Articles

Quibi : Startup With A Billion Dollar Launch To Shutting Down All In Six Months

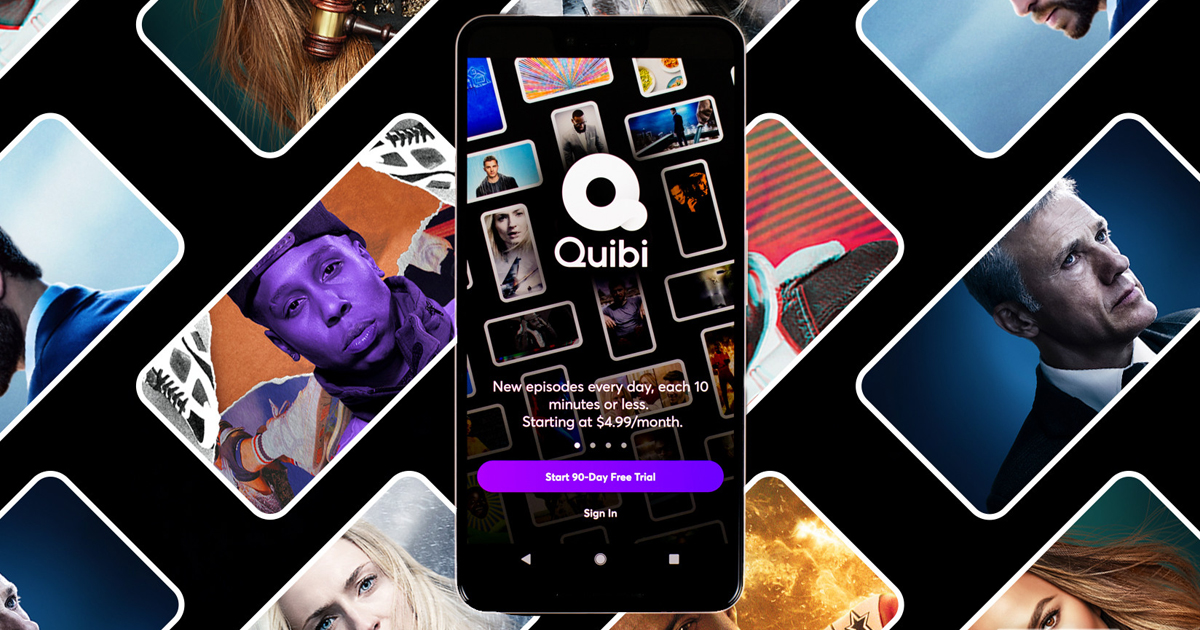

While we see many startups doing exciting things, one should not forget the world of entrepreneurship is riddled with more failures than successes. Hundreds of startups go bust without even making a mark every month while some go on to make a mark and go into oblivion once the consumer no longer needs their business model or products. However, Quibi, short for quick bites, definitely takes the cake for going big with a billion dollar launch and shutting down, all of which took place in a span of six months. So how did a billion dollar startup founded by some big names and partners with some of the biggest names in the world end up going bust? Read ahead to find out the interesting story of Quibi.

Beginnings:

Quibi was founded by Dreamworks Animation co founder Jeffery Katzenberg and former Hewlett Packard Chief Executive Officer Meg Whitman, both of whom have deep roots in the technology and Hollywood industries as well as having a wealth of experience running billion dollar corporations. Quibi was launched on April 6th 2020, as a content provider which is delivered in ten minute episodes called Quick Bites on mobile phones. Quibi’s target group was mainly a younger demographic. It is important to remember the fact that the founders decided to launch Quibi in the midst of the COVID-19 pandemic and when the American public were locked in their homes. The founders did not anticipate this act of god to severely derail their entire plans.

