable player in the darknet economy.

Eddiegalry

July 11, 2025 at 11:49 am

мистическое история бесплатно Самое мистическое – это то, что остается за гранью нашего понимания и заставляет нас верить в существование чего-то большего, чем мы можем себе представить.

JulianFok

July 11, 2025 at 5:02 pm

военная служба по контракту Военнослужащие по контракту: элита российской армии, гаранты безопасности

KerryMerge

July 11, 2025 at 6:00 pm

Greetings, sharp jokesters !

There’s always a new adult joke waiting to go viral. All it takes is a twist, a truth, or an unexpected turn. That’s how modern classics are born.

funny jokes for adults is always a reliable source of laughter in every situation. [url=https://adultjokesclean.guru/]adultjokesclean[/url] They lighten even the dullest conversations. You’ll be glad you remembered it.

NSFW fun: funny dirty jokes for adults to Share – п»їhttps://adultjokesclean.guru/ hilarious jokes for adults

May you enjoy incredible unexpected punchlines!

Jamzodrex

July 11, 2025 at 6:36 pm

Aproveite o melhor horário para jogar fortune tiger de madrugada e ganhe!

GeorgeRok

July 12, 2025 at 10:11 am

Если ищете рабочее зеркало Vavada с бонусами — загляните сюда. [url=https://malamarkethtx.com/]vavada автоматы и слоты казино обзор казино vavada вывод[/url]

Ramonfrads

July 12, 2025 at 10:16 pm

кайт хургада Кайт Египет: Лучшие места для кайтсерфинга! Хургада, Эль-Гуна, Дахаб – выбирай свое направление!

accounts_tievism

July 13, 2025 at 6:59 am

buy ad account facebook account trading platform secure account sales

RobertShoog

July 13, 2025 at 12:26 pm

приемка квартир от застройщика Выгодная аренда строительного пылесоса – чистота и порядок на стройплощадке.

JamesNes

July 13, 2025 at 1:30 pm

продать таблетки с рук Как продать лекарства: Легальные и безопасные способы В современном мире, когда затраты на лекарства постоянно растут, вопрос о том, как продать неиспользованные или оставшиеся после лечения препараты, становится все более актуальным. Однако, важно помнить, что продажа лекарств регулируется законом, и несоблюдение правил может привести к серьезным последствиям. Легальные пути продажи лекарств: Возврат в аптеку: Некоторые аптеки принимают обратно неиспользованные лекарства, особенно если они в оригинальной упаковке и срок годности не истек. Уточните эту возможность в вашей аптеке. Благотворительные организации: Узнайте, есть ли в вашем регионе благотворительные организации, которые принимают лекарства для нуждающихся. Важно, чтобы препараты были в надлежащем состоянии и с действующим сроком годности. Утилизация: Если лекарства не подлежат возврату или передаче, их необходимо правильно утилизировать. Обратитесь в аптеку или медицинское учреждение для получения информации о правилах утилизации лекарственных отходов. Продажа лекарств через интернет и с рук: Продажа лекарств через интернет и с рук в большинстве стран запрещена и преследуется по закону. Это связано с рисками, связанными с подделкой лекарств, неправильным хранением и транспортировкой, а также отсутствием контроля за качеством препаратов. Альтернативные способы: Консультация с врачом: Если у вас остались лекарства после лечения, проконсультируйтесь с врачом о возможности их дальнейшего использования или корректировки дозы. Информирование близких: Расскажите своим близким и друзьям о наличии у вас неиспользованных лекарств. Возможно, кому-то из них они пригодятся. Важно помнить: Не продавайте лекарства, если не уверены в их качестве и подлинности. Не покупайте лекарства с рук или через непроверенные интернет-источники. Соблюдайте правила хранения и утилизации лекарств.

RussellAcede

July 13, 2025 at 11:16 pm

Химчистка мебели ростов Удаление пятен с мебели в Ростове – профессиональное выведение пятен любой сложности.

CharlesAcind

July 14, 2025 at 12:57 am

Купить профилированный лист Винтовые сваи: надежное основание для любого проекта Винтовые сваи – это современное и эффективное решение для строительства фундамента. Они идеально подходят для сложных грунтов, участков с уклоном и местностей с высоким уровнем грунтовых вод. Быстрый монтаж, минимальное воздействие на окружающую среду и возможность повторного использования делают их оптимальным выбором для строительства домов, бань, пирсов и других сооружений.

accounts_tievism

July 14, 2025 at 5:22 am

buy facebook ad accounts account exchange buy pre-made account

GeorgeJag

July 14, 2025 at 1:07 pm