Problems:

While the founders decided to go ahead with Quibi, one of the major problems was the content could only be streamed on mobile devices as the resolution was curated for a mobile viewing experience. The subscribers began complaining about not being able to watch the content on the big screen in their homes. It also launched without simple, easy ways to share or meme its shows on social media thereby decreasing the chances of talk being spread by word of mouth. Quibi had a subscription model which began after a 90 day free trial and it cost $4.99 a month with ads and $7.99 a month without ads. The number of subscribers for Quibi did not go according to plan as the numbers fell way below their forecasting and also due to the presence of streaming giants like Netflix, Amazon Prime Video, Disney Plus and HBO Max. Since the pandemic had already begun to cripple employment, subscribers were forced to choose wisely on where to spend their money. There is also YouTube which is free and also has free ‘quick bite’ content meant Quibi’s chances of succeeding were becoming slim.

Jeffery Katzenberg initially hoped Quibi would be immune to the pandemic’s effect as people would want to consume more content. However, he later went on to blame the COVID-19 pandemic for everything which went wrong with Quibi. In an open letter both Whitman and Katzenberg wrote “Quibi is not succeeding. Likely for one of two reasons: because the idea itself wasn’t strong enough to justify a standalone streaming service or because of our timing. Unfortunately, we will never know but we suspect it’s been a combination of the two (sic.)”

Since the launch of Quibi, the application quickly fell out of the top 50 most downloaded apps within the first week.

Star Studded Signings

Quibi has recruited a who’s who of stars to work on its programming, including Chrissy Teigen, Lebron James, Dwayne Johnson, Reese Witherspoon, Chance the Rapper, Kevin Hart, Jennifer Lopez, Idris Elba, Zac Efron, Tina Fey, Liam Hemsworth, Joe Jonas and Sophie Turner. Some of the biggest names in Hollywood were roped in to make the series and they include Steven Spielberg, Guillermo del Toro, Antoine Fuqua, Catherine Hardwicke and Ridley Scott.

ALSO READ: Most Followed Influencer Accounts On Instagram

Shutdown:

Both Katzenberg and Whitman raised $1.75 billion to tackle the growing digital video market with Quibi. However, due to the mounting pile of problems and the lack of diversity in viewing choices forced Quibi into shutting down and began the process of selling assets. Quibi, which employed 265 people, plans to use its remaining cash of about $350 million to pay back investors. On October 21, 2020, just six months after Quibi’s launch, The Wall Street Journal reported that the streaming service was shutting down. This news was confirmed by the Quibi founders Jeffery Katezenberg and Meg Whitman.

The story of Quibi tells us that no one is immune in the cutthroat world of startups and entrepreneurship. While Quibi set out to take on the content streaming giants, it probably fell to its own Hubris by asking consumers to subscribe for unknown new content over already established content giants like Netfllix, Disney Plus and Amazon Prime Video.

Articles

5 Successful Indian Startups Founded By Women

The workplace has undergone massive changes in the last century. At the turn of the Industrial Revolution, any workplace was dominated by men while the women were delegated to run the homes. However, with the advent of the internet and new and exciting technologies, workplaces have undergone a tectonic shift. Women are no longer comfortable staying at home and are instead opting to lead teams and organisations. As every year passes, we get closer to true gender equality, women have proven time and again that they are equally capable to get the job done if not better in some instances. Names like Wolfe Herd (Bumble founder,) Kylie Jenner (Kylie Cosmetics founder,) Masaba Gupta (Masaba clothing label founder) are just some of the names who are known for leading world famous brands with their unique style of leadership.

As the world celebrates International Women’s Day, we bring to you five women founders who run world famous and successful startups.

1) Upasana Taku-MobiKwik

If you are an Indian and are used to doing online shopping, more often than not at the time of payment, you would be directed to a payment gateway. One of these gateways would normally be MobiKwik. The startup is a well known name in the digital payments and digital wallet space. MobiKwik was founded by Upasana Taku in 2009, who prior to founding MobiKwik used to work with PayPal. Today Upasana Taku is also in charge of bank partnerships, business operations, and talent acquisition at MobiKwik.

2) Richa Kar-Zivame

An enthusiastic MBA student, Richa Kar, developed an online lingerie shopping platform in the year 2011. Currently, Zivame is India’s leading online lingerie store with a valuation of more than $ 100 million. The brilliant idea for her own lingerie business came to light when Richa tracked Victoria’s Secret’s sales, who was one of her clients when she was working at SAP. She observed the lingerie sales figures reached peaks overseas but, Indian women were not provided with the similar innerwear. While Richa was studying the Indian lingerie market, she realized the social embarrassment in India surrounding lingerie shopping. Today Richa Kar could be credited with destigmatising the uneasiness surrounding lingerie shopping in India.

3) Falguna Nayar-Nykaa

After a long stint as an investment banker, Falguni Nayar founded Nykaa.com in the year 2013. An online one stop shop for beauty products from Indian and international brands, Nykaa changed the world of online shopping. Who would have ever thought buying makeup online would be so easy? Falguni Nayar proved many critics wrong and created a brand new place for people who love experimenting with styles, designs and colors.

ALSO READ: Zivame: Founding Story

4) Sabina Chopra-Yatra.com

Yatra.com is a popular Indian website for making flight and hotel bookings. Sabina Chopra was instrumental in identifying the potential for travel commerce in India and people moving towards cheaper or easier travel. By the time, people started looking to make bookings, Sabina made sure Yatra.com was already in place. Sabina was the former Head of India Operations of eBookers, which is also an online travel company based in Europe. Along with this, she was also working with Japan Airlines which further adds to her experience in the travel industry.

5) Rashmi Sinha-SlideShare

SlideShare allows people to upload and access their presentations online. While this feature is presently available everywhere, SlideShare was one of the first players in making this happen. Rashmi Sinha was one of the founders of the presentation sharing platform SlideShare. The company became so successful that in 2012, LinkedIn acquired the company for an amount of $100 million.

Let us know in the comments if you know any other wonderful women who have become leaders of their right or have started up and are doing extraordinary things. We at Startup Stories wish a wonderful Women’s Day to all the women in the world who are changemakers.

Articles

Why Are Ads On Digital Media Failing To Reach The Right Audience?

If you are a regular user of social media platforms and also a fan of consuming content on the digital medium, then there is a very high likelihood that you have seen ads on pages you are reading or watching something. There would be times when you have been targeted by an ad which feels like it was wrongly targeted at you. Imagine if you are a vegetarian by choice and while browsing online, if you are targeted by a food delivery app which shows ads about chicken dishes. The ad would only serve to spoil the mood of the online user instead of serving its actual purpose which is to push the user to buy a chicken dish.

These wrongly targeted ads might be the side effects of performance marketing or a weak brand marketing. Performance marketing means advertising programs where advertisers pay only when a specific action occurs. These actions can include a generated lead, a sale, a click, and more. Inshort, performance marketing is used to create highly targeted ads for a very specific target audience at a low cost. Performance marketing usually means high volume for a very specific cost.

Brand marketers on the other hand believe in narrowly defining target audiences but end up spending a lot of money on ad placements. Gautam Mehra, CEO, Dentsu Programmatic India & CDO, Dentsu International Asia Pacific said, “You’ve defined a persona, you know the emotions you want to elicit, but then you buy a YouTube masthead and CricInfo sponsorships because IPL is up. If brand advertisers look at audience-based buys more deeply than just placements, you will see more relevant ads (sic.)”

ALSO READ: How Digital Marketing Is Impacted Due To The COVID-19 Pandemic

Performance marketing is more of a sales function rather than a marketing function and is about meeting the cost of acquisition. This is a reason why budgets are usually high for performance marketing. Mehra goes on to add, “the fact is that an engineer can out-beat FMCGs on performance marketing. Advertisers who have cracked this are spending 10x and are on an ‘always on’ mode (unlike time-bound brand campaigns.)”

There is always the case of supply and demand, with the supply usually exceeding the demand on digital platforms. Ultimately, it boils down to the choice between no ad versus low relevance ad and it is quite easy to guess that having a low relevance ad is better.

Arvind R. P., Director – Marketing and Communications at McDonald’s India (West and South,) said “McDonalds’ for instance, has seen its share of spends on digital grow from 20% levels a couple of years back to over 40% at present. Outcomes of this journey have been encouraging, proven by our media-mix-modelling and other key metrics. We have seen best results from an optimal mix of Television plus digital (sic.)” Moreover, Arvind also believes performance marketing only approach could turn out to be more suited to short term, versus a more consistent full funnel effort. The latter ensures adequate emphasis on building consideration, as well as growing transactions. Arvind feels digital is a complex medium which needs investment in the right talent who could use the right tools. Brands which underestimate the need for the investment are often disappointed from the return on investment from the digital medium.

With the constantly changing consumer dynamics marketers are now shifting to unscripted marketing which frankly needs more insights into the consumer mindset. The lack of marketers to do the proper research is why digital medium is plagued with irrelevant ads.

Articles

From Unicorn To Bankruptcy; Knotel Bears The Brunt Of COVID-19 Pandemic

It is no secret that in the fast paced world of startups, fortunes can change at the snap of fingers. Sometimes startups tend to scale so quickly that they become unicorns and sometimes the fortunes reverse so quickly that a startup can immediately go bankrupt from being a unicorn. The latter was the case for an American property technology startup Knotel, who are now bankrupt due to the disruptions by the COVID-19 pandemic.

Knotel is a property technology company quite similar to WeWork. Knotel designed, built and ran custom headquarters for companies which It manages the spaces with ‘flexible’ terms. Knotel does a mix of direct leases and revenue sharing deals. Knotel marketed its offering as ‘headquarters as a service’ or a flexible office space which could be customized for each tenant while also growing or shrinking as needed. For the revenue-share agreements, Knotel solicits clients, builds out offices, and manages properties, and shares the rent paid to it by the client with the landlord. This model is the majority revenue generator for Knotel.

In March 2020, just before the COVID-19 pandemic unleashed its economic destruction on the world, Knotel was valued at $ 1.6 billion. What is even more interesting is Knotel raised $ 400 million in Series C funding in August 2019 which led to its unicorn status. However, with the COVId-19 pandemic and its consequent lockdowns and curfews by various governments across the world, startups and businesses shifted to a remote working model. This in turn led to startups pulling out of Knotel properties to cut down on working costs.

ALSO READ: Quibi : Startup With A Billion Dollar Launch To Shutting Down All In Six Months

In late March 2020, according to Forbes, Knotel laid off 30% of its workforce and furloughed another 20%, due to the impact of the coronavirus. It was at this point that Knotel was valued at $ 1.6 billion. The company had started the year with about 500 employees. By the third week of March,Knotel had a headcount of 400. With the cuts, about 200 employees remained with the other 200 having either lost their jobs or on unpaid leave, according to Forbes.

In 2021, Knotel filed for bankruptcy and agreed to sell its assets to Newmark, one of their investors for a total of $ 70 million dollars. As work culture is still undergoing changes as a consequence of the COVID-19 pandemic and with many companies realising that remote work model saves costs and improves work efficiency, the flexible workspace sector would continue to face challenges. Knotel is just the tip of the iceberg and is a warning call for the flexible working spaces industry.

бнанс Створити акаунт

March 23, 2025 at 8:47 pm

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Fredericka Kowalke

April 15, 2025 at 2:15 am

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

Tawana Pavel

May 2, 2025 at 11:41 pm

I’ve been surfing online more than 3 hours lately, but I never discovered any interesting article like yours. It is beautiful price enough for me. In my view, if all webmasters and bloggers made just right content material as you probably did, the net can be much more useful than ever before. “Revolution is not a onetime event.” by Audre Lorde.

Sid Backenstose

June 1, 2025 at 8:12 pm

hi!,I love your writing very so much! share we be in contact extra about your post on AOL? I require a specialist in this space to solve my problem. May be that is you! Looking ahead to peer you.

ua1l4

June 4, 2025 at 8:12 pm

where can i get clomid without prescription can you buy generic clomiphene prices buying clomid price where to get clomiphene pill cost of cheap clomid prices how to get generic clomiphene tablets buying clomid without dr prescription

vtc paris

June 6, 2025 at 6:38 am

Well I really liked reading it. This article procured by you is very useful for accurate planning.

ohu7a

June 7, 2025 at 9:15 am

cost of cheap clomiphene online buying cheap clomiphene no prescription buy generic clomid without prescription can i buy generic clomiphene without prescription how can i get generic clomiphene buying cheap clomiphene where can i buy clomid without dr prescription

can you buy cialis online no prescription

June 9, 2025 at 1:54 pm

I’ll certainly carry back to review more.

Binance推荐

June 10, 2025 at 3:33 pm

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

does flagyl treat tooth infection

June 11, 2025 at 8:11 am

I couldn’t turn down commenting. Adequately written!

8k2i1

June 13, 2025 at 4:35 am

buy azithromycin 250mg without prescription – order tetracycline pill buy generic flagyl

8lgo2

June 14, 2025 at 4:30 pm

buy semaglutide tablets – buy semaglutide pill order periactin 4mg online cheap

ehko2

June 16, 2025 at 3:54 pm

how to buy domperidone – order domperidone 10mg online purchase flexeril pills

ujkrs

June 18, 2025 at 5:09 pm

buy inderal paypal – buy methotrexate 10mg generic methotrexate 10mg cost

nadez

June 21, 2025 at 2:47 pm

buy generic amoxil over the counter – purchase amoxil for sale buy ipratropium

4ujs5

June 23, 2025 at 5:46 pm

zithromax 500mg pill – buy tinidazole online cheap nebivolol price

znggd

June 25, 2025 at 4:02 pm

cheap augmentin 375mg – https://atbioinfo.com/ buy ampicillin online cheap

7quw1

June 27, 2025 at 9:03 am

buy esomeprazole 20mg capsules – https://anexamate.com/ buy nexium cheap

i03rn

June 28, 2025 at 6:37 pm

buy cheap generic coumadin – https://coumamide.com/ losartan 50mg cheap

fqui3

June 30, 2025 at 4:00 pm

buy meloxicam 7.5mg sale – https://moboxsin.com/ meloxicam 15mg generic

Mirna Schroll

July 1, 2025 at 11:23 pm

I’m still learning from you, but I’m improving myself. I definitely liked reading everything that is written on your blog.Keep the posts coming. I enjoyed it!

k7pi5

July 2, 2025 at 1:35 pm

buy prednisone paypal – https://apreplson.com/ prednisone cost

hi0vi

July 3, 2025 at 4:46 pm

best ed drug – site cheapest ed pills

7rh70

July 5, 2025 at 3:45 am

amoxil pill – https://combamoxi.com/ buy generic amoxicillin online

rgfd5

July 10, 2025 at 3:47 am

purchase diflucan online – https://gpdifluca.com/# brand diflucan

kuuss

July 11, 2025 at 5:00 pm

cenforce 50mg us – https://cenforcers.com/ cenforce over the counter

wmbj4

July 13, 2025 at 2:57 am

cialis for sale in toront ontario – https://ciltadgn.com/# safest and most reliable pharmacy to buy cialis

cld8b

July 14, 2025 at 7:16 pm

cheap cialis free shipping – this tadalafil best price 20 mg

ConnieTef

July 15, 2025 at 1:23 am

buy generic ranitidine online – buy ranitidine ranitidine cheap

j0sz9

July 17, 2025 at 12:03 am

where can i buy viagra online yahoo – https://strongvpls.com/ cheap viagra 100mg

ConnieTef

July 17, 2025 at 10:00 am

More articles like this would make the blogosphere richer. https://gnolvade.com/

z67ll

July 18, 2025 at 11:09 pm

This is the compassionate of literature I in fact appreciate. https://buyfastonl.com/amoxicillin.html

ConnieTef

July 20, 2025 at 5:00 am

More text pieces like this would create the интернет better. https://ursxdol.com/propecia-tablets-online/

0aq84

July 21, 2025 at 10:46 pm

More articles like this would remedy the blogosphere richer. https://prohnrg.com/product/rosuvastatin-for-sale/

gx5ie

July 24, 2025 at 1:48 pm

I’ll certainly return to skim more. https://aranitidine.com/fr/acheter-cenforce/

ConnieTef

August 4, 2025 at 9:06 pm

I am in fact thrilled to coup d’oeil at this blog posts which consists of tons of useful facts, thanks representing providing such data. https://ondactone.com/simvastatin/

Grand Prairie ac repair

August 6, 2025 at 3:43 pm

But wanna state that this is very useful, Thanks for taking your time to write this.

website design

August 7, 2025 at 8:46 am

I have recently started a site, the information you provide on this website has helped me greatly. Thanks for all of your time & work.

ConnieTef

August 7, 2025 at 5:25 pm

I am actually happy to glance at this blog posts which consists of tons of useful facts, thanks object of providing such data.

order generic aldactone

pet taxi service by patmypets

August 13, 2025 at 2:58 pm

I truly wanted to type a comment to appreciate you for all of the precious instructions you are sharing on this website. My long internet search has at the end of the day been recognized with extremely good details to share with my neighbours. I would say that most of us website visitors actually are extremely endowed to exist in a magnificent website with so many brilliant individuals with beneficial solutions. I feel pretty happy to have seen your web pages and look forward to many more fabulous times reading here. Thank you once again for a lot of things.

ConnieTef

August 15, 2025 at 2:40 am

The reconditeness in this ruined is exceptional. http://mi.minfish.com/home.php?mod=space&uid=1411828

toto macau

August 17, 2025 at 5:44 am

I’m really enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more pleasant for me to come here and visit more often. Did you hire out a designer to create your theme? Great work!

olxtoto

August 18, 2025 at 12:11 pm

Do you mind if I quote a couple of your articles as long as I provide credit and sources back to your weblog? My blog is in the exact same niche as yours and my visitors would certainly benefit from a lot of the information you provide here. Please let me know if this ok with you. Appreciate it!

ConnieTef

August 21, 2025 at 11:55 am

dapagliflozin without prescription – https://janozin.com/# buy forxiga pills

basket168

August 22, 2025 at 8:19 am

Thanks , I’ve just been searching for info approximately this topic for ages and yours is the greatest I’ve discovered so far. However, what in regards to the conclusion? Are you sure in regards to the source?

canon mallorca

August 24, 2025 at 12:18 am

I enjoy the efforts you have put in this, thanks for all the great articles.

habitación por dias

August 24, 2025 at 5:55 am

Hmm is anyone else having problems with the pictures on this blog loading? I’m trying to figure out if its a problem on my end or if it’s the blog. Any responses would be greatly appreciated.

ConnieTef

August 24, 2025 at 11:47 am

xenical drug – https://asacostat.com/# orlistat 120mg usa

ayuda TFM arquitectura

August 25, 2025 at 2:20 am

Great website. A lot of useful info here. I?¦m sending it to a few buddies ans additionally sharing in delicious. And of course, thank you for your effort!

ConnieTef

August 29, 2025 at 6:08 pm

Facts blog you procure here.. It’s hard to espy great status article like yours these days. I truly recognize individuals like you! Take mindfulness!! http://www.predictive-datascience.com/forum/member.php?action=profile&uid=46042

Lucius Breining

October 6, 2025 at 2:50 am

I have been browsing online more than three hours nowadays, yet I by no means found any interesting article like yours. It’s lovely worth enough for me. In my opinion, if all website owners and bloggers made just right content material as you probably did, the internet might be much more helpful than ever before. “I finally realized that being grateful to my body was key to giving more love to myself.” by Oprah Winfrey.

Cjbkrak

October 8, 2025 at 9:49 am

You can shelter yourself and your ancestors by way of being cautious when buying pharmaceutical online. Some druggist’s websites manipulate legally and put forward convenience, reclusion, rate savings and safeguards for purchasing medicines. buy in TerbinaPharmacy https://terbinafines.com/product/lopressor.html lopressor

46f9h

October 10, 2025 at 2:35 pm

This is the kind of content I have reading. levitra 10 mg prix

gambling casino online

October 12, 2025 at 5:33 pm

More posts like this would force the blogosphere more useful.

Randi Caligari

November 3, 2025 at 2:16 am

I really like your writing style, fantastic information, appreciate it for putting up : D.

Kuwin

November 6, 2025 at 3:29 am

kuwin sở hữu kho game đa dạng từ slot đến trò chơi bài đổi thưởng, mang đến cho bạn những giây phút giải trí tuyệt vời.

谷歌蜘蛛池

November 7, 2025 at 4:24 am

利用强大的谷歌蜘蛛池技术,大幅提升网站收录效率与页面抓取频率。谷歌蜘蛛池

站群程序

November 10, 2025 at 8:26 pm

采用高效谷歌站群策略,快速提升网站在搜索引擎中的可见性与权重。谷歌站群

alexaslot138 rtp

November 10, 2025 at 11:13 pm

I do not even know how I stopped up right here, but I thought this submit was once great. I do not recognise who you are however certainly you are going to a well-known blogger for those who aren’t already 😉 Cheers!

GO88

November 13, 2025 at 7:26 pm

Tham gia cộng đồng game thủ tại Go88 để trải nghiệm các trò chơi bài, poker phổ biến nhất hiện nay.

J88

November 13, 2025 at 10:17 pm

Đến với J88, bạn sẽ được trải nghiệm dịch vụ cá cược chuyên nghiệp cùng hàng ngàn sự kiện khuyến mãi độc quyền.

bandar bola

November 14, 2025 at 5:07 am

It?¦s truly a great and helpful piece of information. I am happy that you shared this useful info with us. Please keep us up to date like this. Thanks for sharing.

谷歌站群

November 14, 2025 at 6:33 am

专业构建与管理谷歌站群网络,助力品牌实现全域流量的强势增长。谷歌站群

Karan Kehres

November 16, 2025 at 5:13 am

I am so happy to read this. This is the type of manual that needs to be given and not the random misinformation that’s at the other blogs. Appreciate your sharing this best doc.

iwin

November 20, 2025 at 6:10 pm

iwin – nền tảng game bài đổi thưởng uy tín, nơi bạn có thể thử vận may và tận hưởng nhiều tựa game hấp

MM88

November 30, 2025 at 6:19 am

Với giao diện mượt mà và ưu đãi hấp dẫn, MM88 là lựa chọn lý tưởng cho các tín đồ giải trí trực tuyến.

provadent review

December 1, 2025 at 4:32 pm

Thank you for sharing with us, I believe this website truly stands out : D.

the brain song

December 2, 2025 at 2:34 am

Great info and straight to the point. I don’t know if this is in fact the best place to ask but do you people have any thoughts on where to get some professional writers? Thank you 🙂

bandar togel

December 7, 2025 at 4:26 pm

I got what you intend,saved to my bookmarks, very nice site.

Kliknij aby dowiedzieć się więcej

December 9, 2025 at 8:21 pm

Strong points made

NBA Live Streaming

December 10, 2025 at 1:30 pm

Thank you for the sensible critique. Me and my neighbor were just preparing to do a little research on this. We got a grab a book from our local library but I think I learned more from this post. I am very glad to see such excellent info being shared freely out there.

fdertol mrtokev

December 19, 2025 at 5:37 am

I am glad to be a visitor of this consummate web blog! , thanks for this rare information! .

kazino_s_minimalnym_depozitom

December 20, 2025 at 8:19 am

https://t.me/s/Kazino_s_minimalnym_depozitom

Kings Casino Anmelden

December 21, 2025 at 7:15 pm

Melden Sie sich nach Ende Ihrer Sitzung vollständig von Casino of Gold ab und trennen Sie sofort die Verbindung zum öffentlichen WLAN.

Stellen Sie sicher, dass das Betriebssystem und die Sicherheitspatches Ihres Geräts

für zusätzlichen Schutz auf dem neuesten Stand sind.

Bevor Sie Ihre Kontoinformationen eingeben oder eine Einzahlung bei € oder eine Auszahlungsanforderung tätigen, stellen Sie sicher, dass Ihre VPN-Verbindung immer stabil ist.

Bei nicht dringenden Fragen zu App-Einstellungen, Bonusansprüchen oder Kontoeinstellungen sollten Sie innerhalb weniger Stunden eine Antwort erhalten. Wenn

Sie sofort Hilfe mit Ihrem Konto benötigen, antwortet der Live-Chat in der Regel in weniger als zwei Minuten. Um

sofort auf Ihrem Telefon zum Hilfecenter zu gelangen, tippen Sie auf das Menü, wählen Sie „Support“ und Sie sehen Optionen wie Live-Chat, Direktnachrichten und Zugriff auf ausführliche FAQs.

References:

https://online-spielhallen.de/iwild-casino-erfahrungen-ein-tiefer-einblick-aus-spielersicht/

dmarket

December 24, 2025 at 10:01 pm

Fantastic website. Plenty of helpful info here. I¦m sending it to several friends ans additionally sharing in delicious. And obviously, thank you in your sweat!

starz

December 25, 2025 at 11:53 am

https://t.me/s/Officials_888STARZ

brandspace

December 25, 2025 at 3:40 pm

What’s Happening i am new to this, I stumbled upon this I’ve found It absolutely useful and it has aided me out loads. I hope to contribute & assist other users like its helped me. Great job.

MARTIN

December 25, 2025 at 7:56 pm

https://t.me/s/it_martIn_casiNo

gambling restrictions Australia

December 27, 2025 at 12:51 am

Our popular meals cater to all tastes, with indoor and outdoor

seating options and sweeping foreshore views. Wrest Point Casino stands out as a premier

gambling and entertainment venue in Tasmania, offering a multitude of

advantages that cater to a wide range of preferences and interests.

Members are encouraged to check regularly with Member Services or the casino’s

official website to stay informed about the latest specials and how to

take advantage of them. Whether it’s through membership specials,

seasonal promotions, or gaming tournaments, Wrest Point

Casino ensures a dynamic and rewarding environment

for all who visit. These offers are designed to reward both new and loyal

customers, featuring everything from exclusive discounts to exciting prize draws.

This strategy underscores the casino’s reputation as a leading

entertainment hub in Hobart, appealing to a broad audience by offering something for everyone.

For withdrawals, particularly after winning at casino games,

customers typically receive their payouts directly in cash.

This setup ensures that all patrons can enjoy the casino’s offerings with ease, regardless of their chosen payment method.

With its commitment to quality, service, and entertainment,

Wrest Point Casino gaming hours remain a cornerstone

of Tasmania’s hospitality and tourism sector.

As Federal Rewards Club members, you will enjoy discounted

accommodation rates and special offers at Country Club Tasmania and Wrest Point.

You’ll also access exclusive offers on our accommodation and dining experiences.

References:

https://blackcoin.co/kats-casino-australia-in-depth-review/

PartyPokies Australia review

December 27, 2025 at 3:39 pm

Cryptocurrency withdrawals are equally straightforward,

with instant processing times and varied limits depending on the currency.

For those who prefer mobile payments, Apple Pay provides a smooth and efficient solution, with deposit

limits between AU$25 and AU$1,000. When it comes to deposits, Rocket Casino

offers a range of options to suit different preferences.

Here’s what’s waiting in the Rocket game hangar. The casino’s

licensing is provided by trusted authorities. What

really sets it apart, though, is the out-of-this-world rewards system.

Missions with Free Spins, Weekly Shots offers, reload promotions

All table games, roulette and video pokers bring 0% of the bet.

It means you have to wager your bonus amount 45 times.

There are no bonus codes for the first, second, weekend reload and

Monday free spin bonuses. Maximum withdrawal limit for no-deposit free spins is 75 AUD.

Monday Free Spins Drop is a no deposit bonus. Wagering requirements for all the bonuses are 45x bonus amount.

References:

https://blackcoin.co/casino-helsinki-more-than-30-years-of-casino-entertainment/

7kCasino

December 28, 2025 at 4:09 pm

https://t.me/s/Officials_7k_casino

alquiler de furgoneta en valencia

December 30, 2025 at 3:29 am

What’s Happening i am new to this, I stumbled upon this I’ve found It positively useful and it has helped me out loads. I hope to contribute & help other users like its aided me. Good job.

vytvorení úctu na binance

January 12, 2026 at 12:37 pm

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

彩券行

January 20, 2026 at 11:40 pm

Set piece efficiency, corner and free kick conversion rates

zaborna torilon

January 21, 2026 at 12:41 pm

I cling on to listening to the news broadcast speak about getting boundless online grant applications so I have been looking around for the best site to get one. Could you advise me please, where could i get some?